Cheap Car And Home Insurance

Securing affordable insurance coverage for your vehicle and home is an essential aspect of financial planning and risk management. With rising costs and diverse coverage options, finding the right insurance policy that fits your budget and needs can be a challenging task. This comprehensive guide aims to shed light on the strategies, considerations, and best practices for obtaining cheap car and home insurance without compromising on quality and protection.

Understanding the Factors Influencing Insurance Costs

Before diving into the world of insurance, it’s crucial to grasp the fundamental factors that impact insurance premiums. These include:

- Risk Assessment: Insurance companies evaluate various risk factors associated with your vehicle or home. For cars, this includes your driving history, vehicle type, and usage. For homes, factors like location, construction materials, and security systems play a role.

- Coverage Requirements: The extent of coverage you require directly affects the cost. Comprehensive policies with higher limits tend to be more expensive.

- Demographics: Your age, gender, and marital status can influence insurance rates. Additionally, your occupation and credit score may be considered by some insurers.

- Location: The area where you reside or park your vehicle significantly impacts insurance costs. High-crime or high-accident areas generally result in higher premiums.

Assessing Your Insurance Needs

Determining the right level of coverage is a delicate balance between cost and protection. Consider your financial situation and the potential risks you face. For instance, if you have a new car, you might opt for a comprehensive policy with higher limits to safeguard against accidents and theft. On the other hand, an older vehicle with a lower market value may only require liability coverage.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Covers damages you cause to others and their property. It's mandatory in most states and offers basic protection. |

| Collision Coverage | Pays for repairs or replacement if your vehicle is damaged in an accident, regardless of fault. |

| Comprehensive Coverage | Covers non-collision incidents like theft, vandalism, fire, or natural disasters. It provides broad protection for your vehicle. |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for you and your passengers, regardless of fault. |

| Uninsured/Underinsured Motorist Coverage | Protects you if an at-fault driver lacks sufficient insurance coverage. |

Exploring Ways to Save on Car Insurance

When it comes to car insurance, there are several strategies to reduce costs without sacrificing coverage:

1. Shop Around and Compare Quotes

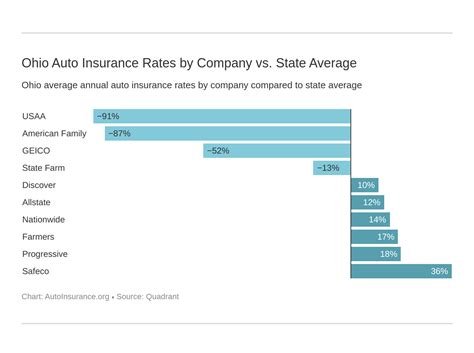

Insurance rates can vary significantly between providers. Utilize online comparison tools and get quotes from multiple insurers. Consider factors like customer satisfaction, claims handling, and financial stability when making your choice.

2. Bundle Policies

If you’re also in the market for home insurance, bundling your car and home policies with the same insurer can lead to substantial discounts. Many insurers offer multi-policy discounts, making it a cost-effective option.

3. Increase Your Deductible

Opting for a higher deductible can lower your insurance premiums. This strategy works best if you have sufficient savings to cover potential out-of-pocket expenses in the event of a claim.

4. Maintain a Clean Driving Record

Insurance companies reward safe drivers with lower premiums. Avoid traffic violations and accidents to keep your record clean and maintain a good driving history.

5. Take Advantage of Discounts

Many insurers offer discounts for various reasons, such as good student discounts, safe driver discounts, and loyalty discounts. Additionally, some companies provide discounts for specific occupations, affiliations, or even for completing defensive driving courses.

Securing Affordable Home Insurance

Finding cheap home insurance requires a similar approach to car insurance, with a focus on assessing risks and coverage needs:

1. Understand Your Coverage Options

Home insurance policies typically cover:

- Dwelling Coverage: Pays for repairs or rebuilding if your home is damaged.

- Personal Property Coverage: Covers your belongings if they are stolen or damaged.

- Liability Coverage: Protects you from lawsuits related to accidents on your property.

- Additional Living Expenses: Covers temporary living expenses if your home is uninhabitable due to a covered incident.

2. Adjust Your Coverage Limits

Review your coverage limits regularly and adjust them as needed. Ensure your limits are adequate to cover the cost of rebuilding or replacing your home and belongings.

3. Maintain a Safe and Secure Home

Implementing safety measures like smoke detectors, fire extinguishers, and security systems can reduce your insurance premiums. Additionally, keeping your home well-maintained can lower the risk of accidents and claims.

4. Consider Higher Deductibles

Similar to car insurance, opting for a higher deductible can lower your home insurance premiums. Assess your financial situation and choose a deductible you’re comfortable with.

Maximizing Savings with Bundled Policies

Bundling your car and home insurance policies with the same insurer is a powerful way to save money. Insurers often offer significant discounts when you combine multiple policies. This strategy not only simplifies your insurance management but also ensures consistent coverage across all your assets.

Expert Tip: Bundle and Save

FAQs

How often should I review my insurance policies?

+It’s recommended to review your insurance policies annually or whenever significant life changes occur, such as buying a new car or home, getting married, or having children. Regular reviews ensure your coverage remains adequate and up-to-date.

Can I switch insurers to save money?

+Absolutely! Shopping around and comparing quotes from different insurers is a great way to find the best deal. Switching insurers can result in significant savings, especially if your current provider has increased your premiums.

What factors can lead to an increase in insurance premiums?

+Several factors can cause insurance premiums to rise, including filing a claim, getting a traffic violation, or moving to a high-risk area. Additionally, inflation and changes in the insurance market can also impact your premiums.

By understanding the factors that influence insurance costs and implementing strategic approaches to secure cheap car and home insurance, you can protect your assets without breaking the bank. Remember to regularly review your policies, stay informed about market changes, and leverage discounts and bundling options to maximize your savings.