Why Car Insurance Is So Expensive

The cost of car insurance is a topic that often sparks curiosity and frustration among vehicle owners. Understanding the factors that contribute to high insurance rates is essential for making informed decisions and potentially reducing expenses. This article aims to delve into the reasons behind the expensive nature of car insurance, shedding light on the complex interplay of variables that influence insurance premiums.

The Economics of Car Insurance

Car insurance is a financial safeguard designed to protect policyholders from the potentially devastating costs of accidents, vehicle damage, and liability claims. However, the very nature of this protection gives rise to a complex economic landscape that often results in high insurance premiums.

The insurance industry operates on the principle of risk pooling, where a large number of policyholders contribute premiums, and the funds are used to cover the costs of claims made by a smaller subset of policyholders who have experienced losses. This system ensures that those who need financial assistance after an accident or vehicle damage can receive it, but it also means that the cost of insurance is influenced by a wide range of factors that affect the overall risk profile of the pool of policyholders.

Key Factors Affecting Insurance Premiums

Several critical factors play a role in determining the cost of car insurance. These factors are often interrelated and can vary significantly depending on the specific circumstances of the policyholder and the region in which they reside.

-

Risk Profile of the Policyholder: The insurance company assesses the risk associated with insuring a particular individual or vehicle. This assessment takes into account factors such as the driver's age, driving record, the type of vehicle being insured, and the location where the vehicle is primarily driven. For example, younger drivers, especially males, are often considered higher-risk due to their propensity for accidents, which can result in higher premiums.

-

Claim History: A driver's past claims history is a significant factor in determining insurance rates. Multiple claims, especially within a short period, can signal a higher risk to the insurance company, leading to increased premiums. Conversely, a clean claim history may result in more favorable rates.

-

Vehicle Type and Usage: The make, model, and year of the vehicle being insured can impact insurance costs. Certain vehicle types, such as high-performance cars or luxury SUVs, may be more expensive to insure due to their higher repair costs or increased likelihood of theft. Additionally, the primary usage of the vehicle, whether for personal or business purposes, can affect insurance rates, as business-related driving may carry a higher risk of accidents.

-

Geographical Location: The region where the vehicle is registered and primarily driven can significantly influence insurance rates. Areas with a higher incidence of accidents, thefts, or natural disasters may have higher insurance costs. Similarly, densely populated urban areas often have higher insurance rates due to increased traffic congestion and the higher likelihood of accidents.

-

Coverage Options and Deductibles: The level of coverage chosen by the policyholder, such as comprehensive, collision, liability, or additional coverage for specific situations, directly impacts the cost of insurance. Additionally, the choice of deductible, which is the amount the policyholder pays out of pocket before the insurance coverage kicks in, can significantly affect premiums. Higher deductibles typically result in lower premiums, as the policyholder assumes more financial responsibility in the event of a claim.

-

Insurance Company and Competition: Different insurance companies have varying pricing structures and risk assessments. As a result, the insurance company chosen by the policyholder can have a substantial impact on the cost of insurance. Additionally, the level of competition in the insurance market can influence premiums, with more competitive markets often resulting in lower insurance rates.

The Complex Nature of Insurance Premiums

The factors outlined above provide a glimpse into the complex web of variables that insurance companies consider when determining insurance premiums. It’s important to note that insurance companies use sophisticated actuarial models and statistical analyses to assess risk and set premiums. These models take into account not only the factors mentioned above but also a multitude of other variables, such as economic conditions, inflation rates, and even societal trends.

Furthermore, insurance rates are not static and can change over time due to various factors, including changes in the policyholder's circumstances (e.g., moving to a new location, acquiring a new vehicle), shifts in the insurance market, and adjustments in the insurance company's risk assessment models.

In conclusion, the expense of car insurance is a result of the complex interplay of risk assessment, claim history, vehicle characteristics, geographical factors, coverage choices, and market dynamics. Understanding these factors can empower policyholders to make more informed decisions about their insurance coverage and potentially explore ways to reduce their insurance costs, such as by maintaining a clean driving record, choosing appropriate coverage levels, or shopping around for competitive insurance rates.

The Future of Car Insurance: Trends and Innovations

As the automotive industry evolves, so too does the landscape of car insurance. The advent of new technologies and changing driving behaviors is shaping the future of insurance, offering both challenges and opportunities for policyholders and insurance providers alike.

Telematics and Usage-Based Insurance

One of the most significant innovations in car insurance is the introduction of telematics and usage-based insurance (UBI). Telematics devices, often installed in vehicles, collect data on driving behavior, such as speed, acceleration, and mileage. This data is then used to assess the risk associated with a particular driver and can result in more personalized insurance rates. UBI policies offer the potential for drivers to save money by demonstrating safe driving habits, as insurance premiums are based on actual driving behavior rather than broad statistical averages.

| Pros of UBI | Cons of UBI |

|---|---|

| Potential for lower premiums for safe drivers | Invasion of privacy concerns |

| Encourages safer driving habits | May be less beneficial for urban drivers with shorter commutes |

| Provides real-time data for insurance companies | May not account for external factors like weather or road conditions |

However, the implementation of telematics and UBI also raises concerns about privacy and the potential for discrimination. Some drivers may be hesitant to have their driving behavior constantly monitored, and there are questions about how this data might be used in the future.

Autonomous Vehicles and Insurance

The rise of autonomous and semi-autonomous vehicles is another significant trend that will impact car insurance in the coming years. As self-driving cars become more prevalent, the nature of accidents and liability will shift, potentially reducing the number of crashes caused by human error. This could lead to a decrease in insurance claims and, subsequently, lower insurance premiums.

However, the transition to autonomous vehicles also introduces new challenges. Insurance companies will need to adapt their policies to account for the unique risks associated with this technology, such as software failures or cybersecurity threats. Additionally, determining liability in accidents involving autonomous vehicles will be complex, as the responsibility may lie with the vehicle manufacturer, the software developer, or even the passenger.

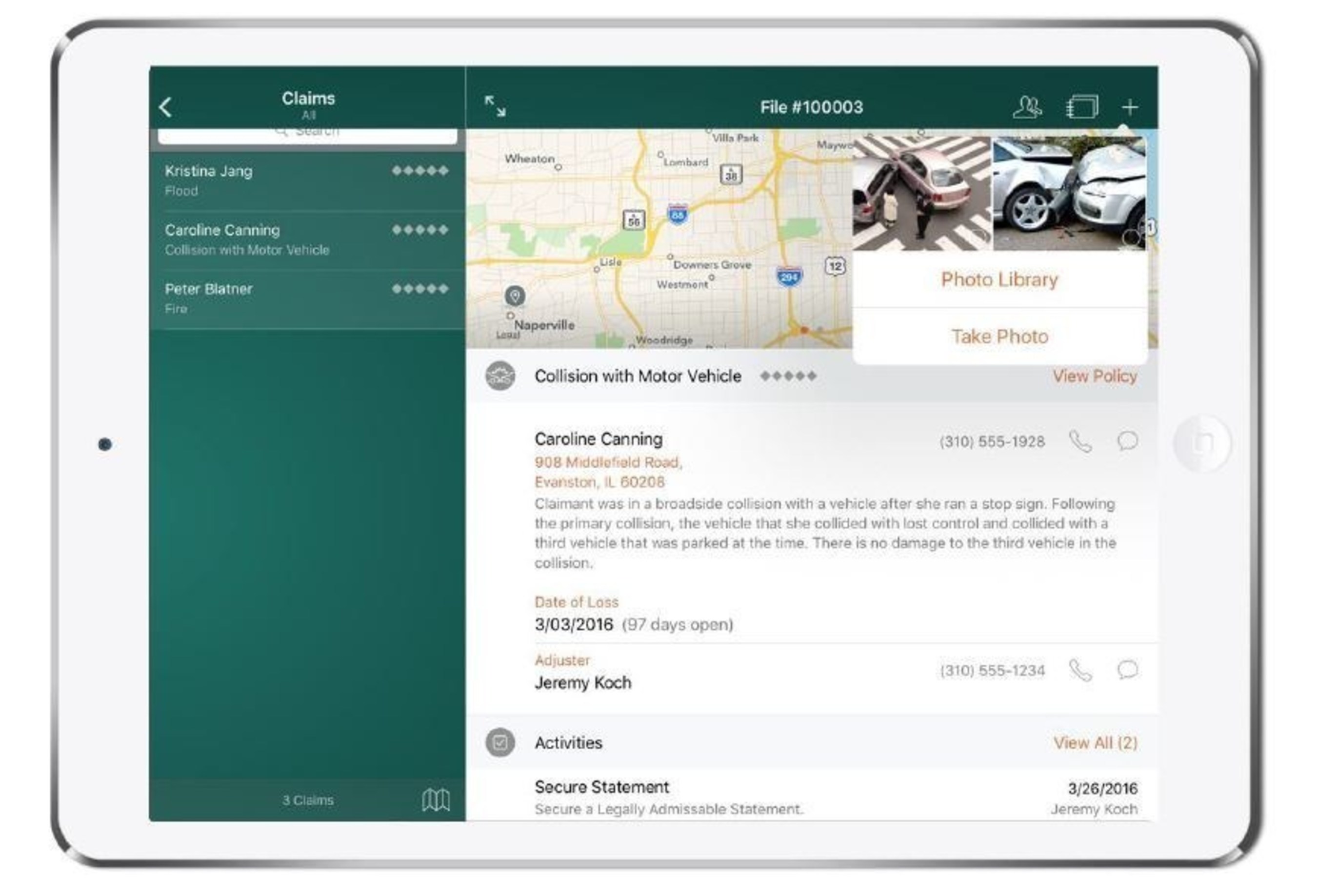

Digital Transformation and InsurTech

The insurance industry is undergoing a digital transformation, with the rise of InsurTech companies and the integration of advanced technologies. InsurTech startups are leveraging digital platforms, artificial intelligence, and data analytics to offer innovative insurance solutions, often with a focus on convenience, personalization, and cost-efficiency.

Digital insurance platforms allow for more streamlined processes, from policy issuance to claims handling. Policyholders can benefit from real-time quotes, digital documentation, and simplified claim processes. Additionally, InsurTech companies are exploring new business models, such as pay-per-mile insurance, which could further revolutionize the industry by offering more flexible and tailored coverage options.

Navigating the Future of Car Insurance

The future of car insurance is likely to be characterized by continued innovation, driven by technological advancements and changing consumer expectations. Policyholders can expect to see more personalized insurance products, streamlined processes, and potentially lower premiums as the industry adapts to new technologies and driving behaviors.

However, it's essential to remain vigilant about privacy concerns and to stay informed about the evolving landscape of car insurance. As autonomous vehicles and InsurTech continue to shape the industry, consumers will need to stay abreast of these developments to make informed choices about their insurance coverage.

Frequently Asked Questions

How do insurance companies determine my insurance premium?

+

Insurance companies use a combination of factors, including your age, driving record, vehicle type, location, and coverage choices, to assess the risk of insuring you. They then use this risk assessment to set your insurance premium.

Can I reduce my insurance costs?

+

Yes, there are several ways to potentially reduce your insurance costs. These include maintaining a clean driving record, shopping around for competitive rates, increasing your deductible, and considering usage-based insurance if available.

What is usage-based insurance, and how does it work?

+

Usage-based insurance (UBI) is a type of car insurance where your premium is based on your actual driving behavior. A telematics device installed in your vehicle collects data on your driving habits, and this data is used to assess your risk and set your insurance rate. UBI can offer lower premiums for safe drivers.

How will autonomous vehicles impact car insurance?

+

Autonomous vehicles have the potential to reduce the number of accidents caused by human error, which could lead to lower insurance claims and potentially lower premiums. However, determining liability in accidents involving autonomous vehicles is complex and may involve insurance companies adapting their policies.

What is InsurTech, and how is it changing car insurance?

+

InsurTech refers to the use of technology and innovation in the insurance industry. InsurTech companies are leveraging digital platforms, AI, and data analytics to offer more streamlined and personalized insurance solutions. This includes real-time quotes, digital documentation, and new business models like pay-per-mile insurance.