What Does Renter's Insurance Cover

Renter's insurance, often overlooked yet crucial, is a safeguard for individuals living in rented accommodations. It provides financial protection against various unforeseen events, ensuring peace of mind for tenants. This comprehensive guide delves into the specifics of what renter's insurance covers, exploring its benefits, and offering an in-depth analysis to help you make informed decisions.

Comprehensive Coverage for Peace of Mind

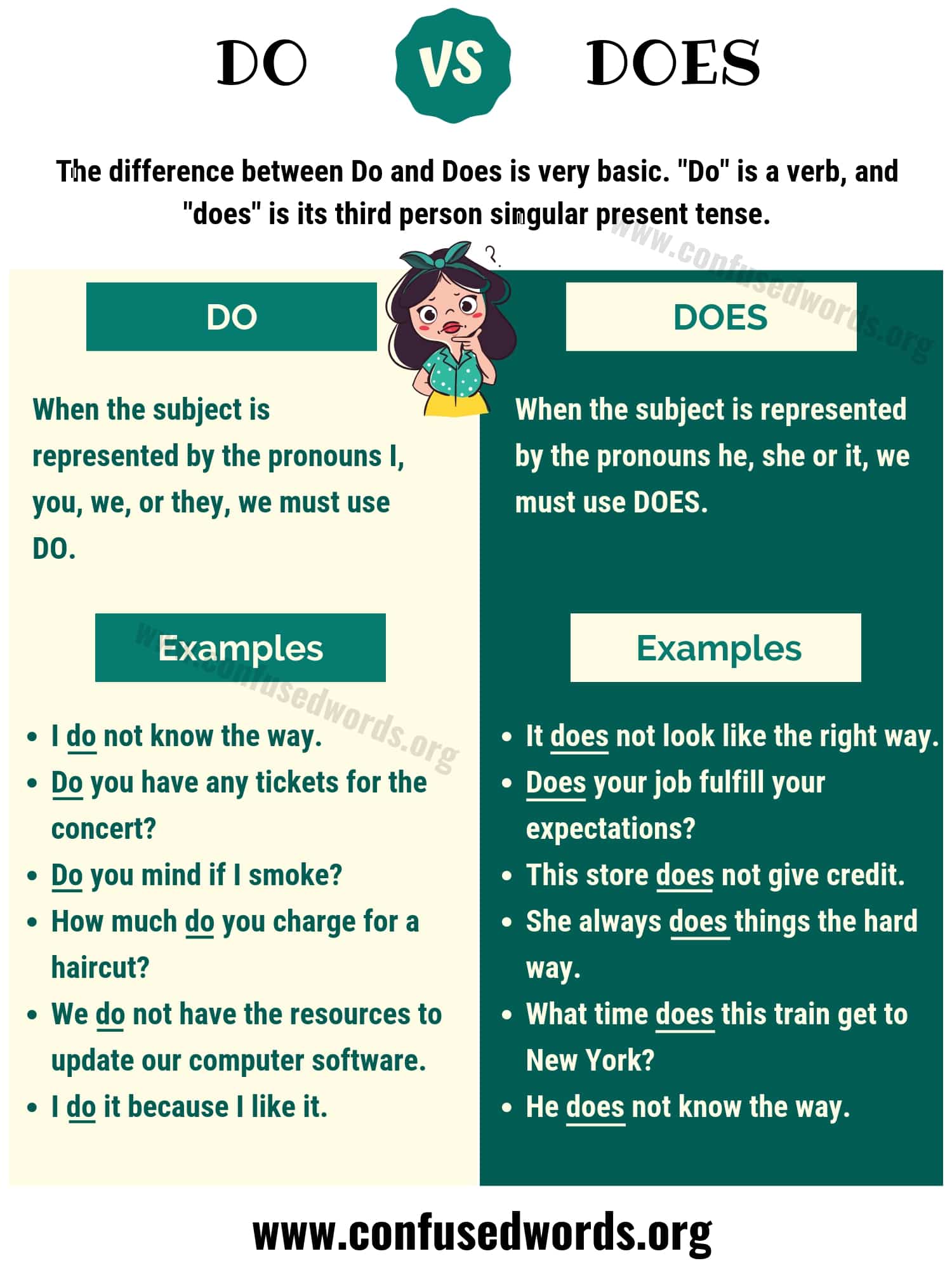

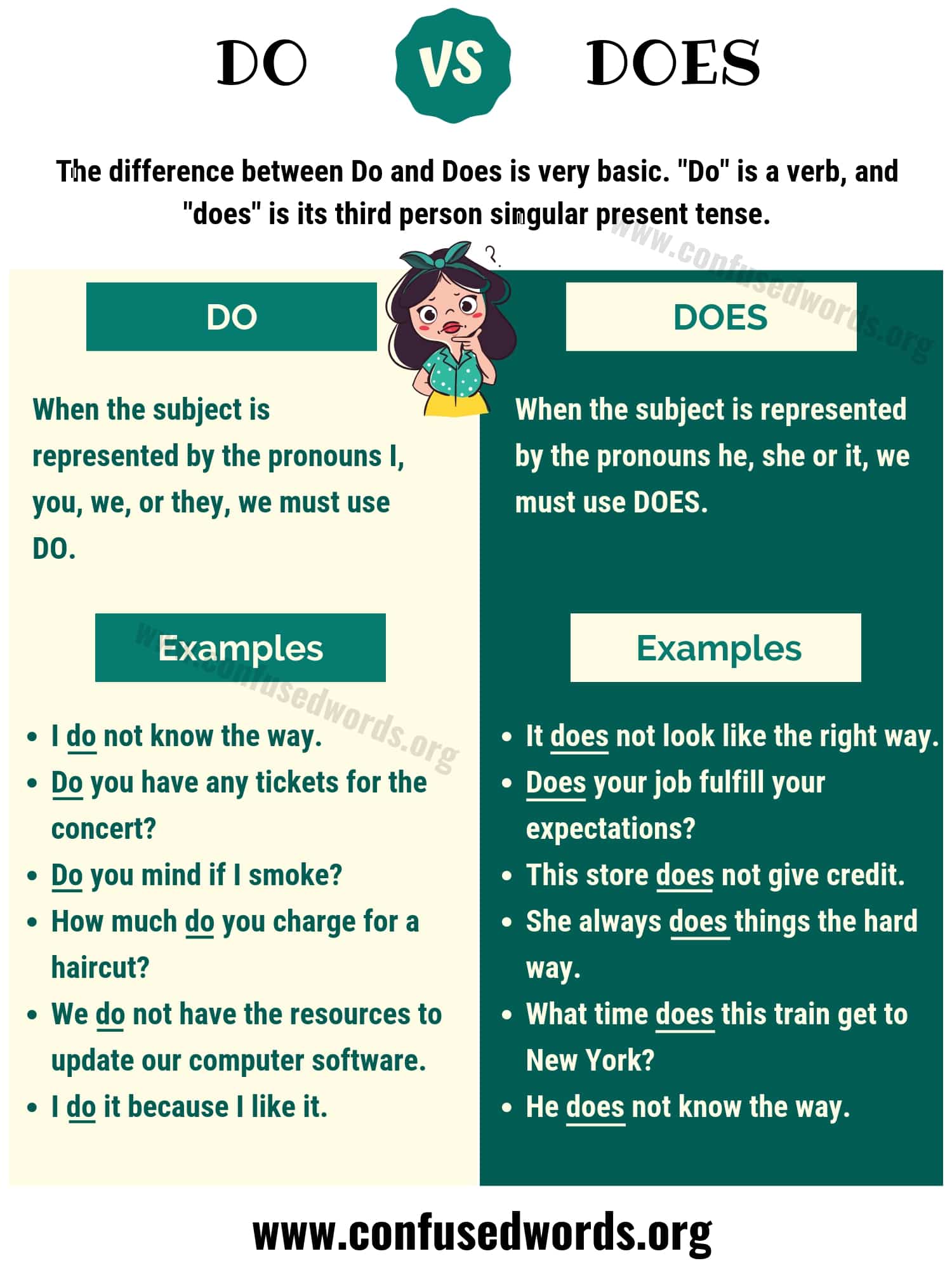

Renter’s insurance is designed to protect both your personal belongings and your liability as a tenant. Here’s a detailed breakdown of its coverage:

Personal Property Protection

The primary purpose of renter’s insurance is to safeguard your personal belongings. This coverage ensures that in the event of a covered loss, such as theft, fire, or natural disasters, your possessions are protected. Typical items covered include furniture, clothing, electronics, and appliances. For instance, if your apartment experiences a break-in and your laptop is stolen, renter’s insurance would provide compensation for the loss.

It's essential to note that certain high-value items like jewelry, artwork, or collectibles might require additional coverage or specific endorsements to ensure adequate protection.

Liability Coverage

Renter’s insurance also provides liability protection, which is a critical aspect often overlooked. This coverage shields you from financial responsibility if someone is injured in your rented space or if your actions cause damage to others’ property. For example, if a guest trips and falls in your apartment, liability coverage would help cover medical expenses and potential legal fees.

Additional Living Expenses

In the unfortunate event that your rented home becomes uninhabitable due to a covered loss, renter’s insurance often includes coverage for additional living expenses. This provision ensures that you have the financial means to secure temporary housing until your residence is repaired or rebuilt.

Medical Payments Coverage

Medical payments coverage, a standard feature in most renter’s insurance policies, provides coverage for medical expenses incurred by guests who sustain injuries on your rented premises. This coverage applies regardless of fault and helps cover the cost of medical treatment, ensuring prompt care without the need for a lengthy legal process.

| Coverage Type | Description |

|---|---|

| Personal Property | Protects belongings like furniture, electronics, and clothing. |

| Liability | Covers legal and medical expenses if someone is injured in your rented space. |

| Additional Living Expenses | Provides financial support for temporary housing if your home is uninhabitable. |

| Medical Payments | Covers medical expenses for guests injured on your premises. |

Understanding Exclusions and Limitations

While renter’s insurance offers comprehensive protection, it’s essential to be aware of certain exclusions and limitations. Here are some common scenarios that might not be covered:

- Intentional Damage: Renter's insurance typically does not cover damage caused intentionally by the policyholder.

- Earthquakes and Floods: Standard renter's insurance policies often exclude coverage for earthquakes and floods. However, separate policies or endorsements can be purchased to cover these events.

- Pet-Related Incidents: Some policies might exclude coverage for injuries or damages caused by certain high-risk dog breeds.

- Certain Natural Disasters: Events like landslides or sinkholes might not be covered by standard policies.

It's crucial to carefully review your policy's exclusions and limitations to ensure you understand the coverage gaps. If you have specific concerns or high-value items, consider discussing them with your insurance provider to tailor your policy accordingly.

The Benefits of Renter’s Insurance

Renter’s insurance offers numerous advantages that go beyond simple financial protection. Here are some key benefits:

- Peace of Mind: Knowing that your personal belongings and liability are protected provides a sense of security, allowing you to focus on other aspects of your life.

- Cost-Effectiveness: Renter's insurance is typically more affordable than other types of insurance, offering comprehensive coverage at a reasonable price.

- Customizable Coverage: You can tailor your policy to fit your specific needs, ensuring that your valuable possessions and unique circumstances are adequately protected.

- Quick Claim Resolution: In the event of a covered loss, renter's insurance providers often offer swift claim resolution, ensuring you receive compensation promptly.

Conclusion: A Necessary Investment

Renter’s insurance is an essential investment for anyone living in a rented space. It provides a safety net, ensuring that your personal belongings and liability are protected. By understanding the comprehensive coverage offered and tailoring your policy to your needs, you can rest assured knowing you’re prepared for unforeseen events.

Frequently Asked Questions

Can renter’s insurance cover my belongings if they’re stolen while I’m traveling?

+

Yes, renter’s insurance often provides coverage for your personal belongings even when they’re away from your rented residence. This protection extends to situations like theft during travel, ensuring that your valuables are safeguarded regardless of their location.

Does renter’s insurance cover damage caused by roommates or guests?

+

In most cases, renter’s insurance covers damage caused by roommates or guests if they’re listed on the policy. It’s essential to review your policy’s terms and conditions to understand the extent of coverage for different individuals residing in your rented space.

What happens if I need to file a claim with my renter’s insurance?

+

Filing a claim with your renter’s insurance typically involves notifying your insurance provider, providing detailed information about the incident, and submitting supporting documentation. The claims process can vary, so it’s beneficial to familiarize yourself with your specific policy’s procedures.