Are Cd Fdic Insured

In the world of finance and banking, ensuring the security of one's assets is paramount. One common question that arises is whether certificates of deposit (CDs) are insured by the Federal Deposit Insurance Corporation (FDIC). This article aims to delve into the intricacies of CD insurance, exploring the mechanisms, limits, and considerations associated with this crucial aspect of personal finance.

Understanding FDIC Insurance for CDs

The FDIC, a United States government corporation, plays a pivotal role in safeguarding depositors’ funds. It was established during the Great Depression to restore trust in the banking system and prevent widespread bank failures. Since its inception, the FDIC has insured deposits across a wide range of financial institutions, providing a safety net for individuals and businesses.

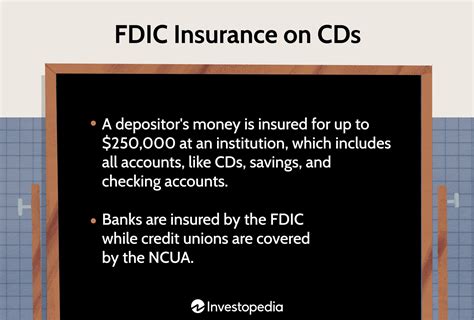

When it comes to CDs, the FDIC insurance coverage is an essential aspect to consider. A CD, or certificate of deposit, is a type of savings account that offers a fixed interest rate for a specified term. These accounts are popular among investors seeking a safe and predictable return on their money. The FDIC insurance extends to CDs, ensuring that depositors' funds are protected in the event of a bank failure.

How FDIC Insurance Works for CDs

FDIC insurance for CDs functions by providing coverage up to a certain limit per depositor, per insured bank, and per ownership category. This means that even if a bank fails, depositors’ funds are protected up to the insured limit, offering peace of mind and financial security.

The coverage limit for FDIC insurance has evolved over the years. As of my last update, the standard insurance amount is $250,000 per depositor, per insured bank, and per ownership category. This means that an individual with multiple accounts at the same bank is insured for up to $250,000 across those accounts. Similarly, joint accounts, trust accounts, and business accounts are also insured up to this limit.

| Ownership Category | Insurance Limit |

|---|---|

| Single Account | $250,000 |

| Joint Account | $250,000 |

| Trust Account | $250,000 |

| Business Account | $250,000 |

CDs and FDIC Insurance: Key Considerations

While FDIC insurance provides a robust safety net for CDs, there are a few key considerations to keep in mind:

- Insurance Limits: As mentioned, the standard insurance limit is $250,000. If you have more than this amount in CDs, consider diversifying your accounts across different banks to ensure full coverage.

- Account Ownership: The insurance limit applies to each ownership category. This means that if you have multiple accounts in different ownership categories (e.g., single, joint, trust), each category is insured separately.

- CD Term and Early Withdrawal: CDs typically have a fixed term, and early withdrawal may result in penalties. However, in the event of a bank failure, the FDIC may provide early access to insured funds, allowing depositors to transfer their funds to another institution.

- Coverage Exclusions: While FDIC insurance covers a wide range of deposit products, certain investments and accounts are not insured. This includes investments in stocks, bonds, mutual funds, life insurance policies, and annuities. It's crucial to understand the coverage limits and exclusions to make informed financial decisions.

Maximizing FDIC Insurance for CD Investors

For individuals and businesses looking to maximize the benefits of FDIC insurance for their CD investments, there are several strategies to consider:

Diversify Across Banks

To ensure that all your CD funds are fully insured, consider spreading your deposits across multiple banks. By doing so, you can take advantage of the separate insurance coverage provided by the FDIC for each institution. This strategy allows you to exceed the standard insurance limit by utilizing multiple banks.

Utilize Different Ownership Categories

As mentioned earlier, the FDIC insurance limit applies separately to each ownership category. By opening CDs in different ownership categories, such as single, joint, trust, or business accounts, you can effectively increase the overall insurance coverage for your funds. This strategy provides an additional layer of protection and peace of mind.

Explore CDARS and ICS

For those seeking convenience and simplicity, two programs offered by the FDIC can help maximize insurance coverage for CDs: CDARS (Certificate of Deposit Account Registry Service) and ICS (Insured Cash Sweep). These programs allow depositors to access FDIC insurance coverage for amounts exceeding the standard limit by spreading their funds across multiple banks through a single institution.

- CDARS: This program enables depositors to invest large sums in CDs while maintaining FDIC insurance coverage. The program facilitates the placement of funds in smaller amounts across multiple banks, ensuring full insurance coverage. The depositor receives a single statement and rate, making it a convenient option for high-value CD investments.

- ICS: The Insured Cash Sweep program is designed for businesses and high-net-worth individuals. It allows for the automatic and continuous investment of cash balances in FDIC-insured CDs, providing a seamless and efficient way to maximize insurance coverage.

Future Implications and Regulatory Changes

The landscape of FDIC insurance for CDs is subject to regulatory changes and economic conditions. While the standard insurance limit has remained at $250,000 for several years, it’s important to stay informed about any potential adjustments or temporary increases during economic crises.

Additionally, the FDIC continuously evaluates and updates its policies to adapt to changing financial environments. Depositors should stay informed about any modifications to insurance coverage, eligibility criteria, and reporting requirements to ensure they are making the most of their CD investments.

Conclusion

Understanding the FDIC insurance coverage for CDs is crucial for individuals and businesses seeking to protect their savings. By comprehending the insurance limits, ownership categories, and strategies for maximizing coverage, depositors can make informed decisions about their CD investments. With the right strategies and a thorough understanding of FDIC insurance, investors can enjoy the security and peace of mind that comes with this robust financial protection.

Are all CDs insured by the FDIC?

+Not all CDs are insured by the FDIC. To be eligible for FDIC insurance, the CD must be issued by an FDIC-insured bank. It’s important to verify the bank’s insurance status before investing in a CD.

What happens if my bank fails, and I have CDs exceeding the insurance limit?

+In the event of a bank failure, the FDIC steps in to ensure depositors’ funds. If your CDs exceed the insurance limit, the FDIC may work with other banks to provide early access to insured funds, allowing you to transfer your funds to a new institution.

Can I combine my CD accounts with my spouse to increase insurance coverage?

+Yes, you can combine CD accounts with your spouse to increase insurance coverage. By opening joint CD accounts, you can take advantage of the separate insurance limit for each joint account, effectively doubling the coverage.