Progressive Drivers Insurance

In the dynamic landscape of the insurance industry, Progressive Drivers Insurance has emerged as a prominent player, revolutionizing the way motorists protect their vehicles and themselves. With a rich history spanning over four decades, Progressive has consistently delivered innovative solutions tailored to the evolving needs of drivers. This article delves into the intricacies of Progressive's offerings, exploring its comprehensive policies, cutting-edge technologies, and unparalleled customer experiences.

A Legacy of Innovation: Progressive’s Journey

Founded in 1937 by Jack Green, Progressive Insurance began its journey with a visionary approach, challenging the traditional norms of the insurance sector. Over the years, Progressive has cultivated a reputation for its commitment to customer satisfaction and its relentless pursuit of technological advancements. The company’s journey is marked by several milestones, each contributing to its status as a leader in the industry.

The Early Years: A Pioneer’s Rise

Progressive’s inception can be traced back to the Great Depression, a period when the insurance industry was in dire need of reform. Jack Green, recognizing the challenges faced by drivers, envisioned a company that would offer affordable and accessible insurance policies. Progressive’s early success was built on the principles of simplicity, transparency, and customer-centricity.

One of Progressive’s groundbreaking initiatives during this period was the introduction of the Drive-In Claims Service. This innovative concept allowed policyholders to make claims directly at Progressive’s offices, a significant departure from the traditional paperwork-intensive process. The Drive-In Claims Service not only streamlined the claims process but also enhanced customer satisfaction by providing a more personalized experience.

Expanding Horizons: The 1970s and Beyond

As the 1970s approached, Progressive was well-positioned to capitalize on the changing dynamics of the insurance market. The company expanded its reach, offering policies in multiple states, and began to explore new avenues of customer engagement. This era witnessed the birth of several landmark initiatives, solidifying Progressive’s position as an industry trailblazer.

A notable development during this time was the launch of the Snapshot Program, a pioneering concept that utilized telematics technology to personalize insurance rates based on individual driving behaviors. This program, which remains a cornerstone of Progressive’s offerings, revolutionized the way insurance premiums were calculated, introducing a fairer and more data-driven approach.

The Comprehensive Progressive Policy

Progressive Drivers Insurance is renowned for its comprehensive insurance policies, meticulously designed to cater to the diverse needs of motorists. These policies go beyond the basic requirements, offering a range of coverage options that provide extensive protection and peace of mind.

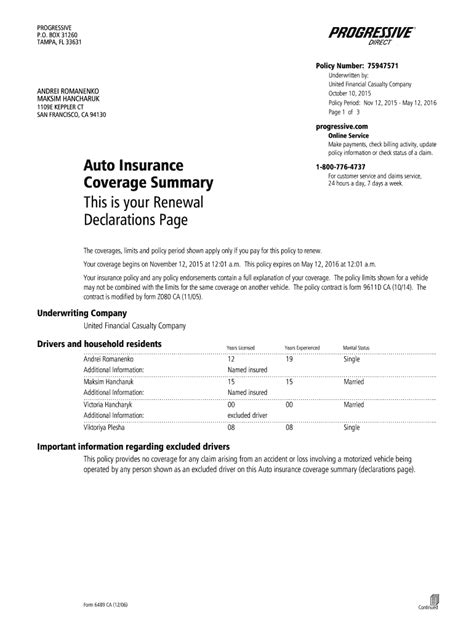

Auto Insurance: Tailored Coverage

Progressive’s auto insurance policies are customizable, allowing drivers to choose the coverage that best suits their requirements. From liability coverage, which protects against bodily injury and property damage claims, to comprehensive and collision coverage, which safeguards against a wide array of perils, Progressive ensures that every policyholder can find the right fit.

A unique feature of Progressive’s auto insurance is the Customizable Deductibles option. Policyholders can select deductibles that align with their budget and risk tolerance, providing a level of flexibility not commonly found in the industry.

Additional Coverage Options

Beyond the standard auto insurance, Progressive offers a range of additional coverage options to enhance protection. These include:

- Rental Car Reimbursement: Covers the cost of renting a vehicle while your car is being repaired after an insured incident.

- Roadside Assistance: Provides emergency services such as towing, battery jumps, and flat tire changes.

- Medical Payments Coverage: Assists with medical expenses for injuries sustained in an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who has little or no insurance.

Technology at the Forefront: Progressive’s Digital Advantage

Progressive Drivers Insurance has embraced technology as a cornerstone of its operations, leveraging digital innovations to enhance customer experiences and streamline processes. This commitment to technological excellence has positioned Progressive as a leader in the digital insurance space.

The Power of Telematics: Snapshot

Progressive’s Snapshot Program, as mentioned earlier, is a testament to the company’s innovative spirit. This program utilizes telematics technology, a combination of telecommunications and informatics, to analyze driving behaviors and provide personalized insurance rates. Snapshot devices are installed in policyholders’ vehicles, collecting data on driving habits such as speed, braking, and time of day.

The data collected by Snapshot is used to calculate insurance premiums, rewarding safe drivers with lower rates. This pay-as-you-drive approach has not only incentivized safer driving practices but has also made insurance more affordable and accessible. Progressive’s Snapshot program has been a game-changer, attracting a new generation of tech-savvy motorists.

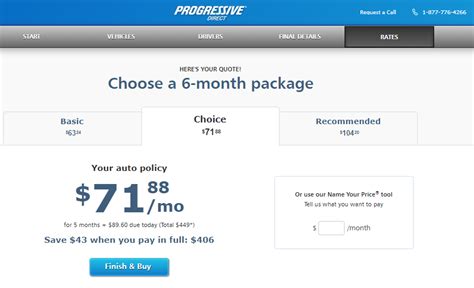

Digital Convenience: Progressive’s Online Platform

Progressive’s online platform is a one-stop destination for policyholders, offering a seamless and convenient experience. Customers can manage their policies, make payments, and access a wealth of resources and tools from the comfort of their homes. The platform’s user-friendly interface ensures that tasks such as policy updates, claim submissions, and quote comparisons are effortless.

Additionally, Progressive’s mobile app extends these conveniences to the fingertips of policyholders, allowing them to access their policies and receive real-time updates on the go. The app’s Roadside Assistance feature provides immediate assistance in emergency situations, further enhancing the overall customer experience.

Unparalleled Customer Experience: Progressive’s Promise

At the heart of Progressive’s success is its unwavering commitment to delivering an unparalleled customer experience. The company’s approach to customer service is characterized by its focus on empathy, responsiveness, and innovation.

24⁄7 Customer Support: Always There When You Need It

Progressive understands that emergencies and queries can arise at any time. To cater to this need, the company offers a dedicated 24⁄7 customer support service. Whether it’s a late-night claim or a simple policy-related question, Progressive’s team of experts is always ready to assist, ensuring that policyholders never feel alone in their time of need.

The 24⁄7 support service is not just a reactive measure but also a proactive one. Progressive utilizes advanced analytics to anticipate customer needs, providing tailored solutions before issues escalate. This proactive approach has not only enhanced customer satisfaction but has also reduced the need for costly interventions.

Progressive Claims: A Seamless Process

The claims process is often a stressful experience for policyholders. Progressive, however, has streamlined this process, making it as seamless and stress-free as possible. From the initial claim submission to the final settlement, Progressive’s claims team works diligently to ensure a swift and fair resolution.

One of the key features of Progressive’s claims process is the use of advanced technology. The company leverages artificial intelligence and machine learning to expedite claim assessments, reducing the time taken to process claims. This technology, combined with the expertise of Progressive’s claims adjusters, ensures that policyholders receive fair and timely settlements.

Looking Ahead: Progressive’s Future Outlook

As the insurance industry continues to evolve, Progressive Drivers Insurance remains at the forefront, poised to embrace new challenges and opportunities. The company’s future outlook is characterized by a continued focus on innovation, customer-centricity, and technological advancements.

Expanding Horizons: New Markets, New Products

Progressive has set its sights on expanding its presence in new markets, both domestically and internationally. The company’s global ambitions are driven by its desire to bring its innovative insurance solutions to a wider audience. Additionally, Progressive is exploring new product offerings, including specialized policies for electric vehicles and autonomous cars, to cater to the evolving needs of motorists.

Sustainability and Social Responsibility

Progressive recognizes its role as a responsible corporate citizen and is committed to integrating sustainability and social responsibility into its operations. The company is actively working towards reducing its environmental footprint, adopting eco-friendly practices, and supporting initiatives that promote sustainability in the insurance sector.

Furthermore, Progressive is dedicated to fostering a diverse and inclusive workplace culture. The company’s commitment to diversity and inclusion extends beyond its internal operations, influencing its approach to customer engagement and community involvement.

The Role of AI and Machine Learning

Artificial intelligence and machine learning will continue to play a pivotal role in Progressive’s future. The company is investing in advanced analytics and predictive modeling to enhance its risk assessment capabilities and improve the accuracy of insurance pricing. Additionally, AI-powered chatbots and virtual assistants are being developed to further streamline customer interactions and provide instant support.

Collaborative Partnerships: Strengthening the Ecosystem

Progressive is committed to fostering collaborative partnerships with industry peers, startups, and technology companies. These partnerships aim to drive innovation, share best practices, and create a more robust and efficient insurance ecosystem. By working together, Progressive and its partners can deliver even more innovative solutions to meet the evolving needs of motorists.

Progressive Drivers Insurance: A Journey of Trust and Innovation

In its rich history, Progressive Drivers Insurance has demonstrated an unwavering commitment to innovation, customer satisfaction, and technological excellence. From its humble beginnings to its current status as an industry leader, Progressive has consistently delivered on its promise of providing comprehensive and affordable insurance solutions.

As the company looks to the future, its journey is guided by a vision of continued growth, sustainability, and social responsibility. Progressive’s commitment to embracing new technologies, expanding its reach, and fostering collaborative partnerships ensures that it remains at the forefront of the insurance industry. With its innovative spirit and customer-centric approach, Progressive is poised to continue delivering unparalleled experiences to motorists worldwide.

How can I get a Progressive insurance quote?

+Getting a Progressive insurance quote is easy and can be done online, over the phone, or through an independent insurance agent. Visit Progressive’s website, provide your basic information, and answer a few questions about your driving history and the vehicles you wish to insure. You’ll receive a personalized quote based on your unique circumstances.

What makes Progressive’s insurance policies unique?

+Progressive’s insurance policies stand out for their customization options and innovative features. The Snapshot program, for instance, uses telematics to offer personalized rates based on your driving behavior. Additionally, Progressive offers a wide range of coverage options, allowing you to tailor your policy to your specific needs.

Does Progressive provide discounts on insurance premiums?

+Yes, Progressive offers a variety of discounts to help lower your insurance premiums. These include discounts for safe driving, multiple policies, and certain vehicle safety features. The Snapshot program can also lead to significant discounts based on your driving habits.

How does Progressive handle insurance claims?

+Progressive has a dedicated claims team that works to provide a seamless and stress-free claims process. You can report a claim online, over the phone, or through the Progressive app. The company uses advanced technology, including AI, to expedite claim assessments and provide fair and timely settlements.

What are some of Progressive’s initiatives for sustainability and social responsibility?

+Progressive is committed to sustainability and social responsibility. Some of its initiatives include reducing its environmental footprint through energy-efficient operations, supporting local communities through charitable donations and volunteerism, and promoting diversity and inclusion within the company and the insurance industry.