Affordable Auto Insurance California

When it comes to auto insurance, California residents often seek out the best options that offer a balance between comprehensive coverage and affordability. The Golden State's unique regulations and diverse landscape present a challenging task for drivers searching for insurance plans that fit their needs and budgets. This guide aims to navigate through the intricacies of the California insurance market, providing an in-depth analysis and expert insights to help you secure the most suitable and cost-effective auto insurance coverage.

Understanding California’s Auto Insurance Landscape

California’s auto insurance market is characterized by a range of providers, each offering distinct coverage options and pricing structures. With a mandate for all drivers to carry liability insurance, understanding the state’s minimum requirements is crucial. These requirements serve as a baseline, but many drivers opt for additional coverage to protect themselves and their vehicles more comprehensively.

The state's Department of Insurance provides a wealth of resources to assist drivers in navigating the insurance landscape. They offer insights into average rates, consumer protections, and tips for comparing policies. This information is invaluable for consumers, empowering them to make informed decisions and potentially save on their insurance premiums.

California’s Minimum Insurance Requirements

California’s minimum liability insurance requirements are designed to protect both drivers and pedestrians in the event of an accident. These requirements dictate the following coverage limits:

- Bodily Injury Liability: 15,000 per person, 30,000 per accident.

- Property Damage Liability: $5,000 per accident.

While these minimums provide a basic level of protection, many drivers opt for higher limits to ensure they're adequately covered in the event of a serious accident. The state also requires drivers to carry uninsured/underinsured motorist coverage, which protects them in the event of an accident with a driver who doesn't have enough insurance to cover the damages.

Factors Influencing Auto Insurance Rates in California

Several factors play a significant role in determining auto insurance rates in California. These include the driver’s age, gender, driving record, and the type of vehicle insured. Additionally, the zip code where the vehicle is garaged can significantly impact rates, as certain areas may have higher rates of accidents or theft.

Insurance companies also consider the driver's credit score when calculating premiums. Studies have shown that individuals with lower credit scores tend to file more insurance claims, leading to higher premiums for this demographic. However, California has regulations in place to limit the extent to which insurance companies can use credit scores as a factor in setting rates.

| Average Annual Premium by Age | $ Amount |

|---|---|

| Under 25 | $2,500 |

| 25-49 | $1,500 |

| 50-64 | $1,200 |

| 65 and above | $1,100 |

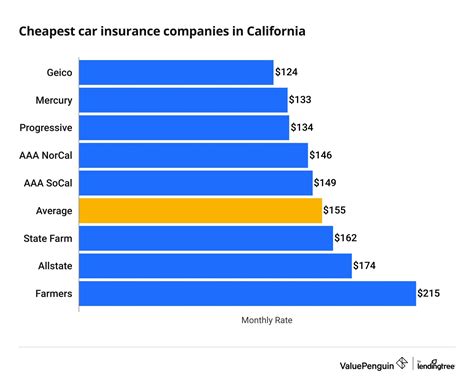

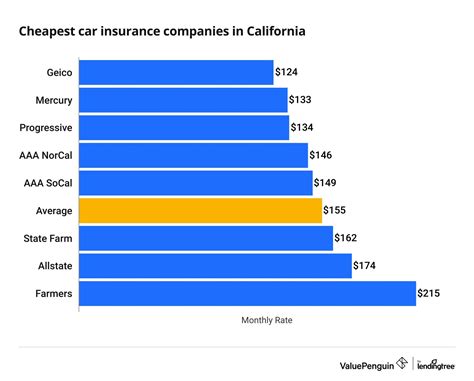

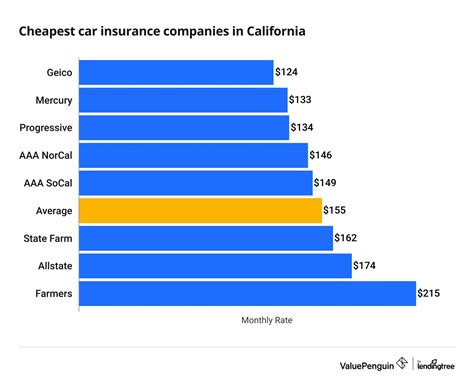

It's worth noting that California's insurance market is highly competitive, which can work in favor of consumers. By comparing quotes from multiple providers, drivers can often find significant variations in pricing for similar coverage levels. Online comparison tools and insurance brokers can be valuable resources in this regard.

Strategies for Securing Affordable Auto Insurance in California

Navigating California’s auto insurance landscape to find affordable coverage requires a strategic approach. Here are some expert tips to help you secure the best rates:

Compare Quotes from Multiple Providers

The California insurance market is diverse, with numerous providers offering a range of coverage options and pricing structures. By comparing quotes from multiple insurers, you can identify the most competitive rates for your specific circumstances. Online comparison tools and insurance brokers can streamline this process, providing a comprehensive overview of the market in a matter of minutes.

Utilize Discounts

Insurance companies offer a variety of discounts that can significantly reduce your premiums. These discounts may be based on factors such as your driving record, vehicle safety features, and even your professional affiliations. Some insurers also provide discounts for bundling multiple policies, such as auto and home insurance. It’s essential to inquire about all available discounts when obtaining quotes to ensure you’re taking advantage of every opportunity to save.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is a relatively new concept that offers potential savings for drivers with safe driving habits. These policies use telematics devices or smartphone apps to monitor your driving behavior, such as mileage, time of day, and abrupt braking. If your driving habits are considered low-risk, you may be eligible for significant premium discounts.

Usage-based insurance can be particularly beneficial for young drivers, who often face higher insurance premiums due to their perceived risk. By demonstrating safe driving habits, these drivers can potentially reduce their premiums significantly.

Shop Around Regularly

Insurance rates are not set in stone and can change over time. It’s essential to regularly review your insurance policy and shop around for better rates. Insurance companies frequently update their rates and policies, and you may find that a provider you previously considered too expensive now offers more competitive rates. By staying informed and comparing quotes regularly, you can ensure you’re always getting the best value for your insurance premium.

Maintain a Clean Driving Record

Your driving record is a significant factor in determining your insurance premiums. A clean driving record, free of accidents and traffic violations, can lead to lower premiums. Conversely, a history of accidents or traffic violations can significantly increase your insurance costs. It’s essential to drive safely and obey traffic laws to maintain a positive driving record and keep your insurance premiums as low as possible.

The Future of Auto Insurance in California

The auto insurance landscape in California is constantly evolving, influenced by technological advancements, changing consumer behaviors, and regulatory updates. Here’s a glimpse into the potential future of auto insurance in the Golden State:

Increased Adoption of Telematics and Usage-Based Insurance

Telematics and usage-based insurance are gaining traction in the California market. As more drivers embrace the idea of paying for insurance based on their actual driving behavior, insurance companies are likely to expand their offerings in this area. This shift could lead to more personalized insurance rates, rewarding safe drivers with lower premiums.

Integration of Autonomous Vehicle Technology

The rise of autonomous vehicle technology is poised to revolutionize the auto insurance industry. As self-driving cars become more prevalent, insurance policies may need to adapt to cover the unique risks associated with this technology. Insurance companies will likely develop new coverage options to address the specific challenges and benefits of autonomous vehicles.

Enhanced Data Analytics and Personalization

Advancements in data analytics and machine learning will likely enable insurance companies to offer even more personalized insurance policies. By analyzing vast amounts of data, insurers can more accurately assess individual risk profiles and offer tailored coverage options. This level of personalization could lead to more efficient and cost-effective insurance solutions for California drivers.

Frequently Asked Questions

What is the average cost of auto insurance in California?

+The average cost of auto insurance in California varies depending on several factors, including the driver’s age, driving record, and the type of vehicle insured. According to recent data, the average annual premium in California is around $1,500. However, it’s important to note that rates can vary significantly based on individual circumstances.

How can I lower my auto insurance premiums in California?

+There are several strategies to lower your auto insurance premiums in California. These include comparing quotes from multiple providers, utilizing available discounts, considering usage-based insurance, regularly shopping around for better rates, and maintaining a clean driving record. Each of these strategies can potentially reduce your insurance costs significantly.

Are there any state-specific discounts available for auto insurance in California?

+Yes, California offers a variety of state-specific discounts for auto insurance. These may include discounts for good students, mature drivers, and those who complete approved defensive driving courses. Additionally, some insurers offer discounts for vehicles equipped with certain safety features, such as anti-theft devices or advanced driver assistance systems.

What factors determine auto insurance rates in California?

+Several factors influence auto insurance rates in California. These include the driver’s age, gender, driving record, and credit score. The type of vehicle insured, its safety features, and the zip code where the vehicle is garaged also play a significant role. Additionally, insurance companies may consider the driver’s marital status, education level, and professional affiliations when calculating premiums.

How often should I review my auto insurance policy in California?

+It’s recommended to review your auto insurance policy annually or whenever you experience significant life changes, such as moving to a new location, purchasing a new vehicle, or getting married. Regularly reviewing your policy ensures that your coverage remains adequate and that you’re taking advantage of any available discounts or new coverage options.