Hdhp Health Insurance Definition

High Deductible Health Plans (HDHPs) are a type of health insurance policy that has gained popularity in recent years due to their potential cost-saving benefits for both individuals and employers. These plans, often coupled with Health Savings Accounts (HSAs), offer a unique approach to healthcare coverage, focusing on high deductibles and out-of-pocket expenses. In this article, we will delve into the intricacies of HDHPs, exploring their definition, mechanics, advantages, and potential drawbacks.

Understanding HDHPs: A Comprehensive Definition

HDHPs are health insurance plans characterized by their relatively high annual deductibles, typically ranging from a few thousand to over ten thousand dollars, depending on the plan and the individual’s healthcare needs. These plans are designed to shift a significant portion of the financial responsibility for healthcare costs onto the insured individuals.

The deductible is the amount an insured person must pay out of pocket before the insurance company starts covering the costs. In an HDHP, this deductible is intentionally set higher than in traditional health insurance plans. The idea behind this design is to encourage individuals to become more conscious of their healthcare choices and to promote cost-effective medical practices.

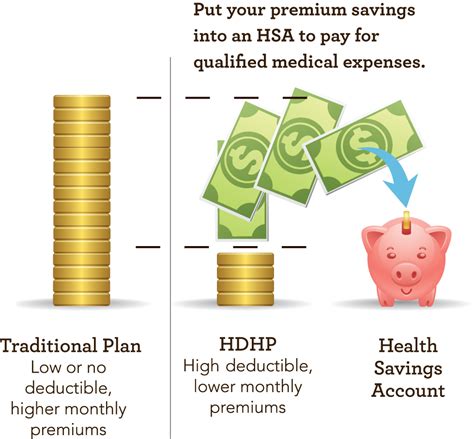

HDHPs often go hand in hand with Health Savings Accounts (HSAs), which are tax-advantaged accounts that individuals can use to save money specifically for medical expenses. HSAs allow individuals to contribute pre-tax dollars, grow their savings tax-free, and withdraw funds tax-free for qualified medical expenses. This combination of HDHP and HSA creates a powerful incentive for individuals to take control of their healthcare spending.

Key Characteristics and Benefits of HDHPs

HDHPs offer several unique features that set them apart from traditional health insurance plans:

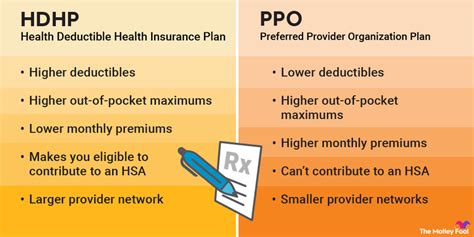

- Lower Premiums: One of the most appealing aspects of HDHPs is their lower monthly premiums compared to other insurance plans. This makes them an attractive option for individuals and families who are willing to accept higher deductibles in exchange for potentially significant cost savings.

- Health Savings Accounts (HSAs): As mentioned earlier, HDHPs are often paired with HSAs. These accounts provide a tax-efficient way to save for future medical expenses, offering individuals the opportunity to build a financial cushion for healthcare costs.

- Cost Awareness: HDHPs promote a higher level of cost consciousness among policyholders. With a significant portion of their healthcare costs coming out of pocket, individuals are more likely to research and compare prices for medical services, leading to more informed healthcare decisions.

- Incentives for Preventive Care: Despite the high deductibles, HDHPs often cover preventive care services, such as annual check-ups, vaccinations, and screenings, at little to no cost. This encourages individuals to prioritize their health and catch potential issues early, which can lead to better overall health outcomes.

- Tax Advantages: In addition to HSAs, HDHPs may also offer tax benefits for individuals who itemize their deductions on their tax returns. These plans can reduce taxable income, potentially resulting in lower tax liabilities.

Real-World Examples and Performance Analysis

To illustrate the impact of HDHPs, let’s examine some real-world scenarios:

Case Study 1: Young, Healthy Individuals

For a young, healthy individual in their 20s, an HDHP with a 2,500 deductible and a monthly premium of 200 might be an excellent choice. With minimal healthcare needs, they can save money on premiums and potentially meet their deductible only for routine check-ups and preventive services, which are often covered fully or at a reduced cost.

Case Study 2: Families with Chronic Conditions

On the other hand, a family with a member who has a chronic condition, such as diabetes, may benefit from an HDHP with a slightly higher deductible, say $5,000. While the deductible may be substantial, the family can maximize their HSA contributions to build a reserve for future medical expenses. Additionally, negotiating rates for specialized treatments and comparing providers can lead to significant cost savings over time.

Performance Analysis

Research suggests that HDHPs, when coupled with HSAs, can effectively reduce healthcare spending without compromising access to necessary medical care. A study by the Journal of the American Medical Association found that employees enrolled in HDHPs with HSAs had a 16% lower per-member healthcare spending growth rate compared to those in traditional plans. This indicates that HDHPs can control rising healthcare costs while still providing adequate coverage.

| Plan Type | Healthcare Spending Growth Rate |

|---|---|

| HDHP with HSA | 3.5% |

| Traditional Health Insurance | 5.0% |

However, it's important to note that the effectiveness of HDHPs can vary based on individual circumstances. Factors such as age, health status, and the frequency of medical services required can influence the overall cost-effectiveness of these plans.

Potential Drawbacks and Considerations

While HDHPs offer numerous advantages, they are not without their potential drawbacks:

- High Out-of-Pocket Costs: The primary concern with HDHPs is the potential for high out-of-pocket expenses, especially for individuals with unexpected or significant medical needs. Meeting the deductible can be a challenge, and for those with limited financial resources, this could create a significant financial burden.

- Limited Provider Networks: Some HDHPs may have narrower provider networks than traditional plans, which could limit access to certain specialists or medical facilities. This can be particularly problematic for individuals with specific healthcare needs.

- Complexity: Understanding the intricacies of HDHPs and HSAs can be complex, especially for those who are new to these concepts. Navigating the rules and regulations surrounding contributions, withdrawals, and qualified medical expenses may require additional financial education.

Future Implications and Industry Trends

HDHPs are expected to play an increasingly significant role in the healthcare industry. As employers and policymakers seek ways to control rising healthcare costs, these plans are viewed as a potential solution. However, it is crucial to ensure that access to healthcare remains equitable and that individuals have the necessary financial resources and education to navigate these plans effectively.

The future of HDHPs may involve further integration with digital health technologies, such as telemedicine and health apps, which can reduce the need for in-person visits and improve cost-effectiveness. Additionally, employer-provided financial education and support for navigating HDHPs and HSAs could become standard practice to ensure employees make informed decisions about their healthcare coverage.

Conclusion: A Balanced Approach to Healthcare

HDHPs offer a unique approach to healthcare insurance, empowering individuals to take control of their healthcare choices and promote cost-consciousness. While these plans come with certain challenges and considerations, they have the potential to reduce overall healthcare spending and provide valuable financial benefits when used effectively. As the healthcare landscape continues to evolve, HDHPs may become an increasingly popular option for those seeking a balanced approach to their healthcare coverage.

What is the average deductible for an HDHP plan?

+The average deductible for an HDHP plan can vary, but it typically falls within the range of 2,000 to 5,000 for individual coverage. Family plans may have higher deductibles, often reaching $10,000 or more.

Can I use an HSA with any HDHP plan?

+Yes, HSAs are specifically designed to be used with HDHPs. However, it’s important to ensure that your HDHP meets the IRS requirements for HSA eligibility. Check with your insurance provider or a tax professional to confirm eligibility.

Are HDHPs suitable for everyone?

+HDHPs can be a great option for individuals and families who are generally healthy and prefer lower monthly premiums. However, for those with chronic conditions or frequent medical needs, traditional health insurance plans with lower deductibles may be more suitable.