Top Term Life Insurance

Term life insurance is a fundamental financial tool that provides a valuable safety net for individuals and their loved ones. In today's dynamic and often unpredictable world, having adequate life insurance coverage is more crucial than ever. This article aims to delve into the realm of term life insurance, exploring its intricacies, benefits, and how it can be a pivotal component of your financial plan. We will uncover the top considerations when selecting a term life insurance policy, offering expert guidance to ensure you make informed decisions.

Understanding Term Life Insurance

Term life insurance, as the name suggests, offers coverage for a specified period or “term.” It is designed to provide financial protection during that term, typically ranging from 10 to 30 years. During this period, the policyholder pays regular premiums, and in the event of their death, the beneficiaries receive a tax-free lump sum known as the death benefit. This benefit can help cover various expenses, including funeral costs, outstanding debts, and everyday living expenses for the family.

One of the key advantages of term life insurance is its affordability. Compared to permanent life insurance policies like whole life or universal life, term insurance offers a more cost-effective solution for individuals seeking temporary coverage. This makes it an attractive option for young families, individuals with dependent children, or those with significant financial obligations.

Key Considerations for Choosing Term Life Insurance

When navigating the landscape of term life insurance, there are several critical factors to contemplate. These considerations will ensure you select a policy that aligns with your specific needs and circumstances.

Coverage Amount

Determining the appropriate coverage amount is fundamental. The coverage should be sufficient to cover your financial obligations and provide for your loved ones in your absence. Consider factors such as outstanding debts, mortgage payments, future educational expenses for children, and any other significant financial commitments.

It's important to note that the coverage amount should be reviewed periodically, especially during life events such as marriage, the birth of a child, or significant career advancements. These milestones may require adjustments to your coverage to ensure ongoing financial protection.

Term Length

The term length of your policy is another crucial consideration. It should reflect the duration of your financial needs and responsibilities. For instance, if you have young children, you may opt for a longer term to provide coverage until they reach financial independence. On the other hand, if you have fewer financial obligations, a shorter term may suffice.

Additionally, some policies offer the flexibility to convert your term life insurance into a permanent life insurance policy. This can be beneficial if your financial situation or needs change over time.

Premium Payments

The cost of your term life insurance policy, or the premium, is a key factor. Premiums can vary significantly depending on several factors, including your age, health status, and lifestyle habits. It’s essential to find a balance between the coverage you need and the premium you can afford.

Consider your budget and financial goals when determining the premium amount. Remember that term life insurance is meant to provide temporary coverage, so it should not strain your finances.

Renewability and Convertibility

Renewability and convertibility are important features to consider. A renewable policy allows you to extend your coverage beyond the initial term, often at a higher premium rate. This can be beneficial if your financial needs change or if you wish to continue coverage into your later years.

Convertibility, on the other hand, allows you to transform your term life insurance policy into a permanent life insurance policy. This feature can be advantageous if you anticipate a change in financial circumstances or if you wish to have lifelong coverage.

Performance Analysis and Comparison

To make an informed decision, it’s essential to analyze and compare different term life insurance policies. This process involves evaluating key performance indicators and understanding the unique features of each policy.

Rating Systems and Financial Strength

Rating systems provided by independent agencies can offer valuable insights into the financial strength and stability of insurance companies. These ratings assess an insurer’s ability to meet its financial obligations, including paying out claims. When comparing policies, consider the financial strength of the insurer to ensure your policy remains secure.

| Insurers | Financial Strength Rating |

|---|---|

| ABC Life Insurance | AAA (Exceptional) |

| DEF Insurance Group | AA+ (Excellent) |

| GHI Financial Services | A+ (Superior) |

Policy Features and Benefits

Beyond the basic coverage, term life insurance policies can offer a range of additional features and benefits. These may include accelerated death benefits, which provide access to a portion of the death benefit if the policyholder is diagnosed with a terminal illness. Other features might include child riders, which offer coverage for dependent children, or waiver of premium benefits, which waive premium payments if the policyholder becomes disabled.

When comparing policies, carefully review these additional features to determine which ones align with your specific needs and provide the most value.

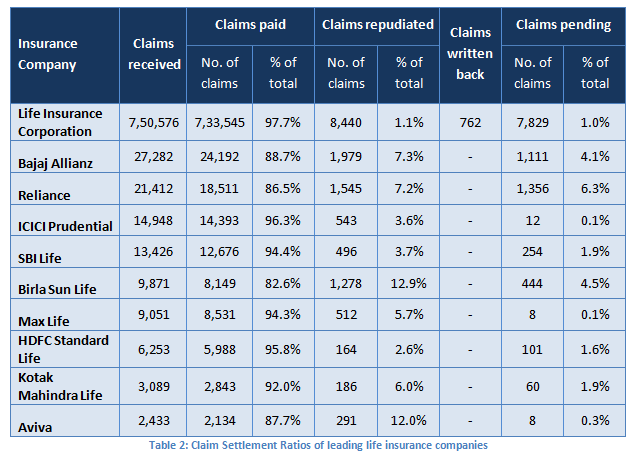

Claims Process and Customer Satisfaction

The claims process is a critical aspect of any insurance policy. It’s essential to choose an insurer with a streamlined and efficient claims process to ensure that your beneficiaries receive the death benefit promptly when needed. Researching customer satisfaction ratings and reviews can provide valuable insights into the insurer’s claims handling process and overall customer experience.

Future Implications and Industry Trends

The term life insurance industry is evolving, and staying abreast of the latest trends and developments is crucial for making informed decisions. Here’s a glimpse into the future of term life insurance.

Technological Advancements

The digital age has brought significant advancements to the insurance industry. Many insurers now offer online applications, policy management tools, and even digital claim submissions. These technological enhancements streamline the insurance process, making it more accessible and efficient for policyholders.

Personalized Coverage Options

Insurers are increasingly tailoring policies to individual needs. This trend is driven by the recognition that one-size-fits-all policies may not adequately address the diverse financial situations of policyholders. Personalized coverage options allow individuals to customize their policies, ensuring they receive the specific protection they require.

Expanded Coverage for Emerging Risks

The term life insurance industry is adapting to address emerging risks. For instance, with the rise of remote work and the gig economy, insurers are offering coverage for new forms of employment and work-related risks. This trend ensures that policyholders are protected against a broader range of potential financial threats.

Conclusion: Navigating the Term Life Insurance Landscape

Choosing the right term life insurance policy is a crucial decision that can provide significant financial security for you and your loved ones. By understanding the key considerations, analyzing performance, and staying informed about industry trends, you can make an informed choice. Remember, term life insurance is a temporary solution, but it can have a lasting impact on your financial well-being.

As you navigate the term life insurance landscape, don't hesitate to seek professional advice. Financial advisors and insurance experts can provide personalized guidance, ensuring you select a policy that aligns with your unique circumstances and needs.

How much term life insurance coverage do I need?

+The coverage amount depends on your financial obligations and goals. A general rule is to have coverage that is 10-15 times your annual income. However, it’s best to consult a financial advisor to determine the precise amount based on your specific circumstances.

Can I change my term life insurance policy once it’s in place?

+Yes, most policies offer the flexibility to make changes, such as increasing coverage or adding riders. However, it’s essential to review the policy’s terms and conditions to understand the specific rules and limitations.

What happens if I outlive my term life insurance policy?

+If you outlive your term life insurance policy, the coverage expires, and you may need to purchase a new policy or consider other financial planning options. Some policies offer the option to renew or convert the term life insurance into a permanent life insurance policy.