Property Mortgage Insurance Rates

Welcome to an in-depth exploration of the world of property mortgage insurance rates, a topic that holds immense importance for prospective homeowners. In this comprehensive guide, we will delve into the intricacies of this financial aspect, providing you with a clear understanding of how mortgage insurance works, who it affects, and most importantly, how to navigate the landscape of rates to make informed decisions.

Understanding Property Mortgage Insurance

Property mortgage insurance, often referred to as PMI, is a financial safeguard designed to protect mortgage lenders against potential losses if a borrower defaults on their home loan. It’s a mandatory requirement for many homebuyers, particularly those with low down payments or limited equity in their properties. PMI ensures that, in the event of a borrower’s inability to repay their mortgage, the lender can recover the remaining loan balance.

The implementation of PMI is a strategic move by lenders to mitigate risks associated with high-loan-to-value mortgages. By requiring borrowers to purchase PMI, lenders gain an additional layer of security, which encourages more flexible lending practices and makes homeownership accessible to a broader range of individuals.

How Does Property Mortgage Insurance Work?

When an individual takes out a mortgage, the lender typically requires a down payment—a percentage of the home’s purchase price paid upfront by the borrower. The remaining amount is financed through the mortgage loan. However, if the down payment is less than 20% of the home’s value, lenders often mandate PMI to protect their interests.

PMI premiums are typically added to the monthly mortgage payments, creating a slightly higher monthly expense for the borrower. These premiums are calculated based on various factors, including the loan amount, loan-to-value ratio, credit score, and the type of mortgage being used. The insurance provides coverage for the lender until the borrower reaches a certain equity threshold in their home, typically around 20%.

Factors Influencing Mortgage Insurance Rates

The rates for property mortgage insurance are not standardized and can vary significantly based on several key factors. Understanding these influences is crucial for homebuyers aiming to navigate the mortgage process effectively.

Loan-to-Value Ratio

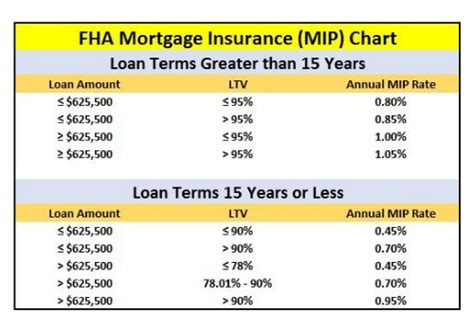

The loan-to-value (LTV) ratio is a critical determinant of PMI rates. This ratio represents the amount of the loan compared to the appraised value of the property. A higher LTV ratio indicates a greater risk for the lender, leading to higher PMI premiums. Conversely, a lower LTV ratio, often achieved with a larger down payment, can result in lower PMI rates.

For instance, if a borrower purchases a home valued at $300,000 and makes a down payment of $60,000 (20%), the LTV ratio would be 66.67%. This lower risk profile might attract more favorable PMI rates compared to a borrower with a 90% LTV ratio, who has made a smaller down payment.

| LTV Ratio | PMI Premium (Annual) |

|---|---|

| 75% | $750 |

| 80% | $1,000 |

| 90% | $1,500 |

Credit Score and Borrower Profile

A borrower’s credit score is another significant factor in determining PMI rates. Lenders assess the borrower’s creditworthiness, including their credit history, income stability, and debt-to-income ratio. A higher credit score generally indicates a lower risk for the lender, which can lead to reduced PMI premiums.

Additionally, lenders consider the borrower's overall profile, including employment history, assets, and financial stability. Borrowers with a strong financial profile may qualify for lower PMI rates, while those with less stability may face higher premiums.

Type of Mortgage

The type of mortgage chosen can also impact PMI rates. Different mortgage programs have varying requirements and structures, which can affect the cost of PMI. For example, FHA loans often require mortgage insurance for the life of the loan, whereas conventional loans may allow for PMI cancellation once a certain equity threshold is reached.

Moreover, certain mortgage programs, such as those offered by the Veterans Administration (VA) or the United States Department of Agriculture (USDA), may have unique mortgage insurance requirements or even waive PMI altogether for eligible borrowers.

Navigating Mortgage Insurance Rates: Strategies and Tips

Understanding the factors that influence mortgage insurance rates is the first step towards making informed decisions. Here are some strategies and tips to help you navigate the world of PMI effectively:

Boost Your Credit Score

A higher credit score can lead to significant savings on PMI premiums. Take steps to improve your credit score by paying bills on time, reducing credit card balances, and disputing any errors on your credit report. A small increase in your score can potentially result in substantial savings over the life of your mortgage.

Make a Larger Down Payment

Increasing your down payment can reduce your LTV ratio, which often translates to lower PMI rates. While this may require more upfront savings, it can significantly impact your long-term financial obligations. Consider saving aggressively for a larger down payment to take advantage of more favorable PMI terms.

Explore Different Mortgage Options

Different mortgage programs have varying PMI requirements. Research and compare different mortgage options to find the one that best suits your financial situation. For example, conventional loans may offer more flexibility in PMI cancellation compared to government-backed loans.

Additionally, consider speaking with multiple lenders to compare their PMI rates and terms. Lenders may offer different pricing structures or have unique programs that could benefit your specific circumstances.

Understand PMI Cancellation Policies

Familiarize yourself with the PMI cancellation policies associated with your mortgage. Conventional loans typically allow for PMI cancellation once the borrower reaches 20% equity in their home. However, the process may vary, and some lenders may have specific requirements or fees associated with PMI cancellation.

For government-backed loans like FHA or VA loans, PMI cancellation may be more complex. FHA loans, for instance, require mortgage insurance for the life of the loan unless the borrower refinances to a non-FHA loan. Understanding these policies can help you plan for the long-term financial implications of your mortgage.

The Future of Property Mortgage Insurance

The landscape of property mortgage insurance is continually evolving, driven by economic trends, regulatory changes, and market dynamics. While it’s challenging to predict the precise direction of PMI rates, there are several key factors that could influence the future of this financial instrument.

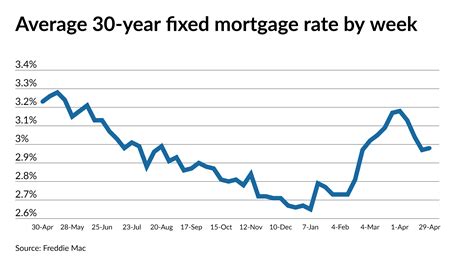

Economic Factors

Economic conditions play a significant role in shaping PMI rates. During periods of economic growth and stability, lenders may be more inclined to offer favorable PMI terms, as the risk of borrower default is perceived to be lower. Conversely, economic downturns or recessions can lead to increased risk perceptions, potentially resulting in higher PMI premiums.

Regulatory Changes

Regulatory bodies, such as the Federal Housing Finance Agency (FHFA) and the Consumer Financial Protection Bureau (CFPB), play a crucial role in shaping mortgage policies, including PMI requirements. Changes in regulations can directly impact the cost and availability of PMI. For instance, policy shifts that aim to increase homeownership accessibility may result in more lenient PMI requirements, benefiting prospective borrowers.

Market Competition

The competitive landscape among mortgage lenders can influence PMI rates. As lenders strive to attract borrowers, they may offer more competitive PMI pricing or unique mortgage insurance programs to set themselves apart from their competitors. Borrowers can benefit from this competition by comparing offers and choosing the lender that best suits their financial needs.

Technological Innovations

Advancements in technology are transforming the mortgage industry, including the way PMI is assessed and managed. Innovative tools and platforms are being developed to streamline the mortgage process, improve risk assessment, and enhance borrower experience. These technological advancements may lead to more efficient and accurate PMI calculations, potentially benefiting borrowers through reduced premiums.

Conclusion: Making Informed Decisions

Understanding property mortgage insurance rates is a crucial aspect of the homeownership journey. By comprehending the factors that influence PMI rates and implementing effective strategies, borrowers can make informed decisions that align with their financial goals. Whether it’s improving credit scores, making larger down payments, or exploring different mortgage options, each step towards a better understanding of PMI can lead to significant savings and a more positive homeownership experience.

As the mortgage industry continues to evolve, staying informed about the latest trends, regulations, and market dynamics is essential. By keeping a close eye on these factors and adapting to changing circumstances, borrowers can navigate the complexities of property mortgage insurance with confidence and make the most of their financial opportunities.

How long do I have to pay for PMI?

+The duration of PMI payments depends on the type of mortgage and your equity in the property. For conventional loans, PMI is typically canceled once you reach 20% equity. However, for FHA loans, PMI is often required for the life of the loan unless you refinance to a non-FHA loan.

Can I get a mortgage without PMI?

+Yes, there are mortgage programs, such as VA and USDA loans, that do not require PMI. These programs have specific eligibility criteria, so consult with a lender to determine if you qualify.

How can I reduce my PMI payments?

+To reduce PMI payments, you can focus on increasing your credit score and making a larger down payment. A higher credit score and a lower LTV ratio often result in lower PMI premiums. Additionally, consider refinancing your mortgage once you reach a certain equity threshold to potentially eliminate PMI.