What Is In Insurance

Insurance is a vital aspect of our modern society, providing financial protection and peace of mind to individuals, businesses, and organizations. It is a complex industry with a rich history and a wide range of applications. In this comprehensive guide, we will delve into the world of insurance, exploring its various facets, how it works, and its impact on our daily lives.

The concept of insurance dates back centuries, with early forms of risk-sharing practices found in ancient civilizations. Over time, insurance has evolved into a sophisticated system, offering coverage for a multitude of risks and uncertainties. Understanding insurance is crucial, as it plays a significant role in managing financial risks and ensuring stability in both personal and commercial endeavors.

Understanding the Basics of Insurance

Insurance, at its core, is a contractual agreement between an individual or entity (the insured) and an insurance company (the insurer). This agreement, known as an insurance policy, outlines the terms and conditions under which the insurer agrees to provide financial protection to the insured in the event of a specified loss or damage.

The fundamental principle behind insurance is the pooling of resources. Insurers collect premiums from a large number of policyholders, who pay regular amounts based on their specific coverage needs. By pooling these premiums, insurers create a fund that can be used to pay out claims when policyholders experience covered losses. This pooling mechanism allows individuals and businesses to transfer the financial burden of unexpected events to the insurer, providing them with a safety net.

Insurance policies are tailored to cover a wide range of risks, including property damage, liability, health issues, and even specialized areas like cyber security and natural disasters. Each policy is designed to meet the specific needs and circumstances of the insured, ensuring that they receive adequate protection for their unique situation.

Types of Insurance and Their Applications

1. Property Insurance

Property insurance is one of the most common types, providing coverage for tangible assets such as homes, vehicles, and businesses. It offers protection against various perils, including fire, theft, natural disasters, and accidental damage. For homeowners, property insurance is crucial in safeguarding their largest investment, ensuring they can rebuild or repair their homes in the event of a covered loss.

Similarly, auto insurance is mandatory in many regions and provides financial protection in case of accidents, theft, or other vehicle-related incidents. Commercial property insurance, on the other hand, is essential for businesses to protect their physical assets, inventory, and equipment, helping them stay operational even in the face of unexpected events.

2. Health Insurance

Health insurance is a vital component of modern healthcare systems, providing individuals and families with access to medical services and coverage for unexpected health issues. It ensures that policyholders can receive necessary medical treatment without facing overwhelming financial burdens. Health insurance plans vary widely, offering different levels of coverage, deductibles, and copayments, allowing individuals to choose a plan that aligns with their healthcare needs and budget.

3. Life Insurance

Life insurance is a unique form of coverage that provides financial security to the policyholder’s beneficiaries in the event of their death. It is designed to offer peace of mind, ensuring that loved ones are financially protected and can maintain their standard of living even after the insured passes away. Life insurance policies come in various forms, including term life insurance, which provides coverage for a specified period, and permanent life insurance, which offers lifelong coverage and builds cash value over time.

4. Liability Insurance

Liability insurance is crucial for individuals and businesses to protect themselves against legal claims and lawsuits arising from accidents or negligence. It provides coverage for damages and legal expenses, ensuring that the insured can defend themselves and mitigate potential financial losses. This type of insurance is particularly important for businesses, as it protects them from the financial risks associated with product defects, employee injuries, or other liability-related incidents.

5. Specialty Insurance

The insurance industry also offers a wide range of specialty insurance policies tailored to specific industries or unique situations. For instance, cyber insurance provides coverage for businesses against cyber attacks, data breaches, and other online risks. Similarly, travel insurance offers protection for travelers, covering unexpected medical expenses, trip cancellations, or lost luggage.

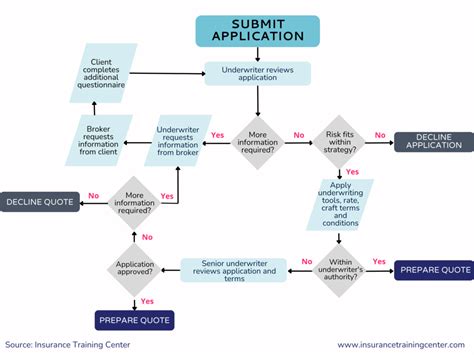

How Insurance Works: The Claims Process

When a policyholder experiences a covered loss, they initiate the claims process by notifying their insurance company. The insurer then assesses the claim, verifies the validity of the loss, and determines the amount to be paid out. This process involves careful evaluation of the policy terms, the nature of the loss, and any applicable deductibles or exclusions.

The claims process can vary depending on the type of insurance and the complexity of the loss. For example, a simple auto accident claim may be resolved relatively quickly, while a complex liability claim involving multiple parties and extensive damages may take longer to settle. Insurance companies employ claims adjusters and investigators to thoroughly assess and negotiate claims, ensuring a fair and timely resolution for policyholders.

In some cases, policyholders may face challenges during the claims process, such as disputes over the value of the loss or delays in receiving payment. It is essential for policyholders to understand their rights and the procedures outlined in their insurance policy to navigate these situations effectively.

The Impact of Insurance on Society

Insurance has a profound impact on society, influencing various aspects of our lives and the economy. By providing financial protection, insurance fosters stability and encourages economic growth. It allows individuals and businesses to take calculated risks, knowing that they have a safety net in place. This, in turn, promotes entrepreneurship, innovation, and overall economic development.

Moreover, insurance plays a critical role in managing catastrophic events, such as natural disasters or large-scale accidents. By pooling resources and sharing risks, insurance companies can provide substantial financial support to affected communities, aiding in their recovery and rebuilding efforts. This collective approach to risk management benefits society as a whole, ensuring that even in the face of devastating events, there is a system in place to provide assistance and support.

The Future of Insurance: Innovations and Challenges

The insurance industry is continually evolving, driven by technological advancements and changing consumer needs. Insurers are adopting digital technologies, such as artificial intelligence and blockchain, to enhance their operations, improve customer experiences, and streamline the claims process. These innovations enable faster and more accurate risk assessment, personalized coverage options, and efficient claim settlements.

However, the industry also faces challenges, including regulatory changes, increasing frequency and severity of natural disasters, and the rise of cyber risks. Insurers must adapt to these evolving risks and develop innovative solutions to provide adequate coverage and protect policyholders in an ever-changing landscape.

Additionally, the rise of InsurTech startups is disrupting traditional insurance models, offering new ways to engage with customers and provide coverage. These startups leverage technology to offer more flexible and tailored insurance products, challenging established insurers to embrace digital transformation and enhance their value proposition.

Conclusion

Insurance is a multifaceted industry that plays a crucial role in our lives, offering protection and peace of mind against a wide range of risks. From property and health insurance to liability and specialty coverage, insurers provide financial security to individuals, families, and businesses. Understanding the basics of insurance, its various types, and the claims process empowers policyholders to make informed decisions and navigate the insurance landscape effectively.

As the insurance industry continues to evolve, embracing technological advancements and adapting to changing risks, it remains a vital component of our society, ensuring stability and supporting economic growth. By staying informed and engaged with the insurance market, individuals and businesses can secure the coverage they need to protect their assets, livelihoods, and loved ones.

How does insurance help individuals and businesses manage financial risks?

+Insurance provides a financial safety net for individuals and businesses by transferring the risk of potential losses to an insurer. By paying regular premiums, policyholders can access coverage for various risks, such as property damage, liability, and health issues. This allows them to manage their finances more effectively and have the means to recover from unexpected events without incurring significant financial burdens.

What factors determine the cost of insurance premiums?

+The cost of insurance premiums is influenced by a variety of factors, including the type of coverage, the amount of coverage needed, the policyholder’s location, their age and health status, and the level of risk associated with the insured activity or asset. Insurers assess these factors to determine the likelihood of a claim being made and set premiums accordingly.

How can individuals choose the right insurance policy for their needs?

+Choosing the right insurance policy involves carefully assessing your specific needs and circumstances. Consider the types of risks you want to protect against, your financial situation, and the level of coverage you require. It’s essential to read and understand the policy terms and conditions, compare different options, and seek advice from insurance professionals to make an informed decision.