State Farm Insurance Vehicle

Welcome to an in-depth exploration of the State Farm Insurance vehicle, a critical component of the insurance landscape. State Farm, a leading provider of auto insurance in the United States, has pioneered innovative approaches to risk assessment and policy management. At the heart of their success is their proprietary vehicle classification system, which forms the basis for their underwriting practices.

This article aims to provide a comprehensive understanding of how State Farm assesses and categorizes vehicles, the implications of these classifications for policyholders, and the future trends shaping this essential aspect of the insurance industry.

Understanding State Farm’s Vehicle Classification System

State Farm’s vehicle classification system is a sophisticated methodology designed to accurately assess the risk profile of different types of vehicles. This system, which has evolved over decades, plays a pivotal role in determining insurance premiums and coverage options.

The classification process considers a multitude of factors, including the vehicle's make, model, year of manufacture, and engine specifications. Additionally, State Farm takes into account the vehicle's intended use, whether for personal, commercial, or specialized purposes.

One of the key advantages of State Farm's approach is its ability to adapt to the dynamic nature of the automotive industry. As new technologies and vehicle categories emerge, State Farm continually refines its classification system to ensure accurate risk assessment.

The Impact of Vehicle Classification on Insurance Premiums

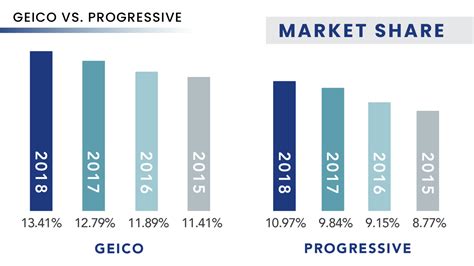

Vehicle classification is a critical determinant of insurance premiums. State Farm, like other insurers, uses this classification to assess the level of risk associated with a particular vehicle and, consequently, the premium that policyholders will pay.

Vehicles that are deemed high-risk due to factors such as powerful engines, sports car designs, or a history of frequent claims, often attract higher premiums. On the other hand, vehicles with lower risk profiles, such as family sedans or electric cars, may benefit from more competitive insurance rates.

It's important for policyholders to understand that insurance premiums are not solely based on vehicle classification. Other factors, such as the driver's age, driving record, and the geographical location, also play significant roles in premium determination.

| Vehicle Type | Risk Profile | Premium Impact |

|---|---|---|

| Sports Cars | High | Elevated Premiums |

| Family Sedans | Moderate | Competitive Rates |

| Electric Vehicles | Low | Potentially Lower Premiums |

Specialized Vehicles and State Farm’s Coverage

State Farm’s vehicle classification system extends beyond traditional passenger cars and light trucks. It also encompasses a wide range of specialized vehicles, each with its unique risk profile and coverage considerations.

This includes recreational vehicles (RVs), motorcycles, boats, and even classic cars. Each of these vehicle types presents distinct challenges and opportunities for insurers, requiring specialized knowledge and tailored coverage options.

Recreational Vehicles (RVs)

RVs, with their unique blend of home and vehicle features, present a complex challenge for insurers. State Farm’s approach to RV insurance is comprehensive, taking into account the size, weight, and living accommodations of these vehicles.

For instance, larger RVs with more amenities may be classified as higher-risk due to their size and potential for more severe damage. Conversely, smaller, more compact RVs might be considered lower-risk, leading to potentially more affordable insurance rates.

Motorcycles

Motorcycle insurance is another area where State Farm’s vehicle classification system shines. The company takes into account factors such as the motorcycle’s engine size, its intended use (cruiser, sport bike, etc.), and the rider’s experience level.

Higher-risk motorcycles, such as powerful sport bikes, often attract higher insurance premiums due to their association with higher accident rates. Conversely, lower-risk motorcycles, like smaller, more economical models, may benefit from more competitive rates.

Boats and Marine Vehicles

State Farm also provides insurance coverage for boats and other marine vehicles. The classification process for these vehicles considers factors such as the boat’s size, type (sailboat, powerboat, etc.), and its intended use (recreational, commercial, etc.).

Just as with other vehicle types, the risk profile of a boat can significantly impact insurance premiums. Boats used for high-risk activities, such as racing or extreme water sports, may face higher insurance costs compared to those used for leisurely activities.

Classic and Collector Cars

State Farm’s vehicle classification system also caters to the unique needs of classic and collector car owners. These vehicles, often cherished for their historical significance and rarity, require specialized coverage to protect their value and unique characteristics.

The classification process for classic cars considers factors such as the vehicle's age, rarity, and condition. This ensures that the insurance coverage is tailored to the specific needs of these vehicles, providing adequate protection without unnecessary expense.

The Future of State Farm’s Vehicle Classification

As the automotive industry continues to evolve, driven by advancements in technology and changing consumer preferences, State Farm’s vehicle classification system must also adapt to remain relevant and effective.

One of the most significant trends shaping the future of vehicle classification is the rise of electric and autonomous vehicles. These vehicles present unique challenges and opportunities for insurers, requiring a rethinking of traditional risk assessment methodologies.

Electric Vehicles (EVs)

The growing popularity of electric vehicles (EVs) is already influencing State Farm’s vehicle classification system. EVs, with their lower emissions and unique safety features, often present a lower risk profile compared to traditional internal combustion engine vehicles.

As a result, State Farm is increasingly recognizing EVs as a separate category within its classification system. This recognition often translates into more competitive insurance rates for EV owners, reflecting the reduced risk associated with these vehicles.

Autonomous Vehicles

The advent of autonomous vehicles (AVs) is another significant development that will shape the future of vehicle classification. AVs, with their advanced safety features and potential to reduce accidents, could significantly alter the risk landscape for insurers.

State Farm, along with other insurers, is actively researching and developing strategies to assess the risk associated with AVs. This includes understanding the liability implications, the potential for reduced accident rates, and the unique challenges presented by AV technology.

Data-Driven Risk Assessment

Advancements in data analytics and machine learning are also transforming the way State Farm assesses vehicle risk. By leveraging vast amounts of data, State Farm can make more precise predictions about the likelihood of accidents and claims, leading to more accurate vehicle classifications.

This data-driven approach allows State Farm to continuously refine its vehicle classification system, ensuring that it remains responsive to the evolving automotive landscape and provides fair and accurate insurance coverage for policyholders.

Conclusion

State Farm’s vehicle classification system is a dynamic and sophisticated tool that underpins its success as a leading auto insurer. By accurately assessing the risk profile of different vehicle types, State Farm is able to provide fair and competitive insurance premiums for its policyholders.

As the automotive industry continues to evolve, with the rise of electric and autonomous vehicles, State Farm's commitment to innovation and adaptability ensures that its vehicle classification system will remain at the forefront of the insurance industry. Through continuous refinement and a data-driven approach, State Farm is well-positioned to meet the challenges and opportunities presented by the future of mobility.

How often does State Farm update its vehicle classification system?

+State Farm continuously monitors industry trends and updates its vehicle classification system as needed. This ensures that the system remains current and reflective of the evolving automotive landscape.

Can vehicle classification impact my insurance coverage?

+Absolutely. Vehicle classification is a key factor in determining insurance premiums and coverage options. Higher-risk vehicles may face higher premiums or more limited coverage options.

How does State Farm classify electric vehicles (EVs)?

+State Farm recognizes EVs as a separate category within its vehicle classification system. This recognition often results in more competitive insurance rates for EV owners due to the lower risk profile associated with these vehicles.