Shelter Mutual Insurance

In the vast landscape of the insurance industry, Shelter Mutual Insurance stands as a prominent name, offering a comprehensive range of insurance solutions to individuals and businesses across the United States. With a rich history spanning decades, Shelter Mutual has established itself as a trusted partner, providing financial protection and peace of mind to its policyholders. This article delves into the world of Shelter Mutual Insurance, exploring its offerings, impact, and the key factors that have contributed to its success.

A Legacy of Financial Protection: Shelter Mutual Insurance

Shelter Mutual Insurance, headquartered in the heartland of the United States, Columbia, Missouri, is a testament to the power of a vision. Founded in 1946 by a group of forward-thinking farmers, the company's journey began with a simple yet profound goal: to offer affordable and reliable insurance coverage to farmers and their families. Over the years, Shelter Mutual has expanded its reach and diversified its offerings, solidifying its position as a leading insurance provider in the country.

The company's core values of integrity, reliability, and community involvement have guided its growth and shaped its reputation. Shelter Mutual's commitment to its customers goes beyond providing insurance policies; it extends to fostering long-lasting relationships built on trust and personalized service. With a focus on innovation and adaptability, the company has successfully navigated the evolving insurance landscape, ensuring it remains a relevant and reliable choice for policyholders.

Comprehensive Insurance Solutions

Shelter Mutual Insurance offers a wide array of insurance products tailored to meet the diverse needs of its customers. Here's an overview of their key offerings:

- Auto Insurance: Shelter Mutual provides comprehensive auto insurance coverage, offering protection for vehicles against accidents, theft, and other unforeseen events. Their policies include options for liability, collision, and comprehensive coverage, ensuring policyholders can customize their plans to fit their needs.

- Homeowners Insurance: The company's homeowners insurance policies protect residences and their contents. From single-family homes to condominiums and mobile homes, Shelter Mutual offers tailored coverage, including protection against natural disasters, theft, and liability claims.

- Life Insurance: Shelter Mutual understands the importance of financial security for families. Their life insurance policies provide peace of mind, offering coverage for a wide range of needs, including term life, whole life, and universal life insurance.

- Business Insurance: For small business owners, Shelter Mutual offers tailored business insurance solutions. From general liability to commercial property and workers' compensation, the company helps protect businesses against various risks, ensuring their long-term viability.

- Annuities and Retirement Planning: Shelter Mutual also assists individuals in planning for their retirement. Their annuity products provide a stable income stream during retirement, offering tax-deferred growth and a guaranteed income option.

| Insurance Type | Key Features |

|---|---|

| Auto Insurance | Customizable coverage, accident forgiveness, rental car coverage |

| Homeowners Insurance | Replacement cost coverage, optional flood insurance, identity theft protection |

| Life Insurance | Term life, whole life, and universal life options, accelerated benefit riders |

| Business Insurance | General liability, commercial property, workers' comp, business interruption coverage |

| Annuities | Fixed and variable annuity options, tax-deferred growth, lifetime income guarantees |

Shelter Mutual's insurance solutions are designed with a customer-centric approach, ensuring that policyholders receive the coverage they need at competitive rates. The company's dedicated agents work closely with individuals and businesses to understand their unique circumstances and tailor insurance plans accordingly.

Community Engagement and Giving Back

Beyond its insurance offerings, Shelter Mutual is deeply rooted in the communities it serves. The company actively participates in various initiatives aimed at making a positive impact on society. Here are some key ways Shelter Mutual gives back:

- Charitable Donations: Shelter Mutual has a long-standing tradition of supporting charitable causes. The company contributes to a wide range of organizations, including those focused on education, healthcare, and disaster relief. Their donations help improve the lives of individuals and communities in need.

- Community Partnerships: Shelter Mutual partners with local organizations and businesses to promote community development. This includes sponsoring events, supporting local sports teams, and participating in community projects, fostering a sense of unity and pride.

- Employee Volunteerism: The company encourages its employees to engage in volunteer work, offering paid time off for volunteer activities. Shelter Mutual's employees actively participate in various volunteer initiatives, such as food drives, habitat restoration, and mentoring programs.

- Scholarship Programs: Recognizing the importance of education, Shelter Mutual offers scholarship opportunities to deserving students. These scholarships help students pursue their academic goals and contribute to the development of the next generation of leaders.

Through these initiatives, Shelter Mutual demonstrates its commitment to making a positive difference in the lives of its policyholders and the communities it serves. The company's community engagement efforts reinforce its reputation as a responsible corporate citizen.

Innovation and Technology

In an era driven by technological advancements, Shelter Mutual has embraced innovation to enhance its services and improve the customer experience. Here's how the company leverages technology:

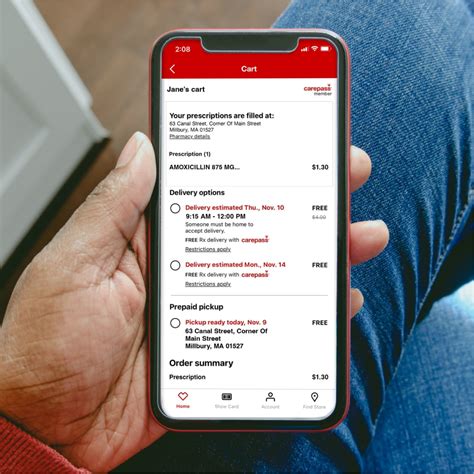

- Digital Platforms: Shelter Mutual has developed user-friendly digital platforms, including a mobile app and an online portal, enabling policyholders to manage their insurance policies conveniently. From policy updates to claims submissions, these platforms offer a seamless experience.

- AI and Machine Learning: The company utilizes artificial intelligence and machine learning technologies to streamline processes and enhance customer service. These technologies enable faster claims processing, personalized policy recommendations, and efficient risk assessment.

- Data Analytics: Shelter Mutual leverages data analytics to gain insights into customer behavior and market trends. This enables the company to develop more effective marketing strategies, improve underwriting accuracy, and provide tailored insurance solutions to its policyholders.

By embracing technology, Shelter Mutual ensures it remains competitive and can deliver efficient, personalized services to its customers. The company's digital transformation initiatives have enhanced its operational efficiency and improved overall customer satisfaction.

Financial Strength and Stability

A key aspect of any insurance company is its financial stability. Shelter Mutual Insurance has consistently demonstrated strong financial performance, earning high ratings from reputable agencies. Here's an overview of the company's financial strength:

- AM Best Rating: Shelter Mutual holds an A (Excellent) rating from AM Best, a leading insurance rating agency. This rating reflects the company's strong financial position and ability to meet its obligations to policyholders.

- Standard & Poor's Rating: Standard & Poor's has also assigned a solid rating to Shelter Mutual, recognizing its financial strength and stable outlook.

- Financial Reserves: The company maintains substantial financial reserves to ensure it can meet its insurance obligations during times of economic uncertainty or natural disasters.

- Investment Portfolio: Shelter Mutual's investment portfolio is well-diversified, consisting of high-quality assets and stable investments. This approach minimizes risk and ensures the company can generate consistent returns to support its insurance operations.

Shelter Mutual's financial stability provides policyholders with the assurance that their insurance policies are backed by a financially sound company. This stability allows the company to offer competitive rates and maintain a long-term commitment to its customers.

Awards and Recognition

Shelter Mutual Insurance's dedication to excellence has been recognized by various industry organizations and publications. Here are some notable awards and accolades received by the company:

- J.D. Power Award: Shelter Mutual has been recognized by J.D. Power for its outstanding customer service and claims handling. The company consistently receives high customer satisfaction ratings, showcasing its commitment to providing exceptional service.

- Best Places to Work: Shelter Mutual has been named one of the best places to work by multiple publications, including Forbes and Fortune. The company's employee-centric culture and focus on work-life balance contribute to its reputation as an employer of choice.

- Insurance Industry Awards: Shelter Mutual has been honored with various awards for its innovative products, outstanding customer service, and industry leadership. These accolades highlight the company's dedication to delivering top-notch insurance solutions and services.

The recognition received by Shelter Mutual Insurance serves as a testament to its commitment to excellence and its ability to deliver on its promises to policyholders and employees alike.

Looking Ahead: Future Prospects

As Shelter Mutual Insurance continues to navigate the evolving insurance landscape, its future prospects remain promising. The company's strong financial position, commitment to innovation, and focus on customer satisfaction position it well for continued growth and success. Here are some key factors that contribute to Shelter Mutual's future outlook:

- Digital Transformation: Shelter Mutual's ongoing digital transformation initiatives will enhance its operational efficiency and customer experience. The company's investment in technology will enable it to better serve its customers and stay competitive in the digital age.

- Diversification: The company's diversified insurance portfolio and expanding product offerings will continue to attract new customers and retain existing policyholders. By offering a comprehensive suite of insurance solutions, Shelter Mutual can meet the evolving needs of its clients.

- Community Engagement: Shelter Mutual's commitment to community involvement and giving back will continue to foster positive relationships with its policyholders and the communities it serves. This approach strengthens the company's brand reputation and enhances its customer loyalty.

- Industry Expertise: Shelter Mutual's experienced leadership and dedicated workforce bring a wealth of industry knowledge and expertise. This expertise allows the company to adapt to changing market conditions and develop innovative solutions to meet customer needs.

As Shelter Mutual Insurance moves forward, it remains focused on its core values of integrity, reliability, and customer service. By staying true to these principles and embracing innovation, the company is well-positioned to thrive in the dynamic insurance industry, providing financial protection and peace of mind to its valued policyholders.

How can I obtain a quote for Shelter Mutual Insurance’s products?

+To obtain a quote for Shelter Mutual Insurance’s products, you can visit their official website and use the online quote tool. Alternatively, you can contact their customer service team or reach out to a local Shelter Mutual agent. They will be able to provide you with personalized quotes based on your specific needs and circumstances.

Does Shelter Mutual Insurance offer discounts on its insurance policies?

+Yes, Shelter Mutual Insurance offers a range of discounts on its insurance policies. These discounts may include multi-policy discounts (bundling multiple insurance types with Shelter Mutual), safe driver discounts, loyalty discounts, and more. The availability and specific criteria for these discounts may vary, so it’s recommended to discuss them with a Shelter Mutual agent to understand your eligibility.

How does Shelter Mutual Insurance handle claims?

+Shelter Mutual Insurance takes a customer-centric approach to claims handling. They aim to provide prompt and efficient service, ensuring policyholders receive fair and timely compensation. The claims process typically involves reporting the claim, assessing the damage, and receiving a settlement. Shelter Mutual’s claims adjusters work closely with policyholders to guide them through the process and ensure a positive experience.