Comprehensive General Liability Insurance

In the realm of business operations, protecting your enterprise against unforeseen risks and liabilities is paramount. Comprehensive General Liability Insurance (CGLI) stands as a cornerstone of this protection strategy, offering a robust safety net for businesses of all sizes and industries. This form of insurance is designed to shield businesses from a wide array of potential liabilities that could arise during the course of their operations. From slip-and-fall accidents on company premises to legal battles arising from slanderous statements, CGLI provides a vital layer of financial protection, ensuring that businesses can continue to operate smoothly even in the face of unexpected events.

Understanding Comprehensive General Liability Insurance

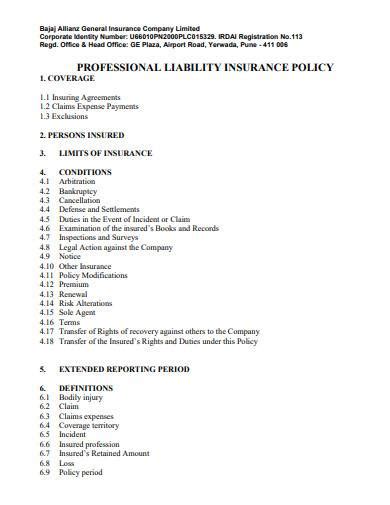

Comprehensive General Liability Insurance is a type of business insurance that offers broad protection against various types of claims, including bodily injury, property damage, personal and advertising injury, and other common liabilities. It is designed to cover the costs associated with legal defense and potential settlements or judgments resulting from these claims. CGLI is a vital tool for businesses to mitigate financial risks and maintain their operational stability.

The concept of comprehensive coverage in liability insurance is crucial. It ensures that the policyholder is protected against a wide range of potential incidents, providing a safety net that covers many types of common liability risks. This all-encompassing approach to insurance coverage is particularly beneficial for businesses that operate in complex or high-risk environments, as it reduces the need for multiple specialized insurance policies.

Key Components of CGLI

- Bodily Injury: Covers medical expenses and legal costs arising from injuries to customers, visitors, or employees on the insured’s premises or due to the insured’s operations.

- Property Damage: Provides coverage for damages to the property of others caused by the insured’s business activities, including repair or replacement costs.

- Personal and Advertising Injury: Protects against claims of libel, slander, copyright infringement, and other forms of personal injury arising from the insured’s advertising or marketing efforts.

- Medical Payments: Offers coverage for medical expenses of injured individuals, regardless of fault, up to a specified limit.

The importance of these key components cannot be overstated. Each aspect of CGLI plays a critical role in protecting the insured business from a wide array of potential liabilities. By understanding these components and tailoring the insurance policy to the specific needs and risks of the business, companies can ensure they have adequate coverage in place.

Benefits and Advantages of Comprehensive General Liability Insurance

Comprehensive General Liability Insurance offers a myriad of benefits that significantly contribute to the financial stability and peace of mind of business owners. Firstly, it provides crucial protection against a wide range of liability claims, including those that might arise from unexpected events or accidents. This broad coverage ensures that businesses are shielded from potentially devastating financial losses.

Secondly, CGLI plays a vital role in risk management. By identifying and addressing potential liabilities, businesses can proactively mitigate risks and implement measures to prevent incidents from occurring in the first place. This not only reduces the likelihood of claims but also fosters a culture of safety and responsibility within the organization.

Risk Mitigation and Management Strategies

Effective risk mitigation and management are integral to the success and longevity of any business. Comprehensive General Liability Insurance forms a critical component of this strategy by offering financial protection against unforeseen events. However, it is important to note that CGLI is just one piece of the puzzle. To fully protect their interests, businesses should employ a multi-faceted approach that combines insurance coverage with proactive risk management strategies.

One key aspect of risk management is conducting regular risk assessments. This involves identifying potential hazards and vulnerabilities within the business operations and environment. By understanding these risks, businesses can implement targeted strategies to minimize their impact. This may include investing in safety equipment, implementing comprehensive training programs, or adopting best practices to prevent accidents and injuries.

| Risk Assessment Strategies | Examples |

|---|---|

| Hazard Identification | Identifying trip hazards, chemical risks, or machinery malfunctions. |

| Safety Audits | Conducting regular audits to ensure compliance with safety standards and regulations. |

| Employee Training | Providing comprehensive safety training to reduce the risk of accidents and incidents. |

Tailoring CGLI to Your Business Needs

Every business is unique, and its insurance needs should reflect this individuality. Comprehensive General Liability Insurance can be customized to address the specific risks and challenges faced by different industries and businesses. This customization ensures that the policy provides the most relevant and effective coverage, taking into account the nature of the business operations, the level of public interaction, and the potential for liability claims.

Industry-Specific Considerations

When tailoring CGLI to your business, it’s crucial to consider the unique aspects of your industry. Different industries come with their own set of risks and liabilities. For instance, a construction company may face higher risks of bodily injury or property damage claims due to the nature of their work, while a technology startup might face more complex personal and advertising injury risks related to intellectual property or data privacy.

By understanding these industry-specific risks, businesses can work with their insurance providers to tailor their CGLI policies accordingly. This might involve increasing coverage limits in certain areas, adding specific endorsements or riders to address unique risks, or even seeking out specialized insurance products designed for their industry.

| Industry | Potential Risks | Tailored CGLI Considerations |

|---|---|---|

| Construction | Bodily injury, property damage | Higher limits for bodily injury and property damage, endorsements for completed operations |

| Healthcare | Professional liability, personal injury | Professional liability coverage, endorsements for patient privacy |

| Retail | Slip and fall accidents, product liability | Increased limits for bodily injury, product liability insurance |

The Role of CGLI in Business Operations

Comprehensive General Liability Insurance is not just a legal requirement or a financial safeguard; it is an integral part of a business’s operational strategy. It provides the peace of mind that allows business owners and managers to focus on their core competencies and growth initiatives without constantly worrying about the financial repercussions of unforeseen events.

Furthermore, CGLI can enhance a business's reputation and credibility. In today's competitive landscape, customers and partners are increasingly conscious of the ethical and responsible practices of the businesses they engage with. By demonstrating a commitment to risk management and liability protection, businesses can build trust and confidence with their stakeholders.

Reputation and Credibility Enhancement

In the competitive business world, reputation and credibility are invaluable assets. Comprehensive General Liability Insurance plays a pivotal role in enhancing and safeguarding these assets. By providing a robust financial safety net against potential liabilities, CGLI demonstrates a business’s commitment to ethical practices and responsible risk management.

This commitment to liability protection can have a significant impact on a company's reputation. It signals to customers, partners, and stakeholders that the business is proactive in mitigating risks and is prepared to handle any unforeseen incidents that may arise. This level of preparedness not only inspires confidence but also sets the business apart as a responsible and trustworthy entity in its industry.

Moreover, in an era where corporate social responsibility is a key consideration for many consumers and investors, having comprehensive liability insurance can be a differentiator. It showcases the business's dedication to operating ethically and responsibly, which can have a positive impact on its brand image and market standing.

Conclusion: Securing Your Business with Comprehensive General Liability Insurance

In conclusion, Comprehensive General Liability Insurance is a critical component of any business’s risk management strategy. It provides a vital layer of protection against a wide range of potential liabilities, ensuring the financial stability and continuity of operations. By understanding the key components of CGLI, tailoring the policy to your business’s unique needs, and implementing effective risk management strategies, you can secure your business against unforeseen events and maintain a strong reputation in the marketplace.

FAQs

What is the difference between General Liability Insurance and Comprehensive General Liability Insurance?

+General Liability Insurance is a broad form of business insurance that covers common liability risks. However, Comprehensive General Liability Insurance goes a step further by providing more extensive coverage, including higher limits and additional endorsements to address a wider range of potential risks.

Is Comprehensive General Liability Insurance mandatory for all businesses?

+While it is not legally mandated for all businesses, Comprehensive General Liability Insurance is highly recommended. It provides crucial protection against a wide array of liabilities, ensuring that businesses can continue to operate smoothly even in the face of unexpected events.

How can I determine the appropriate coverage limits for my business’s CGLI policy?

+Determining coverage limits should be based on a thorough assessment of your business’s specific risks and potential liabilities. It’s advisable to consult with an insurance professional who can guide you in selecting appropriate limits that provide adequate protection without being excessive.

Are there any exclusions or limitations to Comprehensive General Liability Insurance coverage?

+Yes, like any insurance policy, CGLI has certain exclusions and limitations. These may include intentional acts, contract-related liabilities, and specific types of professional services. It’s important to carefully review the policy documents to understand the scope of coverage and any potential exclusions.