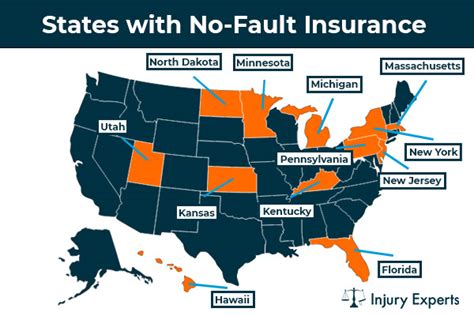

No Fault Insurance Meaning

No-fault insurance is a unique and essential concept in the world of automotive insurance, offering a distinct approach to handling car accident claims. It's a system designed to streamline the process of seeking compensation after an accident, ensuring a more efficient and less adversarial route to recovery. This type of insurance policy has gained significant traction in certain states across the United States, providing an alternative to the traditional at-fault insurance model. In this article, we will delve into the specifics of no-fault insurance, exploring its definition, how it works, its advantages, and its potential drawbacks.

Understanding No-Fault Insurance

No-fault insurance is a mandatory insurance coverage required by law in some states, primarily for motor vehicle accidents. The key principle behind this type of insurance is to provide an efficient and swift compensation mechanism for insured individuals involved in an accident, regardless of who was at fault. This system is designed to minimize legal disputes, reduce the strain on the court system, and expedite the process of recovering financial losses and medical expenses incurred due to the accident.

In a no-fault insurance system, each driver's policy covers their own losses and injuries, eliminating the need to establish fault or liability. This approach aims to simplify the claims process, making it quicker and less contentious. It's worth noting that no-fault insurance doesn't necessarily mean that drivers are immune from lawsuits. In certain circumstances, such as when injuries exceed a specified threshold or in cases of severe negligence, legal action may still be pursued.

Key Components of No-Fault Insurance

No-fault insurance policies typically include the following coverage types:

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for the policyholder and their passengers, regardless of fault.

- Property Damage Liability: Covers the cost of repairing or replacing the policyholder's vehicle and any other property damaged in the accident.

- Bodily Injury Liability: Provides coverage for the policyholder's legal responsibility for bodily injury to others in an accident they caused.

- Uninsured/Underinsured Motorist Coverage: Protects the policyholder if they are involved in an accident with a driver who either doesn't have insurance or doesn't have enough insurance to cover the damages.

How No-Fault Insurance Works

The operation of no-fault insurance can be broken down into several key steps:

- Accident Occurs: When a motor vehicle accident takes place, the drivers involved should exchange insurance information, including policy numbers and contact details.

- Notification of Insurer: Each driver must notify their respective insurance company about the accident as soon as possible. The insurer will then initiate the claims process.

- Claims Filing: The policyholder files a claim with their insurance company, providing details about the accident, injuries, and damages. The insurer will assess the claim and determine the appropriate coverage and compensation.

- Compensation Payment: The insurance company pays out the claim amount directly to the policyholder, covering their medical expenses, lost wages, and other related costs as outlined in the policy.

- Further Action: If the injuries or damages exceed the policy limits or if there are disputes over fault, legal action may be necessary. In such cases, the at-fault driver's insurance company may become involved.

Advantages of No-Fault Insurance

No-fault insurance offers several benefits, including:

- Faster Claims Process: By eliminating the need to establish fault, no-fault insurance speeds up the claims process, allowing policyholders to receive compensation more quickly.

- Reduced Legal Costs: With fewer disputes over fault, there is a lower likelihood of legal battles, which can be costly and time-consuming.

- Privacy: Policyholders don't have to disclose personal details or medical records to the other driver's insurance company, enhancing privacy and reducing potential harassment.

- Simplified Insurance Process: No-fault insurance makes the insurance process more straightforward, as policyholders only need to deal with their own insurance company.

- Potential for Lower Premiums: In some cases, no-fault insurance can lead to lower insurance premiums, as it reduces the risk of costly legal battles.

Drawbacks and Considerations

While no-fault insurance has its advantages, there are also potential drawbacks to consider:

- Limited Compensation: No-fault insurance policies often have caps on the amount of compensation available, which may not cover all damages or injuries, especially in severe cases.

- No Incentive to Drive Safely: Since fault isn't considered, some argue that drivers have less incentive to drive safely, as they are not directly penalized for causing accidents.

- Potential for Fraud: The no-fault system can be susceptible to fraud, as policyholders may attempt to inflate their claims or make false claims to receive compensation.

- Complex Legal Proceedings: While no-fault insurance simplifies the claims process, it doesn't eliminate the need for legal action in certain cases, which can still be complex and time-consuming.

No-Fault Insurance in Practice

No-fault insurance is currently in effect in 12 states and the District of Columbia in the United States. These states include:

- New York

- Florida

- Michigan

- New Jersey

- Massachusetts

- Pennsylvania

- Connecticut

- Hawaii

- Kansas

- Kentucky

- Minnesota

- North Dakota

Each state has its own specific laws and regulations regarding no-fault insurance, including the types of coverage required and the thresholds for pursuing legal action.

Real-World Example: New York’s No-Fault Insurance

New York, one of the pioneering states in implementing no-fault insurance, has a comprehensive system in place. Under New York’s no-fault law, drivers must carry Personal Injury Protection (PIP) coverage, which provides up to $50,000 for medical expenses, lost wages, and other related costs. This coverage is designed to ensure that policyholders can receive prompt medical treatment and financial support after an accident, regardless of fault.

However, New York's no-fault system also allows for certain exceptions where legal action can be pursued. For instance, if an individual sustains a "serious injury" as defined by the state's insurance laws, they can file a lawsuit to seek additional compensation. This threshold includes permanent disfigurement, permanent loss of use of a body organ, member, function, or system, or significant disfigurement.

The Future of No-Fault Insurance

The concept of no-fault insurance continues to evolve and is the subject of ongoing debate among policymakers, insurance companies, and legal experts. Proponents argue that it simplifies the claims process, reduces litigation, and provides a more efficient system for accident victims. On the other hand, critics suggest that it can limit compensation, reduce incentives for safe driving, and lead to higher insurance costs in the long run.

As technology advances, particularly in the realm of autonomous vehicles, the role and relevance of no-fault insurance may change significantly. With the potential for reduced accidents and improved safety, the need for fault-based insurance systems could diminish. However, until autonomous vehicles become the norm, no-fault insurance remains a crucial component of the automotive insurance landscape, offering a more streamlined and efficient approach to accident recovery.

Potential Impact of Autonomous Vehicles

The advent of autonomous vehicles (AVs) has the potential to revolutionize the entire automotive insurance industry, including the role of no-fault insurance. AVs are designed to reduce human error, which is a leading cause of accidents. With AVs, the likelihood of accidents caused by human negligence decreases significantly, potentially leading to a reduction in insurance claims and litigation.

In a future where AVs are prevalent, the concept of fault may become less relevant. Instead of determining liability based on individual driver actions, insurance claims could be primarily focused on vehicle performance and manufacturer liability. This shift could further simplify the insurance process and reduce the need for traditional fault-based insurance systems.

Conclusion

No-fault insurance is a unique and beneficial system that offers a streamlined approach to accident recovery. While it has its advantages, such as faster claims processes and reduced legal costs, it also presents challenges, including limited compensation and potential fraud. As the automotive industry evolves, particularly with the emergence of autonomous vehicles, the role and relevance of no-fault insurance will continue to be shaped and redefined, ensuring a more efficient and equitable system for all road users.

Is no-fault insurance mandatory in all states?

+No, no-fault insurance is not mandatory in all states. Currently, 12 states and the District of Columbia have implemented no-fault insurance laws, while the remaining states operate under a traditional at-fault system.

Can I still sue someone for an accident under no-fault insurance?

+In most cases, no-fault insurance eliminates the need to establish fault and pursue legal action. However, certain circumstances, such as severe injuries or significant damages, may allow for lawsuits to be filed. Each state has its own specific thresholds and regulations regarding when legal action is permitted.

How does no-fault insurance affect insurance premiums?

+No-fault insurance can have varying effects on insurance premiums. In some cases, it may lead to lower premiums as it reduces the risk of costly legal battles. However, in other instances, especially in states with high accident rates, premiums may be higher to cover the costs of providing extensive coverage.