Online Home Insurance Quote

In today's digital age, obtaining an online home insurance quote has become a convenient and efficient way for homeowners to secure the right coverage for their properties. This article explores the process, benefits, and considerations of getting home insurance quotes online, offering valuable insights for individuals seeking to protect their homes and assets effectively.

The Process of Obtaining an Online Home Insurance Quote

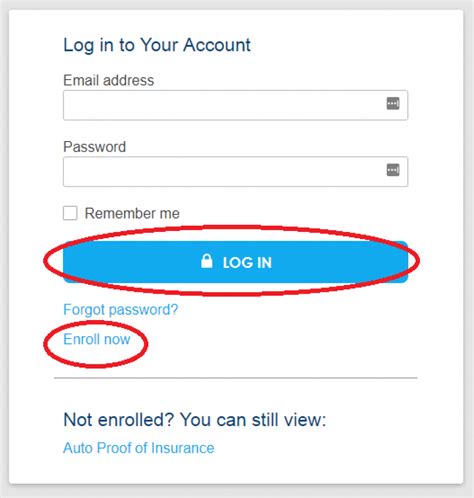

The journey towards safeguarding your home with insurance begins with a few simple steps when done online. Here’s a breakdown of the process:

Gathering Essential Information

Before starting your online quote, gather relevant details about your home. This includes the property’s location, square footage, age, and any unique features or additions. Additionally, have information about your current insurance coverage (if applicable) and any recent claims handy. Providing accurate information ensures a more precise quote.

Navigating the Online Quote Form

Most insurance providers offer user-friendly online quote forms. These forms guide you through a series of questions about your home, its contents, and your desired coverage. Be prepared to provide details about the structure, such as the type of roofing and foundation, as well as the value of personal belongings. Some forms may also inquire about any safety features or upgrades you’ve installed.

Selecting Coverage Options

Online quote forms often present a range of coverage options. These may include liability protection, dwelling coverage, personal property coverage, and additional living expenses. Understand your needs and risks to make informed choices. Consider factors like the cost of rebuilding your home, the replacement value of your belongings, and any specific risks unique to your area, such as natural disasters or crime rates.

Reviewing and Comparing Quotes

Once you’ve submitted your information, the insurance provider generates a quote based on the details provided. Take time to review the quote carefully, paying attention to the coverage limits, deductibles, and any exclusions. Compare quotes from multiple providers to find the best combination of coverage and cost. Some providers offer additional discounts for bundling home and auto insurance or for having certain safety features.

| Insurance Provider | Coverage Options | Deductible | Annual Premium |

|---|---|---|---|

| Provider A | Comprehensive with Flood Coverage | $1,000 | $1,200 |

| Provider B | Standard Home Insurance | $500 | $1,050 |

| Provider C | Enhanced with Identity Theft Protection | $750 | $1,150 |

Benefits of Obtaining an Online Home Insurance Quote

Online home insurance quotes offer several advantages that cater to the modern homeowner’s needs and preferences.

Convenience and Accessibility

One of the most significant benefits is the convenience factor. You can obtain quotes from the comfort of your home, at any time that suits your schedule. This is especially beneficial for busy individuals or those with limited mobility. Additionally, online quotes are typically available 24⁄7, allowing you to compare options and make informed decisions without waiting for business hours.

Efficiency and Speed

Online quote forms are designed to be efficient and straightforward. They guide you through the process, often providing real-time estimates as you input information. This saves time compared to traditional methods, where you might need to schedule appointments or wait for paperwork to be processed. With online quotes, you can quickly gather multiple options and make comparisons.

Comparison Shopping Made Easy

The ability to compare quotes from various providers is a powerful advantage. Online platforms often aggregate quotes from multiple insurers, making it easy to see the differences in coverage and costs side by side. This feature empowers homeowners to make informed choices, ensuring they find the best value for their insurance needs.

Personalized Coverage Options

Online quote forms allow you to customize your coverage. Whether you’re looking for basic liability protection or comprehensive coverage that includes personal belongings and additional living expenses, you can tailor your quote to match your specific requirements. This level of customization ensures you’re not overpaying for coverage you don’t need.

Considerations for Accurate Online Quotes

While online home insurance quotes are convenient, there are a few considerations to keep in mind to ensure you receive an accurate and suitable quote.

Providing Accurate Information

Accuracy is key when filling out online quote forms. Misrepresenting or omitting information can lead to quotes that don’t align with your actual needs. Be honest and thorough in providing details about your home, its features, and any potential risks. This includes disclosing any previous claims or incidents that might impact your insurance eligibility or premiums.

Understanding Coverage Limitations

Online quotes often provide a basic overview of coverage options. However, it’s essential to delve deeper into the fine print to understand any limitations or exclusions. For instance, some policies might have restrictions on certain types of damage or may not cover certain high-value items. Review the policy details carefully to ensure you’re aware of any potential gaps in coverage.

Customizing Coverage to Your Needs

While online quotes offer flexibility, they might not always provide the most suitable coverage for your unique circumstances. Consider your specific risks and needs. For example, if you live in an area prone to natural disasters, ensure your policy includes adequate coverage for those events. Similarly, if you have high-value possessions or a home-based business, you might require additional coverage options.

Consulting with Insurance Experts

Online quotes are a great starting point, but they don’t replace the expertise of insurance professionals. If you have complex insurance needs or require clarification on specific coverage aspects, consider reaching out to insurance agents or brokers. They can provide personalized advice, guide you through the process, and ensure you select the right policy for your home and lifestyle.

The Future of Home Insurance: Online Trends and Innovations

The home insurance landscape is evolving, driven by technological advancements and changing consumer preferences. Here’s a glimpse into the future of online home insurance quotes.

Digital Transformation and Data Analytics

Insurance providers are leveraging digital technologies and data analytics to enhance the online quote process. Advanced algorithms can analyze a wealth of data, including property characteristics, local crime rates, and even weather patterns, to generate more accurate and personalized quotes. This data-driven approach ensures homeowners receive tailored coverage recommendations.

Smart Home Integration

The rise of smart home technology is influencing the insurance industry. Insurers are exploring ways to integrate smart devices and sensors into their risk assessment processes. For instance, smart water leak detectors or fire sensors can provide real-time data, allowing insurers to offer more precise quotes and potentially reduce premiums for homeowners who invest in such safety measures.

Artificial Intelligence and Chatbots

AI-powered chatbots are becoming increasingly common in the insurance industry. These virtual assistants can guide homeowners through the quote process, answer common questions, and provide instant support. Chatbots enhance the user experience, making it easier and more engaging to obtain quotes and understand coverage options.

Blockchain and Digital Records

Blockchain technology is poised to revolutionize how insurance claims are processed. By securely storing and sharing digital records, blockchain can streamline the verification process, reducing the time and effort required for claims settlement. This innovation could also impact the accuracy of online quotes, as insurers would have access to a more transparent and tamper-proof record of a property’s history.

Personalized Coverage Recommendations

As data analytics and machine learning advance, insurance providers will be able to offer even more personalized coverage recommendations. By analyzing an individual’s lifestyle, preferences, and unique risks, insurers can suggest tailored policies that meet specific needs. This level of customization ensures homeowners receive the right coverage without paying for unnecessary add-ons.

How do I know if I’m getting a competitive online home insurance quote?

+

To ensure you’re getting a competitive quote, compare it with quotes from several other providers. Look for similarities in coverage options and premiums. If your quote is significantly higher or lower than others, it might be worth investigating further to understand the reasons behind the discrepancy.

Can I customize my online home insurance quote to include specific coverage options?

+

Yes, online quote forms often allow you to customize your coverage. You can select specific options, such as liability protection, dwelling coverage, or personal property coverage, and adjust limits and deductibles to meet your needs and budget. This customization ensures you get the right level of protection without overpaying.

What happens if I need to make changes to my online home insurance quote after submitting it?

+

Most insurance providers allow you to make changes to your quote before finalizing your policy. You can typically revise your coverage options, adjust deductibles, or update your personal information. However, it’s essential to review the terms and conditions to understand any potential implications, such as changes to your premium.

Are there any discounts available when obtaining an online home insurance quote?

+

Yes, many insurance providers offer discounts for online quotes. These may include discounts for bundling home and auto insurance, having certain safety features (like smoke detectors or security systems), or maintaining a good credit score. Be sure to inquire about available discounts to maximize your savings.

How long does it typically take to receive an online home insurance quote?

+

The time it takes to receive an online home insurance quote can vary depending on several factors, including the complexity of your coverage needs and the insurance provider’s processes. However, with most providers, you can expect to receive a quote within minutes to a few hours after submitting your information. Some providers may even offer instant quotes.