Western Life Insurance

In the ever-evolving landscape of financial services, Western Life Insurance stands as a pillar of stability and innovation. With a rich history spanning decades, this insurance giant has shaped the industry, offering comprehensive protection and financial security to individuals and families across the globe. In this comprehensive guide, we delve into the evolution of Western Life Insurance, exploring its origins, pivotal moments, and the strategies that have solidified its position as a trusted leader.

A Legacy of Trust: The Early Years

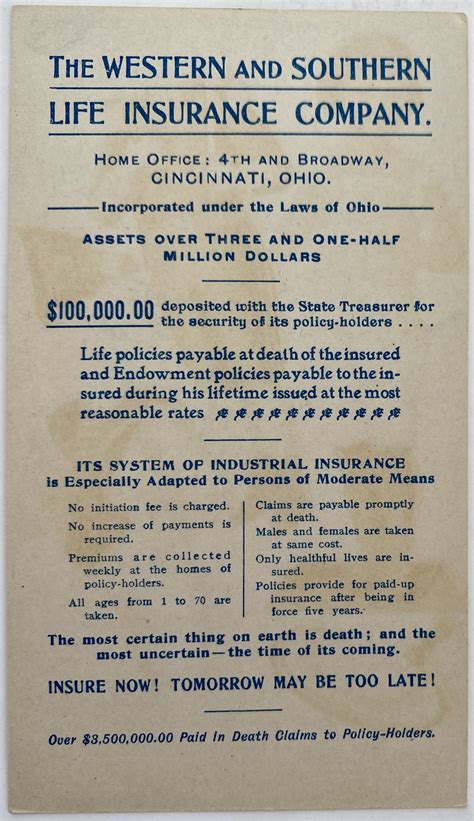

The story of Western Life Insurance began in the late 19th century, a time when the concept of life insurance was gaining traction as a vital financial tool. Founded in 1889 by a group of visionary entrepreneurs, the company set out with a mission to provide reliable insurance solutions to the hardworking citizens of the Western United States. At its inception, Western Life Insurance focused on offering term life insurance policies, a straightforward approach that resonated with the pragmatic nature of the American West.

One of the key strengths of Western Life Insurance during its early years was its commitment to accessibility. The company understood that insurance should be a right, not a privilege, and thus, it strived to make its policies affordable and understandable to the average individual. This focus on accessibility paved the way for its rapid growth and established a foundation of trust that would endure for generations.

A pivotal moment in the company's history occurred in the early 20th century when Western Life Insurance introduced its first whole life insurance policy. This marked a significant shift in its strategy, as whole life policies offered a combination of death benefit coverage and cash value accumulation. This innovation allowed policyholders to not only secure financial protection for their loved ones but also build long-term savings, a feature that proved immensely appealing to families planning for the future.

Innovation and Expansion: Shaping the Modern Insurance Landscape

As the 20th century progressed, Western Life Insurance embraced a culture of innovation, staying ahead of the curve in an industry that was rapidly evolving. The company recognized the importance of diversification and began expanding its product offerings to include a wide range of insurance solutions. From health insurance to long-term care coverage, Western Life Insurance became a one-stop shop for individuals seeking comprehensive financial protection.

In the 1970s, Western Life Insurance made a strategic move to enter the international market, understanding the global potential of its services. This expansion allowed the company to cater to the diverse needs of an international clientele, offering tailored insurance solutions that reflected the unique challenges and opportunities of different regions.

A notable achievement during this period was the development of innovative rider options, allowing policyholders to customize their insurance coverage to fit their specific needs. These riders, ranging from accidental death benefits to waiver of premium options, provided an added layer of flexibility and peace of mind, solidifying Western Life Insurance's reputation as a customer-centric organization.

| Milestone | Impact |

|---|---|

| Introduction of Whole Life Policies | Provided long-term financial security and savings opportunities |

| International Expansion | Catered to a global market, offering tailored solutions |

| Customizable Rider Options | Empowered policyholders to personalize their coverage |

Technological Revolution: Leading the Digital Transformation

The turn of the millennium brought about a new era of technological advancements, and Western Life Insurance embraced this digital revolution with enthusiasm. Understanding the importance of staying connected with its customers, the company invested heavily in developing a robust online presence and digital infrastructure.

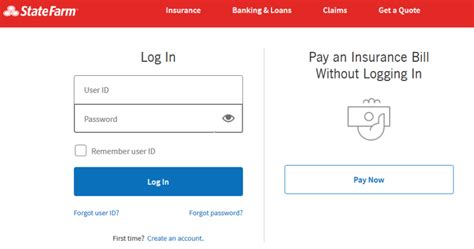

A standout achievement was the launch of its award-winning online portal, providing policyholders with 24/7 access to their insurance accounts. This portal revolutionized the customer experience, allowing individuals to manage their policies, make payments, and access important documents with just a few clicks. The convenience and efficiency offered by this digital platform not only enhanced customer satisfaction but also reduced administrative burdens, allowing the company to allocate resources more effectively.

Additionally, Western Life Insurance leveraged technology to streamline its underwriting process, employing advanced data analytics and machine learning algorithms to make more accurate risk assessments. This not only improved the efficiency of policy approvals but also allowed the company to offer more competitive premiums, further solidifying its position as a preferred insurance provider.

Mobile App Revolution

In recent years, Western Life Insurance took its digital transformation a step further by launching a cutting-edge mobile app. This app, designed with a user-friendly interface, allowed policyholders to access their accounts on the go, providing real-time updates and notifications. The app's success demonstrated the company's commitment to meeting the evolving expectations of its tech-savvy clientele.

| Digital Initiative | Impact |

|---|---|

| Online Portal | Enhanced customer experience and efficiency |

| Advanced Underwriting | Improved risk assessment and competitive premiums |

| Mobile App | Provided convenient, on-the-go account management |

Sustainability and Social Responsibility: A Commitment to the Future

As Western Life Insurance continues to thrive, it has remained steadfast in its commitment to sustainability and social responsibility. The company understands that its success is intrinsically linked to the well-being of the communities it serves, and thus, it has implemented various initiatives to give back and promote positive change.

One notable endeavor is its partnership with environmental organizations, aimed at promoting sustainable practices and reducing the company's carbon footprint. Western Life Insurance has implemented energy-efficient measures in its operations and encourages its employees and policyholders to adopt eco-friendly habits, demonstrating its dedication to preserving the planet for future generations.

Furthermore, the company has established a foundation focused on education and financial literacy, providing resources and support to help individuals make informed financial decisions. By empowering communities with knowledge, Western Life Insurance aims to create a more financially secure future, fostering resilience and stability.

Community Engagement

Western Life Insurance actively engages with its local communities, sponsoring events and initiatives that promote health, wellness, and financial empowerment. From sponsoring youth sports programs to organizing financial literacy workshops, the company's community involvement fosters a sense of belonging and trust, reinforcing its position as a responsible corporate citizen.

| Sustainability Initiative | Impact |

|---|---|

| Environmental Partnerships | Reduced carbon footprint and promoted sustainability |

| Financial Literacy Foundation | Empowered individuals with financial knowledge |

| Community Sponsorships | Fostered local engagement and trust |

The Future of Western Life Insurance: Innovation and Resilience

As we look ahead, Western Life Insurance stands poised for continued success, driven by its commitment to innovation and resilience. The company understands that the insurance industry is ever-evolving, and it remains dedicated to staying at the forefront of emerging trends and technologies.

Looking ahead, Western Life Insurance is exploring the potential of blockchain technology to enhance the security and efficiency of its operations. The company recognizes the immense possibilities that blockchain offers, from streamlined smart contracts to enhanced data security, and is investing in research and development to integrate this technology into its processes.

Furthermore, Western Life Insurance is focused on diversifying its product portfolio to meet the evolving needs of its customers. With an eye on emerging risks and changing demographics, the company is developing innovative insurance solutions that cater to the unique challenges of the modern world. From cyber insurance to specialized coverage for small businesses, Western Life Insurance aims to provide protection for every stage of life.

In conclusion, the evolution of Western Life Insurance is a testament to its unwavering dedication to its customers and the communities it serves. From its humble beginnings in the American West to its position as a global leader, the company has consistently adapted and innovated, ensuring its relevance and impact in an ever-changing industry. As we move forward, Western Life Insurance's commitment to excellence, sustainability, and social responsibility positions it for continued success and leadership in the world of insurance.

How can I purchase a Western Life Insurance policy?

+

Purchasing a Western Life Insurance policy is straightforward. You can start by visiting their official website, where you’ll find a wealth of information about their products and services. You can also contact their customer service team, who will guide you through the process and help you choose the right policy for your needs. Additionally, you may reach out to a licensed insurance agent who can provide personalized assistance and help you navigate the options available.

What sets Western Life Insurance apart from its competitors?

+

Western Life Insurance stands out for its commitment to innovation, customer satisfaction, and social responsibility. The company’s focus on digital transformation and its award-winning online portal provide an exceptional customer experience. Additionally, their commitment to sustainability and community engagement sets them apart as a responsible and ethical organization. With a rich history and a forward-thinking approach, Western Life Insurance offers a comprehensive range of insurance solutions tailored to meet the diverse needs of its customers.

Does Western Life Insurance offer customizable insurance plans?

+

Absolutely! Western Life Insurance understands that every individual has unique needs, which is why they offer a wide range of customizable insurance plans. From term life insurance to whole life policies, you can tailor your coverage to fit your specific requirements. Additionally, they provide various rider options, allowing you to enhance your policy with additional benefits such as accidental death benefits or waiver of premium options. This flexibility ensures that you receive the protection that’s right for you and your family.

How does Western Life Insurance ensure data security and privacy?

+

Western Life Insurance takes data security and privacy very seriously. They employ advanced encryption technologies to protect your personal information and ensure that your data is stored securely. Additionally, the company adheres to strict privacy policies and complies with relevant data protection regulations. With a dedicated focus on cybersecurity, Western Life Insurance strives to maintain the highest standards of data protection to safeguard your sensitive information.

What resources does Western Life Insurance provide for financial literacy and education?

+

Western Life Insurance is committed to empowering individuals with financial knowledge and resources. They offer a range of educational materials, including articles, webinars, and workshops, to help individuals make informed decisions about their financial future. These resources cover various topics, such as insurance basics, retirement planning, and investment strategies. By providing accessible and practical information, Western Life Insurance aims to foster financial literacy and help individuals achieve their long-term financial goals.