New York State Marketplace Insurance

The New York State Marketplace Insurance is a vital component of the state's healthcare system, providing affordable and comprehensive health coverage options to its residents. In this in-depth article, we will explore the intricacies of the New York State Marketplace, its impact on the healthcare landscape, and the benefits it offers to individuals and families. With a focus on specificity and industry relevance, we aim to provide a comprehensive guide to understanding this essential healthcare resource.

Understanding the New York State Marketplace

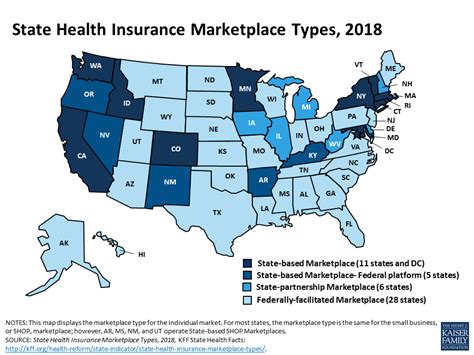

The New York State Marketplace, officially known as the New York State of Health, is an online platform that allows individuals, families, and small businesses to compare and enroll in health insurance plans. It was established as a result of the Affordable Care Act (ACA) and is a key component of New York’s healthcare reform efforts. The Marketplace offers a range of insurance plans from various carriers, ensuring that residents have access to a diverse array of options to meet their unique healthcare needs.

One of the key strengths of the New York State Marketplace is its commitment to transparency and consumer protection. All insurance plans offered on the Marketplace must meet certain standards, ensuring that they provide essential health benefits, cover pre-existing conditions, and adhere to consumer protections outlined in the ACA. This means that individuals shopping for insurance can have confidence in the quality and reliability of the plans available.

Eligibility and Enrollment

The New York State Marketplace is open to all New York residents, regardless of age, health status, or pre-existing conditions. However, it is particularly beneficial for individuals and families who do not have access to employer-sponsored health insurance or those who are self-employed. Enrollment periods are typically held annually, with a defined open enrollment window. However, residents may also qualify for a Special Enrollment Period if they experience certain life events, such as losing job-based coverage, getting married, or having a baby.

During the enrollment process, individuals can compare plans based on factors such as cost, coverage, and provider networks. The Marketplace provides a user-friendly interface that allows users to filter plans based on their specific needs and preferences. This ensures that residents can find a plan that best suits their healthcare requirements and budget.

Plan Options and Coverage

The New York State Marketplace offers a wide range of health insurance plans, including:

- Qualified Health Plans (QHPs): These plans are designed to meet the minimum standards set by the ACA and provide essential health benefits. QHPs are offered by various insurance carriers and are available at different metal levels (Bronze, Silver, Gold, and Platinum) based on the percentage of costs covered by the plan.

- Catastrophic Health Plans: These plans are available to individuals under the age of 30 or those who qualify due to financial hardship. They offer minimal coverage but can be a more affordable option for those who do not anticipate frequent healthcare needs.

- Dental Plans: The Marketplace also offers standalone dental plans, providing coverage for dental care, including preventive services and treatment.

- Vision Plans: Vision plans are available to supplement medical insurance, covering eye exams, eyeglasses, and contact lenses.

The coverage provided by these plans varies based on the specific plan and carrier, but generally includes:

- Hospitalization

- Doctor visits

- Prescription drugs

- Preventive care

- Mental health and substance abuse treatment

- Maternity and newborn care

- Pediatric services

- Emergency services

Financial Assistance and Cost-Saving Measures

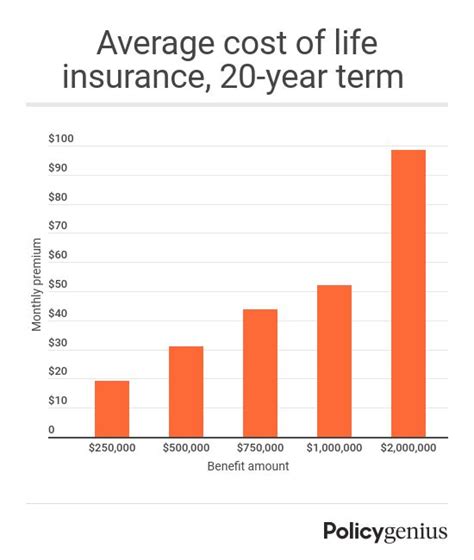

One of the significant advantages of the New York State Marketplace is the availability of financial assistance to make health insurance more affordable. This assistance comes in the form of premium tax credits and cost-sharing reductions, which can significantly reduce the cost of insurance premiums and out-of-pocket expenses.

Premium Tax Credits

Premium tax credits are available to individuals and families who meet certain income requirements. These credits are designed to lower the monthly cost of insurance premiums, making coverage more accessible. The amount of the credit depends on the individual’s or family’s income, the cost of local insurance plans, and the number of people covered by the plan. The credits are applied directly to the monthly premium, making insurance more affordable for those who qualify.

Cost-Sharing Reductions

Cost-sharing reductions are available to individuals and families with lower incomes who enroll in Silver plans. These reductions lower the out-of-pocket costs, such as deductibles, copayments, and coinsurance. By reducing these costs, individuals can better afford the healthcare services they need without facing significant financial burdens.

Small Business Health Options Program (SHOP)

The New York State Marketplace also offers the Small Business Health Options Program (SHOP) for small businesses with 50 or fewer full-time equivalent employees. SHOP allows small businesses to offer their employees health insurance plans through the Marketplace, providing access to a wider range of options and potentially lowering costs. Additionally, small businesses may be eligible for tax credits to help offset the cost of providing insurance coverage to their employees.

Navigating the Marketplace and Choosing the Right Plan

With a wide range of insurance plans and options available, it’s important for individuals and families to understand how to navigate the New York State Marketplace effectively. Here are some key considerations when choosing a health insurance plan:

Evaluate Your Healthcare Needs

Start by assessing your current and future healthcare needs. Consider factors such as the frequency of doctor visits, the need for prescription medications, and any specific medical conditions or treatments you or your family members may require. Understanding your healthcare needs will help you choose a plan that provides adequate coverage without unnecessary expenses.

Compare Plans and Costs

The Marketplace allows you to compare plans based on cost, coverage, and provider networks. Take the time to explore the different options available, including the metal levels (Bronze, Silver, Gold, and Platinum). Remember that while lower-cost plans may have higher deductibles and out-of-pocket expenses, they can still provide comprehensive coverage. It’s essential to find a balance between affordability and coverage that meets your needs.

Consider Provider Networks

Review the provider networks associated with each plan. Make sure that your preferred doctors, hospitals, and specialists are included in the plan’s network. If you have a specific healthcare provider you prefer, choose a plan that includes them to avoid additional costs or inconveniences.

Understand Plan Benefits and Limitations

Carefully read the summary of benefits and coverage provided by each plan. Pay attention to the specifics of what is covered, including any exclusions or limitations. This will help you make an informed decision and avoid any surprises when you need to use your insurance.

Take Advantage of Financial Assistance

If you qualify for premium tax credits or cost-sharing reductions, be sure to apply for them during the enrollment process. These financial assistance programs can make a significant difference in the affordability of your insurance plan.

The Impact of the New York State Marketplace

The New York State Marketplace has had a profound impact on the state’s healthcare landscape. By providing a centralized platform for residents to access health insurance, the Marketplace has increased coverage rates and improved access to care. Here are some key ways in which the Marketplace has made a difference:

Increased Coverage

The Marketplace has played a crucial role in increasing the number of insured individuals in New York. By offering a range of affordable plans and providing financial assistance, the Marketplace has made health insurance more accessible to those who may have previously been uninsured or underinsured. This has led to improved overall health outcomes and reduced healthcare disparities.

Enhanced Consumer Protection

The New York State Marketplace ensures that all insurance plans offered meet certain standards, protecting consumers from unfair practices and ensuring that they receive essential health benefits. This has resulted in greater transparency and peace of mind for individuals and families shopping for insurance.

Improved Access to Care

With increased coverage and financial assistance, more New Yorkers have access to the healthcare services they need. This includes preventive care, chronic disease management, and specialized treatments. By improving access to care, the Marketplace has contributed to better health outcomes and reduced healthcare costs in the long term.

Economic Benefits

The New York State Marketplace has also had positive economic impacts. By increasing insurance coverage, the Marketplace has helped reduce the number of uninsured individuals seeking care at emergency rooms, which can be costly. Additionally, the Marketplace has supported the growth of the healthcare industry in New York, creating jobs and contributing to the state’s economy.

Future of the New York State Marketplace

As healthcare reform continues to evolve, the New York State Marketplace is likely to play an even more significant role in ensuring access to affordable and quality healthcare. Here are some potential future developments and considerations:

Continued Innovation

The New York State Marketplace is committed to staying at the forefront of healthcare innovation. This includes exploring new technologies, such as telemedicine and digital health solutions, to enhance the user experience and improve access to care. By embracing these advancements, the Marketplace can further improve the efficiency and effectiveness of its services.

Expansion of Services

The Marketplace may consider expanding its offerings to include additional types of insurance, such as long-term care insurance or supplemental coverage options. This would provide residents with a more comprehensive range of insurance choices to meet their evolving healthcare needs.

Partnerships and Collaboration

To enhance the success of the Marketplace, ongoing partnerships and collaborations with healthcare providers, community organizations, and advocacy groups are essential. These partnerships can help improve outreach and enrollment efforts, especially in underserved communities, ensuring that all New Yorkers have access to the healthcare coverage they deserve.

Frequently Asked Questions

Can I enroll in the New York State Marketplace outside of the open enrollment period?

+Yes, you can enroll outside of the open enrollment period if you qualify for a Special Enrollment Period due to certain life events, such as losing job-based coverage, getting married, or having a baby.

What is the difference between Bronze, Silver, Gold, and Platinum plans?

+These metal levels represent the percentage of costs covered by the insurance plan. Bronze plans cover a lower percentage of costs, while Platinum plans cover a higher percentage. The choice of metal level depends on your healthcare needs and budget.

Are there any income requirements to qualify for premium tax credits or cost-sharing reductions?

+Yes, there are income requirements to qualify for these financial assistance programs. Premium tax credits are available to individuals and families with incomes between 100% and 400% of the federal poverty level. Cost-sharing reductions are available to those with incomes between 100% and 250% of the federal poverty level.

Can I keep my current doctor if I enroll in a plan through the Marketplace?

+It depends on whether your preferred doctor is included in the plan’s provider network. Review the provider networks carefully to ensure that your chosen doctor is covered by the plan you select.

What happens if I miss the open enrollment period?

+If you miss the open enrollment period, you may still be able to enroll if you qualify for a Special Enrollment Period due to certain life events. However, if you do not qualify, you will need to wait until the next open enrollment period to enroll in a new plan.