Online Insurance Quote Car

The world of insurance is undergoing a digital transformation, and obtaining an online insurance quote for your car has never been easier or more convenient. With just a few clicks, you can compare multiple car insurance policies, explore different coverage options, and make an informed decision about your automotive insurance needs. This guide will walk you through the process of securing an online car insurance quote, offering insights into the key factors that influence your premium and providing practical tips to ensure you get the best coverage at the most competitive rate.

Understanding the Basics of Online Car Insurance Quotes

In the realm of automotive insurance, online quotes represent a swift and efficient way to compare policies and identify the best coverage for your vehicle. These quotes are generated by insurance providers based on a set of criteria, including your personal information, vehicle details, and driving history. By submitting this information via an online form, you can receive tailored quotes that reflect your unique circumstances.

Online car insurance quotes offer a host of benefits. Firstly, they provide convenience by allowing you to compare policies from the comfort of your home or office. Secondly, they offer speed, delivering near-instantaneous quotes that save you the time and effort of visiting multiple insurance agents or brokers. Lastly, online quotes provide transparency, as they present a clear breakdown of the coverage and premium associated with each policy, enabling you to make an informed decision.

Key Factors Influencing Your Online Car Insurance Quote

Several factors come into play when it comes to determining your online car insurance quote. These include your personal information (age, gender, marital status), vehicle details (make, model, year, mileage), and driving history (accident record, traffic violations). Additionally, your location and credit score can also influence the quote you receive.

For instance, younger drivers, especially males, typically pay higher premiums due to their perceived higher risk profile. Similarly, drivers with a history of accidents or traffic violations may face increased insurance costs. The type of car you drive also matters; high-performance vehicles or those with a history of frequent claims may attract higher premiums.

Understanding these factors can help you prepare for the quote process and potentially identify areas where you can influence the cost of your insurance. For example, maintaining a clean driving record or improving your credit score could lead to more favorable insurance rates.

Step-by-Step Guide to Obtaining an Online Car Insurance Quote

Getting an online car insurance quote is a straightforward process. Here’s a step-by-step guide to help you through it:

Step 1: Choose a Reputable Insurance Provider

Start by selecting a reputable insurance company that offers online quotes. Research and compare different providers based on their coverage options, customer reviews, and financial stability. Consider seeking recommendations from friends, family, or financial advisors to ensure you’re dealing with a trusted and reliable insurer.

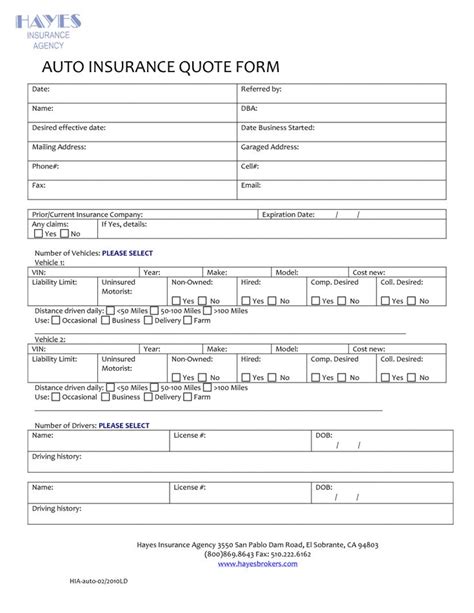

Step 2: Gather Your Information

Before you begin the quote process, gather all the necessary information. This includes your personal details (name, address, date of birth, etc.), vehicle information (make, model, year, VIN), and driving history (accident records, traffic violations). If you have existing insurance, have your policy details handy as well.

Step 3: Visit the Insurance Provider’s Website

Navigate to the website of the insurance provider you’ve chosen. Look for a prominent “Get a Quote” or “Quote” button, which will typically direct you to an online form.

Step 4: Fill Out the Online Form

Complete the online form with your personal and vehicle information. Be as accurate and detailed as possible to ensure you receive an accurate quote. Double-check your entries to avoid any errors that might affect the quote.

Step 5: Review and Compare Quotes

Once you’ve submitted the form, the insurance provider will generate a quote based on the information you’ve provided. Take time to review the quote carefully, paying attention to the coverage details and the premium. Compare this quote with others you may have received to ensure you’re getting the best value for your money.

Step 6: Make an Informed Decision

After reviewing and comparing the quotes, make an informed decision about which policy to choose. Consider not just the premium but also the coverage, customer service, and claims handling reputation of the insurance provider. If you have any questions or concerns, don’t hesitate to reach out to the insurer’s customer support for clarification.

Tips for Getting the Best Online Car Insurance Quote

Here are some tips to help you secure the most competitive online car insurance quote:

- Shop around and compare quotes from multiple insurance providers to find the best rate.

- Consider increasing your deductible to lower your premium. Just ensure you can afford the higher out-of-pocket expense in the event of a claim.

- Take advantage of discounts. Many insurers offer discounts for things like safe driving, good grades (for young drivers), and bundling multiple policies.

- Maintain a good credit score. Insurers often use credit-based insurance scores to assess risk, so a higher credit score may lead to lower premiums.

- Keep your driving record clean. A clean driving record can significantly impact your insurance premium, as it indicates a lower risk to the insurer.

- Review your policy annually and shop around for better rates. Insurance needs and rates can change over time, so it's important to stay informed and up-to-date.

Understanding the Coverage Options in Your Online Car Insurance Quote

When you receive an online car insurance quote, it’s important to understand the different coverage options included. These options determine the scope of protection you’ll have in various situations. Here’s a breakdown of some common coverage types:

Liability Coverage

Liability coverage is a fundamental part of any car insurance policy. It protects you against claims arising from accidents where you’re at fault. This coverage has two main components: bodily injury liability and property damage liability.

- Bodily Injury Liability: Covers the cost of medical expenses and lost wages for individuals injured in an accident caused by you.

- Property Damage Liability: Covers the cost of repairing or replacing property damaged in an accident caused by you, such as the other driver's vehicle or any other property.

Collision Coverage

Collision coverage protects your vehicle in the event of a collision with another vehicle or object, regardless of fault. This coverage pays for the repair or replacement of your vehicle, up to its actual cash value (ACV) at the time of the accident.

Comprehensive Coverage

Comprehensive coverage, often paired with collision coverage, protects your vehicle against damages not caused by a collision. This includes damage from theft, vandalism, natural disasters, falling objects, and collisions with animals.

Uninsured/Underinsured Motorist Coverage

This coverage protects you in the event of an accident with a driver who either doesn’t have insurance (uninsured) or doesn’t have enough insurance to cover the damages (underinsured). It helps cover your medical expenses and property damage costs in such situations.

Personal Injury Protection (PIP) or Medical Payments Coverage

PIP or Medical Payments coverage provides coverage for medical expenses for you and your passengers, regardless of fault in an accident. It can also cover lost wages and other related expenses.

Rental Car Reimbursement Coverage

If your car is in the shop for repairs after an insured accident, this coverage can help pay for a rental car during that time.

Roadside Assistance Coverage

This coverage provides assistance for common roadside emergencies like flat tires, dead batteries, or running out of gas.

The Impact of Your Driving Behavior on Online Car Insurance Quotes

Your driving behavior is a significant factor in determining your online car insurance quote. Insurers consider various aspects of your driving record, including the number and severity of accidents, traffic violations, and even your credit score. Here’s how your driving behavior can impact your insurance rates:

Accident History

If you’ve been involved in multiple accidents, especially those deemed your fault, it can significantly increase your insurance premiums. Insurers view this as a higher risk, as it indicates a pattern of unsafe driving behavior. The more accidents you’ve had, the higher your insurance costs are likely to be.

Traffic Violations

Traffic violations, such as speeding tickets, running red lights, or driving under the influence (DUI), can also lead to higher insurance rates. These violations suggest a disregard for traffic laws and an increased likelihood of being involved in an accident. As a result, insurers may charge higher premiums to cover the perceived increased risk.

Credit Score

Believe it or not, your credit score can also influence your insurance rates. Many insurers use credit-based insurance scores to assess the risk of insuring a driver. A lower credit score may indicate financial instability, which insurers associate with a higher risk of filing claims. As a result, drivers with lower credit scores often pay higher insurance premiums.

Safe Driving Practices

On the other hand, practicing safe driving habits can lead to lower insurance rates. This includes driving defensively, obeying traffic laws, and maintaining a clean driving record. Some insurance providers even offer safe driving discounts or rewards programs that can significantly reduce your premiums over time.

Future Implications of Online Car Insurance Quotes

The future of online car insurance quotes is poised for exciting advancements, largely driven by technological innovations and shifting consumer preferences. Here’s a glimpse into what we can expect:

Enhanced Digital Experience

Insurance providers will continue to refine their online platforms, offering more intuitive and user-friendly interfaces. This will make the quote process even more streamlined and efficient, allowing consumers to obtain quotes with minimal effort.

Advanced Data Analytics

Insurers will increasingly leverage advanced data analytics and machine learning algorithms to personalize quotes based on individual driving behaviors and patterns. This level of customization will enable more accurate risk assessments and potentially lead to more competitive rates for policyholders.

Telematics and Usage-Based Insurance (UBI)

Telematics technology, which collects data about driving behavior, will play a more significant role in online car insurance quotes. UBI programs, which use telematics to monitor and reward safe driving, will become more prevalent, offering policyholders the opportunity to lower their premiums by demonstrating safe driving habits.

Integration of Autonomous Vehicle Technology

As autonomous vehicles become more mainstream, insurers will need to adapt their quote processes to accommodate this new technology. Online car insurance quotes may incorporate factors such as the level of autonomy in a vehicle and the associated safety features, potentially impacting insurance premiums.

Increased Focus on Customer Experience

Insurance providers will continue to prioritize customer experience, offering more personalized and interactive quote processes. This may include the use of chatbots, virtual assistants, or even augmented reality to guide customers through the quote journey, making it more engaging and informative.

Can I get an online car insurance quote without providing my personal information?

+While some insurers may offer preliminary quotes without personal details, a full and accurate quote typically requires personal information such as your name, address, and driving history. This information is necessary for insurers to assess your risk profile and provide an accurate quote.

How long does an online car insurance quote remain valid?

+The validity of an online quote can vary depending on the insurer and the specific policy. Some quotes may be valid for a few days, while others could be valid for up to 30 days. It’s important to check with the insurer to understand the quote’s validity period.

What if I find a better rate after purchasing my policy?

+If you discover a more competitive rate after purchasing your policy, you can often switch insurers or renegotiate your premium. Many insurers allow policyholders to make changes to their coverage or cancel their policy, provided they meet certain criteria and give adequate notice.