What Is Out Of Pocket Maximum In Health Insurance

Understanding health insurance terminology is crucial for navigating the complex world of healthcare coverage. One essential concept to grasp is the "Out-of-Pocket Maximum," which plays a significant role in managing healthcare costs. This article will delve into the intricacies of the out-of-pocket maximum, its implications for policyholders, and how it influences overall healthcare expenses.

Out-of-Pocket Maximum: A Definition

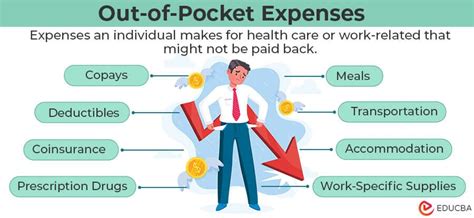

The out-of-pocket maximum, often abbreviated as OOPM, is a predetermined cap on the total amount an insured individual or family must pay for covered healthcare services in a given benefit year. This maximum includes all the costs incurred for deductibles, copayments, and coinsurance, but it typically excludes premiums. Once an individual’s out-of-pocket expenses reach this maximum, the insurance provider covers 100% of the cost for covered services for the remainder of the benefit year.

Key Components of the Out-of-Pocket Maximum

- Deductible: This is the amount an insured person must pay out of pocket before the insurance plan starts covering a portion of the costs. Deductibles reset annually and are separate from the out-of-pocket maximum.

- Copayments: Fixed amounts paid by the insured for specific services, like a doctor’s visit or prescription drugs. Copayments are usually a set dollar amount and are not calculated as a percentage of the total cost.

- Coinsurance: This is a percentage of the cost of a covered service that the insured pays after the deductible has been met. For example, if the coinsurance is 20%, the insured pays 20% of the service cost, and the insurance provider covers the remaining 80%.

- Premium: The monthly or annual payment made to maintain health insurance coverage. Premiums are not included in the out-of-pocket maximum and are separate from other healthcare costs.

How the Out-of-Pocket Maximum Works

Let’s illustrate this with an example. Imagine an individual has an insurance plan with an out-of-pocket maximum of 6,000 for the year. During this period, they pay a 1,500 deductible, 20 copayments for several doctor's visits, and 20% coinsurance for various procedures and medications. As their total out-of-pocket expenses reach 6,000, the insurance company will cover all remaining eligible healthcare costs for the rest of the year.

Benefits and Considerations of the Out-of-Pocket Maximum

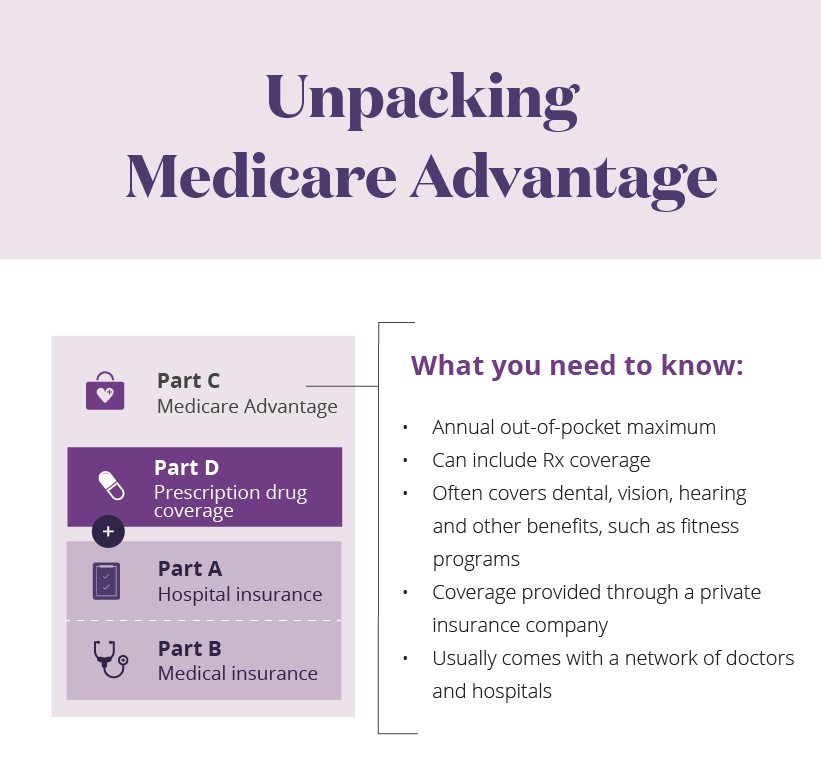

The out-of-pocket maximum offers several advantages to policyholders. Firstly, it provides a sense of financial predictability and control. Knowing that there’s a limit to how much one will have to pay out of pocket for healthcare services can be reassuring, especially for those with chronic conditions or anticipated medical needs.

Financial Protection

Once the out-of-pocket maximum is reached, the insurance provider assumes a larger share of the healthcare costs, offering substantial financial protection. This feature is particularly beneficial for individuals facing high medical expenses due to complex or ongoing treatments.

Comparing Plans

When shopping for health insurance, the out-of-pocket maximum is a critical factor to consider. Plans with lower out-of-pocket maximums may be more expensive in terms of premiums, but they offer greater financial protection. Conversely, plans with higher out-of-pocket maximums may have lower premiums but require policyholders to pay more out of pocket before the insurance coverage kicks in fully.

Out-of-Pocket Maximum and Plan Categories

Health insurance plans are often categorized into Bronze, Silver, Gold, and Platinum tiers based on their actuarial value, which represents the average percentage of costs covered by the plan. Generally, Bronze plans have lower premiums but higher out-of-pocket costs, while Platinum plans offer the opposite. Understanding these categories can help individuals choose a plan that aligns with their healthcare needs and financial situation.

Special Enrollment Periods

In the United States, certain life events, such as losing job-based health coverage, getting married, or having a baby, qualify individuals for a Special Enrollment Period (SEP). During an SEP, individuals can enroll in a health insurance plan outside of the regular Open Enrollment Period. The out-of-pocket maximum is especially relevant during these periods, as it provides a clear financial benchmark for evaluating different plan options.

Real-World Examples and Data

To further illustrate the impact of the out-of-pocket maximum, consider the following hypothetical scenarios:

| Plan | Out-of-Pocket Maximum | Premium |

|---|---|---|

| Plan A | $5,000 | $300/month |

| Plan B | $8,000 | $250/month |

| Plan C | $10,000 | $200/month |

In this example, Plan A has the lowest out-of-pocket maximum but the highest premium, while Plan C has the highest out-of-pocket maximum but the lowest premium. The choice between these plans would depend on individual preferences and expected healthcare needs.

Case Study: Chronic Condition Management

Let’s consider a person with a chronic condition like diabetes. They may require regular doctor visits, medications, and specialized treatments. With a high out-of-pocket maximum, they could face significant financial strain if their condition necessitates frequent and costly interventions. In such cases, a plan with a lower out-of-pocket maximum would provide more financial stability.

Future Implications and Industry Trends

The concept of the out-of-pocket maximum continues to evolve, and its importance is likely to grow as healthcare costs remain a significant concern for individuals and policymakers. Here are some key trends and considerations for the future:

- Rising Healthcare Costs: As medical expenses continue to rise, the out-of-pocket maximum becomes even more critical for financial planning and risk management.

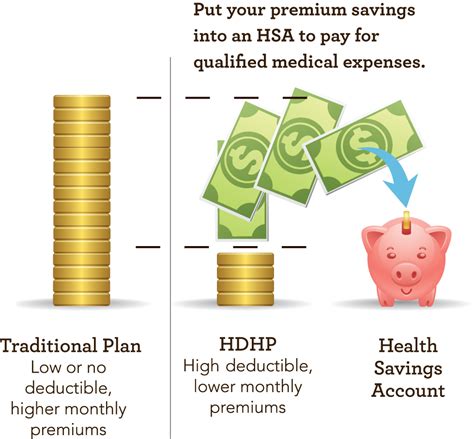

- Consumer-Directed Health Plans: These plans, which often have higher deductibles and out-of-pocket limits, are gaining popularity. They incentivize consumers to make more cost-conscious healthcare decisions.

- Health Savings Accounts (HSAs): HSAs allow individuals to save pre-tax dollars for medical expenses. When combined with high-deductible health plans, they can provide additional financial flexibility and tax benefits.

- Telehealth and Digital Health Solutions: The integration of technology into healthcare has the potential to reduce costs and improve access to care, which could influence the design and affordability of health insurance plans.

Conclusion

The out-of-pocket maximum is a vital component of health insurance plans, offering a critical layer of financial protection to policyholders. As healthcare costs continue to rise, this concept will remain a key consideration for individuals and families seeking to manage their healthcare expenses effectively. By understanding the nuances of the out-of-pocket maximum, individuals can make more informed choices about their health insurance coverage, ensuring they have the financial stability to access the care they need.

What happens if I don’t reach my out-of-pocket maximum in a year?

+If you don’t reach your out-of-pocket maximum, you typically carry over the remaining amount to the next benefit year. This means that any expenses not met in the current year can be applied towards the following year’s out-of-pocket maximum.

Are there any exclusions to the out-of-pocket maximum?

+Yes, out-of-pocket maximums typically exclude premiums and non-covered services. Some plans may also exclude certain types of care, like cosmetic procedures, from the calculation of the out-of-pocket maximum.

Can I use a Health Savings Account (HSA) to cover my out-of-pocket expenses?

+Yes, HSAs can be used to pay for eligible out-of-pocket medical expenses, including deductibles, copayments, and coinsurance. HSAs offer tax advantages and can provide additional financial flexibility for managing healthcare costs.