Renters Insurance Rates

Renters insurance is an essential aspect of financial planning for those who rent their homes or apartments. It provides valuable protection against unforeseen events and can safeguard your possessions and livelihood. Understanding the rates and factors that influence renters insurance premiums is crucial for making informed decisions and ensuring adequate coverage. In this comprehensive guide, we delve into the intricacies of renters insurance rates, exploring the key considerations and providing expert insights to help you navigate this vital aspect of personal finance.

Understanding Renters Insurance Rates

Renters insurance rates, or premiums, are the costs associated with obtaining insurance coverage for your rental property. These rates can vary significantly depending on a multitude of factors, each of which contributes to the overall assessment of risk by insurance providers.

Factors Influencing Renters Insurance Rates

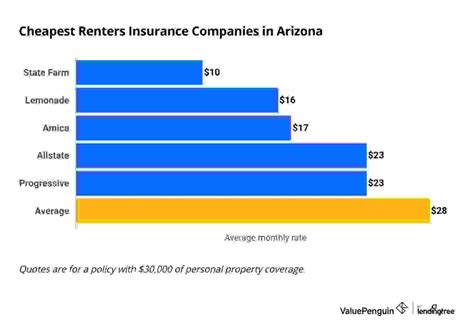

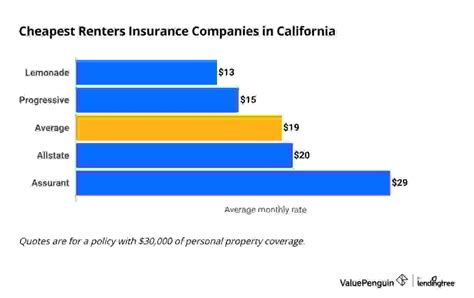

- Location: The geographical area where your rental property is situated plays a pivotal role in determining insurance rates. Regions with higher crime rates, natural disaster risks, or a history of frequent claims may result in increased premiums.

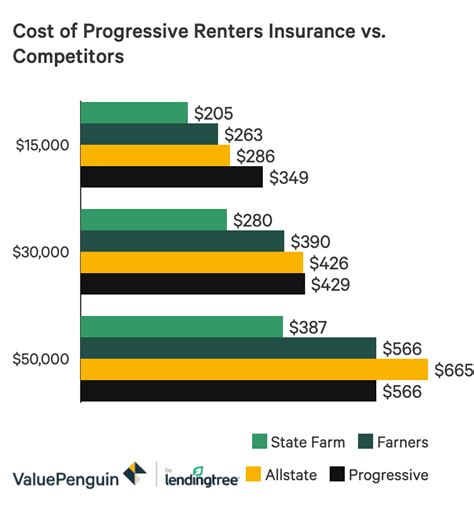

- Value of Belongings: The total value of your personal belongings, often referred to as personal property coverage, is a key consideration. Higher-value items like jewelry, electronics, or artwork may require additional coverage, impacting the overall premium.

- Liability Coverage: Renters insurance typically includes liability coverage, which protects you from financial losses if someone is injured on your property or if you damage someone else’s property. The level of liability coverage you choose can affect your premium.

- Deductibles: Similar to other insurance types, renters insurance policies come with deductibles. Opting for a higher deductible can lower your premium, but it also means you’ll have to pay more out of pocket if you need to file a claim.

- Discounts and Bundling: Many insurance companies offer discounts for various reasons. These may include having multiple policies with the same insurer, installing security systems, or being a loyal customer. Bundling your renters insurance with other policies, such as auto insurance, can often lead to significant savings.

- Policy Add-ons: Additional coverage options, like personal property replacement cost or identity theft protection, can enhance your policy but may also increase the premium.

- Claims History: A clean claims history can work in your favor, as it indicates a lower risk profile. Conversely, a history of frequent claims may result in higher premiums or even difficulty in finding an insurer willing to cover you.

Analyzing Real-World Renters Insurance Rates

To gain a practical understanding of renters insurance rates, let’s explore some real-world examples and analyze the factors that contribute to these premiums.

Case Study: Urban vs. Suburban Renters Insurance

Consider the scenario of two individuals, John and Sarah, both renting apartments. John lives in a bustling city center, while Sarah resides in a quieter suburban area.

- John’s Insurance Premium: John’s insurance premium is likely to be higher due to the increased risk factors associated with urban living. These may include a higher likelihood of theft, vandalism, or even natural disasters like earthquakes or floods.

- Sarah’s Insurance Premium: In contrast, Sarah’s premium is expected to be more affordable due to the relatively lower risk environment of the suburbs. Her policy may still cover essential aspects like personal property and liability, but the premium will likely reflect the reduced risk profile.

| Coverage | John's Premium | Sarah's Premium |

|---|---|---|

| Personal Property | $350 annually | $280 annually |

| Liability | $200 annually | $180 annually |

| Total Premium | $550 annually | $460 annually |

This table illustrates the potential difference in premiums between urban and suburban renters insurance. Note that these figures are for illustrative purposes and may vary significantly based on individual circumstances and the chosen insurance provider.

Additional Considerations

When analyzing renters insurance rates, it’s essential to consider the unique aspects of your situation. For instance, if you own valuable artwork or collectables, you may need to obtain a rider or additional coverage to adequately protect these items. Similarly, if you have pets, especially certain breeds considered high-risk, your insurance premium may be affected.

Maximizing Savings on Renters Insurance

Understanding the factors that influence renters insurance rates empowers you to make strategic decisions to potentially lower your premiums. Here are some expert tips to help you maximize your savings:

- Bundle Policies: Bundling your renters insurance with other policies, such as auto insurance, can lead to significant discounts. Many insurance providers offer multi-policy discounts, so it's worth exploring this option.

- Increase Deductibles: Opting for a higher deductible can reduce your premium. However, it's essential to choose a deductible that aligns with your financial capabilities, as you'll need to pay this amount out of pocket if you need to file a claim.

- Security Measures: Installing security systems, such as alarms or surveillance cameras, can reduce the risk of theft or vandalism. Many insurance providers offer discounts for these measures, so it's a win-win situation.

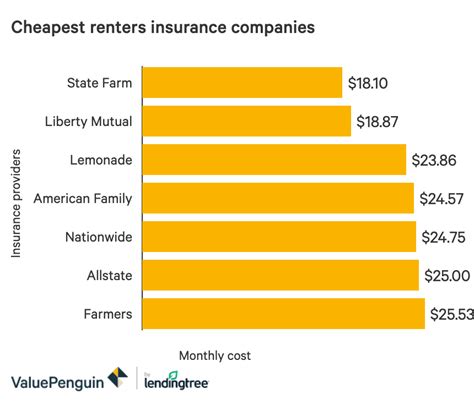

- Compare Quotes: Don't settle for the first insurance quote you receive. Take the time to compare quotes from multiple providers to ensure you're getting the best rate for your specific circumstances.

- Understand Coverage Limits: Ensure you understand the coverage limits of your policy. Some policies may have limitations on high-value items or may not cover certain types of losses. Being aware of these limits can help you make informed decisions about additional coverage if needed.

The Impact of Claims on Renters Insurance Rates

Filing claims can have both immediate and long-term effects on your renters insurance rates. While a single claim may not significantly impact your premium, multiple claims or high-value claims can lead to rate increases or even policy cancellations.

Real-Life Claim Scenarios

Let’s explore a couple of scenarios to understand the potential impact of claims on renters insurance rates.

- Minor Theft Claim: Imagine you discover that a laptop and some jewelry have been stolen from your apartment. You file a claim with your renters insurance provider, and the claim is processed smoothly. In this case, a single minor claim is unlikely to result in a significant rate increase.

- Severe Water Damage Claim: Unfortunately, your apartment experiences severe water damage due to a burst pipe. The repairs and replacement of damaged items result in a substantial claim. In this scenario, your insurance provider may consider this a high-risk incident, potentially leading to a rate increase or even non-renewal of your policy.

Future Trends and Implications for Renters Insurance Rates

As the insurance industry evolves, several trends are expected to shape the future of renters insurance rates. Here’s a glimpse into some potential developments:

- Digital Transformation: The rise of digital insurance platforms and the increasing use of data analytics may lead to more personalized and precise risk assessments. This could result in more accurate premiums based on individual circumstances.

- Climate Change Considerations: With the growing impact of climate change, insurance providers may need to reassess risk profiles in certain areas. This could lead to rate adjustments, especially in regions vulnerable to natural disasters.

- Shared Economy Impact: The rise of the shared economy, including short-term rentals and co-living spaces, may influence insurance rates. Insurance providers may need to adapt their policies to accommodate these evolving living arrangements.

- Technology Integration: Advances in technology, such as smart home devices and AI-powered security systems, may offer opportunities for insurance providers to offer discounts or incentives for policyholders who adopt these measures.

Conclusion: Navigating Renters Insurance Rates with Confidence

Understanding the intricacies of renters insurance rates is a crucial step towards financial security and peace of mind. By analyzing the factors that influence premiums, exploring real-world examples, and adopting strategic approaches to coverage, you can make informed decisions about your renters insurance. Remember, it’s essential to regularly review and assess your coverage needs, as your circumstances and the insurance landscape can change over time.

How often should I review my renters insurance policy?

+It’s generally recommended to review your renters insurance policy annually or whenever your circumstances change significantly. This ensures that your coverage remains adequate and up-to-date.

Can I negotiate my renters insurance premium?

+While it’s less common to negotiate renters insurance premiums directly, you can take steps to potentially lower your premium. This includes comparing quotes, bundling policies, and exploring discounts offered by insurance providers.

What should I do if my renters insurance claim is denied?

+If your renters insurance claim is denied, carefully review the reasons provided by your insurance company. Consider seeking legal advice if you believe the denial is unjustified. It’s essential to understand your rights and the terms of your policy.

Are there any government programs or subsidies available for renters insurance?

+Some states or municipalities offer assistance programs or subsidies for renters insurance. It’s worth researching these options, especially if you’re on a tight budget. Check with your local government or insurance department for more information.