Progressive Insurance Policy

Welcome to an in-depth exploration of the Progressive Insurance Policy, a prominent player in the insurance industry. With its innovative approach and comprehensive coverage options, Progressive has solidified its position as a trusted provider. This article delves into the intricacies of Progressive's insurance policies, offering a detailed analysis of their offerings, benefits, and impact on the market.

Unveiling Progressive’s Insurance Policy Portfolio

Progressive Insurance, a powerhouse in the industry, boasts an extensive range of insurance policies tailored to meet diverse needs. From auto insurance to homeowners’ coverage, Progressive has established itself as a go-to provider, offering unparalleled flexibility and customization.

Auto Insurance: A Comprehensive Approach

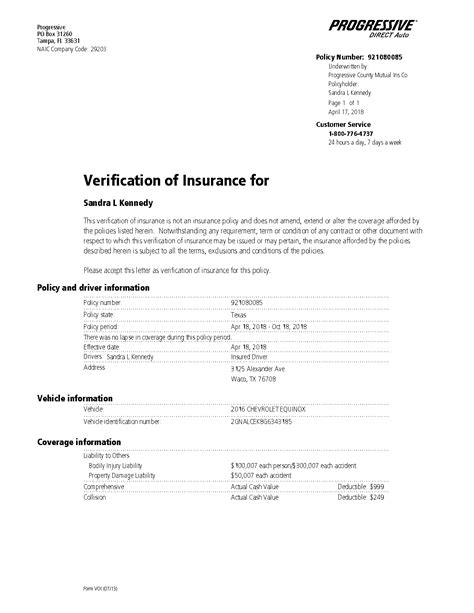

Progressive’s auto insurance policy is a cornerstone of their success. With a focus on personalized coverage, they offer a wide array of options, including:

- Liability Coverage: Protecting policyholders against bodily injury and property damage claims, Progressive’s liability coverage is a fundamental component of their auto insurance.

- Collision and Comprehensive Coverage: These options provide protection against damages caused by accidents or unforeseen events, ensuring peace of mind for drivers.

- Medical Payments Coverage: Progressive’s medical payments coverage offers financial support for medical expenses incurred in an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This crucial coverage safeguards policyholders in the event of an accident with a driver who lacks sufficient insurance.

- Roadside Assistance and Towing: Progressive’s auto insurance policies often include roadside assistance, providing valuable support in emergency situations.

| Coverage Type | Description |

|---|---|

| Liability | Bodily injury and property damage liability protection. |

| Collision | Covers damages to the insured vehicle in an accident. |

| Comprehensive | Protects against non-collision incidents like theft or natural disasters. |

| Medical Payments | Assists with medical expenses after an accident. |

| Uninsured/Underinsured Motorist | Provides coverage when involved in an accident with an uninsured or underinsured driver. |

Homeowners’ Insurance: Protecting Your Haven

Progressive’s homeowners’ insurance policies are designed to safeguard policyholders’ residences and belongings. Their comprehensive coverage includes:

- Dwelling Coverage: Protecting the physical structure of the home against damage or destruction.

- Personal Property Coverage: Providing financial support for the replacement or repair of personal belongings.

- Liability Protection: Covering legal expenses and claims arising from accidents or injuries on the insured property.

- Additional Living Expenses: Progressive’s policies often include coverage for additional living expenses if the home becomes uninhabitable due to an insured event.

- Personal Injury Coverage: This option protects policyholders against certain personal injury claims, such as libel or slander.

| Coverage Type | Description |

|---|---|

| Dwelling | Covers the physical structure of the home. |

| Personal Property | Protects personal belongings inside the home. |

| Liability | Provides coverage for legal expenses and claims. |

| Additional Living Expenses | Assists with temporary living expenses if the home is uninhabitable. |

| Personal Injury | Protects against personal injury claims. |

Progressive’s Insurance Policy: Key Features and Benefits

Progressive’s insurance policies stand out in the market with their unique features and advantages. Here’s a closer look at some of their standout offerings:

Snapshot Program: Personalized Pricing

Progressive’s Snapshot program is a game-changer in auto insurance. By installing a small device in the vehicle, policyholders can track their driving habits, with safer driving potentially leading to discounts on insurance premiums. This innovative approach to pricing encourages safer driving practices and offers a more personalized insurance experience.

Usage-Based Insurance (UBI): Tailored Coverage

Progressive’s UBI program extends beyond the Snapshot device. It allows policyholders to opt for a pay-as-you-drive insurance model, where premiums are calculated based on actual mileage. This flexible pricing structure is especially beneficial for low-mileage drivers, offering them a more cost-effective insurance option.

HomeQuote Explorer: Streamlined Home Insurance

For homeowners, Progressive’s HomeQuote Explorer tool simplifies the insurance process. Policyholders can quickly and easily obtain quotes for homeowners’ insurance, with the option to customize coverage based on their specific needs. This efficient and user-friendly approach has made Progressive a preferred choice for many homeowners.

Customer-Centric Claims Process

Progressive’s claims process is designed with the customer’s experience in mind. With a dedicated claims team and a focus on timely resolution, Progressive ensures that policyholders receive the support they need during challenging times. Their digital claims tools further enhance the efficiency of the claims process, making it more accessible and convenient.

Progressive’s Impact on the Insurance Industry

Progressive Insurance’s innovative approach and comprehensive coverage options have had a significant impact on the insurance industry. Their focus on customer-centric policies and technology-driven solutions has set a new standard for insurance providers.

Industry Leadership and Recognition

Progressive’s commitment to innovation and customer satisfaction has earned them numerous accolades. They are consistently recognized as a top insurance provider, with awards and rankings highlighting their market leadership and customer satisfaction ratings.

Driving Industry Trends

Progressive’s influence extends beyond their own success. Their focus on technology and data-driven decision-making has inspired other insurance providers to adopt similar strategies. The introduction of usage-based insurance and personalized pricing models has become a growing trend, with many companies following Progressive’s lead.

Empowering Policyholders

Progressive’s insurance policies have empowered policyholders by offering greater control over their insurance experience. Through programs like Snapshot and UBI, policyholders can actively influence their insurance premiums, fostering a sense of agency and engagement.

Progressive’s Future Outlook

As the insurance landscape continues to evolve, Progressive is well-positioned to maintain its market leadership. With a commitment to innovation and a customer-centric approach, Progressive is likely to continue shaping the industry with its forward-thinking strategies.

Technological Advancements

Progressive is at the forefront of insurance technology, continuously investing in cutting-edge solutions. From AI-powered claims processing to advanced data analytics, Progressive’s technological advancements are poised to enhance their operations and customer experience.

Expanding Coverage Options

Progressive’s portfolio of insurance policies is already extensive, but they show no signs of slowing down. With a focus on meeting diverse needs, Progressive is likely to expand their coverage options further, ensuring they remain a top choice for a wide range of policyholders.

Enhanced Customer Experience

Progressive’s dedication to customer satisfaction is a key differentiator. They continue to refine their processes, streamlining claims handling and enhancing customer support to provide an exceptional insurance experience.

Conclusion

Progressive Insurance’s policies have revolutionized the insurance industry with their innovative approaches and comprehensive coverage. From auto insurance to homeowners’ protection, Progressive’s commitment to customer satisfaction and technological advancement has solidified their position as a market leader. As they continue to innovate and adapt, Progressive is poised to remain a trusted provider, offering policyholders peace of mind and unparalleled service.

How does Progressive’s Snapshot program work?

+Progressive’s Snapshot program uses a small device installed in your vehicle to track driving habits. Based on these habits, including mileage and driving behavior, policyholders can receive discounts on their auto insurance premiums. This program encourages safer driving and offers a more personalized insurance experience.

What is Usage-Based Insurance (UBI) and how does it benefit policyholders?

+UBI is an insurance model where premiums are calculated based on actual vehicle usage. With Progressive’s UBI program, policyholders can opt for a pay-as-you-drive insurance plan, making it more affordable for low-mileage drivers. This flexible pricing structure allows policyholders to pay premiums that reflect their individual driving habits.

How does Progressive’s HomeQuote Explorer tool simplify the homeowners’ insurance process?

+Progressive’s HomeQuote Explorer is an online tool that allows homeowners to quickly obtain quotes for homeowners’ insurance. It provides an efficient and user-friendly way to compare coverage options and customize policies based on specific needs. This streamlined process has made Progressive a preferred choice for many homeowners seeking convenient and personalized insurance.