Aca Insurance Marketplace

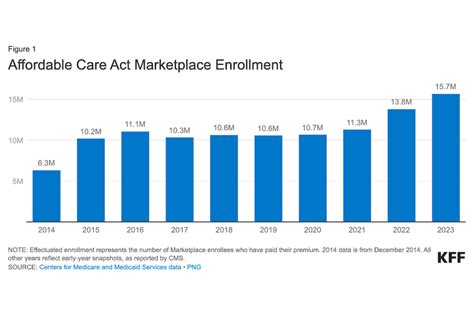

The ACA Insurance Marketplace, a cornerstone of the Affordable Care Act (ACA), has been a pivotal force in reshaping the healthcare landscape in the United States. Since its inception, it has provided millions of Americans with access to affordable health insurance, offering a range of plans and options to cater to diverse needs. This article delves into the intricacies of the ACA Insurance Marketplace, exploring its history, the benefits it offers, and its impact on healthcare accessibility.

Understanding the ACA Insurance Marketplace

The ACA Insurance Marketplace, also known as the Health Insurance Marketplace, is a digital platform that facilitates the purchase of health insurance plans for individuals, families, and small businesses. It was established as a key component of the Affordable Care Act, signed into law in 2010, with the primary goal of making health insurance more affordable and accessible to all Americans.

The marketplace operates on a state or federal level, depending on the state's decision to establish its own exchange or utilize the federally facilitated marketplace. This dual system allows for tailored approaches to meet the unique healthcare needs of each state's population.

Eligibility and Enrollment

Eligibility for the ACA Insurance Marketplace is broad, encompassing individuals, families, and small businesses. During the annual Open Enrollment Period, typically running from November to December, anyone can enroll in a health insurance plan through the marketplace. However, qualifying life events, such as marriage, birth of a child, or loss of job-based coverage, also allow for a Special Enrollment Period outside of the standard timeline.

To facilitate enrollment, the marketplace provides a range of resources, including online applications, call centers, and in-person assistance through navigators and certified application counselors. These resources ensure that individuals have the support they need to navigate the enrollment process and select the most suitable plan for their healthcare needs.

Plan Options and Coverage

The ACA Insurance Marketplace offers a diverse range of health insurance plans, categorized into four main tiers: Bronze, Silver, Gold, and Platinum. These tiers represent the proportion of costs covered by the insurance provider, with Bronze plans covering the least and Platinum plans covering the most.

Each plan also has a network of healthcare providers, including doctors, hospitals, and specialists, with whom it has negotiated rates. Enrollees are generally required to stay within this network to ensure cost-effectiveness. However, emergency services and out-of-network care are typically covered, albeit at a higher cost.

| Plan Tier | Cost-Sharing | Coverage Level |

|---|---|---|

| Bronze | 60% by Provider | 40% by Enrollee |

| Silver | 70% by Provider | 30% by Enrollee |

| Gold | 80% by Provider | 20% by Enrollee |

| Platinum | 90% by Provider | 10% by Enrollee |

In addition to these standard plans, the marketplace also offers Catastrophic plans, primarily for individuals under 30 or those who qualify due to hardship exemptions. These plans provide limited coverage but can be a cost-effective option for those who do not anticipate significant healthcare needs.

Benefits and Impact of the ACA Insurance Marketplace

The ACA Insurance Marketplace has had a profound impact on the accessibility and affordability of healthcare in the United States. Since its implementation, it has provided numerous benefits, including:

- Increased Access to Healthcare: The marketplace has made health insurance more accessible to millions of Americans who were previously uninsured or underinsured. This has resulted in improved health outcomes and reduced financial burdens associated with healthcare.

- Affordable Premiums: Through the use of premium tax credits, the marketplace ensures that insurance premiums are affordable for low- and middle-income individuals and families. These tax credits can significantly reduce the cost of coverage, making it more financially feasible.

- Expanded Coverage: The marketplace has expanded the scope of coverage, ensuring that essential health benefits are included in all plans. These benefits include ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative and habilitative services, and more.

- Protection for Pre-Existing Conditions: One of the most significant achievements of the ACA Insurance Marketplace is the protection it provides for individuals with pre-existing conditions. Insurance providers are prohibited from denying coverage or charging higher premiums based on health status, ensuring that everyone has equal access to affordable healthcare.

- Cost-Sharing Reductions: The marketplace also offers cost-sharing reductions for eligible individuals, which lower the out-of-pocket costs for deductibles, copayments, and coinsurance. This further enhances the affordability of healthcare for those with lower incomes.

Success Stories and Real-World Impact

The impact of the ACA Insurance Marketplace is best understood through the stories of those it has helped. For instance, consider the case of Sarah, a single mother of two, who previously struggled to afford health insurance. Through the marketplace, she was able to find a plan that fit her budget and provided the coverage she needed for her family. This allowed her to access regular check-ups and necessary medical treatments without financial strain.

Another success story is that of John, a small business owner. With the help of the marketplace, he was able to provide health insurance coverage for his employees, which not only improved their overall health but also boosted employee morale and retention. This demonstrates the far-reaching effects of the marketplace, extending beyond individual access to healthcare.

Navigating the ACA Insurance Marketplace

Navigating the ACA Insurance Marketplace can be a complex process, but several resources are available to guide individuals through the enrollment journey.

Online Tools and Resources

The official HealthCare.gov website is a comprehensive resource, offering a user-friendly interface for plan comparison and enrollment. It provides detailed information on plan options, coverage details, and estimated costs based on income and household size. The website also features a helpful plan finder tool, which suggests the best plans based on individual needs and preferences.

In addition to the main website, the marketplace also offers a range of online tools and resources, including:

- Mobile apps for on-the-go plan comparison and enrollment

- Online chat and messaging services for immediate assistance

- Email support for follow-up queries and plan management

- Online learning modules and webinars for understanding healthcare coverage and navigating the marketplace

In-Person Assistance

For those who prefer in-person support, the marketplace provides a network of navigators and certified application counselors. These professionals offer one-on-one assistance, helping individuals understand their healthcare needs, compare plans, and complete the enrollment process. They are available at local community centers, libraries, and other public spaces, ensuring that help is accessible to all.

Navigators and counselors are trained to provide unbiased assistance, ensuring that individuals receive the most suitable plan recommendations without any influence from insurance providers. This ensures that the process is fair and focused on the best interests of the enrollee.

Future Outlook and Ongoing Challenges

While the ACA Insurance Marketplace has achieved significant milestones, there are ongoing challenges and opportunities for improvement. As the healthcare landscape continues to evolve, the marketplace must adapt to meet the changing needs of its users.

Expanding Coverage and Accessibility

One of the key areas of focus for the future is expanding coverage and improving accessibility. This includes efforts to:

- Increase the number of insurers participating in the marketplace, providing more plan options and potentially driving down costs.

- Enhance outreach and enrollment efforts, particularly in underserved communities, to ensure that all eligible individuals are aware of their options and can access affordable healthcare.

- Improve the user experience of the marketplace platforms, making them more intuitive and user-friendly, especially for those who may be less technologically savvy.

Addressing Premium Increases

Premium increases have been a concern for many enrollees, particularly in recent years. To address this, the marketplace is working on strategies to stabilize premiums and make healthcare more affordable. These strategies include:

- Encouraging competition among insurers to drive down costs and improve plan offerings.

- Implementing risk adjustment programs to ensure that insurers are appropriately compensated for high-risk enrollees, preventing the shifting of costs to healthier individuals.

- Expanding the use of cost-sharing reductions and premium tax credits to further reduce the financial burden on enrollees.

Improving Consumer Education

Education is a critical aspect of the marketplace’s success. Many individuals may not fully understand their healthcare needs or the intricacies of insurance coverage. To address this, the marketplace is focusing on:

- Developing and distributing educational materials and resources that explain healthcare coverage, plan options, and the enrollment process in simple, easy-to-understand language.

- Conducting outreach and awareness campaigns to reach a wider audience, including those who may be hesitant to seek out healthcare or insurance coverage due to lack of understanding or cultural barriers.

- Providing ongoing support and guidance to enrollees, helping them navigate the healthcare system and make informed decisions about their coverage and care.

Frequently Asked Questions

How do I know if I’m eligible for the ACA Insurance Marketplace?

+

Eligibility for the ACA Insurance Marketplace is broad and includes individuals, families, and small businesses. You may be eligible if you are a U.S. citizen or lawfully present in the U.S., do not have access to affordable health insurance through your employer or another source, and do not qualify for Medicare, Medicaid, or other government-funded programs. It’s best to visit the official HealthCare.gov website to determine your eligibility and explore your options.

When is the Open Enrollment Period for the ACA Insurance Marketplace?

+

The Open Enrollment Period for the ACA Insurance Marketplace typically runs from November to December each year. However, it’s important to note that this period can vary depending on your state and specific circumstances. It’s recommended to check the official HealthCare.gov website or contact your state’s marketplace for accurate and up-to-date information on enrollment timelines.

What happens if I miss the Open Enrollment Period?

+

If you miss the Open Enrollment Period, you may still be able to enroll in a health insurance plan through the ACA Insurance Marketplace if you qualify for a Special Enrollment Period. Qualifying life events, such as marriage, birth of a child, loss of job-based coverage, or moving to a new state, can trigger a Special Enrollment Period. It’s important to review the list of qualifying events and act promptly to ensure you don’t miss out on coverage.

How do I choose the right health insurance plan for my needs?

+

Choosing the right health insurance plan can be complex, but the ACA Insurance Marketplace provides tools and resources to guide you. Consider your healthcare needs, budget, and preferences. Compare plan options, review coverage details, and estimate costs based on your income and household size. You can also seek assistance from navigators or certified application counselors, who can provide unbiased advice and support throughout the enrollment process.

Can I keep my current doctor or hospital with a plan from the ACA Insurance Marketplace?

+

Whether you can keep your current doctor or hospital depends on the network of providers included in your chosen plan. Each plan has its own network, so it’s important to review the provider directory before enrolling. If your preferred healthcare providers are in-network, you can continue seeing them. If not, you may need to switch providers or choose a different plan that includes your preferred healthcare professionals.