Ameriprise Auto Insurance

When it comes to choosing the right auto insurance, it's crucial to find a provider that offers not only comprehensive coverage but also a seamless and personalized experience. Ameriprise Auto Insurance stands out as a leading option, offering a range of benefits and features that set it apart from its competitors. In this comprehensive review, we will delve into the specifics of Ameriprise's auto insurance offerings, exploring its coverage options, discounts, claims process, and overall customer satisfaction.

Comprehensive Coverage Options

Ameriprise Auto Insurance understands that every driver has unique needs, which is why they provide a wide array of coverage options to ensure you can tailor your policy to your specific requirements. Here’s an overview of the key coverage options available:

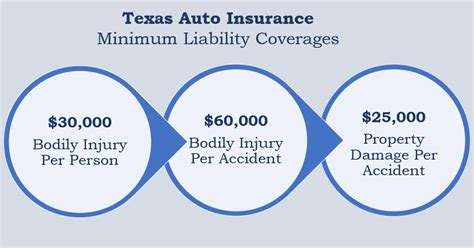

Liability Coverage

Liability coverage is a fundamental component of any auto insurance policy. Ameriprise offers both bodily injury liability and property damage liability coverage, ensuring you’re protected in the event of an accident that results in injuries or property damage to others. With Ameriprise, you can choose coverage limits that align with your needs and state requirements.

Collision and Comprehensive Coverage

Ameriprise’s collision coverage provides protection for your vehicle in the event of an accident, regardless of who is at fault. This coverage helps repair or replace your vehicle, with options for deductible amounts to suit your budget. Additionally, comprehensive coverage is available to protect against non-collision incidents such as theft, vandalism, natural disasters, and damage caused by animals.

| Coverage Type | Description |

|---|---|

| Collision Coverage | Covers repairs or replacements for your vehicle after an accident. |

| Comprehensive Coverage | Protects against non-collision incidents like theft, natural disasters, and vandalism. |

Personal Injury Protection (PIP)

Personal Injury Protection is an essential coverage option that provides medical benefits and wage loss coverage for you and your passengers, regardless of who is at fault in an accident. Ameriprise’s PIP coverage ensures that you and your loved ones receive the necessary medical attention and financial support in the event of an accident.

Uninsured/Underinsured Motorist Coverage

Ameriprise recognizes the importance of protecting yourself against uninsured or underinsured drivers. Their uninsured/underinsured motorist coverage provides compensation for injuries and property damage caused by drivers who lack adequate insurance coverage. This coverage is vital for ensuring you’re not left financially burdened in such circumstances.

Discounts and Savings Opportunities

Ameriprise Auto Insurance understands that saving on your auto insurance premiums is a priority for many drivers. That’s why they offer a range of discounts to help you reduce your costs without compromising on coverage.

Multi-Policy Discount

By bundling your auto insurance with other Ameriprise policies, such as home or life insurance, you can take advantage of significant savings. The multi-policy discount is a great way to streamline your insurance needs and enjoy cost-effective coverage.

Safe Driver Discount

Ameriprise rewards safe driving habits with discounts for accident-free driving. If you maintain a clean driving record, you can qualify for this discount, making it a great incentive to practice safe driving behaviors.

Loyalty Discount

Loyalty pays off with Ameriprise Auto Insurance. The longer you maintain your policy with Ameriprise, the more you can save. This loyalty discount is a testament to Ameriprise’s commitment to valuing long-term customers.

Other Discounts

Ameriprise offers a variety of additional discounts, including discounts for vehicle safety features, good students, and new vehicles. These discounts recognize the proactive measures taken by responsible drivers and reward them with reduced premiums.

| Discount Type | Description |

|---|---|

| Multi-Policy Discount | Save by bundling your auto insurance with other Ameriprise policies. |

| Safe Driver Discount | Reward for accident-free driving and maintaining a clean record. |

| Loyalty Discount | Long-term customers enjoy savings as a token of appreciation. |

| Vehicle Safety Features Discount | Discounts for vehicles equipped with advanced safety technologies. |

| Good Student Discount | Students with good grades can save on their auto insurance premiums. |

| New Vehicle Discount | Purchase a new vehicle and enjoy reduced rates. |

Efficient Claims Process

In the unfortunate event of an accident, Ameriprise Auto Insurance aims to make the claims process as smooth and hassle-free as possible. Their dedicated claims team is readily available to guide you through every step, ensuring a swift and fair resolution.

24⁄7 Claims Support

Ameriprise understands that accidents can happen at any time, which is why they offer 24⁄7 claims support. Whether it’s a minor fender bender or a more serious incident, you can reach their claims team anytime, ensuring prompt assistance and guidance.

Digital Claims Management

Ameriprise embraces digital technology to streamline the claims process. With their online and mobile app tools, you can easily file a claim, upload necessary documents, and track the progress of your claim in real-time. This digital approach not only saves time but also provides convenience and transparency.

Fair and Prompt Settlements

Ameriprise prides itself on providing fair and prompt settlements to its policyholders. Their experienced claims adjusters thoroughly evaluate each claim, taking into account all relevant factors to ensure a fair resolution. With Ameriprise, you can trust that your claim will be handled with integrity and efficiency.

Customer Satisfaction and Awards

Ameriprise Auto Insurance has consistently earned recognition for its exceptional customer service and overall satisfaction. Here’s a glimpse at some of the accolades and customer feedback:

J.D. Power Awards

Ameriprise has been awarded by J.D. Power for its outstanding customer satisfaction in the auto insurance industry. This recognition highlights Ameriprise’s commitment to providing exceptional service and meeting the needs of its policyholders.

Positive Customer Reviews

Ameriprise’s customers have shared numerous positive reviews, praising the company’s responsive customer service, fair claims handling, and comprehensive coverage options. These reviews showcase the trust and satisfaction that Ameriprise has built with its policyholders over the years.

Future Implications and Innovations

As the auto insurance industry continues to evolve, Ameriprise remains dedicated to staying at the forefront of innovation. Here are some insights into Ameriprise’s future plans and strategies:

Digital Transformation

Ameriprise recognizes the importance of digital technologies in enhancing the customer experience. They are continually investing in digital transformation, aiming to provide even more seamless and convenient services through their online and mobile platforms.

Personalized Coverage Options

Understanding that every driver has unique needs, Ameriprise is focused on developing personalized coverage options. By leveraging data and advanced analytics, they aim to offer tailored policies that meet the specific requirements of each policyholder, ensuring optimal protection and value.

Sustainable Practices

Ameriprise is committed to environmental sustainability and social responsibility. They are actively working towards reducing their carbon footprint and promoting eco-friendly practices within the company and among their policyholders. This commitment aligns with the growing awareness of environmental issues and demonstrates Ameriprise’s dedication to making a positive impact.

How can I get a quote for Ameriprise Auto Insurance?

+You can request a quote for Ameriprise Auto Insurance by visiting their official website or contacting their customer service team. Provide your basic information, such as your vehicle details and driving history, and they’ll guide you through the process of obtaining a personalized quote.

What are the payment options for Ameriprise Auto Insurance premiums?

+Ameriprise offers flexible payment options, including monthly, quarterly, or annual payments. You can choose the payment method that best suits your financial preferences, whether it’s through direct debit, credit card, or check.

Can I customize my Ameriprise Auto Insurance policy to include additional coverages?

+Absolutely! Ameriprise understands the importance of tailoring your policy to your specific needs. You can customize your policy by adding optional coverages such as rental car reimbursement, gap coverage, or roadside assistance. Their agents will work with you to ensure your policy aligns with your requirements.