Professional Insurance

Navigating the Complex World of Professional Insurance: A Comprehensive Guide

In the intricate landscape of professional services, insurance serves as a vital safeguard, protecting businesses and individuals from unforeseen risks. This guide aims to delve into the nuances of professional insurance, providing an in-depth understanding of its significance, types, and implications. By exploring real-world scenarios and industry insights, we will empower readers to make informed decisions regarding their insurance needs, ensuring comprehensive coverage and peace of mind.

Understanding the Need for Professional Insurance

Professional insurance, a cornerstone of risk management, is designed to safeguard businesses and individuals against a myriad of potential liabilities and losses. The unique nature of professional services often involves a degree of complexity and risk that necessitates specialized insurance coverage. From consultants and financial advisors to medical practitioners and legal professionals, the need for tailored insurance solutions is paramount.

The primary purpose of professional insurance is to provide financial protection against claims arising from errors, omissions, or negligent acts in the course of professional duties. These claims can stem from a variety of sources, including clients, customers, or even regulatory bodies. In an increasingly litigious world, the potential for such claims is ever-present, making insurance an essential tool for risk mitigation.

Consider the case of a financial advisor who, due to an oversight, provides erroneous investment advice to a client. The client, having suffered significant financial losses, may initiate legal proceedings against the advisor. Without adequate professional liability insurance, the advisor could face not only the financial burden of compensating the client but also the legal costs associated with defending themselves. This scenario underscores the critical role of insurance in protecting professionals from both financial and reputational harm.

Types of Professional Insurance and Their Coverage

The realm of professional insurance is diverse, offering a range of policies tailored to specific professions and industries. Understanding the nuances of these policies is crucial for ensuring adequate coverage.

Professional Liability Insurance (Errors and Omissions)

Professional liability insurance, often referred to as "errors and omissions" (E&O) insurance, is a cornerstone of protection for professionals. It provides coverage for claims arising from mistakes, oversights, or negligent acts in the course of providing professional services. This type of insurance is particularly crucial for industries where the provision of advice or services carries inherent risks, such as legal, financial, and medical professions.

For instance, a legal professional may face a claim for malpractice if their advice results in detrimental consequences for a client. In such cases, professional liability insurance can provide the necessary financial support to cover damages and legal costs. It serves as a vital safety net, allowing professionals to focus on their work without the constant worry of potential liabilities.

| Professional Liability Insurance Coverage | Key Benefits |

|---|---|

| Defense Costs | Covers legal fees and expenses related to defending against claims. |

| Damages | Provides financial protection for compensatory damages awarded to claimants. |

| Reputation Protection | Helps mitigate the impact of negative publicity and potential loss of business. |

Business Owners Policy (BOP)

A Business Owners Policy (BOP) is a comprehensive insurance package designed specifically for small to medium-sized businesses. It combines various coverages, including property insurance, general liability insurance, and business interruption insurance, into a single policy. This streamlined approach offers cost-effectiveness and convenience, making it an attractive option for many businesses.

For instance, a small consulting firm might opt for a BOP to cover its physical assets (property insurance), protect against lawsuits (general liability insurance), and ensure continuity in the event of an interruption (business interruption insurance). By consolidating these essential coverages, the firm can focus on its core operations with the reassurance of comprehensive protection.

Workers' Compensation Insurance

Workers' compensation insurance is a statutory requirement for most businesses with employees. It provides coverage for employees who suffer work-related injuries or illnesses, offering medical benefits and wage replacement. This type of insurance is a vital component of employee protection, ensuring that injured workers receive the necessary care and financial support.

Consider a construction company that employs dozens of workers on various projects. In the event of an on-site accident, workers' compensation insurance would cover the medical expenses and a portion of the lost wages for the injured employee. This not only ensures the well-being of the worker but also protects the company from potential lawsuits and financial liabilities.

The Process of Obtaining Professional Insurance

Navigating the process of obtaining professional insurance can be complex, but with the right approach and guidance, it becomes more manageable. Here's a step-by-step guide to help professionals and businesses secure the coverage they need.

Assessing Your Risks and Needs

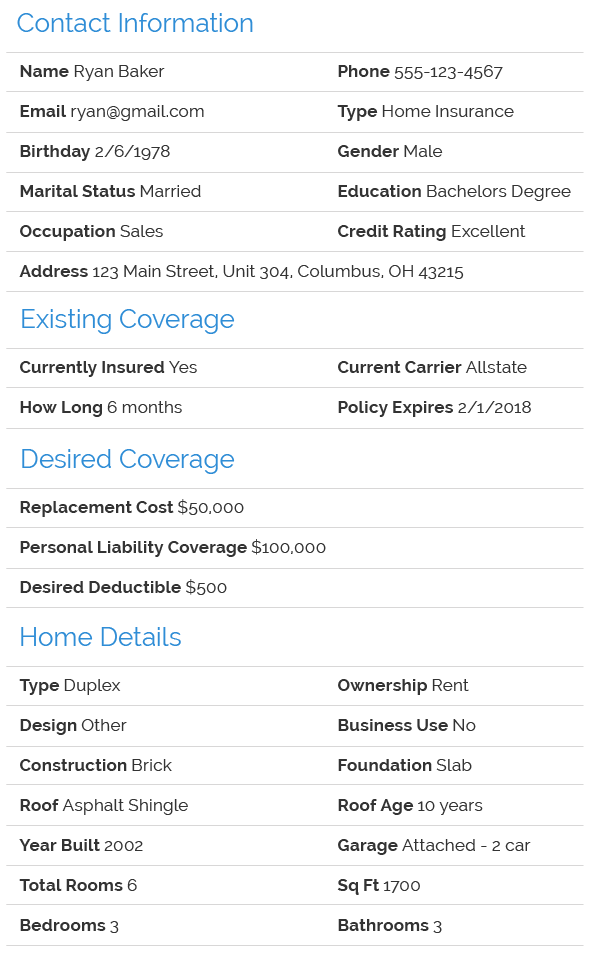

The first step in obtaining professional insurance is to conduct a thorough risk assessment. Identify the potential liabilities and risks associated with your profession or business. Consider factors such as the nature of your work, the industry you operate in, and any unique circumstances that could lead to claims or losses. This self-evaluation is crucial for determining the type and extent of insurance coverage required.

For instance, a medical practitioner should consider the potential for medical malpractice claims, while a technology startup might focus on the risks associated with data breaches or intellectual property disputes. By understanding these risks, professionals can tailor their insurance coverage to address specific vulnerabilities.

Researching Insurance Providers and Policies

Once you have a clear understanding of your insurance needs, it's time to research potential providers and policies. Explore the market to find reputable insurance companies that specialize in your industry or profession. Look for insurers with a strong track record, financial stability, and a comprehensive range of policy options. Compare different policies, considering factors such as coverage limits, deductibles, and any additional benefits or exclusions.

Online resources, industry publications, and professional associations can be valuable sources of information during this research phase. You might also consider seeking recommendations from colleagues or peers who have had positive experiences with specific insurers.

Obtaining Quotes and Selecting a Policy

After shortlisting potential insurers, the next step is to obtain quotes for the policies that align with your needs. Contact the insurers directly or work with an insurance broker who can provide multiple quotes from different providers. Compare the quotes based on coverage, premiums, and any additional perks or services offered. Ensure that the policy limits are adequate to cover potential claims and that the deductible is manageable for your business or professional practice.

It's essential to review the policy documents thoroughly, paying close attention to the fine print. Understand the exclusions and limitations outlined in the policy to ensure that you are fully aware of what is and isn't covered. If you have any questions or concerns, don't hesitate to reach out to the insurer or your broker for clarification.

Finalizing the Policy and Ongoing Management

Once you've selected the most suitable policy, it's time to finalize the agreement. Sign the necessary documents and ensure that you understand the terms and conditions. Keep a copy of the policy for your records, and consider sharing it with relevant stakeholders, such as business partners or clients, to demonstrate your commitment to risk management.

Professional insurance is not a one-time transaction; it requires ongoing management to ensure that your coverage remains adequate and up-to-date. Regularly review your policy, especially after significant changes in your business or professional practice. Stay informed about any changes in regulations or industry standards that could impact your insurance needs. Consider seeking periodic policy reviews from your insurer or broker to ensure that your coverage remains aligned with your evolving requirements.

Real-World Scenarios and Industry Insights

To illustrate the practical implications of professional insurance, let's explore a few real-world scenarios and draw insights from industry experts.

Scenario: A Legal Firm's Malpractice Claim

A prominent legal firm specializing in corporate law faces a malpractice claim from a major client. The client alleges that the firm's negligence in drafting a critical contract led to significant financial losses. The case goes to court, resulting in a substantial award for the client. Without adequate professional liability insurance, the firm would have faced a financial crisis, potentially jeopardizing its reputation and future operations.

Industry Insight: Legal professionals should prioritize professional liability insurance to protect against such high-stakes claims. Policies with generous coverage limits and robust defense provisions are essential to mitigate the financial and reputational risks associated with malpractice allegations.

Scenario: A Construction Company's Workplace Accident

A construction company experiences a serious accident on one of its job sites. An employee sustains severe injuries, leading to extensive medical treatment and a lengthy recovery period. The company's workers' compensation insurance steps in to cover the medical expenses and provide wage replacement during the employee's absence. This insurance not only supports the injured worker but also protects the company from potential lawsuits and financial strain.

Industry Insight: Construction and other high-risk industries must prioritize workers' compensation insurance. By ensuring adequate coverage, companies can demonstrate their commitment to employee welfare and mitigate the financial impact of workplace accidents, which can be costly and disruptive.

Scenario: A Small Business's Cyber Attack

A small online retail business falls victim to a cyber attack, resulting in a data breach that compromises customer information. The business faces not only the immediate costs of resolving the breach but also potential lawsuits from affected customers and regulatory fines. With comprehensive cyber liability insurance, the business can access the necessary resources to manage the crisis, recover data, and address legal and regulatory consequences.

Industry Insight: In an era of increasing cyber threats, small businesses should not underestimate the need for cyber liability insurance. Policies that cover data breaches, business interruption, and legal expenses can provide crucial support during times of crisis, helping businesses navigate the complex landscape of cyber security and privacy regulations.

Future Implications and Emerging Trends

As the professional services landscape continues to evolve, so too do the risks and challenges faced by businesses and individuals. Staying ahead of these changes is crucial for effective risk management and insurance planning.

The Rise of Cyber Threats

With the increasing reliance on digital technologies and online platforms, cyber threats have become a significant concern for professionals and businesses across industries. From data breaches to ransomware attacks, the potential for financial and reputational harm is ever-present. As such, cyber liability insurance is emerging as a critical component of risk management strategies.

Industry experts predict that the demand for comprehensive cyber insurance policies will continue to rise. These policies should not only cover the financial losses associated with cyber attacks but also provide resources for crisis management, data recovery, and compliance with regulatory requirements. Businesses and professionals should stay abreast of the latest cyber security best practices and ensure that their insurance coverage aligns with these evolving threats.

The Impact of Remote Work and Digital Transformation

The COVID-19 pandemic has accelerated the trend towards remote work and digital transformation. While these changes offer numerous benefits, they also introduce new risks and challenges. From cybersecurity concerns to the increased potential for professional errors and omissions, professionals and businesses must adapt their insurance strategies accordingly.

For instance, professionals working remotely may face higher risks of data breaches or privacy violations due to the use of personal devices and unsecured networks. As such, policies that provide coverage for remote work-related liabilities, such as professional liability insurance with remote work endorsements, are becoming increasingly important. Similarly, businesses undergoing digital transformation should consider the unique risks associated with new technologies and ensure that their insurance coverage is suitably adapted.

The Role of Artificial Intelligence and Automation

The integration of artificial intelligence (AI) and automation into various industries is transforming the way professionals work. While these technologies offer efficiency gains and new opportunities, they also introduce unique risks. From algorithmic errors to the potential for AI-related accidents, professionals and businesses must be prepared to address these emerging challenges.

Industry experts suggest that insurance policies will need to evolve to address the specific risks associated with AI and automation. This could involve the development of new coverage options, such as AI liability insurance, which provides protection against claims arising from the use of AI technologies. Additionally, professionals and businesses should stay informed about the latest developments in AI ethics and regulation to ensure that their insurance coverage remains aligned with these evolving standards.

Conclusion: Navigating the Future of Professional Insurance

In an ever-changing professional landscape, insurance remains a cornerstone of risk management. By understanding the diverse types of professional insurance, from liability coverage to workers' compensation, businesses and individuals can protect themselves against a wide range of potential liabilities and losses. As we look to the future, emerging trends such as cyber threats, remote work, and AI integration highlight the need for continuous adaptation and innovation in insurance strategies.

As professionals and businesses navigate the complexities of their respective industries, the importance of comprehensive insurance coverage cannot be overstated. With the right insurance in place, they can focus on their core missions and objectives with the confidence that they are protected against the unexpected. Whether it's a malpractice claim, a workplace accident, or a cyber attack, professional insurance provides the financial and operational support needed to weather these storms and emerge resilient.

In conclusion, professional insurance is not just a legal requirement or a financial safeguard; it is a strategic tool for managing risk and ensuring the long-term success and sustainability of businesses and professionals alike. By staying informed, adapting to changing risks, and working with reputable insurance providers, individuals and businesses can navigate the future of professional insurance with confidence and peace of mind.

What is the difference between professional liability insurance and general liability insurance?

+Professional liability insurance, also known as errors and omissions (E&O) insurance, is designed to protect professionals against claims arising from their specific services or advice. It covers errors, omissions, and negligent acts in the course of providing professional services. General liability insurance, on the other hand, provides broader coverage for a variety of common risks, such as bodily injury, property damage, and advertising injuries. While general liability insurance is more comprehensive, professional liability insurance is tailored to the unique risks faced by professionals in their specific fields.

How much does professional liability insurance typically cost?

+The cost of professional liability insurance can vary widely depending on factors such as the profession, the level of coverage needed, and the insurer. For example, a solo consultant might pay a few hundred dollars per year for basic coverage, while a large law firm might pay tens of thousands of dollars annually for comprehensive protection. It’s important to shop around and compare quotes from multiple insurers to find the best coverage at a competitive price.

What should I look for when choosing a professional liability insurance provider?

+When selecting a professional liability insurance provider, it’s crucial to consider their reputation, financial stability, and specialization in your industry. Look for insurers with a strong track record of handling claims efficiently and fairly. Additionally, consider the insurer’s customer service, policy features, and any additional benefits or resources they offer, such as risk management tools or resources for policyholders.

Can professional liability insurance be customized to my specific needs?

+Yes, professional liability insurance policies can often be tailored to your specific needs and risks. Insurers may offer endorsements or additional coverage options to address unique circumstances. For instance, you might add coverage for specific types of claims, increase your policy limits, or customize your policy to cover remote work or specific industry-specific risks. Working with an insurance broker can help you navigate these customization options to ensure you have the coverage you need.