Workmans Compensation Insurance

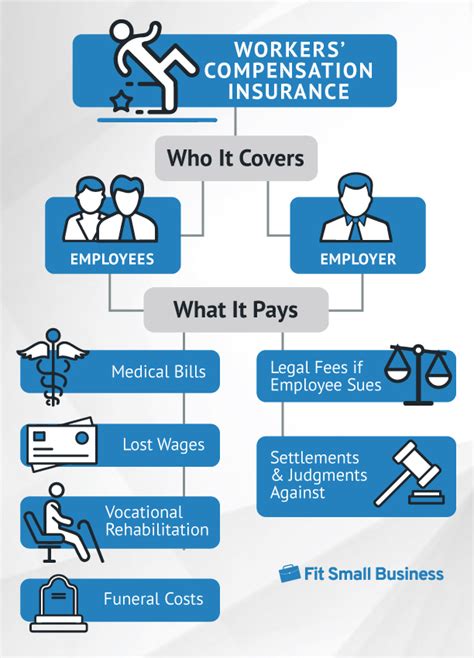

Workman's Compensation Insurance, often referred to as "Workers' Comp," is a vital component of the employment landscape, ensuring the well-being and financial security of workers across various industries. This comprehensive insurance system provides essential coverage for employees who suffer work-related injuries or illnesses, offering a safety net during their recovery and rehabilitation. However, understanding the intricacies of this insurance is crucial, as it varies significantly from one state to another, impacting both employers and employees.

In this extensive guide, we delve deep into the world of Workman's Compensation Insurance, exploring its origins, purpose, and the critical role it plays in modern employment. By the end of this article, you'll have a comprehensive understanding of this insurance, its benefits, and how it operates in different contexts.

The Origins and Purpose of Workman’s Compensation Insurance

Workman’s Compensation Insurance traces its roots back to the early 20th century, emerging as a response to the increasing hazards associated with industrial work. The primary objective of this insurance was to provide a swift and effective means of compensating workers for injuries sustained on the job, without the need for lengthy and often contentious legal battles.

Prior to the establishment of Workman's Compensation Insurance, injured workers had to rely on personal injury lawsuits to seek compensation, a process that was not only time-consuming but also fraught with legal complexities. This system often left workers with limited or no compensation, especially in cases where the fault for the injury was difficult to establish. Recognizing these challenges, lawmakers and industry leaders advocated for a new approach, leading to the birth of Workman's Compensation Insurance.

The core principle behind Workman's Compensation is the trade-off between certainty and liability. By accepting workers' compensation insurance, employees surrender their right to sue their employers for negligence in exchange for guaranteed benefits if they are injured on the job. This system provides a safety net for workers, ensuring they receive prompt medical care and financial support during their recovery, regardless of who was at fault for the accident.

Key Components of Workman’s Compensation Insurance

Workman’s Compensation Insurance is a multifaceted system, comprising several key components that work together to ensure the well-being of employees and the financial stability of employers. Here’s a closer look at these essential elements:

Medical Benefits

One of the cornerstone benefits of Workman’s Compensation Insurance is the coverage it provides for medical expenses related to work injuries. This includes immediate emergency treatment, ongoing medical care, and rehabilitation services. Whether it’s a broken bone, a severe burn, or a repetitive stress injury, Workman’s Compensation ensures that injured workers receive the medical attention they need without incurring substantial financial burdens.

In most states, Workman's Compensation Insurance mandates that employers provide injured workers with a designated healthcare provider or a choice of providers from an approved list. This ensures that employees receive prompt and appropriate medical care, facilitating their recovery and return to work.

Wage Replacement

Another critical aspect of Workman’s Compensation Insurance is the provision of wage replacement benefits. When an employee is injured on the job and unable to work, this insurance steps in to provide a portion of their regular wages, ensuring financial stability during their recovery period. The specific wage replacement rate varies by state and often depends on factors such as the severity of the injury and the worker’s average weekly wage.

In many states, wage replacement benefits are paid out at a set percentage of the employee's pre-injury wages, with the maximum benefit amount typically tied to a state-specific formula. These benefits are designed to bridge the financial gap for injured workers, allowing them to focus on their recovery without the added stress of financial worries.

Vocational Rehabilitation

Workman’s Compensation Insurance often extends beyond medical and wage replacement benefits, encompassing vocational rehabilitation services as well. These services are designed to assist injured workers in returning to work, either in their previous job or in a new role that accommodates their physical limitations or occupational skills.

Vocational rehabilitation can include a range of services, such as job training, skill development, and job placement assistance. By providing these resources, Workman's Compensation Insurance aims to facilitate a seamless transition back to the workforce, ensuring that injured workers can resume their careers and maintain their financial independence.

Death Benefits

In the unfortunate event of a worker’s death due to a work-related injury or illness, Workman’s Compensation Insurance steps in to provide financial support to the worker’s dependents. These death benefits, which vary by state, are designed to compensate for the loss of income and support that the deceased worker would have provided.

The specific death benefits can include a lump-sum payment, ongoing weekly payments, or a combination of both. These benefits are often crucial for the financial stability of the worker's family, helping them navigate the challenges that arise in the aftermath of a tragic workplace incident.

The Role of Workman’s Compensation Insurance in Different Industries

Workman’s Compensation Insurance plays a vital role across a wide range of industries, each with its unique set of occupational hazards and risks. Here’s a closer look at how this insurance operates in some of the most common industries:

Construction Industry

The construction industry is known for its high-risk nature, with workers often facing a range of hazards, including falls, electrocutions, and equipment-related accidents. Workman’s Compensation Insurance is particularly crucial in this sector, providing a safety net for construction workers who sustain injuries on the job.

In construction, Workman's Compensation Insurance covers a broad spectrum of injuries, from minor cuts and strains to more severe accidents resulting in permanent disabilities. The insurance ensures that injured construction workers receive the necessary medical care and financial support, allowing them to focus on their recovery and return to work when possible.

Healthcare Industry

The healthcare industry, with its diverse range of occupations, also relies heavily on Workman’s Compensation Insurance. Healthcare workers, including nurses, doctors, and support staff, face a unique set of risks, from exposure to infectious diseases to physical injuries related to patient care.

Workman's Compensation Insurance in the healthcare industry covers a wide range of occupational injuries and illnesses, ensuring that healthcare professionals receive the necessary medical attention and financial support if they are injured or become ill due to their work. This insurance is particularly crucial in protecting the well-being of those who dedicate their lives to caring for others.

Manufacturing Sector

The manufacturing sector is another high-risk industry, with workers often exposed to heavy machinery, hazardous materials, and repetitive tasks that can lead to occupational injuries. Workman’s Compensation Insurance is essential in this context, providing coverage for a range of injuries, from cuts and burns to more severe conditions like carpal tunnel syndrome.

By offering medical benefits, wage replacement, and vocational rehabilitation services, Workman's Compensation Insurance helps manufacturing workers recover from injuries and return to work, ensuring their long-term financial stability and career sustainability.

Retail and Service Industries

Retail and service industries, which encompass a wide range of occupations, also benefit from Workman’s Compensation Insurance. Workers in these sectors face various risks, from slips and falls to customer-related assaults. Workman’s Compensation Insurance steps in to provide coverage for these injuries, ensuring that affected workers receive the necessary support.

Whether it's a retail clerk who twists an ankle while stocking shelves or a customer service representative who suffers a back injury from prolonged sitting, Workman's Compensation Insurance is there to provide medical care, wage replacement, and other benefits, helping these workers navigate their recovery journey.

The Future of Workman’s Compensation Insurance

As the employment landscape continues to evolve, so too does the role and importance of Workman’s Compensation Insurance. Here are some key trends and developments that are shaping the future of this essential insurance system:

Emphasis on Prevention and Safety

In recent years, there has been a growing emphasis on workplace safety and injury prevention. Many employers and industry associations are investing in safety training, ergonomic improvements, and other measures to reduce workplace accidents and injuries. This shift towards prevention is expected to continue, with a focus on creating safer work environments and reducing the need for Workman’s Compensation Insurance claims.

Technological Advancements

The rise of digital technologies and automation is transforming various industries, and the world of Workman’s Compensation Insurance is no exception. Advanced analytics, artificial intelligence, and machine learning are being leveraged to streamline claims processing, enhance fraud detection, and improve overall efficiency in the Workman’s Compensation system.

These technological advancements are expected to continue shaping the future of Workman's Compensation Insurance, making the system more responsive, efficient, and accurate in serving the needs of injured workers and employers alike.

Focus on Employee Well-being

There is a growing recognition among employers that employee well-being is not only a moral obligation but also a strategic advantage. As such, many organizations are integrating wellness programs and initiatives into their workplaces, aiming to improve the overall health and happiness of their employees. This shift towards a more holistic approach to employee well-being is expected to influence the future of Workman’s Compensation Insurance, with a greater emphasis on preventive measures and employee support.

Regulatory Changes

Workman’s Compensation Insurance is regulated at the state level, and as such, changes in state laws and regulations can significantly impact the insurance landscape. While some states may introduce reforms to streamline the Workman’s Compensation system and reduce costs for employers, others may focus on expanding benefits and protections for injured workers. These regulatory changes will continue to shape the future of Workman’s Compensation Insurance, influencing its scope, coverage, and overall effectiveness.

Conclusion

Workman’s Compensation Insurance is a vital component of the employment ecosystem, providing a safety net for workers and financial stability for employers. By understanding the origins, purpose, and critical components of this insurance, we can appreciate its significance in protecting the well-being and livelihoods of employees across various industries.

As we look to the future, the landscape of Workman's Compensation Insurance is poised for significant changes and developments. From a growing emphasis on workplace safety and employee well-being to the transformative power of digital technologies, the future of this insurance promises to be dynamic and responsive to the evolving needs of workers and employers alike.

What is the difference between Workman’s Compensation Insurance and regular health insurance?

+Workman’s Compensation Insurance is specifically designed to cover work-related injuries and illnesses, providing benefits such as medical care, wage replacement, and vocational rehabilitation. In contrast, regular health insurance covers a broad range of medical conditions and injuries, regardless of whether they are work-related. Workman’s Compensation Insurance typically provides more comprehensive benefits for work-related incidents, whereas regular health insurance may have higher deductibles and out-of-pocket costs.

Who pays for Workman’s Compensation Insurance?

+In most cases, employers are responsible for paying the premiums for Workman’s Compensation Insurance. These premiums are based on factors such as the employer’s industry, the number of employees, and the company’s claims history. By paying these premiums, employers ensure that their workers are covered in the event of a work-related injury or illness.

What happens if an employee is injured on the job but their employer doesn’t have Workman’s Compensation Insurance?

+If an employer fails to carry Workman’s Compensation Insurance, they may face significant legal consequences. Injured employees can file a lawsuit against the employer to recover damages, including medical expenses and lost wages. In addition, the state’s insurance fund may step in to provide coverage for the injured worker, and the employer may be held responsible for reimbursing the fund.

Can an employee choose their own doctor for Workman’s Compensation-related treatment?

+The ability to choose one’s own doctor for Workman’s Compensation treatment can vary by state and by employer policy. In some cases, employers may have a list of approved healthcare providers that injured workers must choose from. However, in other states or under certain employer policies, employees may have the right to select their own doctor, especially if they have a pre-existing relationship with a specific healthcare provider.