Life Insurance Jobs Near Me

Life insurance is an essential financial product that provides peace of mind and security to individuals and their families. The industry plays a crucial role in safeguarding livelihoods and ensuring a stable future, making it a significant sector in the global economy. With its wide reach and diverse range of services, the life insurance industry offers a multitude of career opportunities. If you're interested in exploring life insurance jobs near you, this article will guide you through the various roles, their responsibilities, and the skills required to excel in this dynamic field.

Understanding the Life Insurance Industry

The life insurance industry is a multifaceted domain, offering a wide array of services to individuals, families, and businesses. At its core, life insurance provides financial protection in the event of an individual’s death, ensuring that their loved ones are taken care of and their financial obligations are met. However, the industry’s scope extends far beyond this basic definition.

Life insurance companies also offer a range of investment and savings products, providing individuals with opportunities to grow their wealth and plan for the future. These products can include retirement plans, education funds, and investment portfolios, each designed to meet specific financial goals. The industry's focus on long-term financial planning and security makes it an integral part of many people's lives, further emphasizing the importance of its workforce.

The life insurance industry's structure is typically divided into several key areas, each with its own unique set of responsibilities and roles. These include sales and marketing, underwriting, claims processing, customer service, and investment management. Each of these areas requires a specialized skill set and contributes to the overall success and stability of the industry.

Exploring Life Insurance Jobs Near You

When it comes to finding life insurance jobs near you, there are numerous opportunities to consider, each with its own set of challenges and rewards. Let’s delve into some of the most common roles and their specific requirements and responsibilities.

Life Insurance Sales Agents

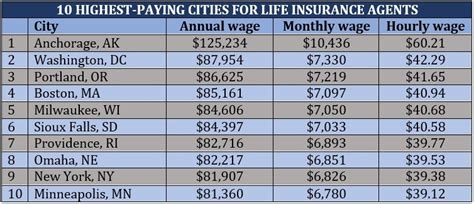

Life insurance sales agents are the front-line representatives of insurance companies, responsible for engaging with potential clients and selling insurance policies. Their primary role is to understand the financial needs and goals of their clients and provide tailored insurance solutions. This often involves explaining complex insurance products in a simple, relatable manner and building trust with clients.

Skills required for this role include excellent communication and interpersonal skills, a strong understanding of financial concepts, and the ability to work independently. Sales agents often work on commission, which means their income is directly tied to their sales performance. Therefore, a proactive and driven attitude is essential for success in this role.

Underwriters

Underwriters play a critical role in the life insurance industry, assessing the risk associated with insuring an individual. They analyze various factors such as age, health status, lifestyle, and family history to determine the likelihood of a claim being made on the policy. Based on this assessment, they set the premium rates and terms of the insurance policy.

Key skills for underwriters include strong analytical abilities, attention to detail, and a deep understanding of risk assessment and management. Underwriters often work closely with actuaries, who provide statistical analysis to support underwriting decisions. This role requires a balanced approach, ensuring that the company's financial interests are protected while also offering competitive insurance products to clients.

Claims Processors

Claims processors are responsible for managing and processing insurance claims, ensuring that clients receive the financial benefits outlined in their policies. This role involves verifying the validity of claims, assessing the extent of the loss, and authorizing payments. Claims processors often work closely with clients during difficult times, providing support and guidance throughout the claims process.

Skills required for this role include strong organizational abilities, attention to detail, and excellent customer service skills. Claims processors must also have a good understanding of insurance policies and be able to interpret and apply them accurately. The ability to remain calm and empathetic when dealing with potentially sensitive situations is also crucial.

Customer Service Representatives

Customer service representatives are the face of the insurance company, providing support and assistance to clients throughout their insurance journey. They handle a wide range of inquiries, from policy changes and renewals to billing questions and general insurance advice. Customer service representatives play a crucial role in building and maintaining positive relationships with clients.

Key skills for this role include exceptional communication and interpersonal skills, a patient and helpful demeanor, and a thorough understanding of insurance products and services. Customer service representatives must be able to explain complex insurance concepts simply and provide accurate information to clients. They often act as a bridge between the company and its clients, ensuring a positive customer experience.

Investment Managers

Investment managers within the life insurance industry are responsible for managing the company’s investment portfolio, ensuring optimal returns while minimizing risk. They analyze market trends, select investment opportunities, and make strategic decisions to grow the company’s financial assets. This role is crucial for the long-term financial stability and growth of the insurance company.

Skills required for investment managers include a deep understanding of financial markets, investment strategies, and risk management. Strong analytical and decision-making abilities are essential, as is the ability to stay abreast of market developments and economic trends. Investment managers often work closely with actuaries and underwriters to ensure that the company's financial goals are aligned with its insurance obligations.

Skills and Qualifications for Life Insurance Jobs

Regardless of the specific role, there are certain skills and qualifications that are highly valued in the life insurance industry. These include:

- Financial Acumen: A strong understanding of financial concepts and principles is essential for all life insurance roles. This includes knowledge of investment strategies, risk management, and financial planning.

- Communication Skills: Excellent communication skills are vital for roles that involve interacting with clients, such as sales agents and customer service representatives. The ability to explain complex concepts simply and build rapport with clients is key.

- Analytical Thinking: Many life insurance roles, such as underwriting and investment management, require strong analytical abilities. The ability to interpret data, assess risks, and make informed decisions is crucial.

- Attention to Detail: Life insurance policies often involve intricate details and fine print. Roles that require attention to detail, such as underwriting and claims processing, play a critical role in ensuring policy compliance and accurate claims assessments.

- Customer Service Orientation: A focus on customer satisfaction and providing excellent service is valued across the industry. Roles such as customer service representatives and claims processors directly impact the client's experience and satisfaction.

- Industry Knowledge: A solid understanding of the life insurance industry, including its regulations, products, and market dynamics, is essential for success in any role.

Future Trends in the Life Insurance Industry

The life insurance industry is constantly evolving, driven by technological advancements, changing consumer preferences, and shifting market dynamics. Here are some key trends that are shaping the future of life insurance jobs:

Digital Transformation

The rise of digital technologies has significantly impacted the life insurance industry, with many companies embracing digital solutions to enhance their operations. This includes the use of artificial intelligence and machine learning for automated underwriting, claims processing, and customer service. As a result, there is a growing demand for professionals with expertise in digital technologies and data analytics.

Focus on Wellness and Lifestyle

There is a growing trend towards wellness-focused insurance products that take into account an individual’s lifestyle and health habits. This shift requires underwriters and sales agents to have a deeper understanding of wellness concepts and how they impact insurance risks. It also opens up opportunities for professionals with expertise in health and wellness to play a role in the industry.

Personalized Insurance Solutions

With the advent of big data and advanced analytics, life insurance companies are increasingly able to offer personalized insurance solutions tailored to individual client needs. This trend requires a shift towards more dynamic and flexible underwriting practices, as well as a focus on data-driven decision-making.

Regulatory Changes

The life insurance industry is subject to constant regulatory changes and updates, which impact the way companies operate and the products they offer. Professionals with a strong understanding of regulatory frameworks and the ability to adapt to changing legal landscapes will be in high demand.

Emerging Markets

As the global economy evolves, there are new opportunities for life insurance companies to expand into emerging markets. This presents a unique set of challenges and opportunities, requiring professionals with cultural sensitivity, language skills, and a deep understanding of local market dynamics.

Conclusion

The life insurance industry offers a diverse range of career opportunities, each with its own unique set of challenges and rewards. Whether you’re interested in sales, underwriting, claims processing, customer service, or investment management, the industry provides a platform for personal and professional growth. By understanding the roles, skills, and trends within the industry, you can make informed decisions about your career path and contribute to the vital work of safeguarding people’s financial futures.

What qualifications are required to work in the life insurance industry?

+The qualifications required can vary depending on the specific role and company. However, a bachelor’s degree in a relevant field such as finance, economics, or business is often preferred. Additionally, certifications such as the Certified Insurance Counselor (CIC) or Chartered Life Underwriter (CLU) can enhance your employability and demonstrate your expertise in the field.

Are there opportunities for career growth in the life insurance industry?

+Absolutely! The life insurance industry offers a wide range of opportunities for career growth and advancement. Many companies provide comprehensive training programs and mentorship opportunities to help employees develop their skills and progress within the organization. With hard work, dedication, and a willingness to learn, you can climb the career ladder and take on more senior roles.

What are the key challenges faced by professionals in the life insurance industry?

+Professionals in the life insurance industry often face a unique set of challenges. These can include keeping up with rapidly changing regulations, managing complex insurance products, and adapting to evolving consumer preferences. Additionally, the emotional nature of dealing with clients’ financial security and potential losses can present unique emotional challenges.