Aarp Life Insurance Options

When it comes to financial planning and securing a stable future, life insurance plays a crucial role, especially for those approaching retirement age. The AARP (American Association of Retired Persons) understands the unique needs of its members and offers a range of life insurance options tailored specifically for seniors. In this comprehensive guide, we will delve into the various AARP life insurance plans, exploring their features, benefits, and how they can provide peace of mind during your golden years.

Understanding AARP Life Insurance

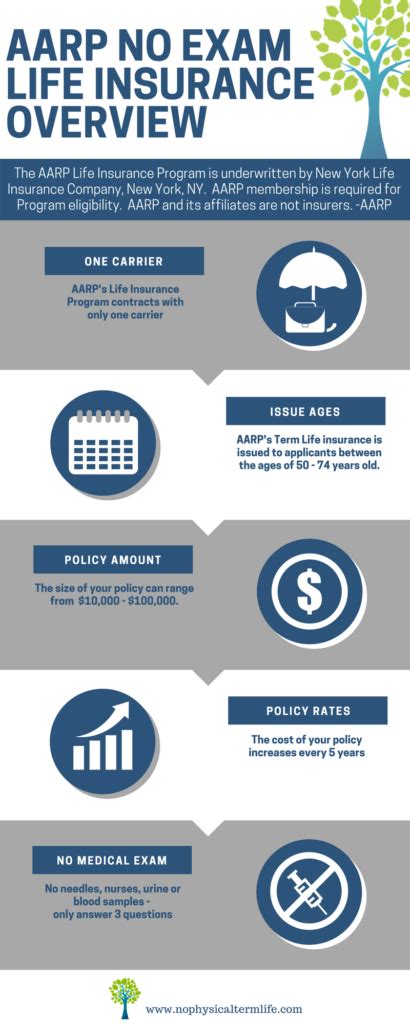

AARP, a renowned organization dedicated to empowering and supporting individuals aged 50 and above, recognizes the importance of financial security. To cater to this demographic, they have partnered with well-established insurance providers to offer a selection of life insurance policies designed to meet diverse needs and circumstances.

The Significance of Life Insurance for Retirees

As individuals transition into retirement, their financial priorities often shift. Life insurance becomes a valuable tool to protect their loved ones, cover potential debts, and ensure a stable financial foundation for their families. Here are some key reasons why life insurance is essential for retirees:

- Funeral and Burial Costs: Planning for end-of-life expenses can provide financial relief to your family during an already emotionally challenging time.

- Debt Repayment: Life insurance proceeds can help repay any outstanding debts, such as mortgages, credit card balances, or personal loans, ensuring your loved ones are not burdened with these financial obligations.

- Legacy and Estate Planning: Life insurance can be a vital component of your estate plan, allowing you to leave a lasting legacy and provide for your beneficiaries.

- Spousal Support: For married couples, life insurance can offer financial security to the surviving spouse, ensuring they have the means to maintain their standard of living.

AARP Life Insurance Options: An In-Depth Exploration

AARP offers a range of life insurance plans to cater to different needs and budgets. Let’s explore some of the most popular options available to its members:

AARP Term Life Insurance

Term life insurance is a popular choice for individuals seeking coverage for a specific period, typically ranging from 10 to 30 years. Here’s what you need to know about AARP’s term life insurance:

- Coverage Options: AARP’s term life insurance plans offer flexible coverage amounts, allowing you to choose the amount that best suits your needs. You can select coverage ranging from 10,000 to 50,000, with some plans offering up to $100,000.

- Affordable Premiums: One of the key advantages of term life insurance is its cost-effectiveness. AARP’s plans provide competitive premiums, making it an accessible option for retirees on a fixed income.

- Renewability: Many AARP term life insurance policies offer the option to renew your coverage, ensuring you can maintain protection as you age. Renewal terms may vary depending on the specific plan.

- Guaranteed Acceptance: Some AARP term life insurance plans offer guaranteed acceptance, meaning you cannot be denied coverage based on your health status. This feature is particularly beneficial for individuals with pre-existing conditions.

| Plan | Coverage Amount | Premium |

|---|---|---|

| AARP Basic Term Life Insurance | $10,000 - $50,000 | Affordable monthly premiums |

| AARP Enhanced Term Life Insurance | $10,000 - $100,000 | Competitive rates with optional riders |

AARP Permanent Life Insurance

Unlike term life insurance, permanent life insurance provides coverage for your entire life, as long as premiums are paid. AARP offers two main types of permanent life insurance:

Whole Life Insurance

- Lifetime Coverage: AARP’s whole life insurance plans guarantee coverage for your entire life, providing peace of mind and financial security.

- Cash Value Accumulation: Whole life insurance policies build cash value over time, which can be borrowed against or withdrawn to meet financial needs.

- Guaranteed Premiums: The premiums for whole life insurance remain fixed throughout the policy, ensuring predictable costs.

Universal Life Insurance

- Flexible Premiums: Universal life insurance allows you to adjust your premium payments and coverage amounts to suit your changing financial circumstances.

- Cash Value Benefits: Similar to whole life insurance, universal life policies accumulate cash value, which can be utilized for various financial needs.

- Policy Customization: AARP’s universal life insurance plans offer flexibility, allowing you to tailor the policy to your specific requirements.

| Plan | Coverage Type | Key Benefits |

|---|---|---|

| AARP Whole Life Insurance | Whole Life | Guaranteed coverage, cash value accumulation, fixed premiums |

| AARP Universal Life Insurance | Universal Life | Flexible premiums, customizable coverage, cash value benefits |

Choosing the Right AARP Life Insurance Plan

Selecting the most suitable AARP life insurance plan depends on various factors, including your financial goals, budget, and personal circumstances. Here are some key considerations to guide your decision:

Coverage Amount

Determine the amount of coverage you require to meet your financial obligations and provide for your loved ones. Consider factors such as outstanding debts, funeral expenses, and any specific financial goals you wish to achieve.

Budget and Premiums

Assess your financial situation and determine how much you can comfortably afford to pay in premiums. AARP’s life insurance plans offer a range of options to suit different budgets, ensuring accessibility for all members.

Health and Medical History

Your health status plays a role in determining the type of coverage you can obtain. AARP offers both guaranteed acceptance plans and medically underwritten options. If you have pre-existing conditions, guaranteed acceptance plans may be a better fit.

Policy Flexibility

Consider whether you require a policy with flexible terms or if a more straightforward, fixed coverage plan suits your needs. AARP’s permanent life insurance plans offer customization options, while term life insurance provides simplicity and affordability.

Additional Benefits and Riders

Some AARP life insurance plans offer optional riders, such as accelerated death benefit riders for terminal illness or accidental death benefit riders. Evaluate if these additional benefits align with your specific circumstances.

Applying for AARP Life Insurance

The application process for AARP life insurance is straightforward and can be completed online or over the phone. Here’s a step-by-step guide to help you get started:

- Eligibility: Ensure you meet the eligibility criteria, which typically includes being an AARP member aged 50 or older.

- Choose a Plan: Review the available AARP life insurance plans and select the one that best aligns with your coverage needs and budget.

- Gather Information: Prepare the necessary documentation, such as proof of identity, and have your medical history readily available.

- Complete the Application: Fill out the online application form or contact an AARP representative to guide you through the process. Provide accurate and honest information to ensure a smooth application.

- Medical Examination (if required): Depending on the plan and your health status, you may need to undergo a medical examination. Follow the instructions provided by the insurance provider.

- Review and Sign Documents: Carefully review the policy documents and ensure you understand the terms and conditions. Sign the necessary paperwork to finalize your coverage.

- Pay Premiums: Set up your premium payments, either through automatic deductions or by making payments manually.

Conclusion

AARP life insurance options provide retirees with a comprehensive range of coverage choices to secure their financial future and protect their loved ones. Whether you opt for the affordability and simplicity of term life insurance or the long-term benefits of permanent life insurance, AARP’s plans offer peace of mind during your retirement years. By understanding your needs and carefully evaluating the available options, you can make an informed decision and ensure your financial stability for years to come.

FAQ

Can I apply for AARP life insurance if I am not an AARP member?

+No, AARP life insurance plans are exclusively available to AARP members. However, becoming an AARP member is relatively straightforward, and you can easily enroll through their website or by contacting their membership team.

Are there any age restrictions for AARP life insurance plans?

+Yes, AARP life insurance plans are typically designed for individuals aged 50 and older. However, some plans may have specific age requirements, so it’s essential to review the eligibility criteria for each plan.

Can I add my spouse to my AARP life insurance policy?

+Yes, many AARP life insurance plans offer the option to add a spouse or domestic partner as a beneficiary. Additionally, some plans allow you to purchase separate coverage for your spouse, providing comprehensive protection for your entire family.