What Is The Best Dental Insurance

Dental insurance is an essential aspect of maintaining good oral health and can significantly impact an individual's overall well-being. With various dental plans available in the market, choosing the best one can be a daunting task. This comprehensive guide aims to provide an in-depth analysis of dental insurance, offering valuable insights to help individuals make informed decisions. By exploring the key features, benefits, and considerations, we will uncover the factors that contribute to an excellent dental insurance plan.

Understanding Dental Insurance Plans

Dental insurance plans are designed to cover a range of dental services, procedures, and treatments, providing financial assistance to individuals seeking dental care. These plans can vary significantly in terms of coverage, cost, and provider networks. Understanding the different types of dental insurance is crucial to selecting the most suitable plan for your needs.

Indemnity Plans

Indemnity, or fee-for-service, plans are traditional dental insurance options that offer flexibility and choice. With this type of plan, you can visit any dentist of your choice, and the insurance company will reimburse a portion of the treatment cost. Indemnity plans typically cover a wide range of services, including preventive care, basic procedures, and major treatments. However, it’s important to note that these plans often come with higher premiums and out-of-pocket expenses.

Preferred Provider Organization (PPO) Plans

PPO plans provide a balance between flexibility and cost-effectiveness. These plans offer a network of preferred dentists and specialists, allowing you to choose from a wide range of providers. When you visit an in-network dentist, you typically receive higher coverage and lower out-of-pocket costs. PPO plans often cover a comprehensive range of services, including preventive care, orthodontics, and restorative treatments. However, visiting out-of-network providers may result in reduced coverage and higher expenses.

Health Maintenance Organization (HMO) Plans

HMO plans are known for their cost-efficiency and structured provider networks. With an HMO plan, you are required to select a primary care dentist within the network, who will coordinate your dental care. HMO plans usually have lower premiums and out-of-pocket costs compared to other plan types. However, the coverage is often more limited, and you may need to obtain referrals from your primary dentist to see specialists. HMO plans are a great option for individuals seeking affordable dental care within a managed network.

Discount Dental Plans

Discount dental plans, also known as dental savings plans, are an alternative to traditional insurance. These plans provide members with access to a network of dentists who offer discounted rates on various dental services. With a discount plan, you pay an annual fee to join and then receive savings on treatments ranging from preventive care to specialty procedures. While these plans do not provide insurance coverage, they can be an affordable option for individuals who require regular dental care.

Factors to Consider When Choosing Dental Insurance

Selecting the best dental insurance plan involves evaluating several key factors to ensure it aligns with your specific needs and preferences. Here are some crucial considerations to keep in mind:

Dental Care Needs

Assessing your current and future dental care needs is essential. Consider your oral health history, any existing dental conditions, and your desired level of preventive care. If you require extensive dental work or have a history of complex dental issues, a plan with higher coverage limits and comprehensive benefits may be more suitable. On the other hand, if you primarily need preventive care and basic procedures, a plan with lower premiums and more affordable out-of-pocket costs could be a better fit.

Provider Network

The provider network of a dental insurance plan plays a significant role in your access to dental care. Review the list of in-network dentists and specialists to ensure it includes reputable and convenient options near your residence or workplace. Consider the availability of providers who specialize in your specific dental needs, such as orthodontists or periodontists. A robust provider network can provide peace of mind and ease of access to quality dental care.

Coverage and Benefits

Understanding the coverage and benefits offered by different dental insurance plans is crucial. Evaluate the scope of coverage, including preventive care, basic procedures, major treatments, and specialty services. Look for plans that provide adequate coverage for the specific dental services you anticipate requiring. Additionally, consider any additional benefits, such as orthodontic coverage, emergency care, or alternative treatments, that may be valuable to you.

Premiums and Out-of-Pocket Costs

Dental insurance plans vary in terms of premiums and out-of-pocket expenses. Assess your budget and financial capabilities to determine the most suitable plan. Consider the monthly or annual premiums, deductibles, copayments, and maximum out-of-pocket limits. Remember that plans with lower premiums may have higher out-of-pocket costs, while plans with higher premiums often provide more comprehensive coverage. Finding a balance between affordability and coverage is essential to ensuring long-term dental health.

Additional Features and Support

Some dental insurance plans offer additional features and support to enhance the overall experience. Look for plans that provide access to a 24⁄7 dental hotline for urgent questions or concerns. Consider plans that offer online portals or mobile apps for convenient appointment scheduling, claim submissions, and policy management. Additionally, plans with educational resources, such as oral health tips or recommended treatment plans, can be valuable for maintaining optimal dental health.

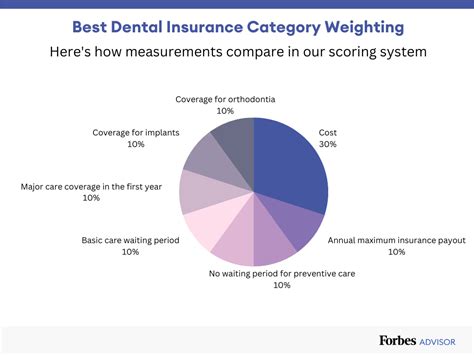

Evaluating the Best Dental Insurance Plans

When it comes to determining the best dental insurance plan, several factors contribute to its excellence. Here are some key attributes to consider:

Comprehensive Coverage

An exceptional dental insurance plan should offer comprehensive coverage that extends beyond basic procedures. Look for plans that cover a wide range of services, including preventive care, restorative treatments, orthodontics, and specialty care. Plans with flexible coverage limits and no annual maximums can provide greater peace of mind and ensure that you receive the necessary dental care without financial constraints.

Low Out-of-Pocket Costs

Affordable dental insurance plans should aim to minimize out-of-pocket expenses for policyholders. Plans with lower deductibles, copayments, and maximum out-of-pocket limits can significantly reduce the financial burden associated with dental care. Additionally, plans that offer generous annual maximums and provide coverage for a high percentage of the cost of treatments can make dental care more accessible and affordable.

Robust Provider Network

A strong provider network is a crucial aspect of an excellent dental insurance plan. Look for plans that offer a diverse and extensive network of dentists and specialists, ensuring that you have access to quality care regardless of your location. A robust network provides convenience, allowing you to choose from a wide range of providers and easily schedule appointments without long wait times.

Excellent Customer Service

The level of customer service provided by a dental insurance company can greatly impact your overall experience. Look for plans with responsive and knowledgeable customer support representatives who can assist with policy inquiries, claim submissions, and any other concerns. Plans that offer multiple channels of communication, such as phone, email, and live chat, provide greater accessibility and ensure timely resolution of issues.

Digital Convenience and Accessibility

In today’s digital age, dental insurance plans that embrace technology and offer convenient digital features can enhance the overall experience. Look for plans with user-friendly online portals or mobile apps that allow for easy policy management, claim submissions, and appointment scheduling. Plans that provide digital tools for finding in-network providers, estimating treatment costs, and accessing educational resources can empower individuals to take control of their dental health.

Top Dental Insurance Providers and Plans

While the best dental insurance plan can vary depending on individual needs and preferences, here is a list of top-rated dental insurance providers and plans that consistently receive positive reviews and offer comprehensive coverage:

Delta Dental

Delta Dental is one of the largest and most reputable dental insurance providers in the United States. They offer a range of plans, including PPO and HMO options, providing extensive coverage for preventive care, basic procedures, and specialty treatments. Delta Dental’s extensive provider network and commitment to customer satisfaction make them a popular choice for individuals and families.

MetLife

MetLife’s dental insurance plans are known for their comprehensive coverage and affordable premiums. They offer a variety of plan options, including PPO and indemnity plans, catering to different needs and budgets. MetLife’s plans typically include preventive care, basic procedures, and major treatments, with some plans also offering orthodontic coverage. Their robust provider network and efficient claim processing make them a reliable choice.

Cigna Dental

Cigna Dental provides a wide range of dental insurance plans, including PPO, HMO, and discount plans. Their plans are designed to meet various dental care needs, offering coverage for preventive care, restorative treatments, and specialty services. Cigna Dental’s extensive provider network and focus on customer service make them a preferred choice for individuals seeking reliable and accessible dental care.

Aetna Dental

Aetna Dental offers a comprehensive suite of dental insurance plans, including PPO and HMO options. Their plans are tailored to provide coverage for a broad spectrum of dental services, ensuring that policyholders receive the necessary care. Aetna Dental’s provider network includes a diverse range of dentists and specialists, making it convenient for individuals to access quality dental care. Their commitment to customer satisfaction and innovative digital tools enhance the overall experience.

United Concordia Dental

United Concordia Dental is a leading provider of dental insurance, offering a variety of plan options to meet different needs. Their plans typically include coverage for preventive care, basic procedures, and major treatments, with some plans extending coverage to orthodontics and specialty care. United Concordia Dental’s provider network is extensive, providing policyholders with access to a wide range of dental professionals.

Tips for Maximizing Your Dental Insurance Benefits

To make the most of your dental insurance plan and ensure you receive the full benefits, consider the following tips:

- Understand Your Plan's Coverage: Familiarize yourself with the specific details of your dental insurance plan, including the covered services, annual maximums, deductibles, and copayments. Knowing your plan's coverage will help you make informed decisions about your dental care.

- Schedule Regular Preventive Care: Take advantage of your plan's coverage for preventive care, such as dental cleanings, check-ups, and X-rays. Regular preventive care can help identify and address potential dental issues early on, preventing more complex and costly treatments in the future.

- Utilize In-Network Providers: To maximize your insurance benefits, prioritize visiting in-network dentists and specialists. In-network providers have agreed to accept the insurance plan's negotiated rates, resulting in lower out-of-pocket costs for you.

- Plan for Major Treatments: If you anticipate requiring major dental treatments, such as crowns, bridges, or implants, discuss your options with your dentist and insurance provider. Understanding the coverage limits and out-of-pocket expenses associated with these procedures will help you budget and plan accordingly.

- Stay Informed About Plan Changes: Dental insurance plans may undergo changes in coverage or provider networks from year to year. Stay updated on any plan modifications and ensure that your preferred providers are still in-network. Being aware of these changes will help you make informed decisions about your dental care.

- Utilize Additional Benefits: Many dental insurance plans offer additional benefits beyond basic coverage. Take advantage of these benefits, such as discounts on dental products, oral health education programs, or alternative treatment options. These additional perks can enhance your overall dental health and well-being.

Conclusion

Choosing the best dental insurance plan requires careful consideration of your specific needs, budget, and preferences. By understanding the different types of dental insurance plans, evaluating key factors, and considering the attributes of an excellent plan, you can make an informed decision. Remember to assess your dental care needs, review provider networks, compare coverage and benefits, and consider premiums and out-of-pocket costs. Additionally, explore the top dental insurance providers and plans available, and utilize the provided tips to maximize your insurance benefits. With the right dental insurance plan, you can maintain optimal oral health and access the necessary dental care with confidence and peace of mind.

How do I choose the right dental insurance plan for my family?

+When selecting a dental insurance plan for your family, consider your family’s specific dental needs, budget, and preferences. Evaluate plans that offer comprehensive coverage, including preventive care, orthodontics, and specialty treatments. Look for plans with a robust provider network to ensure accessibility and convenience. Consider the premiums, deductibles, and out-of-pocket costs, ensuring they align with your financial capabilities. Additionally, prioritize plans with excellent customer service and digital tools for managing policies and scheduling appointments.

Can I switch dental insurance plans during the year?

+Switching dental insurance plans during the year is typically possible, but it may depend on your specific circumstances and the policies of your insurance provider. Some plans may allow for mid-year changes, especially if there are significant life events, such as marriage, divorce, or the birth of a child. However, it’s important to review the terms and conditions of your current plan and consult with your insurance provider to understand the options available to you.

What should I do if I have a dental emergency while traveling?

+If you experience a dental emergency while traveling, it’s important to act promptly. Contact your dental insurance provider to understand the coverage and options available to you in your specific location. They may provide a list of recommended or preferred dentists in the area who can assist you. Additionally, consider seeking assistance from your accommodation’s concierge or local healthcare providers for recommendations. Remember to keep your insurance card and contact information readily accessible.