Ally Dealership Insurance

Welcome to the comprehensive guide to Ally Dealership Insurance, a crucial aspect of automotive retail that often flies under the radar. In this article, we will delve deep into the world of dealership insurance, exploring its intricacies, benefits, and real-world applications. With the expertise of industry insiders and a keen eye for detail, we aim to provide you with an insightful and engaging read.

Understanding the Importance of Dealership Insurance

In the fast-paced and competitive automotive industry, dealerships face a myriad of risks and potential liabilities. From customer interactions to vehicle sales and service, every aspect of dealership operations carries a certain level of risk. This is where Ally Dealership Insurance steps in, offering a comprehensive solution to mitigate these risks and ensure a smooth and secure business environment.

With a legacy spanning several decades, Ally Financial has established itself as a trusted partner in the automotive industry. Their dealership insurance offerings are tailored to meet the unique needs of dealerships, providing coverage for a wide range of scenarios. From protecting the dealership's physical assets to safeguarding against legal liabilities, Ally Dealership Insurance is an indispensable tool for any forward-thinking dealership.

Key Coverage Areas of Ally Dealership Insurance

Ally Dealership Insurance offers a holistic approach to risk management, covering various aspects of dealership operations. Here’s a glimpse into the key coverage areas:

- Property Insurance: Protects the dealership's physical assets, including buildings, inventory, and equipment, against damages caused by natural disasters, theft, or vandalism.

- Liability Insurance: Provides coverage for legal liabilities arising from customer injuries, property damage, or product defects, ensuring the dealership's financial stability.

- Workers' Compensation: Covers medical expenses and lost wages for employees injured on the job, demonstrating the dealership's commitment to employee well-being.

- Commercial Auto Insurance: Offers protection for dealership-owned vehicles, including sales and service fleets, ensuring compliance with legal requirements and minimizing financial risks.

- Umbrella Insurance: Provides additional liability coverage beyond the limits of other policies, offering an extra layer of protection for major claims or lawsuits.

By offering a comprehensive suite of insurance products, Ally Dealership Insurance empowers dealerships to focus on their core business operations with peace of mind, knowing they are adequately protected against potential risks.

Tailored Solutions for Unique Dealership Needs

One of the standout features of Ally Dealership Insurance is its ability to tailor coverage to meet the unique needs of individual dealerships. Every dealership has its own set of challenges and requirements, and Ally understands the importance of a personalized approach.

Customized Risk Assessment

Ally’s team of experienced insurance professionals conducts a thorough risk assessment for each dealership. This process involves a detailed analysis of the dealership’s operations, including sales volume, service offerings, customer demographics, and local regulations. By understanding the dealership’s specific risks, Ally can design a tailored insurance plan that provides the right level of coverage.

Flexible Coverage Options

Ally Dealership Insurance offers a wide range of coverage options, allowing dealerships to choose the policies that best suit their needs. Whether it’s adjusting coverage limits, adding optional endorsements, or customizing deductibles, dealerships have the flexibility to create an insurance plan that aligns with their budget and risk appetite.

For instance, dealerships with a higher sales volume or a focus on luxury brands may require more extensive liability coverage. On the other hand, dealerships in regions prone to natural disasters may prioritize property insurance with specific endorsements for flood or earthquake coverage.

Industry-Specific Expertise

Ally’s insurance experts possess in-depth knowledge of the automotive industry, its unique challenges, and the specific risks dealerships face. This expertise allows them to provide valuable insights and guidance, helping dealerships navigate complex insurance decisions with confidence. By leveraging their industry expertise, Ally ensures that dealerships receive coverage that goes beyond the basics, addressing the nuanced risks of the automotive sector.

Benefits of Choosing Ally Dealership Insurance

Opting for Ally Dealership Insurance brings a host of benefits that extend beyond traditional insurance coverage. Here’s a closer look at some of the key advantages:

Comprehensive Coverage

Ally Dealership Insurance offers a comprehensive suite of insurance products, ensuring dealerships have the necessary coverage for all aspects of their operations. From protecting their physical assets to managing legal liabilities, dealerships can rest assured knowing they are adequately insured.

Risk Management Expertise

Ally’s team of insurance professionals brings a wealth of knowledge and experience in risk management. They work closely with dealerships to identify potential risks and develop strategies to mitigate them. This proactive approach helps dealerships stay ahead of potential issues, minimizing the impact of unforeseen events.

Streamlined Claims Process

In the event of a claim, Ally Dealership Insurance provides a streamlined and efficient claims process. With a dedicated team of claims specialists, dealerships can expect prompt assistance and a hassle-free experience. Ally’s focus on customer satisfaction ensures that dealerships receive the support they need during challenging times.

Competitive Pricing

Ally Dealership Insurance understands the importance of cost-effectiveness for dealerships. Their insurance plans are competitively priced, offering dealerships the coverage they need without straining their budgets. By leveraging Ally’s buying power and industry connections, dealerships can access insurance solutions that provide excellent value for money.

Real-World Success Stories

To illustrate the impact of Ally Dealership Insurance, let’s explore some real-world success stories. These examples showcase how dealerships have benefited from Ally’s comprehensive insurance offerings:

Protecting Dealership Assets

A dealership in a hurricane-prone region invested in Ally’s comprehensive property insurance, including coverage for wind and flood damage. When a powerful storm hit the area, causing extensive damage to the dealership’s buildings and inventory, Ally’s insurance stepped in. The dealership received prompt assistance and a smooth claims process, allowing them to quickly recover and continue operations without financial strain.

Mitigating Legal Liabilities

A dealership faced a lawsuit from a customer who claimed to have been injured on their premises. With Ally’s liability insurance in place, the dealership was protected against the financial impact of the lawsuit. Ally’s legal team provided expert guidance and support throughout the process, ensuring the dealership’s interests were safeguarded. The case was eventually resolved in the dealership’s favor, thanks to Ally’s comprehensive coverage.

Supporting Employee Well-being

A dealership with a focus on employee satisfaction implemented Ally’s workers’ compensation insurance. When an employee suffered an injury on the job, the dealership was able to provide prompt medical care and support. Ally’s insurance coverage ensured that the employee received the necessary treatment and compensation, fostering a positive work environment and employee loyalty.

Future Trends and Innovations in Dealership Insurance

As the automotive industry continues to evolve, so too does the landscape of dealership insurance. Here’s a glimpse into the future trends and innovations that are shaping the industry:

Digital Transformation

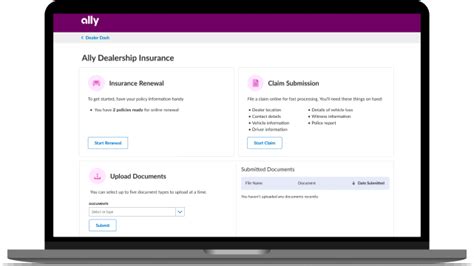

The digital age has brought about significant changes in the insurance industry, and dealership insurance is no exception. Ally Dealership Insurance is embracing digital transformation, leveraging technology to enhance the customer experience. From online policy management and real-time claims tracking to digital payment options, dealerships can expect a seamless and efficient insurance journey.

Data-Driven Insights

With the advent of big data and advanced analytics, dealerships can access valuable insights to make informed insurance decisions. Ally is investing in data-driven technologies to provide dealerships with personalized risk assessments and coverage recommendations. By leveraging data, dealerships can optimize their insurance plans, ensuring they are adequately protected without unnecessary costs.

Enhanced Customer Experience

In today’s competitive market, providing an exceptional customer experience is paramount. Ally Dealership Insurance is focused on delivering a customer-centric approach, offering personalized support and tailored solutions. From dedicated account managers to 24⁄7 customer service, dealerships can expect a responsive and proactive insurance partner.

Collaborative Partnerships

Ally understands the value of collaborative partnerships in the automotive industry. They actively seek partnerships with industry leaders and experts to enhance their insurance offerings. By working together, dealerships can access innovative solutions, exclusive discounts, and specialized coverage options, further strengthening their insurance portfolio.

FAQ

What sets Ally Dealership Insurance apart from other insurance providers?

+Ally Dealership Insurance stands out with its comprehensive coverage, tailored solutions, and industry-specific expertise. They offer a holistic approach to risk management, ensuring dealerships receive the protection they need. Additionally, their focus on customer satisfaction and innovative approaches sets them apart in the market.

How can dealerships benefit from Ally’s risk assessment process?

+Ally’s risk assessment process helps dealerships identify potential risks and develop strategies to mitigate them. By understanding their unique risks, dealerships can tailor their insurance coverage accordingly, ensuring they are adequately protected without unnecessary expenses.

What is the claims process like with Ally Dealership Insurance?

+Ally Dealership Insurance offers a streamlined and efficient claims process. With a dedicated team of claims specialists, dealerships can expect prompt assistance and a hassle-free experience. Ally’s focus on customer satisfaction ensures that dealerships receive the support they need during challenging times.