Preexisting Health Conditions And Insurance

Navigating the intricate world of health insurance, especially when managing pre-existing health conditions, is a complex journey that many individuals face. It is crucial to understand the impact of these conditions on insurance coverage and the various options available to ensure proper care and financial protection.

In this comprehensive guide, we delve into the relationship between pre-existing health conditions and insurance, exploring the challenges, the legal framework, and the strategies to obtain adequate coverage. By shedding light on this often-overlooked aspect of healthcare, we aim to empower individuals to make informed decisions and advocate for their well-being.

Understanding Pre-existing Health Conditions

Pre-existing health conditions refer to any medical issues, illnesses, or disabilities that an individual has prior to applying for health insurance. These conditions can range from chronic diseases like diabetes and heart disease to mental health disorders, genetic disorders, or even injuries sustained before insurance coverage.

The impact of these conditions on insurance can be significant, as they may affect an individual's eligibility for coverage, the cost of premiums, and the benefits provided. It is essential to recognize that the definition and treatment of pre-existing conditions can vary depending on the insurance provider and the jurisdiction.

The Challenge of Pre-existing Conditions in Insurance

Securing health insurance with pre-existing conditions can present a series of challenges. Historically, individuals with pre-existing conditions often faced discrimination in the insurance market. Insurance companies might have denied coverage, imposed waiting periods, or charged exorbitant premiums, making insurance unaffordable or inaccessible.

This situation has improved with the implementation of various legal protections, but the process of obtaining insurance with pre-existing conditions remains a delicate and often confusing one. It requires a deep understanding of the legal rights and the available options to navigate the system successfully.

Legal Protections and Reforms

Over the years, there have been significant legal reforms aimed at protecting individuals with pre-existing conditions and ensuring their access to health insurance. Here are some of the key milestones and their impact:

The Affordable Care Act (ACA)

The ACA, often referred to as Obamacare, was a landmark legislation in the United States that aimed to reform the healthcare system. One of its most significant provisions was the guarantee of coverage for pre-existing conditions. Under the ACA, insurance companies cannot deny coverage or charge higher premiums based solely on an individual’s health status.

The ACA also implemented the Pre-Existing Condition Insurance Plan (PCIP), a temporary program that provided coverage for individuals who had been uninsured for at least six months due to a pre-existing condition. This program helped bridge the gap until the full implementation of the ACA's reforms.

The Americans with Disabilities Act (ADA)

The ADA, enacted in 1990, is a civil rights law that prohibits discrimination against individuals with disabilities. While primarily focused on equal access and opportunity, the ADA also has implications for health insurance. It ensures that people with disabilities, including those with pre-existing conditions, are not subjected to discrimination in obtaining health insurance.

Mental Health Parity and Addiction Equity Act (MHPAEA)

The MHPAEA, signed into law in 2008, requires insurance companies to provide equitable coverage for mental health and substance use disorders. This legislation ensures that pre-existing mental health conditions are treated on par with physical health conditions, addressing a long-standing disparity in insurance coverage.

Strategies for Obtaining Insurance with Pre-existing Conditions

Given the legal protections in place, individuals with pre-existing conditions have several strategies to obtain health insurance:

Employer-Sponsored Insurance

One of the most common ways to obtain insurance with pre-existing conditions is through employer-sponsored group plans. Group plans often provide comprehensive coverage and are less likely to discriminate based on health status. Additionally, the ACA’s requirement for employers to offer coverage or pay a penalty has expanded access to insurance for many individuals.

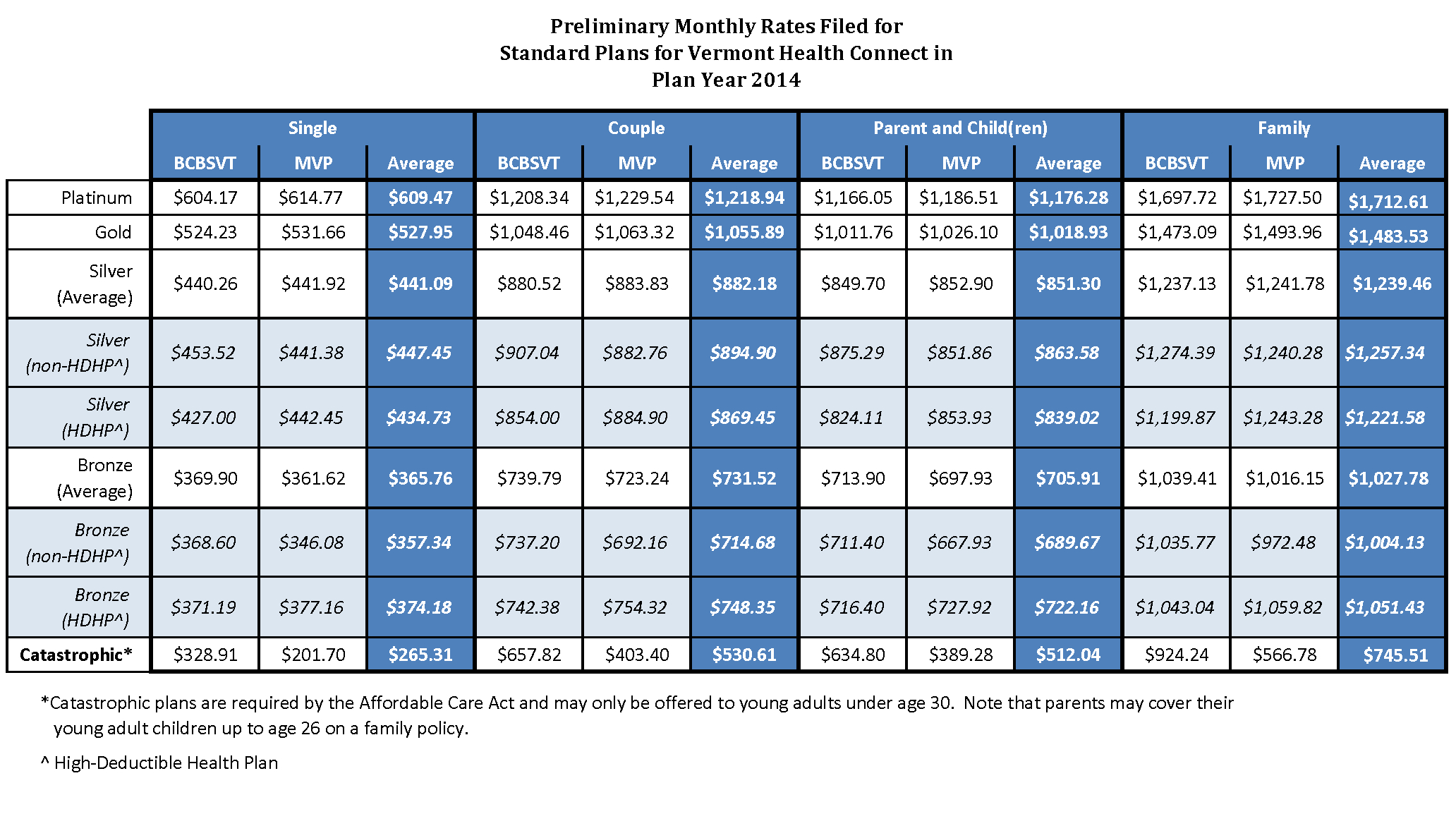

Individual Market Insurance

For those who do not have access to employer-sponsored insurance, the individual market offers options. Under the ACA, insurance companies cannot deny coverage or charge more based on pre-existing conditions. However, the cost of premiums can still vary based on factors like age, location, and tobacco use.

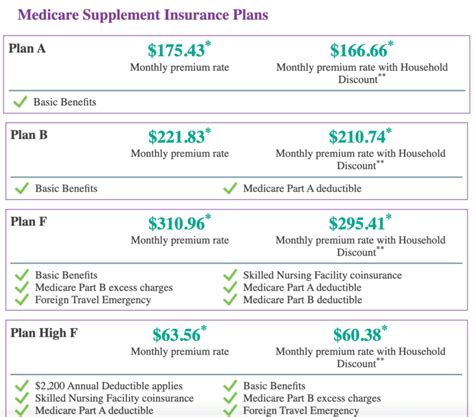

Medicaid and Medicare

Medicaid and Medicare are government-funded healthcare programs that provide coverage for eligible individuals. Medicaid is designed for low-income individuals and families, while Medicare primarily serves those aged 65 and older. Both programs cover pre-existing conditions, making them valuable options for those who qualify.

Short-Term Plans

Short-term health insurance plans are temporary coverage options that can provide a bridge between longer-term plans. While they are more affordable, they often have limitations and may not cover pre-existing conditions. It’s important to carefully review the policy details before opting for a short-term plan.

Managing Pre-existing Conditions and Insurance

Once an individual has secured insurance with a pre-existing condition, the focus shifts to effective management. Here are some key considerations:

Continuous Coverage

Maintaining continuous coverage is crucial to avoid any gaps that could lead to complications. Gaps in coverage might result in the reclassification of a pre-existing condition, potentially impacting future insurance options.

Understanding the Policy

Take the time to thoroughly understand the terms and conditions of your insurance policy. Know what is covered, what is excluded, and any specific requirements for accessing certain benefits. This knowledge can help you make informed decisions about your healthcare.

Regular Doctor Visits

Regular check-ups and maintaining a good relationship with your healthcare provider are essential. This not only ensures that your condition is well-managed but also provides a record of your health status, which can be beneficial when applying for future insurance policies.

Advocating for Yourself

If you encounter any issues with your insurance coverage, don’t hesitate to advocate for yourself. Contact your insurance provider, and if needed, seek assistance from patient advocacy groups or legal services that specialize in healthcare.

The Future of Insurance and Pre-existing Conditions

The landscape of insurance for individuals with pre-existing conditions continues to evolve. With ongoing legal battles and political debates, the future of insurance reform remains uncertain. However, the trend towards greater protections and access to affordable healthcare is encouraging.

As technology advances, we may see more innovative solutions, such as the use of big data and artificial intelligence, to personalize insurance plans and make them more accessible. Additionally, the push for universal healthcare in many countries could further reduce the barriers faced by individuals with pre-existing conditions.

In conclusion, while the journey of obtaining insurance with pre-existing conditions can be challenging, the legal protections and available options provide a solid foundation. By staying informed, advocating for your rights, and exploring the various strategies, you can secure the insurance coverage you need to manage your health effectively.

Can insurance companies still deny coverage for pre-existing conditions?

+Under the Affordable Care Act (ACA), insurance companies cannot deny coverage or charge higher premiums based solely on a pre-existing condition. However, there may be some exceptions, especially in states that have not fully adopted the ACA’s reforms.

What happens if I have a gap in my insurance coverage due to a pre-existing condition?

+Gaps in coverage can potentially lead to the reclassification of a pre-existing condition. This means that if you were previously insured and had a condition managed, it might be considered pre-existing again if you experience a gap. It’s crucial to maintain continuous coverage to avoid this issue.

Are there any limitations to coverage for pre-existing conditions in individual market plans?

+While the ACA guarantees coverage for pre-existing conditions in the individual market, there may be limitations on certain benefits or services. It’s essential to review the policy carefully to understand the scope of coverage and any potential exclusions.