Quote Term Life Insurance

Understanding term life insurance is essential for anyone seeking financial protection and peace of mind for their loved ones. This article will delve into the intricacies of term life insurance, providing a comprehensive guide to help you make informed decisions about your coverage.

Introduction to Term Life Insurance

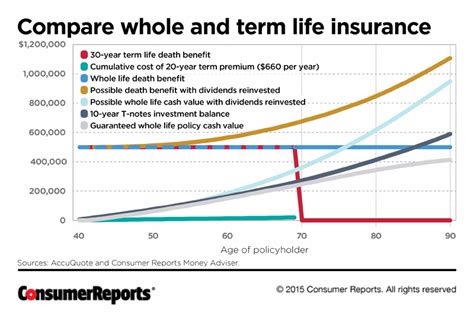

Term life insurance is a type of policy that offers coverage for a specified period, known as the term. Unlike permanent life insurance policies, term life insurance focuses solely on providing financial security during the policy’s active period. It is a popular choice for individuals and families looking for affordable and flexible protection.

The primary purpose of term life insurance is to ensure that your loved ones are financially secure in the event of your untimely demise. It provides a lump-sum payment, known as the death benefit, to your beneficiaries, helping them cover various expenses such as funeral costs, outstanding debts, daily living expenses, and even long-term financial goals like college education for your children.

Key Features and Benefits

Affordability

One of the most appealing aspects of term life insurance is its cost-effectiveness. Premiums for term life insurance are generally much lower compared to permanent life insurance policies. This affordability makes it an attractive option for individuals with limited budgets or those seeking temporary coverage during specific life stages.

For example, consider a 30-year-old non-smoker seeking a $500,000 term life insurance policy for a 20-year term. The annual premium for such a policy could range from $200 to $300, making it an affordable choice for most individuals.

Flexibility

Term life insurance offers a high degree of flexibility to cater to different life situations. Policy terms typically range from 10 to 30 years, allowing individuals to choose coverage that aligns with their specific needs. Whether you’re looking for short-term protection during a career transition or long-term coverage until your children become financially independent, term life insurance can be tailored to your requirements.

Guaranteed Death Benefit

The core benefit of term life insurance is the guaranteed death benefit. If the policyholder passes away during the policy term, their beneficiaries receive the full death benefit, regardless of the cause of death. This financial protection ensures that your loved ones can maintain their standard of living and fulfill their financial obligations.

For instance, imagine a family relying on a single breadwinner's income. With a term life insurance policy in place, the surviving spouse and children can continue paying their mortgage, utilities, and other essential expenses, providing stability during a difficult time.

Renewable and Convertible Options

Many term life insurance policies offer renewal and conversion options, providing further flexibility. Policyholders can often renew their coverage for additional terms, allowing them to extend protection beyond the initial term. Additionally, some policies allow conversion to a permanent life insurance policy, ensuring long-term coverage without the need for a medical exam.

Types of Term Life Insurance

There are several types of term life insurance policies, each designed to meet specific needs. Understanding these variations can help you choose the most suitable option.

Level Term Life Insurance

Level term life insurance offers a fixed death benefit and premium throughout the policy term. This type of policy provides consistent coverage and premium payments, making it easy to budget for.

For instance, if you opt for a 20-year level term policy with a $1,000,000 death benefit, your beneficiaries will receive the full amount if you pass away during the policy term, and your premiums will remain the same for the entire 20 years.

Decreasing Term Life Insurance

Decreasing term life insurance policies are designed to provide coverage that decreases over time. The death benefit and premiums start high and gradually decrease as the policy term progresses. This type of policy is often used to cover specific financial obligations that decrease over time, such as a mortgage.

Consider a 30-year mortgage with a decreasing term life insurance policy. As the mortgage balance decreases, so does the death benefit, ensuring that the policy covers the remaining mortgage amount.

Renewable Term Life Insurance

Renewable term life insurance policies allow policyholders to renew their coverage at the end of the initial term, often without the need for a medical exam. While the premiums may increase with each renewal, it provides an option to extend coverage without the hassle of applying for a new policy.

Convertible Term Life Insurance

Convertible term life insurance policies offer the flexibility to convert the term policy into a permanent life insurance policy, such as whole life or universal life insurance. This conversion can be done without a medical exam, making it an attractive option for those who may need permanent coverage in the future.

Factors Influencing Premiums

The cost of term life insurance premiums is influenced by several factors, each playing a role in determining the overall price.

Age

Age is a significant factor in determining term life insurance premiums. Generally, younger individuals pay lower premiums as they are less likely to pass away during the policy term. As you age, the risk of death increases, leading to higher premiums.

| Age | Annual Premium for $500,000 Policy |

|---|---|

| 25 | $150 - $250 |

| 35 | $200 - $350 |

| 45 | $300 - $600 |

| 55 | $500 - $1,000 |

Health and Lifestyle

Your health and lifestyle choices also impact the cost of term life insurance premiums. Insurers consider factors such as smoking status, body mass index (BMI), and pre-existing medical conditions. Individuals with healthier lifestyles and no pre-existing conditions typically pay lower premiums.

Policy Term

The length of the policy term affects the premium. Longer policy terms generally result in higher premiums, as the insurer assumes a higher risk over an extended period.

Amount of Coverage

The death benefit amount, or the coverage you choose, directly influences the premium. Higher coverage amounts lead to higher premiums, as the insurer assumes a greater financial responsibility.

Choosing the Right Coverage Amount

Determining the appropriate coverage amount is crucial to ensure your loved ones receive adequate financial support in the event of your demise. Consider the following factors when deciding on the coverage amount:

- Debts and Obligations: Evaluate your outstanding debts, including mortgages, car loans, credit card balances, and any other financial obligations. Ensure your coverage can cover these debts to prevent financial strain on your loved ones.

- Income Replacement: Consider the income your family relies on. Calculate the amount needed to replace your income for a specific period, such as until your children reach adulthood or until your spouse can comfortably retire.

- Future Expenses: Think about future expenses, such as your children's college education or any major purchases you plan to make. Ensure your coverage can accommodate these expenses.

- Inflation: Factor in the impact of inflation on your coverage amount. Over time, the purchasing power of money decreases, so adjusting for inflation ensures your coverage remains sufficient.

Applying for Term Life Insurance

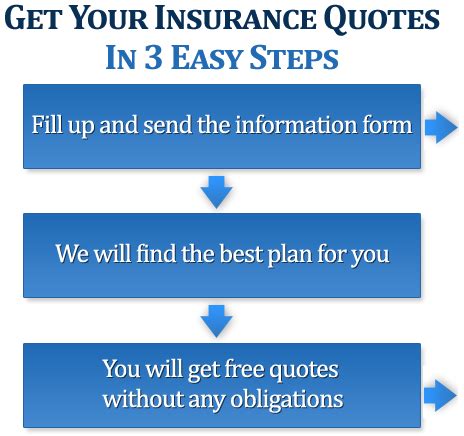

The application process for term life insurance typically involves the following steps:

- Research and Compare: Start by researching and comparing different term life insurance policies from various insurers. Look for reputable companies with a strong financial rating and read reviews to ensure a positive customer experience.

- Obtain Quotes: Request quotes from multiple insurers to compare prices and coverage options. Online quote tools can provide a quick and convenient way to get estimates.

- Medical Exam (if required): Depending on the policy and insurer, you may need to undergo a medical exam. This exam helps assess your health and lifestyle, influencing the final premium.

- Application and Underwriting: Complete the application process, providing accurate and detailed information. The insurer's underwriting team will review your application and determine your eligibility and premium.

- Policy Delivery: Once approved, you will receive your policy documents. Review the policy carefully to ensure it aligns with your expectations and coverage needs.

Frequently Asked Questions

Can I get term life insurance if I have a pre-existing medical condition?

+Yes, individuals with pre-existing medical conditions can still obtain term life insurance. However, the premiums may be higher, and the coverage options may be more limited. It’s essential to disclose all relevant health information during the application process.

How often should I review my term life insurance policy?

+It’s recommended to review your policy at least once a year to ensure it aligns with your current needs and circumstances. Life events such as marriage, the birth of a child, or a significant change in income may warrant an adjustment in your coverage.

Can I cancel my term life insurance policy and get a refund?

+Term life insurance policies typically do not offer refunds upon cancellation. However, you may have the option to surrender the policy, which may result in a small cash value payment if the policy has a surrender value component.

What happens if I outlive my term life insurance policy?

+If you outlive your term life insurance policy, the coverage expires, and you will no longer have protection. However, if you have a renewable or convertible policy, you may have the option to renew or convert the policy to maintain coverage.

Can I add riders to my term life insurance policy?

+Yes, many term life insurance policies allow you to add optional riders to enhance your coverage. Common riders include accelerated death benefit for terminal illness, waiver of premium for disability, and child rider for coverage of dependent children.