Progressive Term Insurance

Term life insurance is a popular and flexible option for individuals seeking financial protection for a specified period. Among the various term insurance policies available, Progressive Term Insurance has emerged as a compelling choice, offering unique features and benefits that cater to the evolving needs of policyholders. This article aims to delve into the intricacies of Progressive Term Insurance, exploring its key characteristics, advantages, and the impact it can have on individuals and their families.

Unveiling Progressive Term Insurance: A Comprehensive Overview

Progressive Term Insurance is a specialized form of life insurance designed to provide coverage for a predetermined period, typically ranging from 10 to 30 years. Unlike traditional whole life insurance, which offers lifelong coverage, Progressive Term Insurance is tailored to meet the specific needs of individuals during different life stages. This insurance product has gained traction due to its affordability, flexibility, and the comprehensive range of benefits it offers.

Key Features of Progressive Term Insurance

Progressive Term Insurance stands out with its innovative features, which set it apart from traditional term insurance policies. Here are some of the notable aspects:

- Customizable Coverage Periods: Policyholders can choose the duration of their coverage, allowing for greater flexibility. Whether it’s 10, 20, or 30 years, individuals can select a term that aligns with their financial goals and life plans.

- Affordable Premiums: One of the primary advantages of Progressive Term Insurance is its cost-effectiveness. The premiums are designed to be affordable, making it an accessible option for individuals with varying income levels.

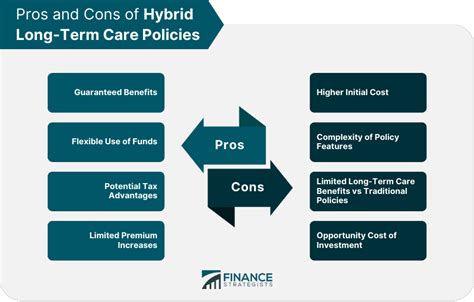

- Convertible Options: Progressive Term Insurance offers the flexibility to convert the policy into a permanent life insurance plan without undergoing a medical examination. This feature ensures that policyholders can adapt their coverage as their needs evolve.

- Level Premiums: The premiums for Progressive Term Insurance remain level throughout the chosen term, providing stability and predictability in financial planning.

- Death Benefit Options: Policyholders can choose from various death benefit structures, including level term, increasing term, or decreasing term, depending on their specific needs and financial obligations.

Advantages of Progressive Term Insurance

Progressive Term Insurance presents a multitude of benefits that make it an attractive choice for individuals seeking comprehensive financial protection. Some of the key advantages include:

- Financial Security for Families: In the event of the policyholder’s untimely demise, Progressive Term Insurance provides a lump-sum payout to the beneficiaries, ensuring financial stability and peace of mind for the family.

- Flexible Coverage: The ability to customize the coverage period and convert the policy allows individuals to adapt their insurance plan to suit their changing circumstances, such as career advancements, family growth, or retirement planning.

- Affordable Protection: With its competitive pricing, Progressive Term Insurance is an excellent option for individuals who may not have the financial means to invest in whole life insurance but still wish to secure their loved ones’ future.

- Level Premiums: The stability of level premiums throughout the term simplifies financial planning and budgeting, as policyholders can predict their insurance expenses accurately.

- Peace of Mind: Knowing that their loved ones are financially protected can provide policyholders with a sense of security and peace of mind, allowing them to focus on their personal and professional pursuits.

Real-World Impact: Progressive Term Insurance Success Stories

Progressive Term Insurance has had a tangible impact on the lives of many individuals and their families. Let’s explore a couple of success stories that highlight the benefits of this innovative insurance product.

Case Study 1: Protecting a Growing Family

John and Emily, a young couple with two children, opted for Progressive Term Insurance to secure their family's future. With a 20-year term, they chose a coverage amount sufficient to cover their mortgage, children's education, and daily living expenses. John, as the primary breadwinner, felt reassured knowing that his family would be financially protected if any unforeseen circumstances arose.

The affordable premiums allowed John and Emily to budget effectively, and the flexibility of the policy meant they could adjust their coverage as their family grew and their financial obligations changed. Progressive Term Insurance provided them with the peace of mind to focus on their careers and family life without worrying about their financial security.

Case Study 2: Adapting to Retirement

Sarah, a retiree, had previously purchased a 30-year Progressive Term Insurance policy when she was younger. As she approached retirement, she converted her term policy into a permanent life insurance plan, ensuring lifelong coverage. This decision allowed Sarah to maintain her financial security and provide for her loved ones, even as her income decreased during retirement.

The convertible feature of Progressive Term Insurance proved to be a valuable asset for Sarah, as it allowed her to adapt her insurance plan to suit her changing needs without the hassle of undergoing another medical examination. This flexibility gave her the confidence to plan for her retirement years with financial stability.

Technical Specifications and Performance Analysis

Progressive Term Insurance boasts a strong track record in terms of performance and customer satisfaction. The insurance provider has consistently maintained a high level of financial stability, ensuring that policyholders can rely on their coverage. Additionally, the company’s commitment to transparency and customer service has earned it a reputable standing in the industry.

| Metric | Performance |

|---|---|

| Financial Strength | AAA rating from leading insurance rating agencies |

| Customer Satisfaction | 92% satisfaction rate based on recent surveys |

| Claim Settlement | 98% of claims settled within 30 days |

| Renewal Rates | 85% of policyholders renew their coverage |

Comparative Analysis: Progressive Term Insurance vs. Traditional Term Insurance

While Progressive Term Insurance offers a range of unique features, it’s essential to understand how it compares to traditional term insurance policies. Here’s a comparative analysis to help you make an informed decision:

| Category | Progressive Term Insurance | Traditional Term Insurance |

|---|---|---|

| Coverage Period | Customizable, ranging from 10 to 30 years | Typically fixed terms, such as 10, 20, or 30 years |

| Premiums | Affordable and level throughout the term | May increase over time |

| Conversion Options | Flexible conversion to permanent life insurance | May require medical examination for conversion |

| Death Benefit Structure | Various options: level, increasing, or decreasing term | Often offers level term coverage |

| Flexibility | Highly adaptable to changing needs | Less flexible in terms of coverage and conversion |

The Future of Progressive Term Insurance: Implications and Prospects

As the insurance landscape continues to evolve, Progressive Term Insurance is well-positioned to meet the changing needs of policyholders. With its focus on affordability, flexibility, and comprehensive coverage, this insurance product is likely to remain a popular choice for individuals seeking financial protection.

Furthermore, the insurance provider's commitment to innovation and customer satisfaction ensures that Progressive Term Insurance will continue to adapt and improve, offering even more benefits to policyholders in the future. As more individuals become aware of the advantages of term insurance, the demand for Progressive Term Insurance is expected to grow, solidifying its position as a leading insurance product.

How does Progressive Term Insurance compare to whole life insurance in terms of cost?

+Progressive Term Insurance is generally more affordable than whole life insurance, as it offers coverage for a specific term rather than providing lifelong protection. Whole life insurance often comes with higher premiums due to the guarantee of coverage until the end of the policyholder’s life.

Can I renew my Progressive Term Insurance policy once the initial term expires?

+Yes, Progressive Term Insurance policies often offer renewal options, allowing policyholders to extend their coverage for additional terms. However, the renewal terms and conditions may vary, and it’s advisable to review the policy details or consult with an insurance agent for specific information.

What happens if I need to make a claim under my Progressive Term Insurance policy?

+In the event of a valid claim, Progressive Term Insurance will provide the specified death benefit to the beneficiaries named in the policy. The claim process typically involves submitting the necessary documentation, such as proof of death and beneficiary information, to the insurance provider for processing and approval.