What Is The Average Home Insurance Cost

Home insurance is a vital financial protection measure for homeowners, providing coverage for a range of potential risks and damages. The cost of home insurance can vary significantly depending on several factors, including the location, type of home, and the level of coverage desired. Understanding the average home insurance cost and the factors that influence it can help homeowners make informed decisions when shopping for insurance policies.

Average Home Insurance Costs and Key Factors

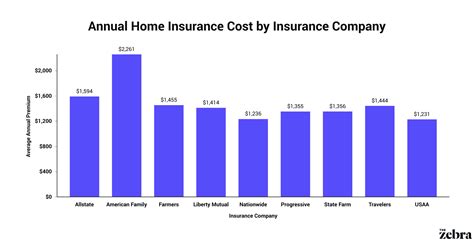

The average annual cost of home insurance in the United States is approximately $1,300, according to industry data. However, it’s essential to note that this figure is just an average, and actual costs can vary widely based on individual circumstances.

Influence of Location

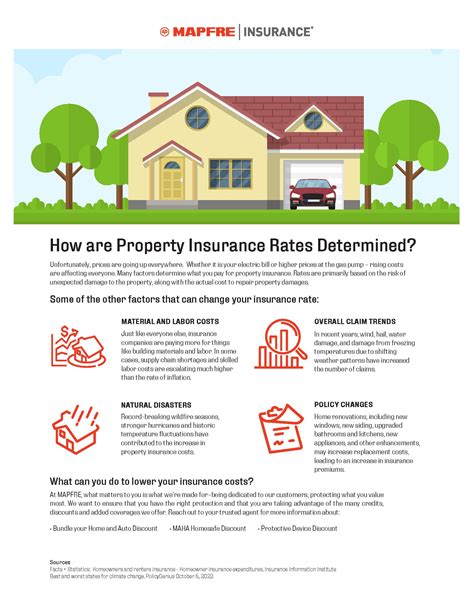

One of the most significant factors affecting home insurance premiums is the location of the property. Insurance companies assess the risk associated with different regions, considering factors like the prevalence of natural disasters, crime rates, and even the local construction standards. For instance, homes in areas prone to hurricanes or wildfires will typically face higher insurance costs due to the increased risk of property damage.

| Region | Average Annual Premium |

|---|---|

| Northeast | $1,500 |

| Southeast | $1,400 |

| Midwest | $1,200 |

| West | $1,100 |

Home Characteristics

The type of home and its specific features also play a role in determining insurance costs. Generally, larger homes or those with unique architectural designs will require more extensive coverage and thus, higher premiums. Additionally, the age of the home can be a factor, as older homes may have outdated electrical or plumbing systems, which can increase the risk of accidents or damage.

Coverage Levels and Deductibles

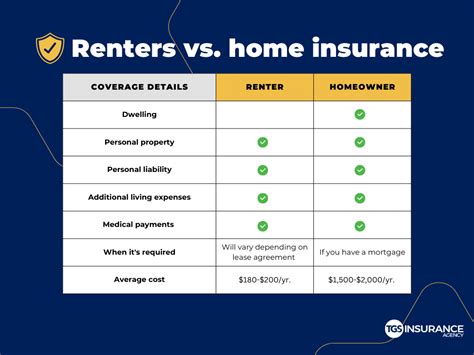

The level of coverage chosen is a critical factor in determining insurance costs. Homeowners can opt for various coverage types, including:

- Dwelling Coverage: This covers the physical structure of the home.

- Personal Property Coverage: Provides protection for the contents of the home.

- Liability Coverage: Protects against lawsuits related to injuries or damage on the insured's property.

- Additional Living Expenses: Covers the cost of temporary housing if the home becomes uninhabitable due to a covered loss.

Homeowners should carefully assess their needs and choose a coverage level that provides adequate protection without being excessive. Additionally, opting for a higher deductible (the amount the homeowner pays out of pocket before the insurance coverage kicks in) can lead to lower premiums. However, it's important to ensure that the deductible is an amount you can afford to pay in the event of a claim.

Factors Influencing Home Insurance Costs

Beyond the factors mentioned above, several other elements can influence the cost of home insurance.

Credit Score

Insurance companies often consider an individual’s credit score when determining premiums. A higher credit score can lead to lower insurance rates, as it is seen as an indicator of financial responsibility and stability.

Claims History

A history of insurance claims can impact future premiums. Frequent claims may result in higher rates or even non-renewal of the policy. It’s important to only make claims when necessary and to ensure that small, easily affordable repairs are not claimed through insurance.

Discounts and Bundles

Insurance companies often offer discounts to encourage certain behaviors or to reward loyalty. Common discounts include:

- Multi-Policy Discounts: Bundling your home and auto insurance policies with the same insurer can result in significant savings.

- Safety Discounts: Installing security systems, smoke detectors, or fire sprinklers can reduce premiums.

- Loyalty Discounts: Staying with the same insurer for an extended period may lead to lower rates.

Local Building Codes

Homes built to higher local building standards may qualify for lower insurance rates. These standards often include provisions for fire safety, wind resistance, and other factors that can reduce the risk of damage to the property.

The Importance of Shopping Around

Given the multitude of factors that can influence home insurance costs, it’s crucial for homeowners to shop around and compare quotes from multiple insurers. Each insurer has its own formula for assessing risk and setting premiums, so getting multiple quotes can help you find the best coverage at the most competitive price.

Online Tools and Resources

Numerous online tools and resources are available to help homeowners estimate their home insurance costs and compare quotes. These platforms often provide an initial estimate based on basic information, such as the home’s location and value. However, for an accurate quote, you’ll need to provide more detailed information about your home and its contents.

Working with an Insurance Agent

While online tools can be helpful, working with an insurance agent can provide valuable personalized guidance. Agents can help you understand the nuances of different policies, ensure you have adequate coverage, and often negotiate better rates on your behalf. They can also provide advice on potential discounts and help you navigate the claims process if needed.

Future Outlook and Trends

The home insurance market is constantly evolving, influenced by various factors such as changing weather patterns, economic conditions, and technological advancements. Here are some key trends and considerations for the future of home insurance:

Climate Change and Natural Disasters

The increasing frequency and severity of natural disasters due to climate change are likely to impact home insurance rates. As extreme weather events become more common, insurers may adjust their rates and coverage options to account for the heightened risk.

Technology and Home Security

Advancements in technology are also expected to play a role in home insurance. For instance, the widespread adoption of smart home devices and security systems could lead to discounts for homeowners who invest in these technologies. Additionally, the use of big data and predictive analytics by insurers may help identify potential risks more accurately, leading to more tailored and efficient insurance policies.

Economic Factors

Economic conditions, including inflation and the overall state of the housing market, can also influence home insurance costs. As the cost of building materials and labor increases, the value of homes may rise, leading to higher insurance premiums to reflect the increased replacement cost.

Conclusion

Understanding the average home insurance cost and the factors that influence it is crucial for homeowners. By being aware of these factors and shopping around for the best coverage and rates, homeowners can ensure they have adequate protection for their homes and possessions without paying more than necessary. The home insurance market is dynamic, and staying informed about emerging trends and developments can help homeowners make the most informed decisions about their coverage.

What is the average cost of home insurance for a specific region, such as California?

+The average cost of home insurance in California is around $1,100 per year. However, this can vary significantly depending on the location within the state, the size and type of home, and the coverage level chosen.

How can I lower my home insurance premiums?

+There are several strategies to reduce home insurance premiums. These include increasing your deductible, bundling your policies with the same insurer, maintaining a good credit score, and investing in home security measures. Additionally, reviewing your coverage regularly and ensuring it aligns with your needs can help prevent overinsurance, which can lead to higher premiums.

What factors can lead to an increase in my home insurance premiums?

+Several factors can lead to an increase in home insurance premiums. These include a history of insurance claims, a decline in your credit score, an increase in the value of your home or its contents, and changes in local building codes or insurance regulations. Additionally, if your home is in an area that becomes more prone to natural disasters, such as wildfires or hurricanes, your premiums may increase to reflect the higher risk.