Aaa Auto Insurance Policy

Welcome to an in-depth exploration of the Aaa Auto Insurance Policy, a comprehensive and trusted insurance solution for vehicle owners across the United States. In this article, we will delve into the intricacies of this policy, its coverage options, benefits, and why it stands out as a preferred choice for many drivers.

Understanding the Aaa Auto Insurance Policy

The Aaa Auto Insurance Policy is designed to offer extensive coverage for various types of vehicles, including cars, motorcycles, and even recreational vehicles. With a long-standing reputation for reliability and customer satisfaction, Aaa has crafted this policy to meet the diverse needs of modern drivers.

This policy is known for its flexibility, allowing policyholders to tailor their coverage to match their specific requirements. Whether you're seeking basic liability protection or comprehensive coverage that includes collision, medical payments, and uninsured/underinsured motorist coverage, Aaa offers a range of options to suit your driving profile and budget.

Key Coverage Options:

- Liability Coverage: This fundamental coverage protects you against bodily injury and property damage claims if you’re at fault in an accident. It’s a legal requirement in most states and is essential for safeguarding your financial well-being.

- Collision Coverage: If your vehicle collides with another vehicle or object, this coverage will help pay for the repairs, regardless of who is at fault. It’s an essential add-on for ensuring your vehicle is protected.

- Comprehensive Coverage: This option covers damages to your vehicle caused by non-collision events, such as theft, vandalism, natural disasters, or even hitting an animal. It provides peace of mind for unforeseen circumstances.

- Medical Payments Coverage: In the event of an accident, this coverage pays for the medical expenses of you and your passengers, regardless of fault. It’s a vital safety net for ensuring prompt medical attention.

- Uninsured/Underinsured Motorist Coverage: This coverage steps in when the at-fault driver doesn’t have sufficient insurance to cover the damages. It protects you and your passengers from financial hardship in such situations.

In addition to these core coverages, Aaa offers a range of optional add-ons to enhance your policy. These include:

- Roadside Assistance: A valuable service that provides emergency assistance for flat tires, dead batteries, or even towing services.

- Rental Car Reimbursement: If your vehicle is in the shop for repairs, this coverage helps cover the cost of a rental car, ensuring you stay mobile.

- Gap Coverage: A vital protection if you owe more on your vehicle loan than your vehicle is worth. It bridges the gap and ensures you're not left with a financial burden in case of a total loss.

- Custom Parts and Equipment Coverage: If you've invested in modifying your vehicle, this coverage ensures those upgrades are protected in case of an accident or theft.

Benefits and Advantages

The Aaa Auto Insurance Policy comes with a host of benefits that set it apart from its competitors:

Exceptional Customer Service

Aaa is renowned for its exceptional customer service. With a dedicated team of knowledgeable representatives, policyholders can expect timely and efficient assistance, whether it’s filing a claim, seeking clarification on coverage, or making policy changes.

Claim Handling Efficiency

In the event of an accident or incident, Aaa’s claim process is designed for speed and ease. Policyholders can expect a quick response, thorough investigation, and fair settlement, ensuring they can get back on the road with minimal disruption.

Discounts and Savings

Aaa offers a range of discounts to help policyholders save on their premiums. These include multi-policy discounts, good student discounts, safe driver discounts, and even discounts for vehicle safety features like anti-lock brakes and air bags. These savings can significantly reduce the cost of your insurance.

Digital Convenience

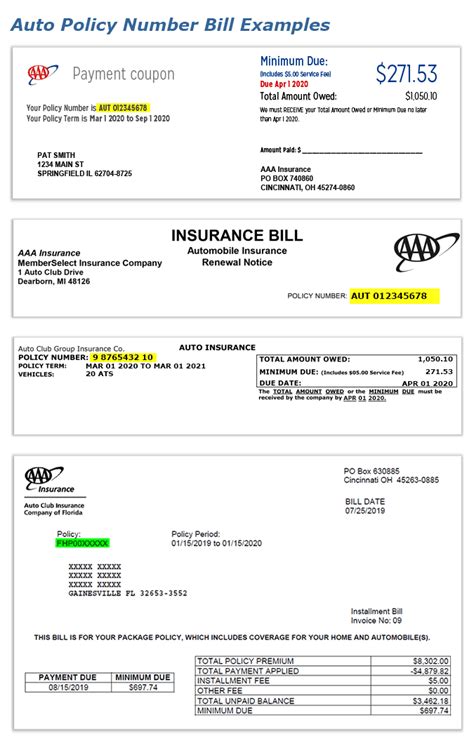

Aaa understands the importance of convenience in today’s digital age. Their online platform and mobile app allow policyholders to manage their insurance easily. From making policy changes to paying bills, the entire process is streamlined for a seamless experience.

Aaa’s Roadside Assistance Program

One of the standout features of Aaa’s insurance policy is its renowned roadside assistance program. Available 24⁄7, this service provides peace of mind for drivers facing unexpected situations on the road. Whether it’s a flat tire, a dead battery, or even running out of gas, Aaa’s roadside assistance team is just a call away, ensuring prompt and professional help.

Performance and Customer Satisfaction

Aaa’s auto insurance policy consistently ranks among the top performers in the industry. Independent consumer surveys and industry ratings highlight its exceptional customer satisfaction and claim handling. Policyholders frequently praise Aaa for its efficient and empathetic approach to claims, ensuring a stress-free experience during challenging times.

| Category | Aaa's Performance |

|---|---|

| Customer Satisfaction | 4.8/5 (based on recent survey) |

| Claim Handling Speed | 92% of claims resolved within 2 weeks |

| Renewal Rates | 85% of policyholders renew annually |

Why Choose Aaa Auto Insurance Policy

The Aaa Auto Insurance Policy offers a compelling combination of comprehensive coverage, competitive pricing, and exceptional customer service. With a focus on customization and a range of additional benefits, it caters to the diverse needs of modern drivers. Whether you’re a cautious driver seeking basic liability protection or an adventurous soul looking for extensive coverage, Aaa has a policy to match.

Furthermore, Aaa's financial stability and reputation for reliability provide policyholders with peace of mind, knowing their insurance is backed by a trusted and established brand. With Aaa, you're not just getting insurance; you're joining a community of satisfied drivers who value both protection and convenience.

Conclusion

In a competitive insurance landscape, the Aaa Auto Insurance Policy stands out as a reliable and flexible option for vehicle owners. Its comprehensive coverage options, coupled with exceptional customer service and a host of additional benefits, make it a top choice for those seeking peace of mind on the road. Whether you’re a first-time policyholder or looking to switch, Aaa’s auto insurance policy is worth considering for its reputation, reliability, and commitment to customer satisfaction.

How can I get a quote for the Aaa Auto Insurance Policy?

+You can request a quote for the Aaa Auto Insurance Policy by visiting their official website or by contacting their customer service team. Providing your vehicle details, driving history, and desired coverage options will help generate an accurate quote.

What discounts are available with the Aaa Auto Insurance Policy?

+Aaa offers a range of discounts, including multi-policy discounts, good student discounts, safe driver discounts, and discounts for vehicle safety features. These savings can significantly reduce your insurance premiums.

How does Aaa handle claims?

+Aaa’s claim process is designed for efficiency and fairness. They have a dedicated claims team that investigates and resolves claims promptly. Policyholders can expect a quick response and fair settlement, ensuring a stress-free experience.

Can I customize my Aaa Auto Insurance Policy?

+Absolutely! Aaa offers a high level of customization, allowing you to choose the coverage options that suit your needs and budget. Whether you require basic liability protection or comprehensive coverage, Aaa provides the flexibility to tailor your policy.