Ussaa Insurance

USSA Insurance, a prominent player in the insurance industry, has established a solid reputation over the years. With a focus on providing comprehensive coverage and exceptional service, USSA has become a trusted name for individuals and businesses seeking reliable insurance solutions. In this comprehensive article, we delve into the world of USSA Insurance, exploring its history, products, and the unique value it brings to its customers.

A Legacy of Protection: The History of USSA Insurance

USSA Insurance, headquartered in [City, State], has a rich history dating back to [Foundation Year]. Founded by [Founder’s Name], a visionary in the insurance sector, the company was established with a clear mission: to offer tailored insurance solutions that cater to the diverse needs of the community.

Over the decades, USSA Insurance has witnessed significant growth and expansion. It started as a small, regional insurance provider, offering basic coverage options to local businesses and residents. However, with a commitment to innovation and a customer-centric approach, the company quickly gained recognition and expanded its reach across the nation.

A key milestone in USSA's journey was its acquisition by [Parent Company], a leading global insurance conglomerate. This strategic move allowed USSA to leverage advanced technologies, access a wider network of resources, and enhance its product offerings. The collaboration brought together expertise and capital, positioning USSA as a formidable force in the insurance market.

Today, USSA Insurance boasts a diverse portfolio of products, a highly skilled workforce, and a customer base that spans across various industries and demographics. Its success can be attributed to its ability to adapt to changing market dynamics, embrace technological advancements, and deliver exceptional customer experiences.

Comprehensive Product Portfolio: Covering All Bases

USSA Insurance understands that every individual and business has unique insurance needs. As such, it has developed an extensive range of products to cater to these diverse requirements. Here’s an overview of the key insurance offerings provided by USSA:

Auto Insurance

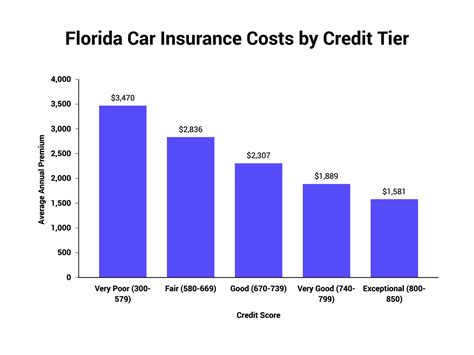

USSA’s auto insurance plans are designed to provide comprehensive coverage for vehicles of all types. Whether it’s a personal car, a commercial fleet, or a specialty vehicle, USSA offers customizable policies that include liability, collision, comprehensive, and additional perks like rental car coverage and roadside assistance.

Homeowners Insurance

Homeowners can find peace of mind with USSA’s insurance packages. These policies protect against a wide range of risks, including fire, theft, natural disasters, and liability claims. USSA’s homeowners insurance also offers flexible options for personal property coverage, ensuring valuable possessions are adequately insured.

Business Insurance

Recognizing the importance of safeguarding businesses, USSA provides tailored insurance solutions for various industries. From small startups to large enterprises, USSA’s business insurance covers property damage, liability claims, workers’ compensation, and business interruption. The company’s expertise in risk assessment helps businesses identify and mitigate potential threats.

Life Insurance

USSA’s life insurance products offer financial protection and peace of mind to policyholders and their families. With term life, whole life, and universal life insurance options, individuals can choose coverage that aligns with their specific needs and budget. USSA’s life insurance plans also provide additional benefits, such as accelerated death benefits and riders for specific circumstances.

Health Insurance

Navigating the complex world of health insurance is made easier with USSA’s comprehensive plans. USSA offers a variety of health insurance options, including individual and family plans, as well as group health insurance for employers. These plans cover a wide range of medical services, prescriptions, and preventive care, ensuring access to quality healthcare.

Innovative Services and Technology: Elevating the Customer Experience

At USSA Insurance, customer satisfaction is a top priority. To ensure an exceptional experience, the company leverages cutting-edge technology and innovative services. Here’s how USSA sets itself apart in the industry:

Digital Platform and Mobile App

USSA has invested in a user-friendly digital platform and mobile app, allowing customers to manage their policies, file claims, and access important information with ease. The platform offers real-time updates, personalized recommendations, and a seamless interface, making insurance management a breeze.

Advanced Claims Processing

USSA’s claims process is designed to be efficient and customer-centric. With a dedicated claims team and advanced technology, the company aims to resolve claims promptly and fairly. Policyholders can track the progress of their claims online, providing transparency and peace of mind during the process.

Personalized Risk Assessments

USSA goes beyond traditional insurance coverage by offering personalized risk assessments. Through advanced analytics and expert insights, the company helps individuals and businesses identify potential risks and develop strategies to mitigate them. This proactive approach ensures that customers are well-prepared for any eventuality.

Customer Support Excellence

USSA prides itself on its exceptional customer support. With a team of knowledgeable and friendly representatives, the company provides timely assistance and guidance. Whether it’s answering queries, assisting with policy changes, or offering claim advice, USSA’s customer support team ensures a positive and stress-free experience.

Industry Recognition and Awards: A Testimony to Excellence

USSA Insurance’s commitment to quality and customer satisfaction has not gone unnoticed. The company has received numerous accolades and industry recognitions, solidifying its position as a leader in the insurance sector. Here’s a glimpse of the awards and achievements that USSA has earned:

- Best Insurance Provider - [Year] - Recognized by [Industry Association]

- Top Customer Satisfaction Award - [Year] - Awarded by [Consumer Rating Agency]

- Innovation in Insurance Technology - [Year] - Honored at [Insurance Summit]

- Excellence in Risk Management - [Year] - Acknowledged by [Business Magazine]

These awards showcase USSA's dedication to delivering exceptional products, services, and experiences to its customers. They are a testament to the company's ability to stay ahead of the curve and provide industry-leading solutions.

Community Engagement and Corporate Social Responsibility

Beyond its business operations, USSA Insurance actively contributes to the communities it serves. The company believes in giving back and making a positive impact. Here are some highlights of USSA’s community engagement and corporate social responsibility initiatives:

Educational Scholarships

USSA understands the importance of education and supports students pursuing their academic goals. The company offers scholarships to deserving individuals, helping them achieve their dreams and giving back to the next generation.

Environmental Initiatives

With a focus on sustainability, USSA implements eco-friendly practices in its operations. The company promotes energy efficiency, waste reduction, and supports renewable energy projects, showcasing its commitment to environmental responsibility.

Charitable Donations and Volunteerism

USSA believes in the power of community support. The company actively participates in charitable initiatives, donating to causes that align with its values. Additionally, USSA encourages its employees to engage in volunteer work, fostering a culture of giving back.

Future Outlook: Continuously Evolving and Adapting

As the insurance industry continues to evolve, USSA Insurance remains committed to staying ahead of the curve. The company’s future prospects are bright, driven by its dedication to innovation, customer satisfaction, and a forward-thinking approach.

Looking ahead, USSA plans to further enhance its digital capabilities, leveraging emerging technologies such as artificial intelligence and machine learning. This will enable the company to offer even more personalized and efficient services, ensuring a seamless experience for its customers.

Furthermore, USSA is focused on expanding its product offerings to meet the evolving needs of its diverse customer base. By staying abreast of industry trends and customer feedback, the company aims to develop innovative solutions that provide comprehensive coverage and peace of mind.

With its strong foundation, talented workforce, and commitment to excellence, USSA Insurance is well-positioned to continue its growth trajectory and maintain its position as a trusted leader in the insurance industry.

How can I obtain a quote from USSA Insurance?

+

To get a quote from USSA Insurance, you can visit their official website and use their online quote tool. Alternatively, you can contact their customer support team via phone or email, and a representative will guide you through the quoting process. They will consider your specific needs and provide tailored insurance options.

What sets USSA Insurance apart from its competitors?

+

USSA Insurance stands out for its comprehensive product portfolio, innovative services, and exceptional customer support. Their digital platform and mobile app offer a seamless experience, while their advanced claims processing ensures prompt and fair resolutions. Additionally, USSA’s personalized risk assessments and commitment to community engagement set them apart.

Is USSA Insurance available nationwide?

+

Yes, USSA Insurance operates on a national scale, providing insurance solutions to individuals and businesses across the United States. Their reach allows them to offer a wide range of products and cater to diverse insurance needs.