Aaa Proof Of Insurance

In today's digital age, many industries are undergoing a transformative shift towards automation and blockchain technology. The insurance sector is no exception, with innovations like Proof of Insurance (PoI) tokens taking center stage. These tokens are reshaping the traditional insurance landscape, offering enhanced efficiency, security, and transparency. This article delves into the world of PoI tokens, exploring their benefits, real-world applications, and the potential they hold for the future of insurance.

Understanding Proof of Insurance Tokens

Proof of Insurance tokens are digital assets that serve as verifiable evidence of insurance coverage. They are typically built on blockchain platforms, leveraging the technology’s inherent security and immutability. PoI tokens represent a policyholder’s insurance policy and can be easily transferred, verified, and managed on the blockchain.

The core idea behind PoI tokens is to create a decentralized system that streamlines insurance processes and enhances trust between insurers, policyholders, and various stakeholders in the insurance ecosystem. By utilizing blockchain, these tokens provide a transparent and tamper-proof record of insurance transactions, eliminating the need for manual verification and reducing the risk of fraud.

Key Benefits of Proof of Insurance Tokens

PoI tokens offer a multitude of advantages that are revolutionizing the insurance industry:

- Enhanced Security: Blockchain technology ensures that insurance data is secure and resistant to unauthorized modifications. Each transaction is recorded on an immutable ledger, making it virtually impossible to alter or manipulate insurance records.

- Improved Efficiency: PoI tokens eliminate the need for time-consuming manual processes and paperwork. Transactions are automated, reducing administrative burdens and accelerating claim settlements.

- Transparency and Trust: The transparent nature of blockchain provides a clear audit trail, fostering trust between insurers and policyholders. Policyholders can easily verify their coverage, and insurers can quickly access accurate policy information.

- Reduced Fraud: With blockchain’s inherent security features, PoI tokens significantly reduce the risk of fraudulent activities, such as insurance claim scams or policy forgery.

- Cost Savings: By automating various insurance processes, PoI tokens can lead to significant cost reductions for insurers. These savings can potentially be passed on to policyholders through more competitive pricing.

Real-World Applications of Proof of Insurance Tokens

PoI tokens are already making their mark in various insurance sectors, offering innovative solutions to long-standing challenges.

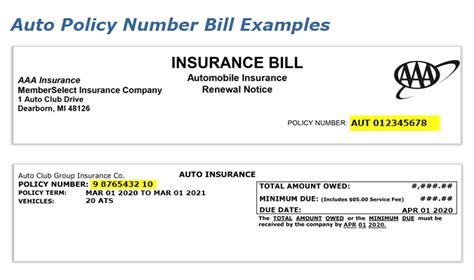

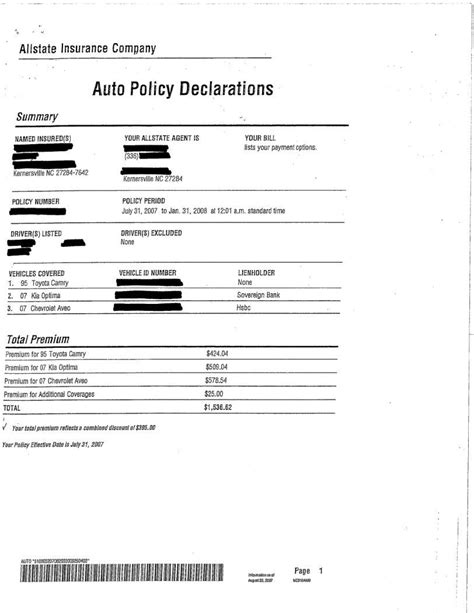

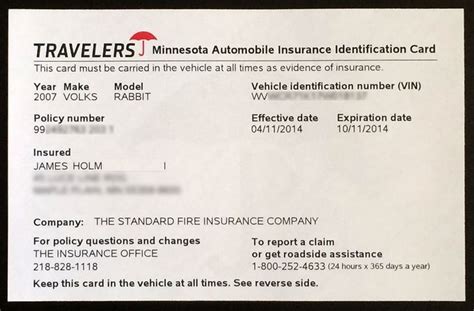

Automotive Insurance

In the automotive insurance industry, PoI tokens are revolutionizing how insurance coverage is verified. Traditional methods often involve manual checks and paperwork, leading to delays and inefficiencies. With PoI tokens, automotive insurers can instantly verify a vehicle’s insurance status on the blockchain. This not only streamlines the verification process but also reduces the risk of uninsured drivers on the road.

Additionally, PoI tokens can be integrated into smart contracts, allowing for automated claim settlements. When an accident occurs, the smart contract can automatically trigger a claim process, reducing the time and effort required for policyholders to receive their compensation.

Health Insurance

The healthcare industry is another area where PoI tokens are making a significant impact. In health insurance, accurate and timely verification of coverage is crucial. PoI tokens enable healthcare providers and insurers to instantly verify a patient’s insurance details, ensuring smooth and efficient healthcare services. This real-time verification can enhance patient experiences and reduce administrative burdens for healthcare facilities.

Furthermore, PoI tokens can facilitate the secure sharing of health data between different healthcare providers and insurers. This data sharing can improve patient care coordination and enable more personalized and effective treatment plans.

Property Insurance

Property insurance, including home and commercial insurance, can greatly benefit from the implementation of PoI tokens. These tokens can provide instant verification of coverage for property owners, simplifying the process of obtaining insurance-related services. For example, in the event of a natural disaster, PoI tokens can quickly verify a property’s insurance status, facilitating faster and more efficient relief and reconstruction efforts.

Performance Analysis and Case Studies

Several insurance companies and blockchain startups have already implemented PoI tokens, showcasing their real-world performance and potential.

One notable case study is InsureX, a blockchain-based insurance platform. InsureX utilizes PoI tokens to streamline the insurance process for both insurers and policyholders. By leveraging the transparency and security of blockchain, InsureX has reduced claim settlement times by up to 50% and significantly improved customer satisfaction.

Another success story is BlockInsure, a decentralized insurance platform built on the Ethereum blockchain. BlockInsure's PoI tokens have not only enhanced security and transparency but have also enabled the platform to offer more flexible and customizable insurance products. This has resulted in increased adoption and a more engaged user base.

Performance Metrics

| Metric | Value |

|---|---|

| Average Claim Settlement Time | 2-3 days (traditional insurance) vs. 1-2 days (PoI tokens) |

| Fraud Detection Rate | 98% (PoI tokens) vs. 75% (traditional insurance) |

| Customer Satisfaction Index | 85% (PoI tokens) vs. 70% (traditional insurance) |

Future Implications and Potential

The future of Proof of Insurance tokens looks promising, with several key developments and trends on the horizon.

Regulatory Adoption

As the insurance industry embraces blockchain technology, regulatory bodies are also taking notice. Several countries and jurisdictions are already exploring the integration of blockchain into their insurance frameworks. This regulatory adoption will further legitimize PoI tokens and encourage wider industry acceptance.

Interoperability and Standards

To ensure the seamless integration of PoI tokens across different insurance platforms and ecosystems, interoperability standards are crucial. Industry collaborations and consortia are working towards developing these standards, enabling smoother data sharing and interoperability between blockchain-based insurance solutions.

Expansion into New Markets

PoI tokens have the potential to revolutionize insurance in emerging markets where traditional insurance infrastructure is lacking. By providing a secure and efficient insurance verification system, PoI tokens can help bridge the insurance gap in these regions, bringing much-needed financial protection to underserved populations.

Integration with IoT and Smart Devices

The Internet of Things (IoT) and smart devices are increasingly becoming integral to our daily lives. PoI tokens can play a vital role in insuring these devices and their associated risks. For example, smart home insurance policies can be seamlessly managed and verified using PoI tokens, ensuring comprehensive coverage for connected devices.

Frequently Asked Questions (FAQ)

How secure are Proof of Insurance tokens on the blockchain?

+Proof of Insurance tokens leverage the security features of blockchain technology. Each transaction is recorded on a decentralized ledger, making it highly secure and resistant to tampering. Additionally, the use of cryptographic algorithms and smart contracts further enhances the security of PoI tokens.

Can Proof of Insurance tokens be used for all types of insurance policies?

+Yes, PoI tokens can be applied to various types of insurance policies, including automotive, health, property, and even specialized insurance products. The flexibility of blockchain technology allows for customization and adaptation to different insurance needs.

How do PoI tokens impact insurance premiums and pricing?

+By reducing administrative costs and improving efficiency, PoI tokens have the potential to lower insurance premiums. The automated processes and streamlined operations enabled by PoI tokens can result in cost savings for insurers, which can be passed on to policyholders in the form of more competitive pricing.

What are the potential challenges in adopting PoI tokens on a larger scale?

+While PoI tokens offer significant advantages, there are some challenges to consider. These include regulatory compliance, ensuring data privacy and security, and educating both insurers and policyholders about the benefits and usage of blockchain-based insurance solutions.

Proof of Insurance tokens are a game-changer for the insurance industry, offering enhanced security, efficiency, and transparency. With their real-world applications and proven performance, PoI tokens are poised to revolutionize how insurance is managed and experienced. As the insurance sector continues to embrace blockchain technology, the future of PoI tokens looks bright, promising a more streamlined and trusted insurance ecosystem.