Progressive Select Insurance

Progressive Select Insurance is a renowned brand in the insurance industry, known for its innovative approach and comprehensive coverage options. With a focus on providing personalized insurance solutions, Progressive Select has established itself as a trusted partner for individuals and businesses seeking reliable protection. In this comprehensive article, we will delve into the world of Progressive Select Insurance, exploring its offerings, success stories, and the reasons behind its widespread popularity.

The Progressive Select Advantage

Progressive Select Insurance stands out in the competitive insurance market with its unique value proposition. The company understands that every client has distinct needs, and thus, it offers a tailored approach to insurance coverage. By analyzing individual requirements and risk profiles, Progressive Select creates customized policies that provide the right level of protection without unnecessary expenses.

One of the key strengths of Progressive Select is its extensive product portfolio. From auto and home insurance to business coverage and specialty lines, the company caters to a wide range of insurance needs. This versatility allows clients to consolidate their insurance policies under one provider, simplifying the management of their risk management strategies.

Auto Insurance Excellence

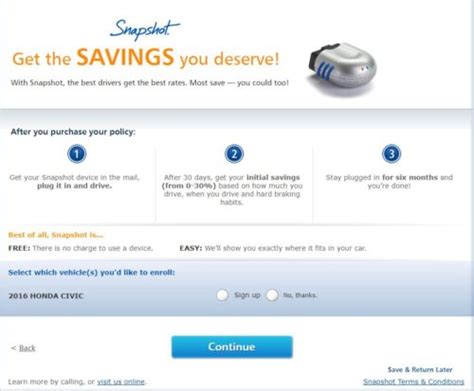

Progressive Select’s auto insurance offerings are particularly noteworthy. The company provides a comprehensive suite of coverage options, including liability, collision, comprehensive, and personal injury protection (PIP) insurance. What sets Progressive Select apart is its innovative approach to auto insurance, with features such as usage-based insurance (UBI) and accident forgiveness.

Usage-based insurance, also known as pay-as-you-drive (PAYD) or telematics insurance, is a cutting-edge concept that allows policyholders to customize their premiums based on their actual driving behavior. Progressive Select's UBI program uses advanced telematics technology to track driving habits, rewarding safe drivers with lower premiums. This approach not only promotes safer driving practices but also offers significant savings for responsible motorists.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Protects policyholders from claims arising from bodily injury or property damage caused by their vehicle. |

| Collision Coverage | Covers the cost of repairing or replacing the insured vehicle after an accident, regardless of fault. |

| Comprehensive Coverage | Provides protection against non-collision incidents such as theft, vandalism, natural disasters, and animal collisions. |

| Personal Injury Protection (PIP) | Offers medical coverage for the policyholder and passengers, regardless of fault, and can include lost wages and funeral expenses. |

Home Insurance Solutions

When it comes to protecting your home, Progressive Select offers a wide range of coverage options to suit different needs. From standard homeowners insurance to specialized policies for high-value homes or unique circumstances, the company ensures that your residence and its contents are adequately protected.

Progressive Select's home insurance policies typically include coverage for the structure of your home, personal belongings, liability protection, and additional living expenses in case of a covered loss. The company also offers optional endorsements and riders to customize your policy further, such as coverage for high-value items like jewelry or artwork.

| Coverage Type | Description |

|---|---|

| Dwelling Coverage | Protects the physical structure of your home against damage from covered perils, including fire, windstorms, and vandalism. |

| Personal Property Coverage | Covers your personal belongings, such as furniture, electronics, and clothing, in case of theft, damage, or loss. |

| Liability Coverage | Provides financial protection if you're sued for bodily injury or property damage caused to others. |

| Additional Living Expenses | Covers the cost of temporary housing and other necessary expenses if your home becomes uninhabitable due to a covered loss. |

Business Insurance Expertise

Progressive Select understands the unique risks faced by businesses, and its commercial insurance offerings are designed to provide comprehensive protection. Whether you own a small business or a large corporation, the company can tailor a policy to fit your specific needs.

Progressive Select's business insurance policies can include coverage for property damage, liability claims, business interruption, and cyber risks. The company also offers specialized coverage for unique business needs, such as professional liability insurance for consultants or product liability insurance for manufacturers.

| Coverage Type | Description |

|---|---|

| Commercial Property Insurance | Protects your business's physical assets, including buildings, equipment, and inventory, against damage or loss. |

| General Liability Insurance | Provides coverage for bodily injury, property damage, and personal and advertising injury claims arising from your business operations. |

| Business Interruption Insurance | Offers financial protection in case your business is forced to shut down due to a covered loss, covering lost income and ongoing expenses. |

| Professional Liability Insurance | Covers claims of negligence, errors, or omissions in the services provided by your business, protecting your reputation and finances. |

The Progressive Select Experience

At Progressive Select Insurance, the client experience is a top priority. The company’s commitment to delivering exceptional service is evident in its dedicated customer support teams, user-friendly online platforms, and seamless claim processes.

Personalized Customer Service

Progressive Select recognizes that insurance can be complex, and its knowledgeable agents are available to guide clients through the process. Whether you’re seeking a new policy, making changes to an existing one, or filing a claim, the company’s customer service representatives are trained to provide clear and concise information, ensuring a positive and stress-free experience.

Digital Convenience

In today’s fast-paced world, convenience is key. Progressive Select understands this and has invested in cutting-edge technology to enhance the client experience. Its online platform allows policyholders to manage their insurance needs from the comfort of their homes or on the go. From quoting and purchasing policies to making payments and accessing policy documents, the digital tools offered by Progressive Select provide unparalleled convenience.

Streamlined Claims Process

When the unexpected occurs, Progressive Select is dedicated to making the claims process as smooth as possible. The company’s efficient claims handling team works diligently to assess and settle claims promptly. Policyholders can initiate claims online, via phone, or through the Progressive Select mobile app, ensuring quick and convenient access to the support they need during challenging times.

Why Choose Progressive Select Insurance

Progressive Select Insurance has earned its reputation as a leading insurance provider for several compelling reasons.

Customized Coverage

The ability to tailor insurance policies to individual needs is a key differentiator for Progressive Select. By analyzing each client’s unique circumstances, the company ensures that the coverage provided is both comprehensive and cost-effective.

Innovative Solutions

Progressive Select is at the forefront of insurance innovation. Its usage-based insurance program, accident forgiveness, and digital platforms are just a few examples of how the company stays ahead of the curve, offering clients cutting-edge solutions that enhance their insurance experience.

Excellent Customer Service

The dedication to exceptional customer service is evident in every interaction with Progressive Select. From knowledgeable agents to efficient claims handling, the company goes the extra mile to ensure client satisfaction.

Financial Strength and Stability

Progressive Select is backed by the financial strength and stability of the Progressive Corporation, one of the largest and most respected insurance companies in the United States. This financial backing provides policyholders with the assurance that their insurance needs are being met by a trusted and reliable partner.

Conclusion

Progressive Select Insurance has established itself as a leader in the insurance industry through its commitment to personalized coverage, innovation, and exceptional customer service. With a wide range of insurance products, digital convenience, and a streamlined claims process, Progressive Select offers a comprehensive and reliable insurance experience. Whether you’re an individual, a business owner, or a family seeking peace of mind, Progressive Select is a trusted partner in managing your insurance needs.

How does Progressive Select’s usage-based insurance work, and what are the benefits for policyholders?

+Progressive Select’s usage-based insurance, or UBI, utilizes telematics technology to track driving behavior. Policyholders install a small device or use a mobile app to monitor their driving habits, including speed, braking, and mileage. Based on this data, safe drivers can qualify for lower premiums, promoting safer driving and providing financial incentives. UBI offers a more accurate assessment of individual risk, allowing responsible drivers to save on their insurance costs.

What sets Progressive Select’s home insurance policies apart from other providers?

+Progressive Select’s home insurance policies are distinguished by their flexibility and customization options. Policyholders can choose from a range of coverage limits and deductibles to suit their needs and budget. Additionally, Progressive Select offers specialized endorsements for high-value items, water backup coverage, and identity theft protection, ensuring that your home and its contents are comprehensively protected.

How does Progressive Select ensure efficient and fair claims handling for its policyholders?

+Progressive Select is dedicated to providing a seamless claims experience. The company’s claims team is highly trained and utilizes advanced technology to streamline the process. Policyholders can initiate claims online or via phone, and the company’s app offers convenient tools for uploading photos and documents. Progressive Select’s commitment to fair and timely claims handling ensures that policyholders receive the support they need when it matters most.