State Farm Cancel Insurance

Canceling an insurance policy is a significant decision that requires careful consideration and understanding of the process. State Farm, one of the leading insurance providers in the United States, offers a range of insurance products, including auto, home, life, and health insurance. In this comprehensive guide, we will delve into the process of canceling an insurance policy with State Farm, exploring the steps involved, the reasons behind policy cancellations, and the potential consequences and alternatives.

Understanding Policy Cancellation with State Farm

Policy cancellation is a formal process that terminates your insurance coverage with State Farm. It is essential to approach this decision with caution, as insurance policies often provide vital financial protection and security. Understanding the reasons behind policy cancellations and the implications can help you make an informed choice.

Common Reasons for Policy Cancellation

There are several common scenarios that may lead to the cancellation of an insurance policy with State Farm:

- Relocation or Change in Circumstances: If you move to a different state or experience a significant change in your personal or financial situation, your insurance needs may change. For instance, if you relocate to an area with lower insurance rates or different coverage requirements, you might choose to cancel your existing policy.

- Switching to a Different Insurer: Sometimes, individuals decide to explore other insurance options due to factors like better rates, improved coverage, or a more personalized service. In such cases, canceling your State Farm policy becomes necessary to avoid duplicate coverage.

- Policy Lapse: Policy lapses occur when policyholders fail to make timely premium payments. If you miss a payment or fall behind on your premiums, State Farm may cancel your policy to protect their financial interests.

- Fraud or Misrepresentation: In rare cases, insurance policies may be canceled due to fraud or misrepresentation on the part of the policyholder. This includes providing false information during the application process or making fraudulent claims.

- Non-Renewal: State Farm, like many insurance providers, has the right to non-renew a policy. This decision is typically based on factors such as the policyholder’s claims history, risk assessment, or changes in the insurance market.

The Cancellation Process

Canceling your State Farm insurance policy involves a straightforward process, but it’s important to follow the correct steps to ensure a smooth transition:

- Contact State Farm: Initiate the cancellation process by contacting State Farm directly. You can reach out to your local State Farm agent or their customer service team through their official website or helpline.

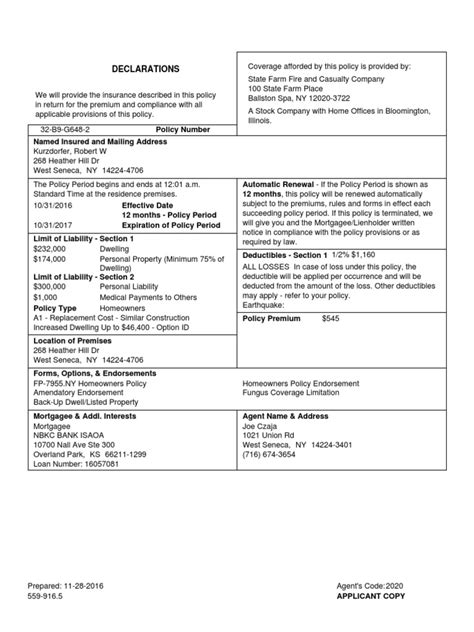

- Provide Notice: Inform State Farm of your intention to cancel your policy. Be prepared to provide specific details, such as the policy number, effective cancellation date, and reason for cancellation. It’s crucial to give advance notice to allow sufficient time for processing.

- Review Policy Terms: Before canceling, carefully review your policy documents, including the terms and conditions, cancellation provisions, and any potential penalties or fees associated with early termination.

- Return Unnecessary Items: If you have received any physical items, such as ID cards or policy documents, ensure you return them to State Farm promptly. This helps maintain a clear record of your policy status.

- Request a Cancellation Confirmation: After providing notice, request a written confirmation of cancellation from State Farm. This document serves as proof that your policy has been terminated and can be useful for future reference.

- Update Other Parties: If your State Farm policy is linked to other parties, such as a mortgage lender or auto loan provider, notify them about the cancellation. This ensures that all relevant stakeholders are aware of the change in your insurance coverage.

Potential Consequences and Alternatives

Canceling an insurance policy with State Farm can have several implications, and it’s essential to consider these carefully:

- Financial Impact: Canceling your policy may result in financial consequences, such as losing any accumulated discounts or benefits. Additionally, if you have a loan or mortgage that requires insurance coverage, canceling your policy could lead to additional fees or penalties.

- Coverage Gap: If you do not have an alternative insurance policy in place, canceling your State Farm policy can leave you with a coverage gap. This gap may expose you to financial risks, especially in the event of unexpected accidents or losses. It’s crucial to have continuous insurance coverage to protect your assets and well-being.

- Alternative Options: Before canceling your State Farm policy, explore alternative insurance providers. Compare rates, coverage options, and customer satisfaction to find a suitable replacement. Ensure that you understand the coverage and exclusions of any new policy to avoid surprises.

- Consider Short-Term Coverage: If you are canceling your policy due to temporary circumstances, such as a short-term relocation, consider short-term insurance options. These policies provide coverage for a limited period and can bridge the gap until you return to your permanent residence or make a long-term insurance decision.

Analyzing the Decision to Cancel

When faced with the decision to cancel your State Farm insurance policy, it’s essential to analyze your specific situation and consider the following factors:

Assessing Your Insurance Needs

Take the time to evaluate your current and future insurance requirements. Consider factors such as your age, health status, assets, and financial stability. Understand the risks you may encounter and the level of coverage you need to mitigate those risks effectively.

Comparing Insurance Providers

Research and compare different insurance providers in your area. Look for companies with a solid reputation, financial stability, and a track record of satisfying customer claims. Compare coverage options, premiums, and additional benefits to find a provider that aligns with your needs and budget.

Understanding Coverage Gaps

Before canceling your State Farm policy, ensure you have a clear understanding of any potential coverage gaps. Identify the areas where you may be vulnerable without insurance coverage. For instance, if you have a mortgage, consider the consequences of canceling your homeowner’s insurance. Similarly, if you own a vehicle, assess the risks associated with driving without auto insurance.

Seeking Professional Advice

If you are uncertain about canceling your State Farm policy or have complex insurance needs, consult with an insurance professional or financial advisor. They can provide personalized guidance based on your specific circumstances and help you make an informed decision.

Alternatives to Policy Cancellation

Instead of canceling your State Farm insurance policy outright, there are alternative options to consider, which may better suit your needs:

Policy Modification

If you are experiencing financial difficulties or have changing insurance requirements, discuss policy modifications with your State Farm agent. You may be able to adjust your coverage limits, deductibles, or add optional endorsements to tailor your policy to your current situation.

Exploring Discounts and Promotions

State Farm, like many insurance providers, offers various discounts and promotions. Review your policy and explore potential discounts based on your driving record, safety features in your vehicle, or loyalty to the company. Taking advantage of these discounts can help reduce your premiums and make your insurance more affordable.

Bundle Your Policies

Consider bundling your insurance policies with State Farm. By combining multiple policies, such as auto and home insurance, you may be eligible for bundle discounts. Bundling not only saves you money but also simplifies your insurance management, as you can work with a single provider for all your insurance needs.

Reviewing Payment Options

If financial constraints are a primary reason for considering policy cancellation, explore alternative payment options with State Farm. Discuss the possibility of flexible payment plans or payment arrangements to make your insurance premiums more manageable.

Conclusion: Making an Informed Decision

Canceling an insurance policy with State Farm is a significant step that requires careful consideration. By understanding the reasons behind policy cancellations, following the correct cancellation process, and exploring alternatives, you can make an informed decision that aligns with your insurance needs and financial situation. Remember, insurance provides vital protection, and maintaining continuous coverage is essential for your peace of mind and financial security.

Can I cancel my State Farm insurance policy at any time?

+Yes, you have the right to cancel your State Farm insurance policy at any time. However, it’s important to provide advance notice and follow the cancellation process outlined by State Farm to avoid any potential penalties or fees.

Will I receive a refund if I cancel my policy mid-term?

+In most cases, if you cancel your State Farm policy mid-term, you may be eligible for a partial refund of your premium. The amount of refund will depend on the terms of your policy and the cancellation provisions. Contact State Farm for specific details regarding your policy.

What happens if I cancel my policy due to a move?

+If you are canceling your State Farm policy due to a move, inform State Farm of your new address and any changes in insurance requirements. They can guide you through the process of updating your policy or finding suitable insurance coverage for your new location.

Are there any penalties for canceling my policy early?

+State Farm’s policies may include provisions for early cancellation penalties. These penalties can vary based on the type of insurance and the terms of your policy. Review your policy documents carefully to understand any potential penalties before canceling.

Can I cancel my policy online?

+State Farm offers online resources and tools to manage your insurance policies. While you may be able to initiate the cancellation process online, it’s recommended to contact State Farm directly to ensure a smooth and accurate cancellation.