Water Damage Insurance Claim

Water damage is an all-too-common occurrence that can wreak havoc on homes and businesses, causing extensive property damage and significant financial loss. It is an issue that homeowners and business owners must be prepared for, as even a minor water leak or a burst pipe can lead to costly repairs and replacement costs. This comprehensive guide aims to delve into the intricacies of water damage insurance claims, offering an in-depth understanding of the process, the challenges one might face, and the strategies to navigate them successfully.

Understanding Water Damage and its Impact

Water damage is a pervasive issue that can stem from various sources, including natural disasters like floods, heavy rainfall, or snowmelt. Additionally, it can result from human-induced factors such as plumbing failures, appliance malfunctions, roof leaks, or foundation cracks. The impact of water damage can range from minor cosmetic issues to severe structural problems that compromise the integrity of a building.

The financial implications of water damage can be substantial. Repairs often involve multiple trades, from plumbers and roofers to electricians and restoration specialists. The cost of these repairs can quickly escalate, especially when considering the need for specialized equipment and materials, not to mention the potential for long-term issues like mold growth if the damage is not addressed promptly and thoroughly.

The Water Damage Insurance Claim Process

Filing a water damage insurance claim is a critical step in mitigating financial losses and ensuring a swift recovery. The process, while standardized, can vary slightly depending on the insurance provider and the specific policy terms.

Initiating the Claim

The first step in the water damage insurance claim process is to notify your insurance provider as soon as possible after the incident. Most insurance companies have a dedicated hotline or online platform for reporting claims. It’s important to provide as much detail as possible about the damage, including the date, time, and cause, if known.

Once the claim is reported, the insurance company will assign an adjuster to your case. The adjuster's role is to assess the extent of the damage, determine its cause, and evaluate whether the claim is covered under your policy. They may schedule an in-person inspection or request additional documentation, such as photographs or estimates from contractors.

Documenting the Damage

Proper documentation is crucial when filing a water damage insurance claim. Take detailed notes of the incident, including the date and time it occurred, the potential cause, and any visible signs of damage. Capture photographs of the affected areas, both close-up and wide-angle shots, to provide a comprehensive visual record.

It's also essential to document any temporary measures you take to prevent further damage. For instance, if you need to remove standing water or set up temporary barriers to prevent water from spreading, make sure to note these actions and their associated costs. These expenses may be reimbursable under your policy.

Policy Review and Coverage Determination

After the initial claim report, the insurance adjuster will thoroughly review your policy to understand the extent of your coverage. Water damage insurance policies often have specific exclusions and limitations, so it’s crucial to understand what is and isn’t covered. For example, some policies may exclude damage caused by flooding, while others may provide limited coverage for certain types of water-related incidents.

The adjuster will assess whether the damage is a result of a covered peril, such as a burst pipe or appliance malfunction. They will also consider any applicable deductibles and policy limits when determining the amount of coverage available for your claim.

Obtaining Estimates and Repairs

Once the insurance adjuster has determined that your claim is covered, you will need to obtain estimates for the necessary repairs. It’s advisable to seek estimates from multiple reputable contractors to ensure a competitive price. Provide these estimates to your insurance adjuster for review and approval.

During the repair process, it's essential to keep detailed records of all expenses, including invoices, receipts, and any additional costs that arise. These records will be crucial when it comes time to settle your claim and ensure you receive the full amount owed under your policy.

Common Challenges in Water Damage Insurance Claims

While the water damage insurance claim process is designed to provide policyholders with financial protection, it is not without its challenges. Understanding these potential obstacles can help you navigate the process more effectively and increase your chances of a successful claim.

Policy Exclusions and Limitations

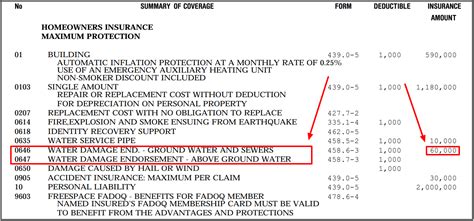

Water damage insurance policies often come with a range of exclusions and limitations. For instance, many policies exclude damage caused by flooding or sewage backup, which can be significant sources of water damage. Other common exclusions may include damage resulting from wear and tear, neglect, or gradual deterioration.

It's essential to carefully review your policy and understand these exclusions before filing a claim. If the damage falls under an excluded category, your insurance provider may deny your claim, leaving you responsible for the full cost of repairs.

Determining the Cause of Damage

Determining the cause of water damage can be a complex task, especially when the source is not immediately apparent. Insurance adjusters will thoroughly investigate the incident to understand the cause, as this can impact whether the damage is covered under your policy.

For instance, if a plumbing issue is determined to be the result of neglect or lack of maintenance, your insurance provider may deny coverage, arguing that the damage was avoidable. On the other hand, if the cause is found to be a sudden and accidental event, such as a burst pipe, the claim is more likely to be approved.

Disputes Over the Extent of Damage

Insurance adjusters have a responsibility to assess the extent of damage accurately. However, disputes can arise when policyholders and adjusters have differing opinions on the severity of the damage or the necessary repairs.

Policyholders may feel that the adjuster has underestimated the damage, resulting in an insufficient payout. In such cases, it's crucial to have detailed documentation and estimates from reputable contractors to support your claim for a higher payout.

Strategies for a Successful Water Damage Insurance Claim

Navigating the water damage insurance claim process can be challenging, but by implementing the following strategies, you can increase your chances of a successful outcome.

Communicate Effectively with Your Insurance Provider

Effective communication is key when dealing with your insurance provider. Keep detailed records of all conversations, including the date, time, and substance of each discussion. If possible, communicate in writing, as this provides a clear record of your interactions.

If you have concerns or questions about your claim, don't hesitate to reach out to your insurance provider. They should be able to provide clear and concise answers to help you understand the process and your rights under your policy.

Document Everything

As mentioned earlier, documentation is critical when filing a water damage insurance claim. Take photographs, keep detailed notes, and retain all relevant documents, including estimates, invoices, and receipts. These records will be invaluable when it comes time to negotiate a settlement.

Seek Professional Help if Needed

Water damage insurance claims can be complex, and if you’re unsure about any aspect of the process or your rights under your policy, it may be beneficial to seek professional assistance. Consider hiring a public adjuster or an attorney who specializes in insurance claims to guide you through the process and ensure your rights are protected.

Public adjusters are licensed professionals who work on behalf of policyholders, not insurance companies. They can help you navigate the claims process, negotiate with your insurance provider, and ensure you receive the full compensation you're entitled to under your policy.

Understand Your Policy and Your Rights

Take the time to thoroughly review your insurance policy and understand your rights and responsibilities. Know the specific terms and conditions of your coverage, including any exclusions and limitations. This knowledge will empower you to advocate for your rights effectively and make informed decisions throughout the claims process.

Conclusion

Water damage can be a devastating event, but with a solid understanding of the insurance claim process and the right strategies, you can minimize the financial impact and expedite the recovery process. Remember to act promptly, document thoroughly, and communicate effectively with your insurance provider to ensure a successful water damage insurance claim.

What should I do if my water damage claim is denied?

+If your water damage claim is denied, you have the right to appeal the decision. Review the denial letter carefully to understand the reasons for the denial. If you believe the decision is incorrect or unfair, gather additional evidence to support your case and contact your insurance provider to discuss your appeal. You may also consider seeking legal advice or the assistance of a public adjuster to guide you through the appeals process.

How long does it typically take to settle a water damage insurance claim?

+The timeline for settling a water damage insurance claim can vary depending on several factors, including the complexity of the claim, the extent of the damage, and the cooperation of all parties involved. In general, simple claims with minimal damage can be settled within a few weeks. However, more complex claims or those involving disputes may take several months or even longer to resolve.

Can I make temporary repairs before the insurance adjuster inspects the damage?

+Yes, it’s generally advisable to make temporary repairs to prevent further damage and mitigate the loss. However, it’s important to document these repairs thoroughly and provide the insurance adjuster with a detailed account of the actions taken and the associated costs. This documentation will be crucial when negotiating your claim settlement.