Insurance Form

Completing insurance forms accurately is crucial for ensuring coverage and understanding your policy. Insurance forms are essential documents that provide crucial information to insurance companies, helping them assess risks, determine coverage, and process claims efficiently. These forms are designed to capture detailed data about individuals, their assets, and specific insurance needs. Accurate completion of insurance forms is vital, as it directly impacts the coverage and benefits you receive. In this comprehensive guide, we will delve into the intricacies of insurance forms, offering expert insights and practical tips to help you navigate this essential process seamlessly.

Understanding the Importance of Insurance Forms

Insurance forms serve as the foundation for your insurance policy, capturing vital details that influence coverage and benefits. They are the primary means of communication between you and your insurance provider, ensuring a clear understanding of your needs and the associated risks.

Accurate completion of insurance forms is crucial for several reasons. Firstly, it ensures that your policy accurately reflects your specific requirements, covering the assets or risks you wish to protect. Secondly, detailed and honest disclosure on these forms helps insurance companies assess risks more effectively, leading to fair premium calculations. Lastly, accurate form completion is essential for claim processing, as it provides the necessary information to validate and process claims promptly.

Common Types of Insurance Forms

Insurance forms come in various types, each tailored to specific insurance needs. Here are some common types of insurance forms and their purposes:

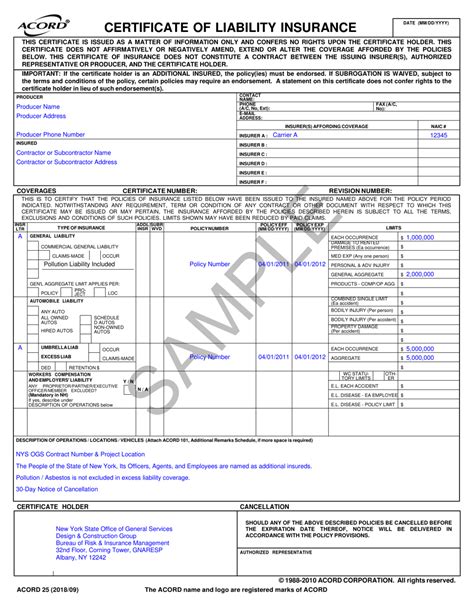

Application Forms

Application forms are the primary documents used when applying for insurance coverage. They capture essential information about the insured individual or entity, including personal details, asset descriptions, and specific coverage requirements. These forms are comprehensive and often require detailed responses to ensure accurate risk assessment and policy formulation.

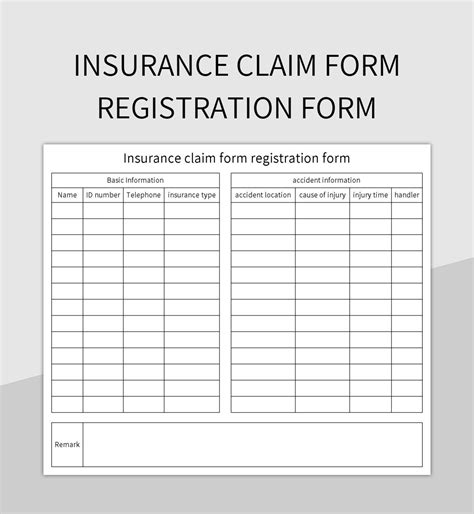

Claim Forms

Claim forms are crucial for initiating and processing insurance claims. These forms provide a detailed account of the incident or loss, including the date, time, location, and circumstances. Claim forms also require information about the impacted assets, their value, and any supporting documentation, such as photographs or repair estimates. Accurate and timely completion of claim forms is essential for a smooth claims process.

Renewal Forms

Renewal forms are used when existing insurance policies are up for renewal. These forms often require an update of the insured’s personal and asset details, ensuring that the policy remains aligned with current needs. Renewal forms also provide an opportunity to review and adjust coverage, taking into account any changes in risk factors or asset values.

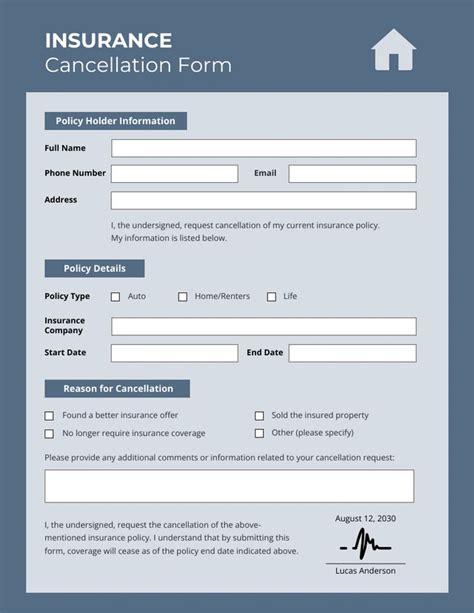

Change of Circumstances Forms

Change of circumstances forms are used to notify insurance companies about significant changes that may impact the policy. These changes could include the acquisition of new assets, relocation, or changes in personal or business circumstances. By promptly informing the insurance provider, you ensure that your coverage remains relevant and up-to-date.

Key Considerations When Completing Insurance Forms

Completing insurance forms accurately and honestly is essential for maintaining a strong relationship with your insurance provider and ensuring the effectiveness of your coverage. Here are some key considerations to keep in mind:

Honesty and Transparency

Always provide accurate and truthful information on insurance forms. Misrepresentations or omissions can lead to claim denials or policy cancellations. Be transparent about your personal and financial situation, as well as any known risks associated with your assets or activities.

Detailed Information

Provide as much detail as possible when completing insurance forms. For example, when describing assets, include specific details such as make, model, age, and any unique features. Similarly, when reporting incidents, provide a comprehensive account, including all relevant facts and circumstances.

Review and Update Regularly

Insurance forms should be reviewed and updated regularly, especially when significant changes occur. Whether it’s a new addition to your family, the purchase of a valuable asset, or a change in business operations, ensuring that your insurance forms reflect these changes is crucial for maintaining adequate coverage.

Seek Professional Guidance

If you have complex insurance needs or are unsure about completing certain forms, seek guidance from insurance professionals or brokers. They can provide expert advice tailored to your specific circumstances, ensuring that your insurance forms are completed accurately and comprehensively.

Tips for Efficient and Effective Form Completion

Completing insurance forms can be a detailed and time-consuming process, but with the right approach, you can streamline the process and ensure accuracy. Here are some practical tips to make form completion more efficient and effective:

Gather Relevant Documents

Before starting, gather all the necessary documents and information. This could include identification documents, asset ownership records, financial statements, and any relevant photographs or valuations. Having these documents readily available will save time and ensure that you provide accurate details.

Read Instructions Carefully

Insurance forms often include detailed instructions and guidelines. Take the time to read and understand these instructions, as they provide valuable information about the required format, specific details to include, and any potential pitfalls to avoid.

Use Digital Tools

Many insurance companies now offer digital platforms or apps that allow you to complete forms online. These tools often provide a more user-friendly experience, with built-in guidance and error prevention features. Utilizing digital tools can streamline the form completion process and reduce the risk of errors.

Review and Double-Check

Once you have completed the form, take the time to review it thoroughly. Check for accuracy, completeness, and any potential errors. Double-checking your work ensures that you provide the best possible information to your insurance provider, reducing the likelihood of delays or complications.

The Impact of Accurate Form Completion on Your Coverage

Accurate and honest completion of insurance forms has a direct impact on your coverage and benefits. Here’s how it influences your insurance journey:

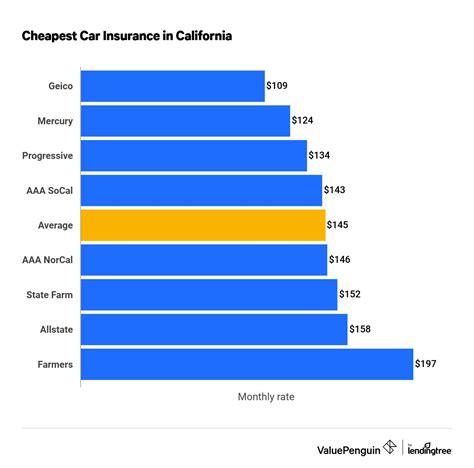

Fair Premium Calculations

Insurance companies use the information provided on forms to assess risks and calculate premiums. Accurate disclosure of risks and assets ensures that your premiums are fair and reflective of your specific circumstances. Misrepresenting information can lead to higher premiums or, in extreme cases, policy cancellation.

Prompt Claims Processing

When an incident occurs, the information provided on your insurance forms becomes crucial for claim processing. Accurate and detailed documentation of the incident, along with supporting evidence, speeds up the claims process. It helps insurance adjusters understand the context and validate your claim, ensuring a faster resolution.

Avoiding Claim Denials

Honest and comprehensive completion of insurance forms is essential for avoiding claim denials. Insurance companies have the right to investigate and deny claims if they find discrepancies or misrepresentations. By providing accurate information upfront, you reduce the risk of claim denials and ensure that you receive the benefits you are entitled to.

Future Implications and Industry Trends

The insurance industry is continuously evolving, and technology is playing a significant role in shaping the future of insurance forms. Here are some key trends and implications to consider:

Digital Transformation

The shift towards digital platforms and mobile apps is transforming the insurance form completion process. Insurers are investing in technology to offer more user-friendly interfaces, real-time data validation, and seamless integration with other digital services. This digital transformation improves efficiency, enhances the customer experience, and reduces the likelihood of errors.

Data Analytics and Risk Assessment

Insurance companies are leveraging advanced data analytics techniques to assess risks more accurately. By analyzing historical data, market trends, and customer behavior, insurers can refine their risk assessment models. This evolution in risk assessment techniques ensures more precise premium calculations and coverage recommendations.

Artificial Intelligence and Automation

Artificial Intelligence (AI) and automation are revolutionizing various aspects of the insurance industry, including form completion and processing. AI-powered systems can analyze and extract relevant information from forms, streamlining the review process and reducing the need for manual intervention. Automation also enables faster claims processing and more efficient customer service.

Personalized Insurance

The future of insurance forms lies in personalization. Insurers are exploring ways to offer tailored insurance products and services based on individual needs and circumstances. By collecting and analyzing data from various sources, including insurance forms, insurers can design coverage options that are more relevant and beneficial to specific customer segments.

Conclusion: Navigating the Insurance Form Process

Insurance forms are a critical component of your insurance journey, impacting coverage, premiums, and claims. By understanding the importance of accurate form completion and following best practices, you can ensure a smooth and efficient process. Remember to be honest, provide detailed information, and seek professional guidance when needed.

As the insurance industry continues to evolve, embracing digital transformation and leveraging advanced technologies, the insurance form completion process will become even more streamlined and customer-centric. By staying informed about industry trends and adopting new tools, you can navigate the insurance landscape with confidence and ensure the best possible coverage for your unique needs.

How often should I review and update my insurance forms?

+It is recommended to review and update your insurance forms annually or whenever significant changes occur in your personal or business circumstances. Regular reviews ensure that your coverage remains relevant and up-to-date.

Can I complete insurance forms online, or do I need to submit physical copies?

+Many insurance companies now offer digital platforms or apps for online form completion. However, some insurers may still require physical copies, especially for certain types of insurance or in specific jurisdictions. Check with your insurance provider to determine the preferred method of submission.

What happens if I make a mistake or forget to include certain details on my insurance forms?

+If you realize a mistake or omission after submitting your insurance forms, contact your insurance provider promptly. They can guide you on the best course of action, which may include submitting an amended form or providing additional information. Being proactive and transparent is crucial to maintaining a positive relationship with your insurer.