And Renters Insurance

Renters insurance, a seemingly simple concept, plays a pivotal role in the lives of millions of tenants across the United States. It is a safety net that protects renters from financial losses due to unforeseen circumstances, offering peace of mind and financial security. However, despite its importance, many renters are either unaware of its existence or underestimate its value, often learning about it only after a devastating event occurs.

This comprehensive guide aims to delve deep into the world of renters insurance, exploring its intricacies, benefits, and the impact it can have on individuals and families. By understanding the nuances of this often-overlooked insurance policy, renters can make informed decisions to safeguard their possessions, liabilities, and most importantly, their future.

Understanding Renters Insurance: More Than Just Possessions

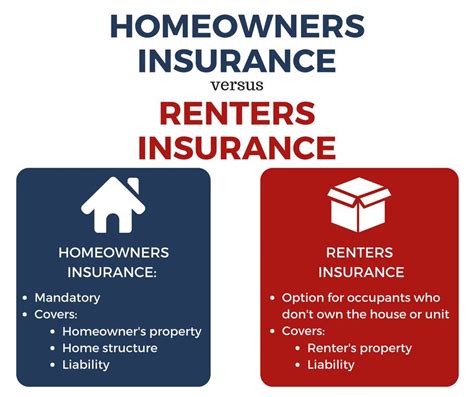

At its core, renters insurance is a policy designed to protect the personal property of tenants living in rented spaces, whether it’s an apartment, condo, or house. It provides coverage for a wide range of potential losses, including damage or theft of personal belongings, liability protection, and additional living expenses in case of a covered loss that makes the rented space uninhabitable.

However, the scope of renters insurance extends far beyond these basic protections. It can also cover medical expenses for visitors injured on the rented property, personal liability for injuries or damages caused to others, and even provide coverage for identity theft and credit card fraud. In essence, renters insurance acts as a comprehensive safeguard, ensuring that tenants are not left financially vulnerable in the face of unexpected events.

Key Components of Renters Insurance

- Personal Property Coverage: This is the most fundamental aspect of renters insurance. It covers the cost of repairing or replacing your belongings, from furniture and electronics to clothing and sporting goods, in case of theft, fire, or other covered perils.

- Liability Protection: This coverage is vital as it shields renters from financial ruin in case they are sued for bodily injury or property damage caused to others. It covers the cost of legal defense and any settlement or judgment up to the policy limits.

- Additional Living Expenses: In the event of a covered loss that renders your rented home uninhabitable, this coverage steps in to reimburse you for temporary living expenses, such as hotel stays or restaurant meals, until you can return to your home.

- Medical Payments to Others: Renters insurance typically includes a provision to cover medical expenses for visitors who suffer an injury on your rented property, regardless of fault.

Additionally, some renters insurance policies may offer optional coverages, such as:

- Personal Injury Protection: This coverage provides protection against lawsuits resulting from false arrest, libel, or slander.

- Loss Assessment Coverage: This coverage is particularly beneficial for condo renters, as it covers their share of expenses for certain covered losses that affect the entire building.

- Identity Theft Coverage: This emerging coverage provides resources and services to help restore your identity in case of theft.

| Coverage Type | Description |

|---|---|

| Personal Property | Covers the cost of repairing or replacing belongings due to theft, fire, or other covered perils. |

| Liability Protection | Provides financial protection against lawsuits for bodily injury or property damage caused to others. |

| Additional Living Expenses | Reimburses temporary living expenses in case of a covered loss that makes the rented home uninhabitable. |

| Medical Payments to Others | Covers medical expenses for visitors injured on the rented property, regardless of fault. |

The Importance of Renters Insurance: Real-Life Scenarios

Understanding the importance of renters insurance is not just about recognizing the potential risks, but also about realizing the real-world impact it can have on individuals and families. Let's explore a few scenarios that highlight the critical role of renters insurance in protecting tenants' financial well-being.

Scenario 1: Fire Damage

Imagine a devastating fire breaks out in your apartment complex. Fortunately, you and your family escape unharmed, but your belongings are not so lucky. The fire damages or destroys most of your personal property, including furniture, electronics, and sentimental items. Without renters insurance, you would be left to foot the entire bill for replacing these items, which could easily run into thousands of dollars.

However, with renters insurance, you can file a claim and receive compensation to cover the cost of replacing your belongings. This coverage ensures that you can quickly and efficiently rebuild your life without being weighed down by the financial burden of replacing your possessions.

Scenario 2: Liability Protection

While hosting a dinner party, one of your guests slips and falls on your recently waxed kitchen floor. They suffer a serious injury, requiring medical attention and time off work for recovery. If sued for the injury, you could be held financially responsible for their medical bills, lost wages, and pain and suffering. Without liability protection, this could lead to significant financial strain and potentially ruinous legal fees.

Renters insurance with liability protection steps in to cover these costs, providing a crucial safety net. It ensures that you are not left financially devastated in the wake of an accident for which you are legally responsible.

Scenario 3: Additional Living Expenses

Due to a severe storm, your apartment suffers significant water damage, making it uninhabitable for several weeks. During this time, you need to find alternative accommodation and cover the costs of temporary living expenses, such as hotel stays, meals, and transportation.

Additional living expenses coverage in your renters insurance policy can reimburse these costs, providing you with the financial support needed to maintain your standard of living during this difficult time. This coverage ensures that you don't have to choose between staying in a comfortable, safe environment and saving money.

Choosing the Right Renters Insurance: Factors to Consider

Selecting the right renters insurance policy is a critical decision that requires careful consideration of several factors. While the specific coverage needs of each renter will vary, there are some universal considerations that can guide you in making an informed choice.

Coverage Limits and Deductibles

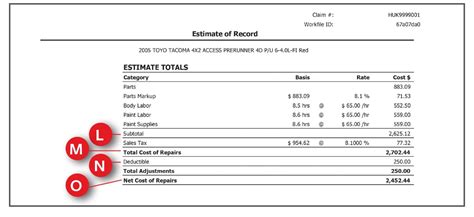

Coverage limits refer to the maximum amount your insurance company will pay for a covered loss. It’s essential to ensure that your coverage limits are sufficient to cover the replacement cost of your belongings. Similarly, the deductible is the amount you pay out of pocket before your insurance kicks in. A higher deductible can lead to lower premiums, but it’s important to choose a deductible that you can comfortably afford in the event of a claim.

Policy Coverage and Optional Endorsements

Different renters insurance policies offer varying levels of coverage. Some policies may have more comprehensive personal property coverage, while others may offer more robust liability protection. It’s crucial to review the policy’s coverage details and ensure it aligns with your specific needs. Additionally, consider any optional endorsements or add-ons that can enhance your coverage, such as identity theft protection or personal injury protection.

Reputation and Financial Strength of the Insurance Provider

Choosing a reputable and financially stable insurance provider is essential to ensure that your claims will be paid out promptly and fairly. Research the insurer’s reputation for customer service and claims handling. You can also check financial ratings from independent agencies like AM Best or Standard & Poor’s to assess the insurer’s financial stability.

Premium Cost and Discounts

While it’s important to find a policy that offers comprehensive coverage, you also want to ensure that it fits within your budget. Compare premiums from different insurers to find the best value for your money. Additionally, many insurers offer discounts for policy bundling (e.g., combining renters and auto insurance), safety features (such as smoke detectors or security systems), or membership in certain organizations (like alumni associations or professional groups). Take advantage of these discounts to lower your premium cost.

Renters Insurance: A Vital Investment for Your Future

Renters insurance is not just another expense; it’s an investment in your financial security and peace of mind. By understanding the comprehensive nature of renters insurance and the critical role it plays in protecting your possessions, liabilities, and future, you can make an informed decision to safeguard your interests.

Remember, life is full of unexpected events, and renters insurance provides the financial backup you need to weather these storms. It ensures that you can continue to lead a stable and comfortable life, even in the face of unforeseen circumstances. So, don't delay—invest in renters insurance today and secure your future.

How much does renters insurance cost on average?

+

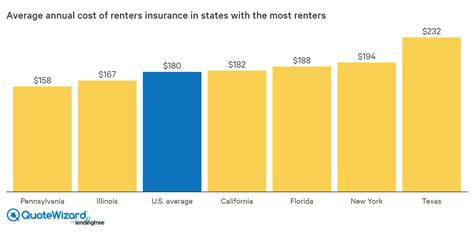

The average cost of renters insurance in the United States is around 15 to 30 per month, or 180 to 360 per year. However, the actual cost can vary widely based on several factors, including the coverage limits, deductibles, location, and the value of your personal property.

Does renters insurance cover my roommate’s belongings too?

+

Yes, in most cases, renters insurance policies cover the personal property of all roommates living in the same rented residence. However, it’s essential to review your policy’s specifics to ensure that your roommate’s belongings are covered.

What should I do if I need to file a claim with my renters insurance?

+

If you need to file a claim, contact your insurance provider as soon as possible. They will guide you through the process, which typically involves providing documentation of the loss, such as photos or receipts, and filling out a claim form. It’s important to keep records of all communications and documents related to the claim.