What Does Insurance Mean

Insurance is a fundamental concept that plays a pivotal role in our daily lives, offering a safety net against unforeseen events and financial risks. At its core, insurance is a contract between an individual or entity (the policyholder) and an insurance company. This contract, known as an insurance policy, outlines the terms and conditions under which the insurance provider agrees to compensate the policyholder for losses or damages incurred in specific situations.

The purpose of insurance is to provide financial protection and peace of mind. It operates on the principle of risk pooling, where many individuals or entities contribute small, regular payments (known as premiums) to a common fund. This fund is then used to compensate those who suffer a loss or damage covered by their insurance policy. In this way, insurance helps to spread the financial burden of unforeseen events across a large group, making it more manageable for those directly affected.

The Mechanics of Insurance

When an individual or business purchases an insurance policy, they are essentially buying a promise from the insurance company. This promise is to provide financial coverage in the event of a specific incident or circumstance, such as a car accident, a house fire, or a medical emergency.

Insurance policies are highly detailed documents that outline the specific risks covered, the conditions under which coverage applies, and the limits of that coverage. For instance, a homeowner's insurance policy might cover damage caused by fire, but not by earthquakes, unless an additional rider (an amendment to the policy) is purchased. Similarly, a health insurance policy might cover hospital stays but may have separate provisions for outpatient treatments or prescription medications.

The amount of the premium paid for an insurance policy is determined by a variety of factors, including the type of insurance, the level of coverage desired, and the risk profile of the policyholder. For example, a young, healthy individual may pay lower premiums for health insurance compared to an older person with a history of medical conditions. Likewise, a homeowner in an area prone to natural disasters may pay higher premiums for their home insurance policy.

The Role of Deductibles and Copays

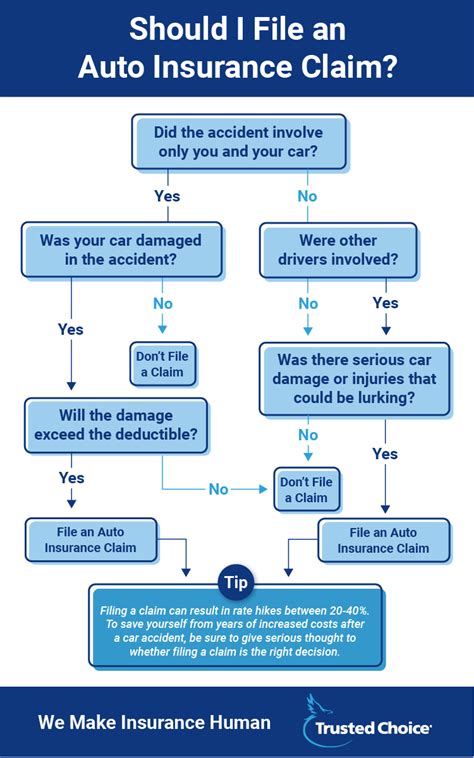

In many insurance policies, particularly health and auto insurance, deductibles and copays are common features. A deductible is the amount the policyholder must pay out of pocket before the insurance coverage kicks in. For example, if a car insurance policy has a 500 deductible and the repairs cost 3,000, the policyholder will pay the first 500, and the insurance company will cover the remaining 2,500.

A copay, on the other hand, is a fixed amount the policyholder pays for a covered service, usually after the deductible has been met. For instance, a health insurance policy might have a $30 copay for doctor's office visits. This means the policyholder pays $30 each time they visit the doctor, and the insurance company covers the rest of the cost.

| Insurance Type | Common Deductibles and Copays |

|---|---|

| Health Insurance | $500 deductible, $30 copay for doctor visits |

| Auto Insurance | $1,000 deductible for comprehensive and collision coverage |

| Homeowner's Insurance | $1,500 deductible for wind and hail damage |

These mechanisms are designed to encourage policyholders to be mindful of their healthcare or property usage, and to deter excessive or unnecessary claims, thus helping to keep insurance premiums affordable for everyone.

Types of Insurance and Their Applications

Insurance comes in various forms, each tailored to specific needs and circumstances. Here are some of the most common types of insurance and their key applications:

Life Insurance

Life insurance provides financial protection to the policyholder’s beneficiaries in the event of their death. It can help cover funeral expenses, pay off debts, or provide ongoing income to support the family. There are two main types of life insurance: term life and permanent life. Term life insurance provides coverage for a specific period, while permanent life insurance, such as whole life or universal life, offers coverage for the policyholder’s entire life and also accumulates cash value.

Health Insurance

Health insurance covers the cost of medical and surgical expenses. It can help pay for doctor’s visits, hospital stays, prescription drugs, and sometimes even preventative care and wellness programs. Health insurance is particularly important given the high cost of healthcare, which can quickly deplete one’s savings without insurance coverage.

Auto Insurance

Auto insurance provides financial protection against physical damage and/or bodily injury resulting from traffic collisions and against liability that could arise from an accident. It is typically required by law for all vehicle owners to have some form of auto insurance. The main types of auto insurance coverage include liability, collision, comprehensive, and personal injury protection (PIP) or medical payments.

Homeowner’s Insurance

Homeowner’s insurance provides financial protection against disasters. A standard homeowner’s insurance policy typically covers damage caused by fire, lightning, windstorms, hail, explosions, riots, and vandalism. It also includes liability coverage for accidents that occur on the insured property and may cover the cost of living elsewhere while the home is being repaired.

Business Insurance

Business insurance is designed to protect businesses against a variety of risks, including property damage, liability claims, and interruption of business due to unforeseen circumstances. This can include coverage for commercial property, general liability, professional liability (also known as errors and omissions insurance), and business interruption insurance.

Travel Insurance

Travel insurance provides coverage for trip cancellations, interruptions, delays, and medical emergencies while traveling. It can also cover lost or stolen luggage and personal effects. Travel insurance is particularly beneficial for those traveling to destinations with limited access to medical care or where unexpected events, such as natural disasters or political unrest, could disrupt travel plans.

The Benefits and Importance of Insurance

Insurance offers numerous benefits that contribute to financial stability and peace of mind. Here are some key advantages of having insurance coverage:

- Financial Protection: Insurance provides a financial safety net, protecting policyholders from potentially catastrophic costs associated with unexpected events.

- Peace of Mind: Knowing you have insurance coverage can reduce stress and anxiety, allowing you to focus on other aspects of your life or business without worrying about unforeseen financial burdens.

- Risk Management: Insurance helps manage risks by transferring the financial burden of potential losses to the insurance company. This allows individuals and businesses to focus on their primary goals and objectives.

- Legal Compliance: Certain types of insurance, such as auto insurance and worker's compensation insurance, are often required by law. Having the required insurance coverage ensures compliance with legal obligations.

- Access to Expertise: Insurance companies provide access to a wealth of knowledge and expertise in risk management and claims handling. This can be particularly beneficial for businesses that may not have the internal resources to manage complex risks.

The Future of Insurance

The insurance industry is evolving rapidly, driven by advancements in technology and changing consumer expectations. The rise of digital platforms and mobile applications has made it easier for consumers to compare policies, understand their coverage, and file claims. Insurance companies are also leveraging data analytics and machine learning to improve risk assessment and pricing, leading to more accurate and personalized insurance offerings.

Moreover, the concept of insurance is expanding beyond traditional areas. For instance, there's growing interest in cyber insurance to protect against digital risks, and parametric insurance, which uses predefined triggers based on specific events (e.g., a hurricane reaching a certain wind speed) to determine payouts, offering a more rapid and certain form of protection.

As we move forward, insurance will continue to play a critical role in our lives, helping us manage risks and providing the financial protection we need to thrive in an uncertain world. By understanding the various types of insurance and their applications, individuals and businesses can make informed decisions to protect their assets and ensure their long-term financial stability.

What happens if I need to make an insurance claim but my policy has a deductible?

+If you have a deductible in your insurance policy and you need to make a claim, you’ll first need to pay the deductible amount out of your own pocket. This is your responsibility as the policyholder. Once you’ve paid the deductible, the insurance company will then cover the remaining amount of the claim, up to your policy limits.

How do I know if I have enough insurance coverage for my needs?

+Determining the right amount of insurance coverage can be complex and depends on various factors, including your personal or business financial situation, the value of your assets, and the types of risks you’re exposed to. It’s a good idea to regularly review your insurance needs with a qualified insurance professional who can help you assess your coverage and make any necessary adjustments.

Are there any disadvantages to having insurance?

+While insurance offers many benefits, there are some potential drawbacks. One is the cost of premiums, which can be a significant expense, especially for those on a tight budget. Additionally, there may be situations where the insurance policy doesn’t cover the full extent of the loss, or there may be disagreements with the insurance company over the value of the claim, which can lead to legal battles.