Usaa Car Insurance Number

USAA, or the United Services Automobile Association, is a unique insurance provider that exclusively serves current and former members of the U.S. military, as well as their families. With a focus on offering comprehensive coverage and exceptional service, USAA has earned a strong reputation within the military community. This article will delve into the world of USAA car insurance, exploring its features, benefits, and the unique USAA car insurance number.

Understanding USAA Car Insurance

USAA offers a wide range of insurance products tailored to meet the needs of military members and their families. Their car insurance policies provide coverage for various situations, including accidents, theft, and natural disasters. What sets USAA apart is its commitment to delivering personalized service and a range of exclusive benefits for its members.

Comprehensive Coverage Options

USAA car insurance policies offer a comprehensive range of coverage options. These include:

- Liability Coverage: Protects policyholders from claims arising from bodily injury or property damage caused by the insured vehicle.

- Collision Coverage: Covers repair or replacement costs for the insured vehicle in case of an accident, regardless of fault.

- Comprehensive Coverage: Provides protection against damages caused by events other than collisions, such as vandalism, theft, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Offers financial protection in the event of an accident with a driver who has insufficient or no insurance.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for the policyholder and their passengers, regardless of fault.

USAA allows policyholders to customize their coverage, ensuring they receive the protection they need without paying for unnecessary extras.

Exclusive Benefits for Military Members

USAA understands the unique needs and challenges faced by military personnel and their families. As such, they offer a range of exclusive benefits with their car insurance policies, including:

- Deployment Discount: USAA recognizes the sacrifices made by military members during deployment. They offer a discount on car insurance premiums to eligible members, providing financial relief during this challenging period.

- Vehicle Storage Coverage: If a policyholder’s vehicle is stored due to deployment or other military-related reasons, USAA provides coverage for potential damages or losses that may occur during storage.

- Military Installation Access: USAA offers on-base insurance services at select military installations, making it more convenient for members to manage their insurance needs while stationed there.

- Discounts for Safe Driving: USAA rewards safe driving habits with discounts on car insurance premiums. Policyholders can earn these discounts by maintaining a clean driving record and utilizing safe driving practices.

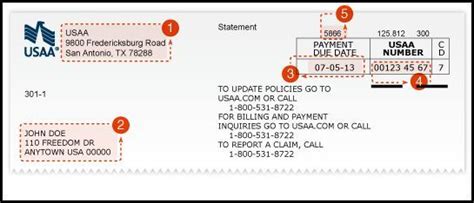

The USAA Car Insurance Number

The USAA car insurance number is a unique identifier assigned to each policyholder. This number serves as a reference for all car insurance-related matters, making it an essential component of the USAA insurance experience.

Policy Identification

The USAA car insurance number is a crucial element in identifying a policyholder’s specific coverage and benefits. It ensures that policyholders receive the correct information and services related to their insurance policy.

For example, when a policyholder contacts USAA's customer service team, they will be asked to provide their car insurance number. This number helps the representative quickly access the policyholder's records, providing efficient and accurate assistance.

Managing Your Policy Online

USAA’s online platform, accessible via their website or mobile app, allows policyholders to manage their car insurance policies conveniently. By logging in with their USAA car insurance number, policyholders can:

- View their policy details and coverage options.

- Make payments and manage billing information.

- Update personal and vehicle information.

- File claims and track their progress.

- Access policy documents and certificates.

Reporting Claims

In the event of an accident or other insured event, policyholders can report claims to USAA using their car insurance number. This number ensures that the claim is correctly associated with the policyholder’s account, facilitating a smoother claims process.

Policyholders can report claims online, over the phone, or through the USAA mobile app. By providing their car insurance number, they can quickly initiate the claims process and receive the necessary support from USAA's claims team.

USAA’s Claims Process and Customer Service

USAA is renowned for its exceptional customer service and efficient claims process. When a policyholder needs to file a claim, they can expect a seamless and supportive experience.

Easy Claims Reporting

USAA offers multiple channels for policyholders to report claims, ensuring convenience and accessibility. Policyholders can choose to report claims online, through the USAA mobile app, or over the phone. The process is straightforward and guided, making it easy for policyholders to provide the necessary information.

Claims Adjusters Dedicated to Military Families

USAA understands the unique circumstances that military families may face when dealing with insurance claims. As such, they employ claims adjusters who are specifically trained to handle the needs of military members and their families. These adjusters are sensitive to the challenges and complexities that may arise due to frequent relocations, deployments, or other military-related situations.

Timely Claims Resolution

USAA is committed to resolving claims promptly and efficiently. They strive to provide timely updates and keep policyholders informed throughout the claims process. USAA’s goal is to ensure that policyholders receive the compensation they are entitled to as quickly as possible, minimizing any financial burdens during this challenging time.

Additional Support and Resources

USAA offers a range of additional support and resources to assist policyholders during the claims process. This includes:

- Online Claims Tracking: Policyholders can track the progress of their claims online, receiving real-time updates and staying informed about the status of their claim.

- Claims Hotline: USAA provides a dedicated claims hotline, allowing policyholders to speak directly with a claims representative and receive immediate assistance.

- Resources for Military Members: USAA offers specialized resources and guidance for military members dealing with insurance claims, ensuring they receive the support they need during deployments or other military-related circumstances.

The Bottom Line

USAA car insurance stands out as a premier insurance option for military members and their families. With its comprehensive coverage options, exclusive benefits tailored to military needs, and exceptional customer service, USAA has earned a reputation for excellence in the insurance industry.

The USAA car insurance number is a vital component of this experience, serving as a unique identifier that simplifies policy management and ensures efficient service. Whether it's managing your policy online, reporting a claim, or seeking assistance, your USAA car insurance number is your key to a seamless and supportive insurance journey.

How can I obtain my USAA car insurance number if I don’t have it readily available?

+If you are a USAA member but don’t have your car insurance number on hand, you can easily retrieve it by logging into your USAA online account. Once logged in, navigate to the “Insurance” section, and you will find your policy information, including your car insurance number. If you encounter any issues or have further questions, you can contact USAA’s customer service team for assistance.

Can I add multiple vehicles to my USAA car insurance policy, and what are the benefits of doing so?

+Yes, USAA allows policyholders to add multiple vehicles to their car insurance policy. This can be beneficial as it often results in discounts and savings. By insuring multiple vehicles under one policy, you may qualify for multi-car discounts, which can significantly reduce your overall insurance premiums. Additionally, managing multiple vehicles under a single policy simplifies the insurance process and ensures consistent coverage for all your vehicles.

Are there any exclusions or limitations to USAA car insurance coverage?

+While USAA car insurance offers comprehensive coverage, there may be certain exclusions or limitations depending on the specific policy and coverage options chosen. It’s important to carefully review your policy documents to understand any exclusions or limitations that may apply. Common exclusions may include damage caused by racing or off-road driving, intentional acts, or damages arising from nuclear incidents. However, USAA provides clear and transparent information about these exclusions to ensure policyholders are well-informed.