Umbrella Insurance Rates

Umbrella insurance is a crucial financial safeguard for individuals and families, providing an extra layer of protection beyond the limits of standard liability policies. This type of insurance is designed to protect policyholders from significant financial losses due to catastrophic events, personal injuries, or high-value lawsuits. With rising litigation costs and an increasingly litigious society, having an umbrella policy has become a prudent choice for many.

In this comprehensive guide, we delve into the world of umbrella insurance rates, exploring the factors that influence these rates, the benefits they offer, and the strategies to obtain the best coverage at competitive prices. By understanding the intricacies of umbrella insurance, you can make informed decisions to secure your financial future and safeguard your assets effectively.

Understanding Umbrella Insurance Rates

Umbrella insurance rates are determined by a variety of factors, each playing a critical role in the overall cost of the policy. These factors include the policyholder’s location, their primary insurance coverage, their personal assets, and their risk profile. Let’s break down each of these elements to gain a clearer understanding of their impact on umbrella insurance rates.

Location-Based Differences

One of the primary factors influencing umbrella insurance rates is the policyholder’s geographical location. Insurance providers consider the cost of living, local litigation trends, and the overall risk profile of the area when setting rates. For instance, areas with a higher cost of living or a history of frequent litigation may see higher umbrella insurance premiums.

| Location | Average Umbrella Insurance Rate |

|---|---|

| New York City, NY | $350 per year |

| Los Angeles, CA | $320 per year |

| Chicago, IL | $280 per year |

| Houston, TX | $250 per year |

Additionally, certain states have unique legal systems that can impact insurance rates. For example, states with a "joint and several liability" system, where a defendant can be held fully responsible for damages even if they are only partially at fault, may see higher umbrella insurance costs.

Primary Insurance Coverage

The type and limits of your primary insurance policies, such as auto, home, or renters insurance, can significantly impact your umbrella insurance rates. Insurance providers typically require policyholders to have a certain amount of liability coverage on their primary policies before they are eligible for an umbrella policy.

For instance, many providers may require a minimum of $300,000 in liability coverage on your auto insurance policy before offering an umbrella policy. The higher the liability limits on your primary policies, the more protection you have, which can result in lower umbrella insurance rates.

| Primary Insurance Type | Minimum Liability Coverage Required |

|---|---|

| Auto Insurance | $300,000 |

| Homeowners Insurance | $500,000 |

| Renters Insurance | $200,000 |

Personal Assets and Risk Profile

Your personal assets and overall risk profile are key considerations when determining umbrella insurance rates. Insurance providers assess the value of your assets, such as your home, investments, and other valuable possessions, to understand the potential exposure in the event of a claim.

Individuals with higher-value assets may be seen as higher-risk policyholders, as they have more to lose in the event of a lawsuit. As a result, they may face higher umbrella insurance premiums. On the other hand, policyholders with a low-risk profile, such as those with a clean driving record and no history of claims, may enjoy more competitive rates.

Benefits of Umbrella Insurance

Umbrella insurance offers a range of benefits that make it an invaluable asset for individuals seeking comprehensive financial protection. Beyond the peace of mind that comes with having extra liability coverage, umbrella insurance provides critical safeguards in various scenarios.

Protection Against Catastrophic Events

One of the primary advantages of umbrella insurance is its ability to protect policyholders from catastrophic financial losses. In the event of a major accident, natural disaster, or other catastrophic event, the costs of repairs, medical bills, and legal fees can quickly exceed the limits of standard liability insurance.

Umbrella insurance steps in to cover these excess costs, providing a crucial safety net. For example, if you're involved in an auto accident where the other party sustains severe injuries and sues for millions of dollars, your auto insurance policy's liability limits might be insufficient. In this scenario, umbrella insurance would kick in to cover the excess costs, protecting your personal assets.

Broad Coverage for Various Liability Risks

Umbrella insurance offers a wide range of coverage that extends beyond the typical liability risks associated with auto and home insurance. It provides protection for personal liability risks, such as injuries caused on your property, libel or slander, or even false arrest claims.

Additionally, umbrella insurance can cover liability risks related to your recreational activities, such as boating, hunting, or even dog ownership. This broad coverage ensures that you're protected from a variety of potential liability scenarios, giving you comprehensive peace of mind.

Affordable and Flexible Coverage

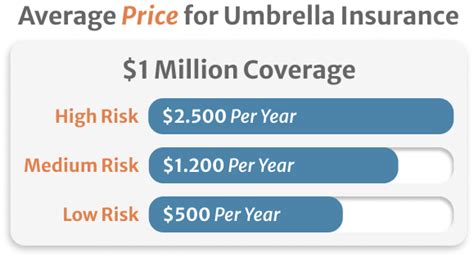

Despite the extensive protection it offers, umbrella insurance is remarkably affordable. Policies typically start at around 150 to 300 per year for $1 million in coverage, making it a cost-effective way to significantly increase your liability protection.

Furthermore, umbrella insurance is flexible, allowing policyholders to customize their coverage limits based on their specific needs and risk profile. Whether you require $1 million, $5 million, or even $10 million in coverage, umbrella insurance policies can be tailored to fit your requirements.

Strategies for Obtaining the Best Umbrella Insurance Rates

Securing the best umbrella insurance rates requires a combination of understanding the market, assessing your individual needs, and employing strategic approaches to coverage and policy management. Here are some key strategies to help you navigate the process effectively.

Shop Around and Compare Rates

The umbrella insurance market is competitive, with a range of providers offering different rates and coverage options. Shopping around and comparing rates from multiple providers is essential to finding the best deal. Online comparison tools and insurance brokers can be valuable resources in this process.

When comparing rates, be sure to consider not just the cost, but also the coverage limits and any additional benefits or discounts offered. Some providers may offer discounts for bundling umbrella insurance with other policies, such as auto or homeowners insurance.

Bundle Policies for Discounts

Bundling your insurance policies can often lead to significant savings. Many insurance providers offer multi-policy discounts when you combine your auto, home, and umbrella insurance policies with them. By bundling your policies, you not only save money but also streamline your insurance management, making it more convenient and efficient.

Assess Your Risk Profile and Needs

Understanding your risk profile and assessing your specific needs is crucial when selecting umbrella insurance coverage. Evaluate your assets, your liability risks, and the potential costs associated with various scenarios. This self-assessment will help you determine the appropriate coverage limits for your umbrella policy.

For instance, if you own a high-value home and have significant investments, you may want to consider higher coverage limits to adequately protect your assets. On the other hand, if you have a low-risk profile and fewer assets, you might opt for a more basic umbrella policy with lower limits.

Maintain a Clean Record

Insurance providers often reward policyholders with clean records, offering lower rates as an incentive for responsible behavior. Whether it’s maintaining a spotless driving record, ensuring your home is secure, or taking measures to prevent accidents and injuries on your property, keeping a clean record can significantly impact your umbrella insurance rates.

Additionally, staying claim-free can lead to reduced rates over time. Insurance providers may offer loyalty discounts or rate reductions for policyholders who have not made any claims during a certain period.

Explore Discounts and Special Offers

Insurance providers frequently offer a range of discounts and special offers to attract new customers and reward existing policyholders. These discounts can significantly reduce your umbrella insurance rates, making coverage more affordable.

Some common discounts include:

- Loyalty Discounts: Provided to policyholders who have been with the same insurance provider for an extended period.

- Payment Method Discounts: Offered for paying premiums in full or through automatic payments.

- Safety Discounts: Awarded for taking safety measures, such as installing security systems or completing defensive driving courses.

- Multi-Policy Discounts: Given when you bundle multiple insurance policies with the same provider.

The Future of Umbrella Insurance

As the insurance landscape continues to evolve, so too does the world of umbrella insurance. With advancements in technology, changing societal dynamics, and an increasingly interconnected global economy, the future of umbrella insurance holds both challenges and opportunities.

Impact of Technology and Digital Transformation

The digital revolution has already begun to reshape the insurance industry, and its impact on umbrella insurance is significant. Online comparison tools, digital applications, and AI-powered risk assessment algorithms are transforming the way insurance is sold, underwritten, and managed.

These digital advancements offer increased convenience, faster processing times, and more personalized insurance experiences. Policyholders can now easily compare rates, purchase policies, and manage their coverage entirely online, without the need for physical paperwork or face-to-face interactions.

Furthermore, digital technologies are enhancing risk assessment capabilities, allowing insurance providers to more accurately predict and manage risks. This precision in risk assessment can lead to more tailored and affordable umbrella insurance policies, benefiting both policyholders and insurers.

Changing Societal Dynamics and Risk Profiles

Societal changes, such as an aging population, increased urbanization, and evolving recreational activities, are influencing the risk profiles of individuals and families. These changes are prompting insurance providers to adapt their umbrella insurance offerings to better cater to the evolving needs of policyholders.

For instance, as the population ages, the risk of medical malpractice claims may increase, leading to a greater demand for umbrella insurance that covers such liabilities. Similarly, with more people living in urban areas, the risk of certain types of accidents and injuries may rise, necessitating more comprehensive umbrella insurance coverage.

Global Economic Integration and Emerging Risks

The global economy is becoming increasingly interconnected, with businesses and individuals operating across borders. This integration brings new opportunities but also introduces unique risks, such as international litigation and cross-border liability claims.

Umbrella insurance providers are recognizing the need to offer policies that provide protection against these emerging risks. As the world becomes more interconnected, the demand for umbrella insurance policies that offer global coverage is likely to rise, ensuring policyholders are protected regardless of their geographical location.

Innovative Insurance Solutions and Product Development

In response to changing market dynamics and emerging risks, insurance providers are developing innovative solutions and products. These include:

- Parametric Insurance: This innovative approach pays out based on predefined parameters, such as the severity of a natural disaster, rather than waiting for individual claims to be made. It offers faster payouts and can be particularly beneficial in covering catastrophic events.

- On-Demand Insurance: With the rise of the gig economy, on-demand insurance is becoming increasingly popular. This type of insurance allows policyholders to purchase coverage only when they need it, providing flexibility and cost savings.

- Personalized Insurance Products: Utilizing advanced data analytics and AI, insurance providers are developing personalized insurance products that cater to the unique needs and risk profiles of individual policyholders.

Conclusion

Umbrella insurance is an essential component of a comprehensive financial protection strategy, offering policyholders an extra layer of security and peace of mind. By understanding the factors that influence umbrella insurance rates, the benefits they provide, and the strategies for obtaining the best coverage, you can make informed decisions to safeguard your assets effectively.

As the insurance industry continues to evolve, staying informed about the latest developments and trends in umbrella insurance is crucial. By keeping abreast of changes in the market, you can ensure that your insurance coverage remains up-to-date and aligned with your evolving needs.

What is the average cost of umbrella insurance per year?

+The average cost of umbrella insurance can vary widely depending on several factors, including the policyholder’s location, primary insurance coverage, personal assets, and risk profile. On average, umbrella insurance policies typically range from 150 to 300 per year for 1 million in coverage. However, rates can be higher or lower based on individual circumstances.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>How much umbrella insurance coverage do I need?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>The amount of umbrella insurance coverage you need depends on your personal assets, liability risks, and financial goals. As a general guideline, it's recommended to have at least 1 million in coverage to provide adequate protection. However, if you have significant assets or face higher-than-average liability risks, you may want to consider higher coverage limits.

Can I bundle my umbrella insurance with other policies for discounts?

+Yes, bundling your umbrella insurance with other policies, such as auto, home, or renters insurance, can often lead to significant savings. Many insurance providers offer multi-policy discounts when you combine your policies with them. Bundling not only saves money but also simplifies insurance management.

What factors influence umbrella insurance rates?

+Several factors influence umbrella insurance rates, including location, primary insurance coverage, personal assets, and risk profile. Insurance providers consider these factors to assess the potential exposure and risk associated with insuring an individual or family. Understanding these factors can help you make informed decisions about your coverage and rates.