Workers Compensation Insurance Quotes

Workers' compensation insurance is an essential aspect of any business, offering crucial protection for both employers and employees in the event of workplace injuries or illnesses. Understanding the process of obtaining workers' comp insurance quotes is key to ensuring your business is adequately covered. This comprehensive guide aims to delve into the intricacies of workers' compensation insurance, providing an in-depth analysis of the factors that influence quotes, the benefits of having adequate coverage, and the steps to secure the best insurance plan for your business.

The Importance of Workers’ Compensation Insurance

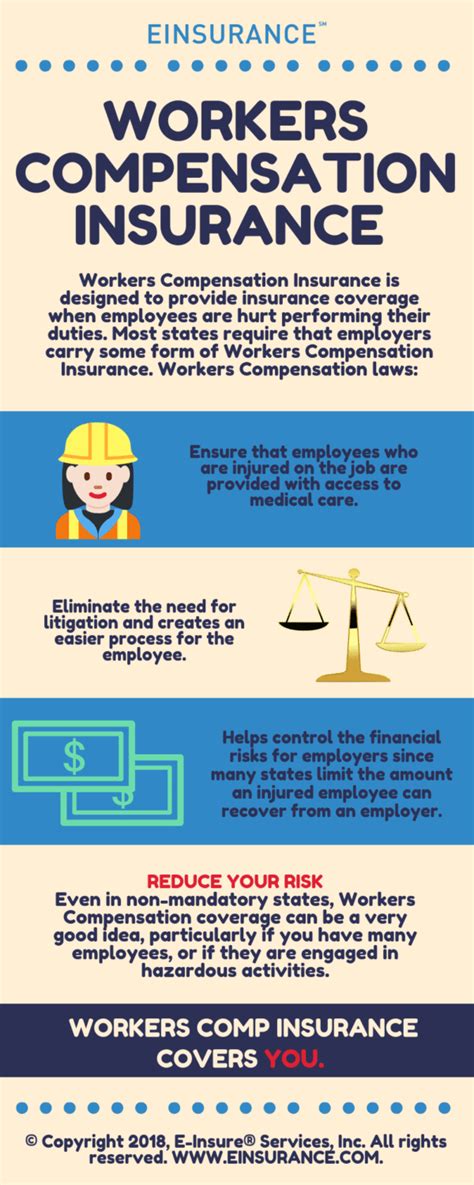

Workers’ compensation insurance, often referred to as “workers’ comp,” is a vital safety net for businesses and their employees. It provides financial support to workers who suffer injuries or become ill due to their work, ensuring they can receive medical treatment and, in some cases, partial wage replacement during their recovery. For employers, it offers legal protection, mitigating the financial risks associated with workplace incidents and potential lawsuits.

In many jurisdictions, workers' compensation is mandated by law, making it a non-negotiable requirement for businesses. Even in areas where it's not compulsory, having this insurance is a strategic move that demonstrates a company's commitment to the well-being of its employees and its financial responsibility.

Understanding Workers’ Compensation Insurance Quotes

Obtaining quotes for workers’ compensation insurance involves a thorough evaluation of your business’s unique characteristics and risks. Insurance providers assess a variety of factors to determine the premium you’ll pay for coverage. These factors include:

Industry and Business Type

The nature of your business plays a significant role in determining your insurance quote. High-risk industries, such as construction, manufacturing, and mining, typically attract higher premiums due to the increased likelihood of workplace accidents. In contrast, offices and retail stores generally have lower premiums as the risk of severe injuries is considered lower.

| Industry | Risk Level | Average Premium |

|---|---|---|

| Construction | High | $2,500 - $5,000 |

| Retail | Low | $1,000 - $2,000 |

| Healthcare | Medium | $1,500 - $3,000 |

Company Size and Employee Count

The size of your business, as measured by the number of employees, is another critical factor. Larger businesses often have a more diverse range of job roles, which can increase the risk of different types of injuries. Additionally, the larger the workforce, the more potential there is for workplace incidents. Therefore, premiums for larger businesses tend to be higher.

Loss History

Your business’s past record of workplace injuries and illnesses is a significant determinant of your insurance quote. A history of frequent or severe workplace incidents may result in higher premiums as it indicates a higher risk of future claims. On the other hand, a clean record can lead to more favorable quotes.

Safety Measures and Loss Prevention Programs

Insurance providers highly value businesses that prioritize workplace safety. If your company has implemented robust safety measures, such as regular training programs, hazard identification processes, and effective incident reporting systems, it may be rewarded with lower premiums. These measures not only reduce the likelihood of workplace injuries but also demonstrate a proactive approach to risk management.

State Regulations and Requirements

The specific regulations and requirements of your state can impact your insurance quote. Some states have stricter guidelines for workers’ compensation coverage, which may influence the cost and availability of insurance plans.

The Benefits of Adequate Workers’ Compensation Coverage

Having robust workers’ compensation insurance provides a multitude of benefits for both employers and employees:

Protection for Employees

In the event of a workplace injury or illness, workers’ compensation insurance ensures that employees have access to the medical treatment they need without incurring significant financial burdens. It also provides a portion of their wages while they’re unable to work, helping to maintain their financial stability during recovery.

Legal Compliance and Peace of Mind for Employers

For employers, workers’ compensation insurance offers legal protection. In many states, having this insurance is a legal requirement. Even where it’s not mandatory, it provides a crucial safety net, protecting employers from potential lawsuits related to workplace injuries. This coverage ensures that employers can focus on their core business operations with the peace of mind that comes from knowing they’re protected against unexpected workplace incidents.

Potential for Cost Savings

Adequate workers’ compensation coverage can lead to significant cost savings for businesses. By effectively managing workplace safety and reducing the likelihood of incidents, businesses can lower their insurance premiums over time. Additionally, having a strong safety record and low claim rates can make your business more attractive to insurance providers, leading to even better insurance rates.

Securing the Best Workers’ Compensation Insurance Plan

When it comes to selecting the right workers’ compensation insurance plan for your business, there are several key steps to follow:

Assess Your Business’s Needs

Start by evaluating your business’s unique requirements. Consider the nature of your work, the potential risks involved, and the specific needs of your employees. This assessment will help you determine the level of coverage your business requires.

Compare Quotes from Multiple Insurers

Obtain quotes from a variety of insurance providers. Comparing different quotes will give you a better understanding of the market rates and the range of coverage options available. It’s important to note that the cheapest quote may not always be the best option, as the level of coverage and the insurer’s reputation also play significant roles.

Evaluate the Insurer’s Reputation and Financial Strength

Research the insurer’s reputation and financial stability. You want to ensure that the insurance provider you choose is reliable and has the financial capacity to honor claims. Check ratings from reputable agencies and read reviews from other businesses to get a sense of the insurer’s track record.

Understand the Policy’s Terms and Conditions

Carefully review the policy’s terms and conditions. Pay attention to the coverage limits, exclusions, and any specific clauses that may impact your business. Ensure that the policy aligns with your business’s needs and that you understand the implications of each provision.

Consider Additional Benefits and Services

Some insurance providers offer additional benefits or services, such as loss prevention programs, safety training, or access to specialized medical professionals. These extras can enhance your overall coverage and provide additional support for your business and employees.

Conclusion: The Value of Workers’ Compensation Insurance

Workers’ compensation insurance is an invaluable tool for businesses, providing a critical layer of protection for both employers and employees. By understanding the factors that influence insurance quotes and taking proactive steps to secure the best coverage, businesses can ensure they’re adequately prepared for any workplace incidents. This not only protects the financial health of the business but also demonstrates a commitment to the well-being of its workforce.

How often should I review my workers’ compensation insurance policy?

+It’s recommended to review your policy annually or whenever your business undergoes significant changes, such as expansion, relocation, or a shift in business operations. Regular reviews ensure your coverage remains aligned with your business’s evolving needs.

Can I negotiate workers’ compensation insurance rates?

+While insurance rates are largely determined by a variety of factors, you may have some room for negotiation, especially if you’re a loyal customer or if your business has implemented effective loss prevention measures. It’s worth discussing potential discounts or adjustments with your insurer.

What happens if I don’t have workers’ compensation insurance and an employee gets injured?

+In states where workers’ compensation insurance is mandatory, operating without it can lead to severe penalties, including fines and even criminal charges. Additionally, you may be personally liable for any injuries sustained by your employees, which can result in costly lawsuits.