Supplemental Insurance Companies

In today's healthcare landscape, the concept of supplemental insurance has gained significant traction as a means to bridge the gaps left by traditional health insurance plans. This type of insurance, also known as ancillary or gap insurance, provides an additional layer of financial protection to individuals and families, offering coverage for expenses that primary health insurance may not fully cover. As the demand for these policies rises, a diverse array of companies has emerged, each with its unique approach and offerings. This article aims to delve into the world of supplemental insurance companies, exploring their roles, products, and the impact they have on healthcare consumers.

Understanding the Role of Supplemental Insurance Companies

Supplemental insurance companies play a pivotal role in the healthcare industry by addressing the limitations of standard health insurance policies. While primary health insurance plans aim to cover a broad spectrum of medical needs, they often come with deductibles, co-pays, and specific coverage exclusions. This is where supplemental insurance steps in, providing coverage for these out-of-pocket expenses and offering additional benefits that enhance overall healthcare coverage.

These companies specialize in designing policies that cater to the unique needs of their clients. Whether it's covering expenses related to chronic illnesses, providing cash benefits for specific medical procedures, or offering income protection during extended illnesses, supplemental insurance companies aim to reduce the financial burden on individuals and ensure they receive the care they need without worrying about the associated costs.

The Evolution of Supplemental Insurance

The concept of supplemental insurance has evolved significantly over the years. Initially, these policies were primarily focused on providing coverage for specific events or conditions, such as accident insurance or critical illness coverage. However, with the increasing complexity of healthcare systems and rising healthcare costs, the scope of supplemental insurance has broadened.

Modern supplemental insurance policies often offer a comprehensive range of benefits. For instance, they may include coverage for prescription medications, dental and vision care, mental health services, and even alternative therapies. Some policies also provide benefits for preventive care, encouraging policyholders to prioritize their health and take proactive measures to maintain it.

| Supplemental Insurance Type | Key Features |

|---|---|

| Accident Insurance | Provides benefits for injuries sustained in accidents, covering expenses like medical bills, transportation, and rehabilitation. |

| Critical Illness Insurance | Offers a lump-sum payment upon diagnosis of specified critical illnesses, providing financial support during treatment. |

| Hospital Indemnity Insurance | Pays a daily or weekly benefit for each day spent in the hospital, helping to cover expenses not covered by primary insurance. |

| Dental and Vision Insurance | Covers routine dental and eye care, as well as more extensive procedures, filling the gaps left by primary insurance plans. |

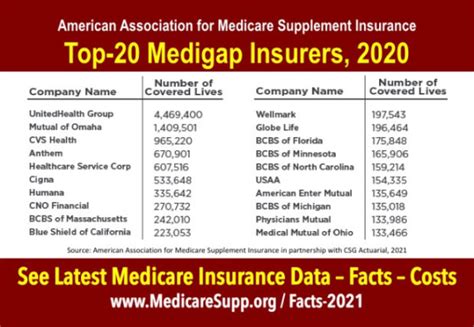

Key Players in the Supplemental Insurance Market

The supplemental insurance market is diverse and highly competitive, with numerous companies vying for the attention of consumers. While the specific offerings and target audiences may vary, these companies share a common goal: to provide affordable, accessible, and comprehensive healthcare coverage.

Company A: Leading the Way in Innovation

Company A, a renowned player in the industry, has consistently demonstrated its commitment to innovation. They have developed a range of cutting-edge products that cater to the evolving needs of their customers. For instance, their “Wellness Plus” policy offers incentives for policyholders to maintain a healthy lifestyle, providing discounts on gym memberships and wellness programs. This approach not only reduces healthcare costs but also encourages a proactive approach to health.

Additionally, Company A has introduced a unique feature called "Flex Benefits," allowing policyholders to customize their coverage based on their specific needs. Whether it's increasing benefits for mental health services or adding coverage for travel vaccinations, this flexibility ensures that individuals can tailor their insurance to their unique circumstances.

Company B: Focused on Community Impact

Company B, with its community-centric approach, has gained a strong reputation for its commitment to social responsibility. They offer a range of policies designed to cater to the specific needs of different communities. For example, their “Community Care” program provides supplemental coverage to underserved areas, ensuring that residents have access to the healthcare services they require.

Furthermore, Company B actively engages in community outreach programs, partnering with local healthcare providers to organize health fairs and educational workshops. By doing so, they not only raise awareness about the importance of supplemental insurance but also provide an opportunity for individuals to understand their coverage options and make informed decisions.

Company C: Pioneer in Digital Insurance

Company C has revolutionized the supplemental insurance industry by embracing digital technology. They have developed a user-friendly online platform that allows policyholders to manage their insurance plans with ease. From purchasing a policy to filing a claim, the entire process is streamlined and accessible.

Moreover, Company C offers a mobile app that provides real-time updates on policy details, claim status, and even personalized health tips. This digital approach not only enhances the customer experience but also ensures that policyholders have instant access to their insurance information whenever needed.

| Supplemental Insurance Company | Unique Offering |

|---|---|

| Company A | "Wellness Plus" policy with lifestyle incentives and "Flex Benefits" customization. |

| Company B | "Community Care" program focusing on underserved areas and community outreach initiatives. |

| Company C | Digital insurance platform and mobile app for seamless policy management and personalized health tips. |

The Impact of Supplemental Insurance on Healthcare Consumers

The introduction and growth of supplemental insurance companies have had a profound impact on the lives of healthcare consumers. By offering additional coverage and financial protection, these companies have empowered individuals to take control of their healthcare decisions without being burdened by financial worries.

Enhanced Access to Healthcare Services

Supplemental insurance policies often cover a wide range of healthcare services that primary insurance may exclude or limit. This includes alternative therapies, specialized treatments, and preventive care. As a result, policyholders have greater flexibility in choosing the healthcare providers and treatments that best suit their needs, leading to improved overall health outcomes.

Reduced Financial Burden

One of the primary benefits of supplemental insurance is the reduction of out-of-pocket expenses. By covering deductibles, co-pays, and other costs not included in primary insurance, policyholders can access necessary medical care without worrying about the financial strain. This is particularly beneficial for individuals with chronic conditions or those who require ongoing medical treatment.

Increased Peace of Mind

Knowing that they have supplemental insurance coverage provides policyholders with a sense of security and peace of mind. They can rest assured that in the event of a medical emergency or unexpected illness, they will have the financial support they need to navigate the healthcare system and receive the best possible care. This peace of mind extends beyond the individual, often benefiting their entire family or community.

Empowering Preventive Care

Many supplemental insurance companies recognize the importance of preventive care in maintaining good health. As such, they offer coverage for routine check-ups, vaccinations, and health screenings. By encouraging policyholders to prioritize their health through these preventive measures, these companies contribute to a healthier population and potentially reduce the need for costly medical interventions down the line.

The Future of Supplemental Insurance

As the healthcare industry continues to evolve, the role of supplemental insurance companies is likely to become even more significant. With advancements in medical technology and an increasing focus on personalized medicine, the demand for tailored insurance solutions is expected to rise.

Looking ahead, we can anticipate that supplemental insurance companies will continue to innovate, developing policies that address emerging healthcare needs. This may include coverage for new treatments and therapies, as well as enhanced benefits for mental health and wellness. Additionally, with the increasing adoption of digital health technologies, we can expect to see further integration of digital tools into the supplemental insurance landscape, enhancing the customer experience and streamlining claim processes.

In conclusion, supplemental insurance companies play a crucial role in ensuring that individuals have access to the healthcare services they need, without being hindered by financial constraints. As the market continues to evolve, these companies will remain at the forefront of providing innovative solutions to meet the diverse and changing needs of healthcare consumers.

How does supplemental insurance differ from primary health insurance?

+Supplemental insurance is designed to complement primary health insurance by covering expenses and benefits that primary plans may not include. While primary insurance provides broad coverage for a range of medical needs, supplemental insurance focuses on specific gaps, offering additional financial protection for out-of-pocket costs and unique healthcare requirements.

What are the benefits of choosing a digital insurance platform like Company C’s offering?

+A digital insurance platform offers several advantages, including easy access to policy information, streamlined claim processes, and personalized health tips. It allows policyholders to manage their insurance plans efficiently and provides real-time updates, ensuring they stay informed about their coverage and benefits.

How can supplemental insurance help individuals with chronic illnesses manage their healthcare costs?

+Supplemental insurance provides coverage for a wide range of expenses related to chronic illnesses, including prescription medications, specialist visits, and ongoing treatments. By offering financial support for these costs, supplemental insurance reduces the financial burden on individuals, allowing them to focus on their health and well-being.