Us Medical Insurance

The United States healthcare system, renowned for its complexity and unique characteristics, stands as a topic of great interest and importance, especially when discussing medical insurance. With a significant portion of the population relying on private health insurance plans, understanding the intricacies of the US medical insurance landscape is crucial. In this comprehensive article, we delve into the world of US medical insurance, exploring its historical context, key features, and the impact it has on individuals and the healthcare industry as a whole.

A Historical Perspective: The Evolution of US Medical Insurance

The story of medical insurance in the United States is a fascinating journey, shaped by societal changes, economic shifts, and advancements in medical science. It is a narrative that has evolved over decades, transforming from a relatively simple concept to a complex, multifaceted system that plays a pivotal role in the lives of Americans.

The roots of medical insurance in the US can be traced back to the early 20th century, a time when healthcare was often a luxury afforded only by the wealthiest. In those days, paying for medical treatment out-of-pocket was the norm, and the costs could be prohibitively high for many. This reality sparked the emergence of early insurance models, designed to provide financial protection against the potentially devastating expenses of medical care.

One of the earliest forms of medical insurance was the Blue Cross system, which began in the 1920s. This system, initially developed to provide hospital coverage for school teachers in Dallas, Texas, quickly gained popularity and spread across the country. Blue Cross plans offered prepaid hospital care, allowing individuals to access medical services without the immediate financial burden. This marked a significant shift towards making healthcare more accessible and affordable.

The post-World War II era saw a rapid expansion of medical insurance coverage, driven by a combination of factors. The establishment of the Veterans Health Administration (VHA) provided comprehensive healthcare to millions of veterans, setting a precedent for government-funded healthcare. Simultaneously, private insurance companies began to offer more comprehensive plans, often tied to employment benefits, making insurance more widespread.

The 1960s and 1970s brought about a significant transformation with the introduction of Medicare and Medicaid, two government-funded programs that aimed to provide healthcare coverage for the elderly and low-income individuals, respectively. These programs, established under the Social Security Act, were landmark initiatives, ensuring that a significant portion of the population had access to necessary medical services. Medicare, in particular, has since become a cornerstone of healthcare coverage for seniors, with over 60 million beneficiaries as of 2020.

The evolution of medical insurance in the US continued through the latter half of the 20th century and into the 21st century, with various reforms and legislative changes. The Affordable Care Act (ACA), often referred to as Obamacare, marked a significant milestone in 2010. The ACA aimed to increase the quality and affordability of health insurance, expand Medicaid coverage, and make individual insurance mandatory, thereby reducing the number of uninsured Americans. While the ACA has had its share of controversies and challenges, it has undoubtedly influenced the landscape of medical insurance in the US.

Understanding the US Medical Insurance Landscape

The US medical insurance landscape is a complex network of public and private insurance providers, offering a wide array of plans and coverage options. At its core, medical insurance in the US functions as a risk-sharing mechanism, where individuals or groups pay premiums to an insurance provider, who in turn assumes the financial risk of covering medical expenses. This system ensures that individuals have access to necessary healthcare services without facing financial ruin.

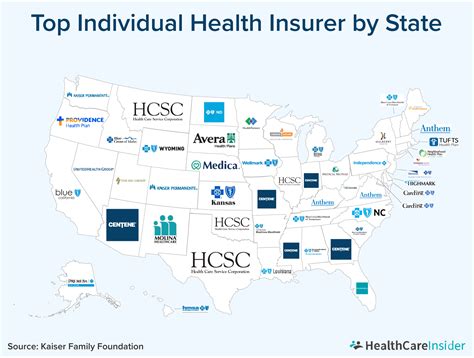

Public vs. Private Insurance

In the US, medical insurance is primarily categorized into two broad categories: public and private insurance. Public insurance, as the name suggests, is provided and funded by the government. It includes programs like Medicare, Medicaid, and the Children’s Health Insurance Program (CHIP). These programs are designed to cater to specific populations, such as seniors, low-income individuals, and children, respectively.

On the other hand, private insurance is offered by private insurance companies and is typically obtained through employers as part of employee benefits packages. However, individuals can also purchase private insurance plans directly from insurance providers. Private insurance plans offer a wide range of coverage options, from comprehensive plans that cover a broad spectrum of medical services to more specialized plans that focus on specific needs, such as dental or vision care.

Key Features of US Medical Insurance Plans

US medical insurance plans come in various forms, each with its unique features and coverage specifications. Here are some key aspects that define these plans:

- Premiums: Premiums are the regular payments made by the insured to the insurance provider. These payments are typically made monthly and can vary based on factors like age, health status, location, and the specific plan chosen. Higher premiums often indicate more comprehensive coverage.

- Deductibles: A deductible is the amount an insured individual must pay out-of-pocket before the insurance coverage kicks in. For instance, if a plan has a $500 deductible, the insured must pay the first $500 of medical expenses themselves before the insurance provider starts covering costs.

- Co-payments (Co-pays): Co-pays are fixed amounts the insured pays for a covered medical service. For example, a plan might have a $20 co-pay for each doctor's office visit. Co-pays can vary depending on the type of service and the specific plan.

- Co-insurance: Co-insurance is the percentage of the total cost of a covered medical service that the insured is responsible for paying. For instance, if a plan has an 80/20 co-insurance, the insurance provider will cover 80% of the cost, and the insured will pay the remaining 20%.

- Out-of-Pocket Maximums: This is the maximum amount an insured individual will have to pay out-of-pocket during a given benefit period. Once the out-of-pocket maximum is reached, the insurance provider covers 100% of the costs for covered services.

- Network Providers: Many insurance plans have networks of preferred providers, which are healthcare professionals and facilities that have agreed to offer services at discounted rates. Staying within the network can lead to lower out-of-pocket costs.

- Coverage Limits: Insurance plans often have limits on the amount they will pay for certain services or in total during a benefit period. Exceeding these limits may result in additional out-of-pocket expenses.

- Pre-existing Conditions: Historically, some insurance plans would not cover pre-existing conditions, but under the ACA, insurance providers are required to cover all pre-existing conditions without exclusions or waiting periods.

Performance and Access to Care

The performance of medical insurance plans is a critical aspect that impacts the overall healthcare experience for individuals. Plans that offer comprehensive coverage, have an extensive network of providers, and provide easy access to specialized services are generally considered more effective. Additionally, plans with lower out-of-pocket costs, such as lower deductibles and co-pays, can improve access to care by making healthcare more affordable.

| Metric | Description |

|---|---|

| Coverage Level | Measures the comprehensiveness of the plan, including the range of services covered. |

| Network Size | Indicates the number and variety of healthcare providers within the plan's network. |

| Out-of-Pocket Costs | Refers to the expenses the insured must pay, including deductibles, co-pays, and co-insurance. |

| Access to Specialists | Assesses the ease with which insured individuals can access specialized medical services. |

The Impact of US Medical Insurance

US medical insurance has a profound impact on individuals, the healthcare industry, and the broader economy. It plays a pivotal role in shaping healthcare accessibility, quality, and affordability, influencing everything from personal health outcomes to the financial stability of healthcare providers and the overall healthcare system.

Personal Health and Financial Well-being

For individuals, medical insurance can be a lifeline, providing access to necessary healthcare services that might otherwise be unaffordable. It ensures that individuals can receive timely medical attention, from routine check-ups to emergency care, without facing financial hardship. By spreading the risk across a large population, insurance plans help individuals manage the unpredictable costs of healthcare, offering peace of mind and financial security.

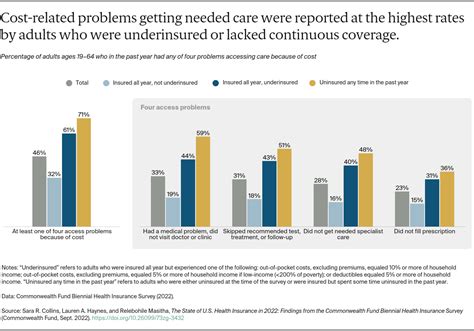

However, the complexity and cost of medical insurance can also present challenges. High premiums, deductibles, and co-pays can make insurance unaffordable for some, leading to underinsurance or even uninsurance. This can result in individuals delaying or forgoing necessary medical care, which can have serious health consequences.

Healthcare Industry Dynamics

The healthcare industry is intricately tied to the medical insurance landscape. Insurance providers play a crucial role in determining the financial viability of healthcare services, influencing the pricing and availability of medical treatments and procedures. Insurance companies negotiate with healthcare providers to establish reimbursement rates, which can impact the profitability of medical practices and hospitals.

The competitive nature of the insurance market also drives innovation in healthcare delivery. Insurance providers often incentivize healthcare organizations to adopt cost-saving measures and improve the efficiency of care delivery. This can lead to the development of new treatment protocols, technological advancements, and improved patient outcomes.

Economic and Societal Implications

US medical insurance has far-reaching economic and societal implications. It is a significant driver of healthcare spending, with insurance premiums and out-of-pocket costs contributing to the overall cost of healthcare. The insurance market also influences employment practices, as many Americans obtain insurance through employer-sponsored plans.

From a societal perspective, medical insurance can promote health equity by ensuring that a broader segment of the population has access to healthcare. This can lead to improved public health outcomes, reduced health disparities, and a more productive workforce. However, the complexities and variations in insurance coverage can also contribute to healthcare disparities, as certain populations may face barriers to accessing quality care due to insurance limitations or lack of coverage.

Looking Ahead: The Future of US Medical Insurance

The future of US medical insurance is a topic of ongoing debate and speculation. While the landscape has undergone significant changes in recent years, there are several trends and developments that are likely to shape the future of medical insurance in the United States.

Healthcare Reform and Policy Changes

Healthcare reform is a continuous process, and future policy changes are expected to influence the direction of medical insurance. The ACA has already undergone various modifications, and future administrations may introduce further reforms to address affordability, accessibility, and quality of care. These reforms could include expanding Medicaid coverage, modifying individual mandate requirements, or introducing new initiatives to reduce healthcare costs.

Technology and Innovation

Advancements in technology are poised to play a significant role in the future of medical insurance. Telehealth services, for instance, have gained prominence during the COVID-19 pandemic, offering a convenient and accessible way for individuals to receive medical care. Insurance providers are likely to incorporate telehealth services into their plans, offering greater flexibility and cost-effectiveness for both providers and patients.

Artificial intelligence (AI) and machine learning are also expected to revolutionize the insurance industry. These technologies can enhance the accuracy and efficiency of claims processing, fraud detection, and risk assessment. Additionally, AI-powered tools can assist in personalized healthcare planning, helping individuals make more informed decisions about their insurance coverage and healthcare needs.

Consumer-Centric Approaches

The focus on consumer-centric approaches is likely to continue gaining momentum. Insurance providers are increasingly recognizing the importance of tailoring plans to meet the unique needs of individuals and families. This could involve offering more flexible coverage options, such as short-term or catastrophic plans, as well as providing tools and resources to help consumers navigate the complex insurance landscape and make informed decisions about their healthcare.

Cost Containment Strategies

Controlling healthcare costs is a critical challenge facing the insurance industry. Future strategies may focus on incentivizing cost-saving measures, such as encouraging the use of generic medications, promoting preventive care, and implementing value-based care models. These approaches aim to improve the efficiency of healthcare delivery while ensuring that patients receive high-quality, affordable care.

Integration of Social Determinants of Health

There is growing recognition of the role that social and economic factors play in individual health outcomes. Future insurance models may integrate social determinants of health (SDOH) into their plans, offering coverage or incentives for services that address these factors. This could include coverage for social services, such as housing assistance or nutritional programs, which can improve overall health and reduce healthcare costs in the long term.

Conclusion

The US medical insurance landscape is a complex and dynamic environment, shaped by a rich historical context and ongoing policy and technological advancements. While medical insurance provides essential financial protection, ensuring access to necessary healthcare services, it also presents challenges and opportunities for individuals, healthcare providers, and the broader healthcare system.

As we look to the future, it is clear that the path of US medical insurance will continue to be influenced by a myriad of factors, from healthcare reform and technological innovation to consumer preferences and cost containment strategies. By understanding these trends and their potential impacts, we can better navigate the complexities of the US medical insurance landscape and work towards a healthcare system that is more accessible, affordable, and effective for all.

How do I choose the right medical insurance plan for me?

+Choosing the right medical insurance plan involves considering several factors, such as your healthcare needs, budget, and the network of providers available. Evaluate the plan’s coverage, including what services are covered and any exclusions or limitations. Assess your potential out-of-pocket costs, including premiums, deductibles, and co-pays. Also, consider the plan’s network to ensure your preferred healthcare providers are included. It’s beneficial to research and compare multiple plans to find the one that best aligns with your needs and financial situation.

What happens if I have a pre-existing condition?

+Under the Affordable Care Act (ACA), insurance providers are required to cover all pre-existing conditions without exclusions or waiting periods. This means that regardless of your health status, you should be able to find an insurance plan that covers your pre-existing condition. However, it’s important to carefully review the plan’s coverage to ensure that your specific condition is covered and to understand any potential limitations or requirements related to your condition.

How can I reduce my out-of-pocket costs for medical insurance?

+There are several strategies to reduce your out-of-pocket costs for medical insurance. First, consider a plan with a lower deductible if you anticipate needing frequent medical care. Additionally, take advantage of preventive care services, which are often covered at no cost under many plans. Utilize in-network providers to minimize costs, as out-of-network care can be significantly more expensive. Finally, explore options like Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs) to help cover eligible medical expenses and potentially reduce your taxable income.

What are the penalties for not having health insurance in the US?

+The individual mandate under the Affordable Care Act (ACA) required most individuals to have health insurance or face a penalty. However, as of 2019, the penalty for not having health insurance has been eliminated. While there is no longer a federal penalty, some states have their own individual mandate penalties. It’s important to check your state’s specific laws to understand any potential penalties for not having health insurance.