Airbnb Insurance Policy

The Airbnb insurance policy is a critical component of the platform's ecosystem, offering protection and peace of mind to both hosts and guests. As Airbnb continues to revolutionize the travel and hospitality industry, understanding the intricacies of its insurance coverage becomes increasingly important. This article aims to delve deep into the specifics of the Airbnb insurance policy, exploring its features, benefits, and limitations. By the end of this comprehensive guide, readers will have a thorough understanding of how Airbnb's insurance policy works and how it impacts their travel experiences.

Understanding the Airbnb Insurance Policy

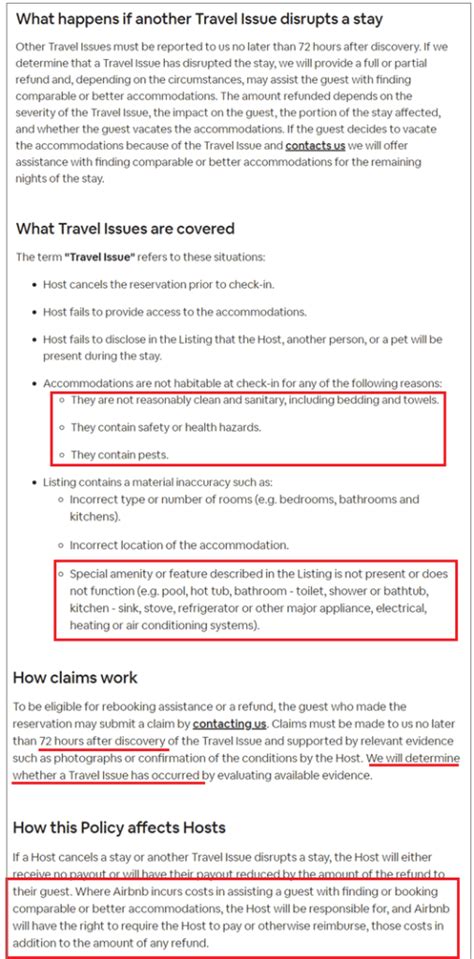

The Airbnb insurance policy is a comprehensive set of measures designed to address potential risks and liabilities associated with short-term rentals. It is a critical aspect of the Airbnb platform, providing financial protection and legal coverage to hosts and guests alike. The policy covers a range of scenarios, from property damage and personal injuries to liability claims and loss of personal belongings.

Airbnb's insurance policy is unique in that it adapts to the diverse needs of its global community. It offers different levels of coverage, catering to hosts with various rental types and guests with distinct travel preferences. The policy's adaptability ensures that regardless of the specific circumstances, users can rely on adequate protection.

One of the key strengths of the Airbnb insurance policy is its host protection program. This program provides liability insurance to hosts, covering them against third-party claims for bodily injury or property damage that occur during a guest's stay. The coverage extends to both the host's primary residence and any secondary properties listed on the platform, offering a robust safety net for hosts engaging in short-term rentals.

For guests, the Airbnb insurance policy offers a different set of protections. It includes host guarantee coverage, which reimburses guests for property damage caused by a host up to a certain limit. Additionally, the policy covers medical expenses for guests who sustain injuries during their stay, providing financial relief during unexpected health emergencies.

The insurance policy also addresses the issue of lost and damaged personal belongings. While it does not provide direct compensation for these losses, it facilitates a claims process that can lead to reimbursement. This aspect of the policy demonstrates Airbnb's commitment to ensuring a positive and secure travel experience for its guests.

Key Features of the Airbnb Insurance Policy

The Airbnb insurance policy boasts several notable features that set it apart from traditional insurance offerings. Firstly, it is designed to be accessible and straightforward, with clear and concise terms and conditions. This transparency ensures that both hosts and guests understand the scope and limitations of their coverage.

Secondly, the policy is dynamic, evolving to keep pace with the changing needs of the Airbnb community. Airbnb regularly reviews and updates its insurance offerings, incorporating feedback from users and adapting to emerging trends in the travel industry. This commitment to continuous improvement ensures that the policy remains relevant and effective.

Another significant feature of the Airbnb insurance policy is its focus on accessibility. Airbnb has made efforts to ensure that its insurance coverage is inclusive and available to a wide range of users. This includes offering competitive rates and flexible payment options, making insurance protection more attainable for hosts and guests from diverse backgrounds.

Furthermore, the policy emphasizes prompt claims resolution. Airbnb understands the importance of timely assistance in the event of an insurance claim. To this end, it has implemented efficient claims processes, leveraging technology and a dedicated claims team to provide swift responses and resolutions to insurance-related issues.

| Insurance Coverage | Key Benefits |

|---|---|

| Host Liability Insurance | Covers hosts against third-party claims for bodily injury or property damage. |

| Host Guarantee | Reimburses guests for property damage caused by a host up to a specified limit. |

| Guest Medical Expenses | Provides financial coverage for guests' medical treatment during their stay. |

| Lost/Damaged Belongings | Facilitates claims for lost or damaged personal items, offering potential reimbursement. |

How the Airbnb Insurance Policy Works

Understanding how the Airbnb insurance policy operates is crucial for hosts and guests alike. This section will provide a step-by-step guide to the insurance process, from activation to claims resolution.

Activation of Insurance Coverage

For hosts, insurance coverage is typically activated automatically when they list their property on the Airbnb platform. However, it’s essential to review the terms and conditions to ensure a clear understanding of the coverage limits and exclusions. Hosts can also explore additional insurance options to enhance their protection, such as purchasing separate rental insurance policies.

Guests, on the other hand, may need to take specific actions to activate their insurance coverage. While Airbnb provides basic insurance protection, guests can often opt for enhanced coverage by purchasing travel insurance through third-party providers. This additional insurance can offer more comprehensive protection, including coverage for trip cancellations, delays, and medical emergencies.

Filing an Insurance Claim

In the event of an insurance-related incident, both hosts and guests must follow specific procedures to file a claim. Airbnb provides detailed guidelines on its website, outlining the necessary steps and documentation required for a successful claim.

For hosts, the process typically involves submitting a claim form, providing evidence of the damage or liability, and cooperating with Airbnb's claims team. It's crucial for hosts to respond promptly to any inquiries and provide accurate information to facilitate a swift resolution.

Guests, when filing a claim, will need to gather relevant evidence, such as photographs of damaged property or medical records for injury-related claims. They should also maintain open communication with Airbnb's support team to ensure a smooth claims process.

It's important to note that while Airbnb's insurance policy offers a robust safety net, it does have certain limitations and exclusions. These may include pre-existing conditions, intentional damage, or situations arising from illegal activities. Understanding these limitations is crucial to managing expectations and ensuring a fair claims process.

Case Studies: Real-World Applications of the Airbnb Insurance Policy

To illustrate the practical impact of the Airbnb insurance policy, let’s explore a few case studies that demonstrate its effectiveness in real-world scenarios.

Host Liability Coverage in Action

Consider the case of John, an Airbnb host who accidentally left a faulty appliance unattended, resulting in a fire that caused significant property damage. In this scenario, John’s host liability insurance coverage would kick in, providing him with financial protection against potential third-party claims. The insurance policy would cover the costs associated with repairing the damage and any legal expenses arising from the incident.

Guest Medical Expense Reimbursement

Imagine a guest, Sarah, who slips and falls in the shower during her Airbnb stay, sustaining minor injuries. Sarah’s medical expenses would be covered by the Airbnb insurance policy’s guest medical expense provision. This coverage ensures that Sarah receives the necessary medical treatment without incurring significant financial burden.

Lost Belongings Claims

Another common scenario involves guests reporting lost or stolen belongings during their stay. In such cases, the Airbnb insurance policy’s lost/damaged belongings coverage comes into play. While it may not directly compensate for the lost items, it facilitates a claims process that can lead to reimbursement. This aspect of the policy provides guests with a sense of security and supports their efforts to recover their belongings or receive compensation.

Future Implications and Industry Insights

As the short-term rental market continues to evolve, the role of insurance within the Airbnb ecosystem is poised to undergo significant transformations. Industry experts anticipate several key trends and developments that will shape the future of Airbnb’s insurance policy.

Expanding Coverage Options

Airbnb is likely to enhance its insurance offerings to cater to a wider range of user needs. This may include introducing more specialized coverages, such as business travel insurance for corporate guests or extended liability protection for hosts with high-value properties. By diversifying its insurance portfolio, Airbnb can better serve its diverse user base and address emerging market demands.

Integration of Technology

The integration of advanced technologies is expected to play a pivotal role in the future of Airbnb’s insurance policy. This includes the use of artificial intelligence (AI) and machine learning algorithms to streamline claims processing, enhance fraud detection, and improve overall efficiency. Additionally, the adoption of blockchain technology may revolutionize how insurance transactions are recorded and verified, enhancing security and transparency.

Collaborations and Partnerships

Airbnb is likely to forge strategic partnerships with leading insurance providers to offer its users even more comprehensive coverage. These collaborations can lead to the development of tailored insurance products that seamlessly integrate with the Airbnb platform, providing users with a seamless and convenient insurance experience.

Regulatory Changes and Compliance

The evolving regulatory landscape surrounding short-term rentals will also impact Airbnb’s insurance policy. As governments and regulatory bodies introduce new rules and guidelines, Airbnb will need to adapt its insurance offerings to remain compliant. This may involve adjusting coverage limits, expanding liability protections, or introducing additional rider policies to address specific regional requirements.

What are the coverage limits for Airbnb’s host liability insurance?

+Airbnb’s host liability insurance typically provides coverage up to a limit of $1,000,000 per occurrence for bodily injury or property damage claims. However, it’s important to note that this limit may vary based on the host’s location and specific rental circumstances.

Are there any exclusions in Airbnb’s insurance policy?

+Yes, Airbnb’s insurance policy does have certain exclusions. These may include pre-existing conditions, intentional damage, or situations arising from illegal activities. It’s crucial to review the policy’s terms and conditions to understand the specific exclusions that apply to your situation.

Can I purchase additional insurance coverage through Airbnb?

+While Airbnb provides basic insurance protection, it also offers hosts and guests the option to purchase additional coverage through third-party providers. This allows users to tailor their insurance protection to their specific needs and preferences.