All State Car Insurance Quote

When it comes to choosing the right car insurance, getting an accurate and reliable quote is essential. Allstate, a well-known insurance provider, offers comprehensive coverage options and competitive rates. In this comprehensive guide, we will delve into the process of obtaining an Allstate car insurance quote, exploring the factors that influence your premium and providing valuable insights to help you make an informed decision.

Understanding the Allstate Car Insurance Quote Process

Allstate offers a user-friendly online platform and a network of local agents to assist you in obtaining a personalized car insurance quote. The quote process is designed to be straightforward and efficient, allowing you to receive an estimate of your potential insurance costs quickly.

To begin, you can visit the Allstate website and navigate to the car insurance quote section. Here, you will be guided through a series of questions to provide the necessary information for an accurate quote. Alternatively, you can reach out to an Allstate agent, who can assist you over the phone or in person, offering personalized advice and expertise.

The Information You Need

When requesting an Allstate car insurance quote, be prepared to provide the following details:

- Vehicle Information: Make, model, year, and VIN (Vehicle Identification Number) of your car.

- Personal Details: Your name, date of birth, driver’s license number, and address.

- Driving History: Any previous accidents, claims, or violations.

- Coverage Preferences: The types and levels of coverage you require.

- Additional Information: Details about your garage, annual mileage, and any safety features your car possesses.

By having this information readily available, you can streamline the quote process and ensure an accurate estimate of your insurance costs.

Online Quote Process

Let’s take a closer look at the steps involved in obtaining an Allstate car insurance quote online:

- Visit the Allstate Website: Go to https://www.allstate.com and navigate to the car insurance quote section.

- Provide Basic Information: Start by entering your name, email address, and contact details. You will also need to select your state of residence.

- Vehicle Details: Input the necessary information about your vehicle, including make, model, year, and VIN.

- Driving History: Share details about your driving experience, including any accidents, claims, or violations.

- Coverage Preferences: Choose the types of coverage you require, such as liability, collision, comprehensive, and additional optional coverages.

- Review and Customize: After providing the initial information, you will receive a preliminary quote. Review the coverage and limits, and adjust them as needed to fit your specific requirements.

- Submit Your Quote: Once you are satisfied with the coverage and price, submit your quote request. An Allstate representative may contact you to discuss further details and finalize the quote.

The online quote process is designed to be intuitive and user-friendly, allowing you to explore different coverage options and receive a personalized estimate within a matter of minutes.

Factors Affecting Your Allstate Car Insurance Quote

Like any insurance provider, Allstate considers a range of factors when determining your car insurance premium. Understanding these factors can help you anticipate the cost of your coverage and potentially identify areas where you can save.

Vehicle-Related Factors

The make, model, and year of your vehicle play a significant role in determining your insurance premium. Certain vehicles may have higher repair costs or be more prone to theft, influencing the overall cost of coverage. Additionally, the safety features and anti-theft devices installed in your car can positively impact your premium, as they reduce the risk of accidents and theft.

Here's a table showcasing the impact of vehicle-related factors on your Allstate car insurance quote:

| Vehicle Factor | Impact on Premium |

|---|---|

| Make and Model | Can affect repair costs and theft risk |

| Year | Older vehicles may have lower premiums |

| Safety Features | Reduces accident risk, lowering premiums |

| Anti-Theft Devices | Deters theft, potentially reducing premiums |

Driver-Related Factors

Your driving history and personal characteristics are crucial in determining your car insurance premium. Allstate, like most insurers, takes into account factors such as your age, gender, marital status, and driving record. Younger drivers, for instance, may face higher premiums due to their perceived higher risk on the road.

The following table highlights the impact of driver-related factors on your Allstate car insurance quote:

| Driver Factor | Impact on Premium |

|---|---|

| Age | Younger drivers often pay higher premiums |

| Gender | Gender can influence premiums in some states |

| Marital Status | Married drivers may receive lower premiums |

| Driving Record | Clean records lead to lower premiums |

Location and Usage Factors

Your geographic location and how you use your vehicle can also impact your insurance premium. Areas with higher crime rates or a history of severe weather events may result in higher premiums. Additionally, the number of miles you drive annually and the purpose of your driving (commuting, leisure, or business) can influence your quote.

Below is a table outlining the location and usage factors that affect your Allstate car insurance quote:

| Location and Usage Factor | Impact on Premium |

|---|---|

| Geographic Location | Areas with higher crime or weather risks may have higher premiums |

| Annual Mileage | Lower mileage can lead to reduced premiums |

| Purpose of Driving | Commuting or business use may result in higher premiums |

Tips to Lower Your Allstate Car Insurance Quote

While various factors influence your car insurance premium, there are strategies you can employ to potentially reduce your quote and save on your coverage costs. Here are some tips to consider:

- Bundle Policies: Combining your car insurance with other Allstate policies, such as homeowners or renters insurance, can lead to significant discounts.

- Increase Your Deductible: Opting for a higher deductible can lower your premium, as you will pay more out-of-pocket in the event of a claim.

- Explore Discounts: Allstate offers a range of discounts for safe driving, good student status, and loyalty. Ask your agent about the discounts you may be eligible for.

- Maintain a Clean Driving Record: A spotless driving record with no accidents or violations can help you qualify for lower premiums.

- Consider Telematics Programs: Allstate's Drivewise program uses telematics technology to monitor your driving behavior. Safe driving habits can result in rewards and discounts.

- Shop Around: Compare quotes from multiple insurance providers to ensure you are getting the best rate for your specific needs.

Understanding Your Allstate Car Insurance Quote

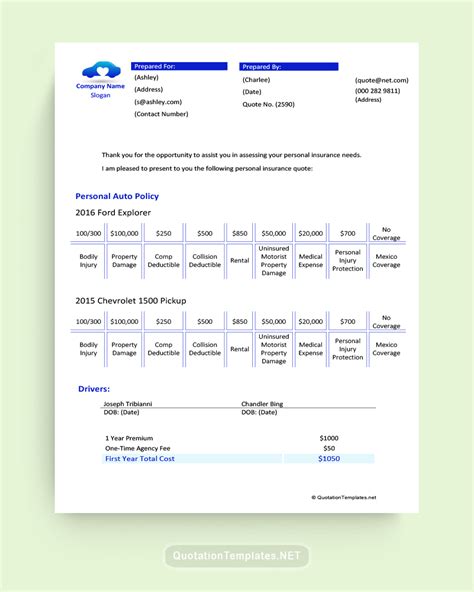

Once you receive your Allstate car insurance quote, it's essential to understand the components that make up your premium. Here's a breakdown of the key elements you'll find in your quote:

- Coverage Types: Your quote will include the various types of coverage you selected, such as liability, collision, comprehensive, and any optional coverages.

- Coverage Limits: The limits of each coverage, specifying the maximum amount Allstate will pay for a covered claim.

- Premiums: The cost of your coverage, typically displayed as a monthly or annual amount.

- Deductibles: The amount you will need to pay out-of-pocket before Allstate covers the rest of a claim.

- Discounts: Any applicable discounts you qualify for, such as multi-policy, safe driver, or good student discounts.

Reviewing your quote carefully and discussing it with an Allstate agent can help you make informed decisions about your coverage and identify areas where you may be able to save.

The Benefits of Allstate Car Insurance

Allstate offers a range of benefits and features that make it a compelling choice for your car insurance needs. Here are some key advantages:

- Customizable Coverage: Allstate allows you to tailor your coverage to your specific needs, ensuring you have the right protection without paying for unnecessary extras.

- Flexible Payment Options: You can choose from various payment plans, including monthly, quarterly, or annual payments, to fit your budget.

- Claims Support: Allstate provides 24⁄7 claims support, ensuring you can quickly and efficiently file a claim when needed.

- Accident Forgiveness: With Allstate’s accident forgiveness program, your rates won’t increase after your first at-fault accident, providing peace of mind.

- Discounts: As mentioned earlier, Allstate offers a wide range of discounts to help you save on your insurance premiums.

Frequently Asked Questions

How long does it take to get an Allstate car insurance quote online?

+The online quote process typically takes around 10-15 minutes, depending on how quickly you provide the necessary information.

Can I get an Allstate car insurance quote over the phone?

+Yes, you can reach out to an Allstate agent by phone, and they will guide you through the quote process and provide a personalized estimate.

What factors determine my Allstate car insurance premium the most?

+Your driving history, including accidents and violations, is one of the most significant factors. Additionally, your age, gender, and the make and model of your vehicle play crucial roles.

Can I negotiate my Allstate car insurance quote?

+While Allstate’s quotes are based on standard rates, you can discuss your specific circumstances and potential discounts with an agent to see if further adjustments are possible.

How often should I review and update my Allstate car insurance policy?

+It’s recommended to review your policy annually to ensure your coverage remains adequate and to take advantage of any new discounts or coverage options.

In conclusion, obtaining an Allstate car insurance quote is a straightforward process, allowing you to quickly assess your potential insurance costs. By understanding the factors that influence your premium and exploring the various coverage options and discounts available, you can make an informed decision and secure the right car insurance for your needs. Remember, Allstate offers customizable coverage, flexible payment options, and comprehensive support to ensure you’re well-protected on the road.