Online Insurance Auto Quote

In today's fast-paced world, convenience and efficiency are paramount. This is especially true when it comes to purchasing insurance, a necessary expense for many individuals and businesses. The traditional process of visiting an insurance agent's office or making lengthy phone calls to compare rates and coverage options can be time-consuming and often daunting. However, with the advent of online insurance platforms, obtaining an auto insurance quote has become a seamless and straightforward process.

This article aims to delve into the world of online insurance, exploring how technology has revolutionized the way we access and obtain auto insurance quotes. We will uncover the benefits, features, and unique aspects of these digital platforms, providing an in-depth analysis of their impact on the insurance industry and the consumer experience.

The Rise of Online Insurance Platforms

The insurance landscape has witnessed a significant transformation with the integration of technology. Online insurance platforms have emerged as a game-changer, offering a modern and convenient approach to insurance procurement. These platforms leverage the power of the internet and advanced algorithms to provide users with a streamlined and personalized experience when seeking auto insurance quotes.

One of the key advantages of online insurance platforms is their accessibility. Unlike traditional insurance agencies, which often have limited operating hours and physical locations, online platforms are accessible 24/7. This means that individuals can compare quotes and obtain coverage at their own convenience, regardless of their geographical location or time zone.

Furthermore, these platforms utilize advanced technology to automate various processes, such as data collection and risk assessment. By inputting their personal information and vehicle details, users can receive instant quotes tailored to their specific needs. This level of automation not only speeds up the quote process but also ensures accuracy, as errors that may occur during manual data entry are minimized.

User-Friendly Interfaces and Personalized Experiences

Online insurance platforms have invested heavily in developing user-friendly interfaces that are intuitive and easy to navigate. This ensures that even individuals with limited technical knowledge can seamlessly navigate through the quote process. The platforms often provide clear and concise instructions, step-by-step guides, and interactive tools to assist users in making informed decisions.

Additionally, these platforms utilize advanced algorithms and machine learning techniques to offer personalized experiences. By analyzing a user's profile, driving history, and other relevant factors, the platform can generate customized quotes and coverage recommendations. This level of personalization ensures that individuals receive tailored insurance solutions that meet their unique needs and budget constraints.

| Platform Feature | Description |

|---|---|

| Instant Quotes | Obtain real-time quotes based on your vehicle and personal information. |

| Comparative Analysis | Easily compare quotes from multiple insurers to find the best deal. |

| Personalized Recommendations | Receive tailored coverage suggestions based on your specific needs. |

| Policy Management | Conveniently manage your insurance policies, make payments, and access policy documents online. |

The Benefits of Online Insurance Auto Quotes

Online insurance auto quotes offer a plethora of advantages that traditional insurance methods may lack. Here are some key benefits that have contributed to the popularity of these digital platforms:

Time Efficiency

One of the most significant advantages is the time efficiency provided by online insurance platforms. The traditional process of obtaining insurance quotes often involves multiple phone calls, visits to insurance agents, and tedious paperwork. In contrast, online platforms streamline the entire process, allowing users to obtain multiple quotes within minutes. This saves valuable time and effort, especially for busy individuals who prioritize convenience.

Cost Comparison and Savings

Online insurance platforms provide an excellent opportunity for cost comparison. Users can easily input their information and receive quotes from multiple insurers simultaneously. This transparency enables consumers to compare prices, coverage options, and additional benefits offered by different providers. By leveraging this information, individuals can make informed decisions and potentially save significant amounts on their auto insurance premiums.

Enhanced Convenience and Accessibility

The accessibility of online insurance platforms cannot be overstated. Individuals can access these platforms from the comfort of their homes or on the go using their smartphones or laptops. This level of convenience is especially beneficial for those with busy schedules or limited mobility. Additionally, the ability to obtain quotes at any time, day or night, ensures that individuals can fit insurance-related tasks into their schedules without disruption.

Data Security and Privacy

Online insurance platforms prioritize data security and privacy to protect their users’ sensitive information. These platforms employ robust encryption protocols and security measures to safeguard personal and financial data. Users can have peace of mind knowing that their information is protected against potential cyber threats and unauthorized access.

The Future of Online Insurance

The future of online insurance looks promising, with continuous advancements in technology shaping the industry. Here are some potential developments and trends that may further enhance the online insurance experience:

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning technologies are expected to play an increasingly significant role in online insurance platforms. These advanced technologies can further improve risk assessment, fraud detection, and personalized recommendations. By analyzing vast amounts of data, AI algorithms can identify patterns and trends, leading to more accurate pricing and coverage options for users.

Integration of Telematics and Usage-Based Insurance

Telematics, the technology that collects and analyzes data from vehicles, is expected to revolutionize the insurance industry. Online insurance platforms may integrate telematics data to offer usage-based insurance policies. These policies would take into account an individual’s driving behavior, such as miles driven, driving patterns, and even the time of day, to provide more accurate and fair insurance premiums. This shift towards usage-based insurance could encourage safer driving habits and reward responsible drivers.

Enhanced Customer Service and Support

While online insurance platforms excel in providing a seamless and efficient quote process, the future may see improvements in customer service and support. Integrating live chat, video conferencing, and AI-powered virtual assistants could enhance the overall user experience. These features would allow users to receive real-time assistance, clarify doubts, and resolve issues promptly.

Expanded Coverage Options and Customization

Online insurance platforms may expand their coverage options to cater to a wider range of consumer needs. This could include specialized policies for electric vehicles, autonomous cars, or even coverage for shared mobility services. Additionally, platforms may offer increased customization options, allowing users to build their own insurance packages tailored to their specific requirements.

Increased Collaboration and Partnerships

The insurance industry is likely to witness increased collaboration between online insurance platforms and traditional insurers. This partnership could lead to the development of innovative products and services, combining the best of both worlds. Traditional insurers may leverage the technology and data-driven insights of online platforms, while online platforms could benefit from the expertise and established networks of traditional insurers.

How accurate are the quotes provided by online insurance platforms?

+Online insurance platforms utilize advanced algorithms and real-time data to generate quotes. While these quotes provide a good estimate, the final premium may vary slightly based on additional factors assessed during the application process. However, the quotes serve as a reliable starting point for comparison and decision-making.

Can I purchase insurance directly from an online platform, or do I need to contact an agent?

+Online insurance platforms often provide the option to purchase insurance directly through their website or app. However, some platforms may also offer the ability to connect with licensed insurance agents who can assist with policy selection and provide additional guidance. The choice depends on your preference and the platform’s specific offerings.

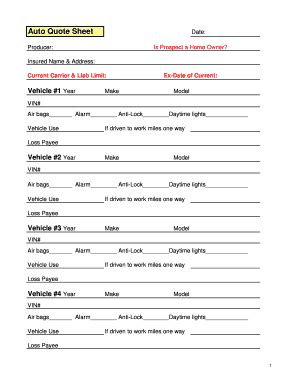

What personal information do I need to provide to obtain an auto insurance quote online?

+To obtain an auto insurance quote online, you will typically need to provide basic personal information such as your name, date of birth, and contact details. Additionally, you will need to provide details about your vehicle, including make, model, year, and mileage. Some platforms may also request information about your driving history and any previous insurance claims.